Australia Healthcare Insurance Market Poised for Significant Growth Amid Emerging Opportunities

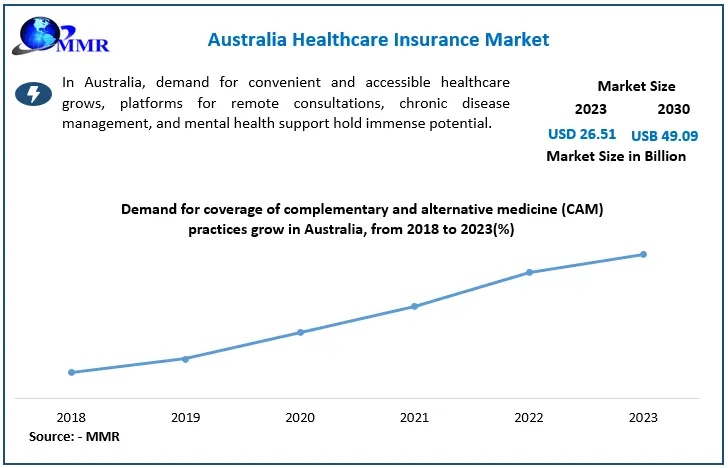

The Australian healthcare insurance market size is on a trajectory of robust growth, with projections estimating an increase from USD 26.51 billion in 2023 to nearly USD 49.09 billion by 2030, reflecting a compound annual growth rate (CAGR) of 9.2%. This expansion is driven by several factors, including the integration of digital health technologies, a heightened focus on preventive care, and the development of specialized insurance products tailored to diverse demographics.

Request Sample Link For More Details: https://www.maximizemarketresearch.com/request-sample/226451/

Market Estimation, Growth Drivers, and Opportunities

The anticipated growth in Australia's healthcare insurance sector is underpinned by the adoption of digital health solutions such as telemedicine, wearable health devices, and data-driven health tools. These technologies enhance patient engagement and facilitate efficient healthcare delivery. The emphasis on preventive care and wellness initiatives presents insurers with opportunities to invest in services that promote healthier lifestyles, potentially reducing long-term healthcare costs. Additionally, crafting specialized insurance policies that cater to specific demographic groups and health needs can attract new customer segments, further propelling market growth.

U.S. Market Trends and Investments in 2024

In the United States, the healthcare insurance landscape has witnessed notable trends and investments in 2024. A significant development includes Clear Haven Capital Management's commitment of $400 million to support Future Family, a fertility financing company. This investment aims to expand access to fertility treatments like in vitro fertilization (IVF) and egg freezing, addressing the growing demand for assisted reproductive technologies.

Furthermore, the expansion of Medicare coverage for patient advocacy services has bolstered companies like Solace, a healthtech startup that raised $60 million in its Series B funding round. Solace connects patients with healthcare advocates to assist with tasks such as appointment scheduling and paperwork, reflecting a broader trend toward enhancing patient support services within the healthcare system.

Market Segmentation with Largest Market Share

Within the Australian healthcare insurance market, private health insurance (PHI) holds the largest market share. PHI plans in Australia typically fall into two categories: hospital policies and general treatment policies, with some offering combined coverage. These plans provide a range of benefits, including coverage for hospital services, dental care, physiotherapy, and alternative therapies. The increasing prevalence of chronic diseases and the rising costs associated with medical treatments have driven more individuals to opt for private health insurance to mitigate out-of-pocket expenses.

Competitive Analysis

The global healthcare insurance market features several key players with substantial market shares:

-

UnitedHealth Group: As the largest healthcare company globally by revenue, UnitedHealth Group has expanded its services through acquisitions, including the purchase of LHC Group for $5.4 billion in 2023 and the planned acquisition of Amedisys Inc. for $3.3 billion. These moves aim to bolster its home health capabilities.

-

Allianz: A German multinational financial services company, Allianz is the world's largest insurance company and the largest financial services company in Europe.

-

Cigna Group: Cigna has focused on expanding its global footprint and enhancing digital health services. The company has invested in telehealth platforms and mobile applications to improve customer engagement and streamline healthcare delivery.

-

Anthem, Inc.: Now known as Elevance Health, the company has rebranded to reflect its commitment to advancing whole-person health. Elevance Health has invested in data analytics and artificial intelligence to personalize healthcare solutions and improve outcomes.

-

Aetna Inc.: A subsidiary of CVS Health, Aetna has integrated its insurance products with CVS's pharmacy services, aiming to provide a more cohesive healthcare experience. Investments in MinuteClinic walk-in clinics and HealthHUB locations exemplify this integrated approach.

Want to access more insights? The journey starts from requesting Sample : https://www.maximizemarketresearch.com/request-sample/226451/

Regional Analysis

-

United States: The U.S. health and medical insurance market is projected to grow from USD 1.5 trillion in 2024 to USD 2.01 trillion by 2029, with a CAGR exceeding 6%. This growth is driven by rising incidences of chronic diseases and an increasing emphasis on preventive care. The expansion of Medicare coverage and employer-sponsored wellness programs also contribute to market growth.

-

United Kingdom: The UK's National Health Service (NHS) provides universal healthcare, but there is a growing market for private health insurance, driven by individuals seeking faster access to specialists and elective procedures. Government policies supporting public-private partnerships have facilitated growth in this sector.

-

Germany: Germany operates a dual public-private healthcare system. The government's support for private health insurance, through policies that allow higher-income individuals to opt out of the public system, has sustained a robust private insurance market.

-

France: The French healthcare system combines universal coverage with a significant role for private insurers, known as "mutuelles," which offer complementary coverage. Government policies that encourage supplemental insurance to cover co-payments and non-reimbursed services have bolstered this market.

-

Japan: Japan's healthcare system is characterized by universal health insurance. While the majority of citizens are covered by public schemes, there is a niche market for private health insurance offering additional benefits, such as coverage for advanced medical treatments not included in the public system.

-

China: China's healthcare reform efforts have focused on expanding public health insurance coverage. However, gaps in coverage and rising healthcare costs have led to increased demand for private health insurance. Government initiatives promoting private sector participation in healthcare provision have further stimulated market growth.

Conclusion

The Australian healthcare insurance market is poised for substantial growth, driven by technological advancements, a focus on preventive care, and the development of specialized insurance products. Observations from the U.S. market underscore the importance of strategic investments in patient support services and digital health platforms. To capitalize on emerging opportunities, Australian insurers should prioritize technological infrastructure enhancements, foster collaborations with healthcare providers, and design innovative, customer-centric insurance products. These strategies will not only enhance operational efficiency but also position insurers competitively in a rapidly evolving healthcare landscape.

To Gain More Insights into the Market Analysis, Browse Summary of the research report:https://www.maximizemarketresearch.com/market-report/australia-healthcare-insurance-market/226451/

Related Reports :

Global Pelvic Floor Diagnostic Testing Market https://www.maximizemarketresearch.com/market-report/global-pelvic-floor-diagnostic-testing-market/120902/

Global Carbuncle Treatment Market https://www.maximizemarketresearch.com/market-report/global-carbuncle-treatment-market/81673/

Global Burning Mouth Syndrome Testing Market https://www.maximizemarketresearch.com/market-report/global-burning-mouth-syndrome-testing-market/87287/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 9607365656