Security is a top concern in the cryptocurrency industry. Centralized exchanges (CEXs) act as intermediaries, storing user funds in a central database. This makes them vulnerable to cyberattacks, leading to massive financial losses. In contrast, decentralized exchanges (DEXs) offer a more secure trading environment by eliminating third-party control.

How DEXs Enhance Security

- No Centralized Control

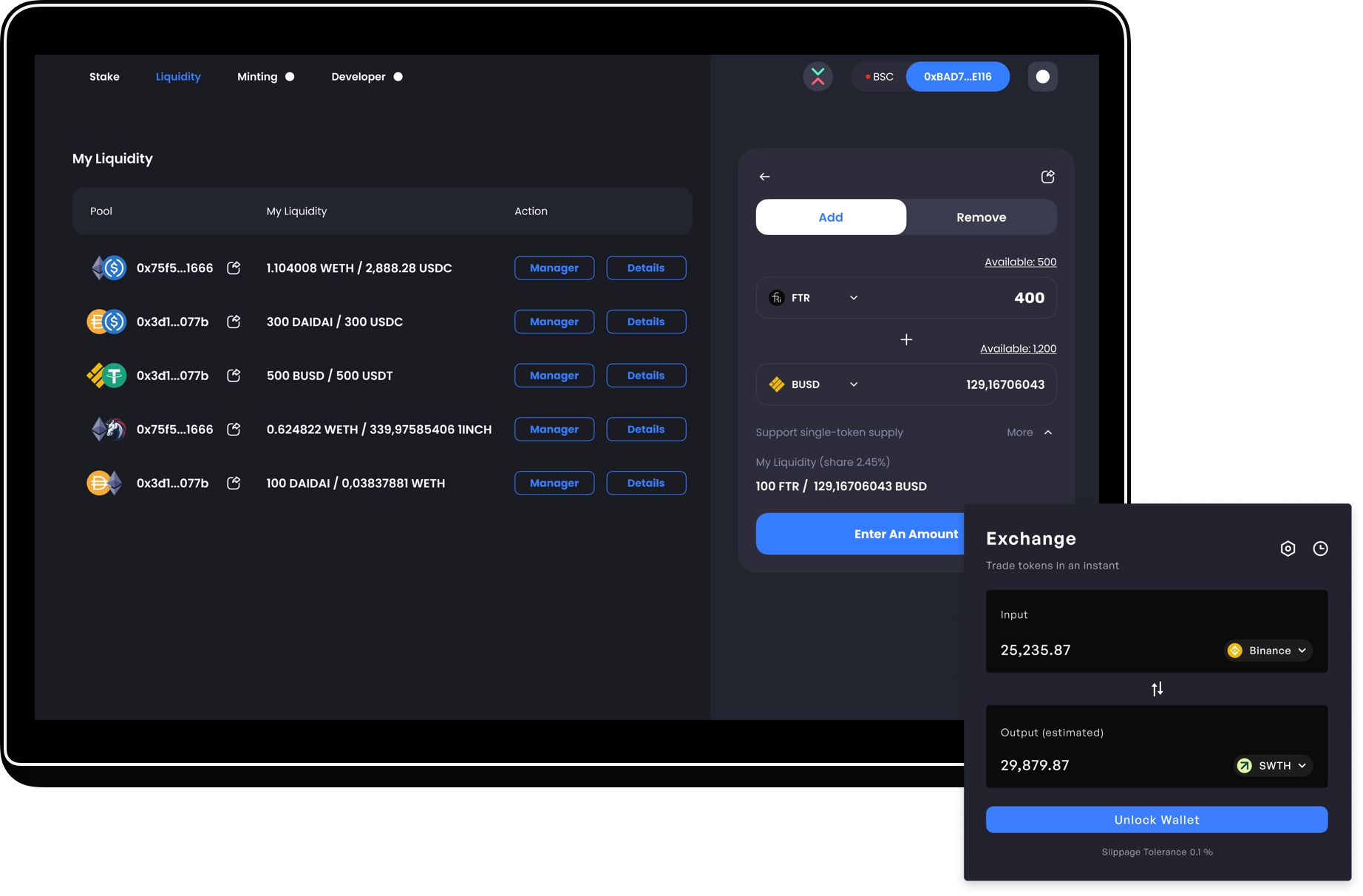

Unlike CEXs, decentralized exchanges operate on blockchain technology and smart contracts. This ensures that users retain full control over their assets, eliminating the risk of exchange hacks and insider fraud. - No Custodial Risk

DEXs do not require users to store funds on the platform. Instead, trades occur directly between wallets, reducing the chances of large-scale security. - Advanced Security Features

Modern decentralized exchanges integrate advanced security measures like multi-signature authentication and zero-knowledge proofs, ensuring safer transactions.

Final Thoughts

While centralized platforms offer convenience, they come with security risks. DEXs provide enhanced safety, transparency, and autonomy, making them a preferred choice for crypto traders.

Want to build your own exchange platform? It's a wise choice! Partner with a decentralized exchange development company to create a secure and efficient trading solution.