Managing payroll is a critical task for any business, whether you’re a small business owner, freelancer, or independent contractor. Paying employees or contractors accurately and on time ensures trust and compliance with labor laws. Traditionally, payroll has been handled manually, but with the rise of payroll check generators, automating the process has become easier than ever.

So, which option is better—using a payroll check generator or managing payroll manually? In this blog, we’ll break down the differences, benefits, and drawbacks of both methods to help you choose the best payroll solution for your needs.

What Is a Payroll Check Generator?

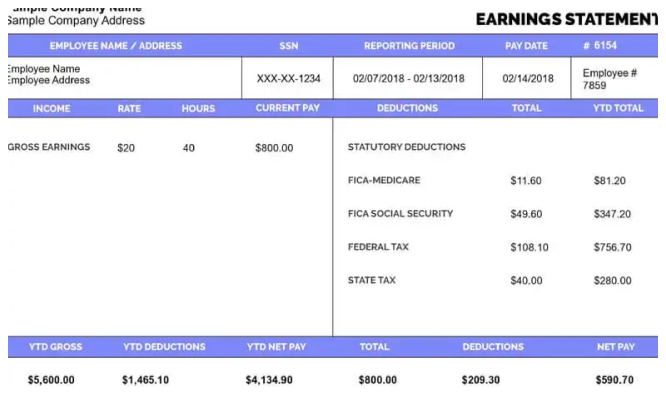

A payroll check generator is an online tool or software that automates the process of calculating wages, deductions, and net pay. It generates professional payroll checks and check stubs, making payroll faster and more efficient.

Key Features of a Payroll Check Generator:

✔ Automatic calculations for gross pay, taxes, and deductions.

✔ Generates printable pay stubs for employees or contractors.

✔ Reduces payroll errors by handling tax withholdings correctly.

✔ Saves time compared to manual payroll processing.

✔ Secure online storage for payroll records.

Many payroll check generators integrate with accounting software like QuickBooks or FreshBooks, making them ideal for small businesses and freelancers who want a seamless payroll process.

What Is Manual Payroll?

Manual payroll is the traditional way of processing employee wages without using automated tools. Employers manually calculate wages, taxes, deductions, and issue payments via handwritten checks or bank transfers.

Steps Involved in Manual Payroll Processing:

-

Tracking employee work hours (if applicable).

-

Calculating gross pay based on hourly wages or salaries.

-

Deducting taxes and benefits manually.

-

Writing payroll checks or initiating bank transfers.

-

Maintaining records for tax compliance.

Manual payroll gives businesses full control over the payroll process, but it requires significant time, effort, and attention to detail.

Payroll Check Generator vs. Manual Payroll: A Detailed Comparison

Let’s compare the two payroll methods across various factors:

| Feature | Payroll Check Generator | Manual Payroll |

|---|---|---|

| Ease of Use | ✅ Easy to use, automated | ❌ Time-consuming, requires calculations |

| Accuracy | ✅ Reduces errors with automatic tax calculations | ❌ Prone to human errors |

| Time Required | ✅ Quick (few minutes) | ❌ Slow (hours per pay period) |

| Tax Compliance | ✅ Automatically calculates deductions and taxes | ❌ Requires manual tax calculations |

| Cost | ✅ Affordable, some tools are free | ✅ Free but time-intensive |

| Payroll Records | ✅ Stored digitally, easy to access | ❌ Must be manually organized |

| Best for | Small businesses, freelancers, contractors, startups | Small teams, businesses with very few employees |

While both methods have their advantages, payroll check generators offer more efficiency, accuracy, and convenience.

Benefits of Using a Payroll Check Generator

If you’re still wondering whether a payroll check generator is the right choice, here are some compelling reasons why businesses, freelancers, and contractors prefer automated payroll:

1. Saves Time and Reduces Workload

Manual payroll processing can take hours or even days, especially for businesses with multiple employees. A payroll check generator automates calculations, saving valuable time and effort.

Business owners and freelancers can focus on growing their business rather than getting stuck with payroll paperwork.

2. Reduces Payroll Errors

One of the biggest risks of manual payroll is making mistakes in tax calculations, deductions, or employee wages. Errors can lead to:

✔ Incorrect employee payments.

✔ IRS penalties for incorrect tax filings.

✔ Frustrated employees or contractors.

A payroll check generator automatically applies the correct tax rates and calculations, reducing the chances of payroll errors.

3. Ensures Tax Compliance

Calculating taxes manually is complex. Businesses need to factor in:

✔ Federal income tax.

✔ State and local taxes.

✔ Social Security and Medicare (FICA taxes).

✔ Unemployment tax (FUTA/SUTA).

A payroll check generator handles these calculations automatically, ensuring that payroll taxes are accurate and up to date with IRS guidelines.

4. Generates Professional Pay Stubs Instantly

A payroll check generator creates professional, itemized pay stubs that employees and contractors can use for:

✔ Proof of income (loans, credit applications).

✔ Tax reporting.

✔ Record-keeping.

With manual payroll, creating check stubs requires additional work, making it less efficient.

5. Digital Record-Keeping for Easy Access

Manually tracking payroll records requires physical files or spreadsheets, which can be difficult to organize.

A payroll check generator keeps all payroll records in a secure digital format, making it easy to retrieve past paychecks for tax filings or audits.

When Should You Use Manual Payroll?

Despite its inefficiencies, manual payroll might be a good option in certain situations:

✔ For very small businesses with only 1-2 employees.

✔ If payroll taxes are minimal and calculations are simple.

✔ For businesses that prefer full control over payroll without relying on software.

If you have the time, patience, and expertise to handle complex tax calculations manually, this method can work. However, as your business grows, it’s often better to switch to a payroll check generator.

Best Payroll Check Generators for Businesses and Freelancers

If you decide to use a payroll check generator, here are some of the best options available:

1. PayStubs.com

✔ Instantly generates professional payroll check stubs.

✔ Easy-to-use online interface.

✔ Ideal for small businesses and freelancers.

2. CheckStubMaker

✔ Offers custom pay stub templates.

✔ Calculates deductions automatically.

✔ Supports various payment frequencies (weekly, bi-weekly, monthly).

3. ThePayStubs.com

✔ Creates accurate payroll checks and pay stubs.

✔ Allows self-employed individuals to generate proof of income.

✔ Digital storage for payroll records.

4. FormPros

✔ Great for small businesses and independent contractors.

✔ Generates check stubs and printable paychecks.

✔ User-friendly online tool.

5. StubCreator

✔ Generates pay stubs with customizable fields.

✔ Useful for freelancers and gig workers.

✔ Quick and affordable payroll solution.

These tools make payroll processing fast, efficient, and hassle-free, especially for those who don’t have an accounting background.

Final Verdict: Which One Is Better?

If you’re deciding between manual payroll and a payroll check generator, here’s a quick recap:

✔ Use a Payroll Check Generator If:

-

You want to save time and reduce errors.

-

You need accurate tax calculations and compliance.

-

You require professional payroll check stubs for employees or contractors.

-

You prefer digital record-keeping over manual paperwork.

✔ Use Manual Payroll If:

-

You have only 1-2 employees and simple tax requirements.

-

You are comfortable handling payroll calculations manually.

-

You want full control without relying on payroll software.

For most businesses, a payroll check generator is the better option because it streamlines payroll processing, improves accuracy, and ensures tax compliance. If you’re still managing payroll manually, consider making the switch today! 🚀💰