North America Life Reinsurance Market Projected to Reach USD 181.50 Billion by 2029, Driven by Rising Demand and Strategic Innovations

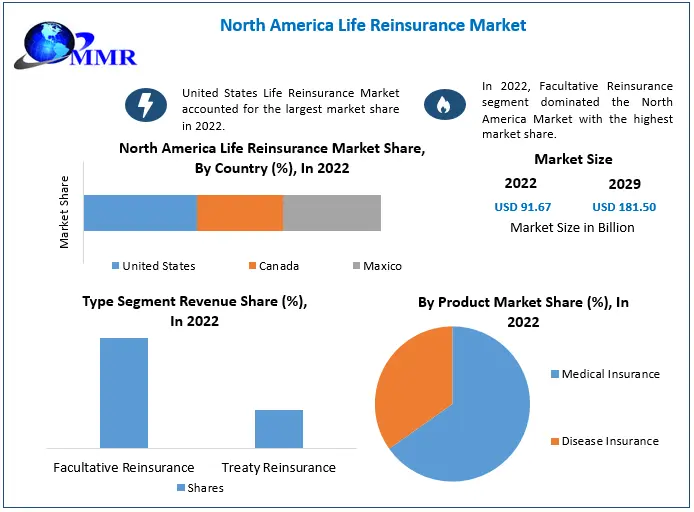

The North America Life Reinsurance Market size is poised for significant growth, with projections indicating an expansion from USD 91.67 billion in 2022 to approximately USD 181.50 billion by 2029. This represents a Compound Annual Growth Rate (CAGR) of 10.25% over the forecast period.

Ask for Sample to Know US Tariff Impacts on Market : https://www.maximizemarketresearch.com/request-sample/189292/

Market Estimation, Growth Drivers, and Opportunities

The anticipated growth in the North American life reinsurance market is underpinned by several key factors:

-

Demographic Shifts: An aging population and increasing life expectancy are leading to higher demand for life insurance products, subsequently boosting the need for reinsurance solutions.

-

Risk Management Needs: Insurers are increasingly seeking reinsurance to manage capital requirements and mitigate risks associated with large policy portfolios.

-

Regulatory Changes: Evolving regulatory frameworks are prompting insurers to reassess their risk exposures and capital allocations, thereby increasing reliance on reinsurance.

-

Technological Advancements: The integration of advanced analytics and digital platforms is enhancing underwriting processes and risk assessment capabilities, making reinsurance more efficient and accessible.

U.S. Market Trends and Investments

In 2024, the U.S. life reinsurance sector witnessed significant developments:

-

Strategic Ventures: MetLife and General Atlantic announced the formation of Chariot Reinsurance, a Bermuda-based entity with an initial equity contribution exceeding $1 billion. This venture aims to manage $10 billion in existing MetLife policies, reflecting a trend of insurers collaborating with asset managers to optimize capital efficiency.

-

Capital Reallocation: Equitable Holdings entered into a reinsurance agreement with Reinsurance Group of America, reinsuring approximately 75% of its in-force individual life business. The capital released from this transaction is being utilized to increase Equitable's stake in AllianceBernstein Holding, highlighting the strategic use of reinsurance to support broader financial objectives.

Want to access more insights? The journey starts from requesting Sample: https://www.maximizemarketresearch.com/request-sample/189292/

Market Segmentation and Dominant Shareholders

The North American life reinsurance market is segmented based on product offerings and reinsurance types:

-

Product Offering: The mortality solutions segment holds the largest market share, driven by the demand for products that provide financial protection against death-related risks.

-

Reinsurance Type: Traditional life reinsurance dominates the market, encompassing treaties that cover a broad range of life insurance policies.

Competitive Analysis

The market is characterized by the presence of several key players:

-

Swiss Re: Leading the U.S. individual life reinsurance market with a 24% share, Swiss Re reported $147 billion in new business volume, reflecting its strong market position and underwriting expertise.

-

Reinsurance Group of America (RGA): Holding a 20% market share, RGA's strategic partnerships, such as the recent deal with Equitable Holdings, underscore its role in facilitating capital optimization for insurers.

-

Munich Re: With a 16% market share, Munich Re's introduction of longevity reinsurance solutions in 2024 demonstrates its commitment to addressing emerging demographic trends and associated risks.

-

SCOR: Accounting for 15% of the market, SCOR continues to expand its footprint through innovative product offerings and strategic collaborations.

-

Gen Re: Holding a 9% market share, Gen Re focuses on providing comprehensive reinsurance solutions tailored to the evolving needs of life insurers.SOA

Collectively, these top five reinsurers dominate the market, leveraging their financial strength and technical expertise to support the stability and growth of the life insurance sector.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report : https://www.maximizemarketresearch.com/market-report/north-america-life-reinsurance-market/189292/

Regional Analysis

Within North America, the United States is the predominant market, driven by a mature insurance industry, high consumer awareness, and a robust regulatory environment. Canada also contributes significantly, with insurers increasingly adopting reinsurance to manage capital and enhance product offerings.

Government policies in both countries support the growth of the reinsurance market by promoting financial stability, encouraging innovation, and ensuring consumer protection.

Conclusion

The North America Life Reinsurance Market is on a trajectory of robust growth, fueled by demographic trends, strategic investments, and technological advancements. As insurers seek to navigate an increasingly complex risk landscape, reinsurance will play a pivotal role in providing financial resilience and enabling innovation. Companies that adapt to evolving market dynamics and leverage emerging opportunities are well-positioned to thrive in this expanding market

Related Reports :

North America Active Pharmaceutical Ingredients Market https://www.maximizemarketresearch.com/market-report/north-america-active-pharmaceutical-ingredients-market/2264/

Global Adrenocortical Carcinoma Treatment Market https://www.maximizemarketresearch.com/market-report/global-adrenocortical-carcinoma-treatment-market/66037/

Global Patient Blood Management Market https://www.maximizemarketresearch.com/market-report/global-patient-blood-management-market/83392/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 9607365656