If you’ve ever received a paycheck, you’ve likely seen a paycheck stub attached to it or provided digitally. But do you understand what all the numbers and sections mean? Many people glance at their paycheck stub without fully knowing how it affects their finances.

In this guide, we’ll break down everything you need about paycheck stubs, including why they matter, how to read them, and how they can help you manage your money better.

What Is a Paycheck Stub?

A paycheck stub (also known as a pay stub or wage statement) is a document that shows details about your earnings and deductions for a specific pay period. It’s usually provided by your employer either in paper form or digitally if you have direct deposit.

A paycheck stub serves as proof of income and helps employees understand how their wages are calculated, including taxes, benefits, and deductions.

Why Are Paycheck Stubs Important?

Paycheck stubs are more than just a breakdown of your earnings. They serve several important purposes, including:

-

Proof of Income – Lenders, landlords, and financial institutions may require paycheck stubs when you apply for loans, mortgages, or rental housing.

-

Tax Preparation – Paycheck stubs help you track earnings and withholdings so you can accurately file your taxes.

-

Verifying Accuracy – They allow employees to check for errors in wages, deductions, and benefits to ensure they are being paid correctly.

-

Budgeting and Financial Planning – Understanding your paycheck stub can help you manage your expenses and savings better.

How to Read a Paycheck Stub

Your paycheck stub contains several sections, each providing important financial information. Here’s what you need to know:

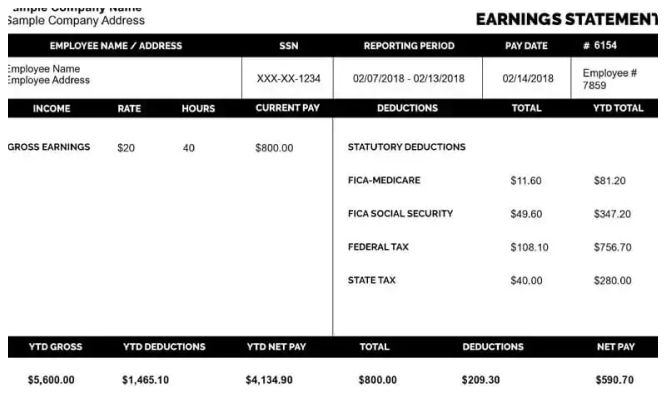

1. Employee and Employer Information

This section includes:

✔ Your name and address

✔ Your employer’s name and address

✔ Your employee ID number (if applicable)

This information ensures that the paycheck stub is correctly assigned to you.

2. Pay Period and Pay Date

✔ The pay period shows the start and end dates for which you’re being paid.

✔ The pay date is when your employer issued the paycheck.

Understanding this section is important for tracking when and how often you get paid (weekly, biweekly, semimonthly, or monthly).

3. Gross Pay

✔ Gross pay is the total amount you earned before any taxes or deductions.

For hourly employees, this is calculated as:

🡆 Hourly rate × Number of hours worked

For salaried employees, this is usually a fixed amount based on annual salary and pay frequency.

4. Deductions and Taxes

This section details the money taken out of your paycheck for taxes and other withholdings. Common deductions include:

✔ Federal Income Tax – Based on your W-4 form and taxable income.

✔ State Income Tax – Some states have income tax; others don’t (e.g., Texas, Florida).

✔ Social Security (FICA Tax) – 6.2% of your wages go toward Social Security benefits.

✔ Medicare Tax (FICA Tax) – 1.45% of your wages go toward Medicare.

✔ Health Insurance – If you have employer-sponsored health, dental, or vision insurance, the cost will be deducted here.

✔ Retirement Contributions (401(k) or Pension) – If you contribute to a retirement plan, those funds will be deducted pre-tax or post-tax.

✔ Other Deductions – Union dues, life insurance, or other voluntary deductions may also be included.

5. Net Pay ("Take-Home Pay")

✔ Net pay is the actual amount you receive after all deductions.

This is the money that goes into your bank account or is issued on a physical paycheck.

Common Paycheck Stub Issues and How to Fix Them

Sometimes, paycheck stubs may have errors. Here’s what to watch out for:

🔹 Incorrect Hours or Pay Rate – Check that the hours worked and pay rate match your agreement.

🔹 Missing Overtime Pay – If you worked overtime, ensure it’s reflected at the correct rate (usually 1.5x your hourly wage).

🔹 Incorrect Tax Withholding – If your tax withholdings seem off, you may need to update your W-4 form with your employer.

🔹 Unfamiliar Deductions – If you see deductions you don’t recognize, ask your HR or payroll department for clarification.

If you find an issue, notify your employer or HR department as soon as possible. Most payroll errors can be corrected quickly.

Digital vs. Paper Paycheck Stubs: Which Is Better?

Many employers have switched to electronic paycheck stubs to reduce paper waste and improve convenience. Here’s a quick comparison:

| Feature | Digital Paycheck Stubs | Paper Paycheck Stubs |

|---|---|---|

| Convenience | Accessible online anytime | Must keep physical copies |

| Security | Can be password-protected | Can be lost or stolen |

| Storage | Stored in employer's payroll system | Requires manual filing |

| Eco-Friendly? | Yes | No |

Most employees prefer digital paycheck stubs, but some still request paper copies for record-keeping.

How Long Should You Keep Your Paycheck Stubs?

You don’t need to keep paycheck stubs forever, but holding onto them for a while can be helpful. Here’s a general guideline:

✔ At least 1 year – Until you receive your W-2 for tax filing.

✔ Up to 3 years – If needed for tax audits or disputes.

✔ Up to 7 years – If you’re self-employed or need them for long-term financial records.

If you’re storing paycheck stubs digitally, make sure to back them up securely.

How to Get a Copy of Your Paycheck Stub

If you need a copy of a past paycheck stub, try these options:

✅ Employer’s Payroll Portal – Many companies provide access to digital paycheck stubs online.

✅ HR or Payroll Department – Request a copy directly from your employer.

✅ Bank Statements – While not as detailed, bank deposits can show your net pay amounts.

Some employers may charge a fee for retrieving old paycheck stubs, so it’s best to keep your own records.

Final Thoughts

Understanding your paycheck stub is crucial for managing your finances, catching errors, and planning for taxes. Whether you receive paper or digital pay stubs, reviewing them carefully can help you track your earnings and deductions.

If you ever have concerns about your paycheck stub, don’t hesitate to ask your employer or payroll provider for clarification. Staying informed about your pay ensures you’re being compensated fairly and accurately.