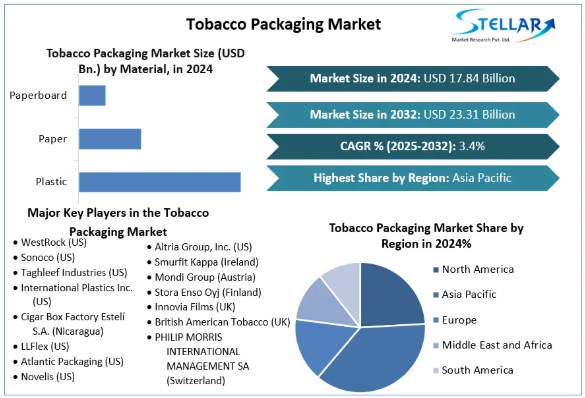

Tobacco Packaging Market size was valued at USD 17.84 Bn in 2024 and is expected to reach USD 23.31 Bn by 2032, at a CAGR of 3.40%.

Market Estimation & Definition

Tobacco packaging encompasses all packaging used for products like cigarettes, cigars, roll-your-own tobacco, heated tobacco units, e-cigarettes, and nicotine pouches. Packaging serves functional roles—protecting products from physical damage, moisture, and tampering—and regulatory functions, including displaying mandated health warnings and tax stamps.

Estimates suggest the market stood at around USD 18.9–19.0 billion in 2024, growing at close to 4.5%–4.8% CAGR. By 2032, the global value is projected to fall between USD 27.8 and 30.2 billion. These figures reflect the twin dynamics of declining tobacco usage in high-income regions alongside innovation and expansion in emerging markets.

Request your sample copy of this report now! https://www.stellarmr.com/report/req_sample/tobacco-packaging-market/2454

Market Growth Drivers & Opportunity

-

Regulatory Compliance & Plain Packaging Mandates

Over 25 countries enforce plain or standardized packaging. Governments are increasing health warning space—often covering 65–75% of pack faces—and limiting branding and promotional space, driving packaging redesign and compliance costs. -

Sustainability Trends & Eco-Materials

Consumer and regulatory pressure is pushing tobacco firms toward recyclable paperboard, biodegradable plastics, and compostable materials. Paper & paperboard account for over 80% of materials used, while plastic is the fastest-growing material, particularly in emerging regions. -

Anti-Counterfeit Technology Adoption

Digital tax stamps, QR codes, holograms, and tamper-evident seals are increasingly required to combat illicit trade and comply with traceability mandates under international health treaties. -

Heated Tobacco & Novel Products

The rise of heated tobacco units and e-cigarettes necessitates specialized packaging with higher heat-resistance, moisture barriers, and child-resistant formats—driving innovation and higher-value packaging solutions. -

Growth in Emerging Markets

Asia-Pacific commands around 30–38% of global revenue, led by China, India, Japan, South Korea, and Southeast Asia. Rising adult smoking prevalence and regulatory modernization underpin demand for both conventional and next-generation packaging formats.

Segmentation Analysis

Based on recent market reports, the tobacco packaging industry is segmented as follows:

a) By Material

-

Paper & Paperboard (~80–83% share in 2024): preferred for its low cost, recyclability, and regulatory acceptance.

-

Plastic (~42% share forecast in some markets by 2025): gaining traction in Asia and Africa for low-cost flexible formats and high-end printed finishes.

-

Other Materials: Metals, jute, foil, and specialty laminates—used like value-add liners or premium packaging components.

b) By Packaging Type

-

Primary Packaging (~65–66% share in 2024): includes soft packs, folding cartons, pouches, and films that directly encase tobacco products.

-

Secondary Packaging (~60%+: fastest-growing segment ~5–5.5% CAGR): comprises cartons, trays, bundles, and display boxes used for transport and retail shelf presence.

c) By Product Type

-

Folding Cartons (~40% share): traditional and premium packs favored in regulated markets.

-

Soft Packs & Pouches (~49% share for soft packs): flexible film sachets, pouches, and reclosable packs growing fastest (~6% CAGR).

-

Other Formats: Bags, tins, jars, heat seals—used for specialty nicotine items.

To delve deeper into this research, kindly explore the following link: https://www.stellarmr.com/report/tobacco-packaging-market/2454

Country-Level Analysis: United States & Germany

United States

-

Holds over 30% of global market share, with projected packaging market value nearing USD 3.8 billion by 2032.

-

Innovation in eco-friendly paperboard, child-resistant designs, and anti-tamper features is driven by regulation and health awareness.

-

Packaging suppliers are also integrating automation and traceability technologies to meet U.S. regulatory demands and production efficiency.

Germany

-

As a leading European market, Germany is shaped by strong EU-level directives: plain packaging, rigorous health-warning rules, and efforts to limit plastic waste.

-

Manufacturers in Germany and Western Europe emphasize high-barrier coated boards, eco-compliant laminates, and sustainable packaging formats aligned with the EU Packaging and Packaging Waste Regulation.

Competitor & Industry Analysis

Key global and regional packaging suppliers active in tobacco include:

-

Amcor plc

-

Smurfit WestRock (merged entity of Smurfit Kappa & WestRock)

-

Mondi plc

-

International Paper

-

Graphic Packaging International

-

Constantia Flexibles Group

-

Essentra plc

-

Huhtamaki Oyj

-

Sonoco Products Company

Notable Developments

-

A key merger between Smurfit Kappa Group and WestRock in 2025 created a leading global paper packaging provider.

-

Constantia Flexibles acquired a majority stake in a European flexible packaging firm in 2025 to strengthen its sustainable and compliance-ready offerings.

-

Amcor has further expanded its tobacco packaging footprint via acquisitions in South America and Asia, emphasizing rigid and flexible formats suited to new regulation and products.

Strategic Focus Areas

-

Developing barrier-coated paperboard to replace plastic laminates while maintaining product protection.

-

Embedding digital anti-counterfeit solutions in primary packaging to comply with tax- and traceability mandates.

-

Shifting to automation-compatible formats for heated tobacco and e-cigarette verticals.

-

Emphasizing secondary packaging design to uphold brand identity in tight regulatory environments and support retail logistics.

Explore Our Top Trends :

Maldives E Cigarette Market https://www.stellarmr.com/report/Maldives-E-Cigarette-Market/595

Nigeria Plywood Market https://www.stellarmr.com/report/Nigeria-Plywood-Market/614

Press Release Conclusion

Outlook Summary: The tobacco packaging market is projected to grow steadily, with size rising from USD 18.9 billion in 2024 to USD 27.8–30.2 billion by 2032, at a CAGR of roughly 4.5–4.8%. While volume growth is dampened by tobacco-use declines and plain-pack mandates in developed regions, innovation in sustainable materials, compliance-centric designs, and novel product formats ensures continued value creation.

Key Takeaways:

-

Regulatory mandates, plain packaging, and health warnings drive demand for compliant packaging solutions.

-

Eco-conscious materials and design are now strategic imperatives globally.

-

Asia-Pacific, including China and India, offers significant expansion potential.

-

The U.S. excels in technological integration, while Germany leads on compliance and material innovation.

Challenges include balancing between rising excise taxes, declining volumes, and high compliance costs. Packaging providers must invest in R&D to differentiate via sustainability, automation-readiness, and anti-counterfeit capability.

About Stellar Market Research:

Stellar Market Research is a global leader in market research and consulting services, specializing in a wide range of industries, including healthcare, technology, automobiles, electronics, and more. With a team of experts, Stellar Market Research provides data-driven market insights, strategic analysis, and competition evaluation to help businesses make informed decisions and achieve success in their respective industries.

For more information, please contact:

Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656