Running a small business organisation is interesting, but it comes with its private specific financial disturbing situations. Many small commercial organisation proprietors locate themselves beaten in phrases of dealing with cash, planning fees, and maintaining their fee variety healthfully. That’s why having a robust economic plan is important—not best to stay on but to thrive and develop within the competitive market.

Financial planning lets you have clean dreams, keep away from highly-priced mistakes, and make informed options. Whether you’re surely starting or already have a consistent flow of clients, the ones recommendations will help you keep your enterprise heading in the right path.

1. Set Clear Financial Goals

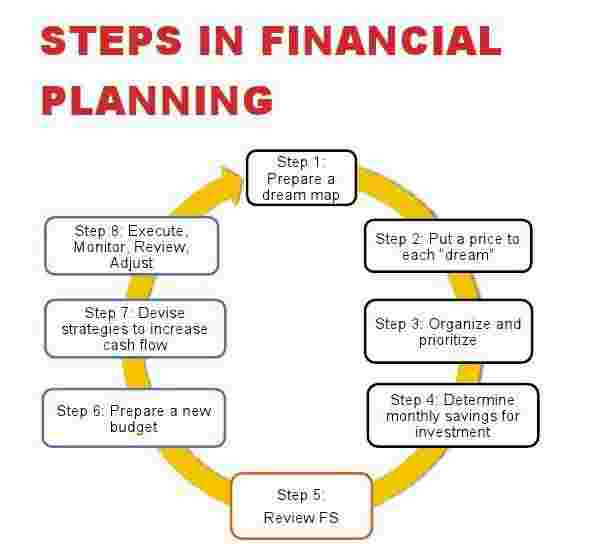

One of the first steps in successful economic planning is placing smooth, sensible dreams. These goals want to cover every brief-term desire, like protecting monthly expenses, and prolonged-time period objectives, collectively with developing your product line or beginning new locations. Clear goals provide you with a roadmap for budgeting and help you stay triggered inside the path of hard instances.

Without smooth economic desires, it’s easy to lose popularity or put money into topics that don’t pass your business commercial enterprise employer in advance. Write down your desires and revisit them regularly to keep your fee range aligned collectively together with your imagination and prescient.

2. Separate Personal and Business Finances

A common mistake many small business employer proprietors make is blending personal and industrial company rate variety. This can cause confusion, tax troubles, or perhaps hassle securing loans or investments. Open a devoted organisation financial enterprise corporation account and use separate credit score rating playing cards for enterprise corporation fees. This separation permits you to tune your business organisation 's monetary health virtually and simplifies accounting.

3. Create a Detailed Budget and Understand the Basic Function of a Bookkeeper

Budgeting is extra than sincerely listing your earnings and expenses—it’s about facts wherein every greenback is coming from and in which it’s going. A genuine price range allows you to plan for sluggish months, sudden prices, and boom possibilities.

Here’s where the Basic Function of a Bookkeeper becomes vital. A bookkeeper maintains accurate statistics of all monetary transactions, tracks invoices, video show units costs, and allows you to hold updated economic data. These facts are essential for making smart options and staying compliant with tax felony recommendations.

Hiring a professional bookkeeper or using dependable bookkeeping software software can prevent time, lessen errors, and offer you with peace of mind expertise your price variety are in suitable hands.

4. Monitor Cash Flow Regularly

Cash flow is the lifeblood of any commercial enterprise. Even in case you’re profitable on paper, on foot out of cash can shut you down quickly. Track your cash inflows and outflows cautiously, so that you continuously recognize your to be had charge variety.

Regular coins with the flow tracking permits you to find out potential shortfalls before they take place, permitting you to alter spending or find out funding options proactively. Use devices like spreadsheets or economic software program software software to make this machine a whole lot much less hard and further correct.

5. Build an Emergency Fund

Every industrial employer agency faces sudden costs—from gadget breakdowns to unexpected drops in income. Having an emergency fund acts as a safety net, so you don’t want to rely on excessive-hobby loans or risk your operations.

Aim to keep enough to cowl at the least three to 6 months of crucial expenses. Keep this cash in an available but separate account, so it’s organized on the equal time as you need it without tempting you to spend it on every day operations.

6. Manage Debt Wisely and Navigate Business in Oman

Debt may be a beneficial tool for growth, however it is able to moreover end up a heavy burden if no longer controlled cautiously. Understand the distinction between top debt—like loans that finance increase—and terrible debt, collectively with excessive-hobby credit score score rating playing cards for regular spending.

If you’re walking an enterprise Business in Oman, it’s essential to be privy to local lending phrases and monetary hints. Managing your debt with the right technique and records guarantees you don’t overextend yourself and might hold your enterprise corporation wholesome ultimately.

7. Invest in Professional Financial Advice

Even if you’re top with numbers, the expertise of an accountant or monetary planner can offer big benefits. They assist with tax making plans, financial forecasting, and optimizing your company form.

Professional recommendation can prevent coins, maintain you compliant, and open doors to investment possibilities you could not be privy to. Consider consulting an expert annually or whenever your business corporation evaluates big adjustments.

8. Use Technology to Simplify Financial Management

Managing a budget doesn’t need to be complex or time-consuming. There are many brilliant deals on less expensive tools and apps designed particularly for small companies. These can automate invoicing, song expenses, supply fee reminders, and generate monetary opinions.

Investing in the right generation frees up some time for awareness on growing your organisation as an alternative of getting slowed down via the manner of way of the use of place of work artwork.

9. Plan for Taxes Early

Tax time may be worrying if you’re not organized. Understand your tax responsibilities, final dates, and preserve prepared statistics at some diploma inside the 3 hundred and sixty 5 days. This makes submitting a fantastic deal plenty much less tough and permits you to avoid outcomes.

Take advantage of deductions and credit score ratings available to small groups.Keeping unique statistics and going for walks with a tax professional can maximize your economic financial savings.

10. Review and Adjust Financial Plans Regularly

Your corporation is constantly evolving, so your economic plan needs to too.

. Schedule everyday check-ins—monthly or quarterly—to test your budget, coins float, and economic dreams.

Adjust your plan based totally genuinely truly to your regular overall performance, market modifications, and surprising events. Staying bendy and proactive will maintain you in advance of functionality issues and geared up to seize new opportunities.

Conclusion

Good monetary making plans are the foundation of a successful small enterprise business enterprise. By placing clean desires, setting aside price range, understanding bookkeeping, and coping with debt correctly, you create stability and room for increase. Remember to leverage technology, try to find professional advice, and keep reviewing your plan to live on route.

Whether you’re actually starting out or looking to enhance, following those tips will help you collectively convey a resilient commercial enterprise agency and stable your monetary future.