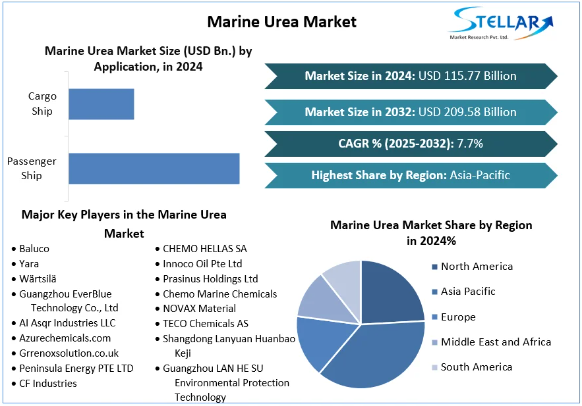

Marine Urea Market size was valued at USD 115.77 billion in 2024. The market is expected to grow at a CAGR of 7.7 % during the forecast period from 2025-2032, reaching nearly USD 209.58 billion by 2032.

Market Estimation & Definition

Marine urea—commonly known as AUS 40—is a 32–41% aqueous solution of synthetic urea used primarily in Selective Catalytic Reduction (SCR) systems aboard ships to reduce nitrogen oxide (NOₓ) emissions and comply with IMO Tier III and related environmental regulations.

The market is segmented by:

-

Type (concentration): 39–40%, 40–41%, etc.

-

Application: Cargo ships, passenger vessels, oil tankers, and other vessels

-

Region: Asia Pacific, Europe, North America, Middle East & Africa, South America

-

Key stakeholders: Shipowners/operators, port suppliers, urea producers and distributors

Secure your sample copy of this report immediately! https://www.stellarmr.com/report/req_sample/marine-urea-market/2460

Market Growth Drivers & Opportunities

A. IMO Methane & NOₓ Regulations

The enforcement of IMO’s Tier III standards in sensitive emission control areas compels shipping operators to install SCR systems that rely on AUS 40 to meet NOₓ reduction targets. This regulatory shift fuels core demand.

B. Fleet Expansion & Retrofit Trend

Accelerating growth in global shipping—especially in Asia—alongside retrofit activity in existing fleets boosts demand. Over two-thirds of new cargo and oil vessels now come equipped with SCR systems.

C. Port-side Infrastructure & Automation

Significant investments in bunkering and storage facilities for marine urea at major ports improve accessibility and reliability. Automated dosing and real-time monitoring tech are enhancing accuracy and safety.

D. Rising Quality Expectations

Growing emphasis on high-purity AUS 40 encourages stricter quality control across ports and suppliers. The higher-concentration (40–41%) grade is gaining traction for performance-sensitive applications.

E. Emerging Green Manufacturing Solutions

Pilot initiatives in green ammonia and bio-based urea aim to reduce carbon intensity of marine urea production, aligning with broader decarbonization goals in shipping.

Segmentation Analysis

By Type (Concentration)

-

The 39–40% grade constitutes the largest share (around 40–45%), favored for its balance of performance and cost.

-

The 40–41% grade is the fastest‑growing segment, driven by stricter emission norms requiring more effective NOₓ reduction.

By Application

-

Cargo Carriers dominate consumption (~44–45% share), owing to their scale and compliance requirements.

-

Oil Tankers account for ~22–23%, while container ships and passenger vessels contribute ~16–35%, with passenger vessels showing the fastest growth rate.

By Region

-

Europe leads in market share (~33–37%) due to strict enforcement in North and Baltic Sea ECAs.

-

North America holds ~25–32%, supported by port-level regulations and retrofits.

-

Asia Pacific contributes ~22–27% and is the most rapidly growing region, spurred by expanding trade and retrofit programs.

-

Middle East, Africa, and South America comprise the remainder, with penetration below 10% in many emerging ports.

To learn more about the findings of this research, please check: https://www.stellarmr.com/report/marine-urea-market/2460

Country-Level Analysis: United States & Germany

United States

The U.S. marine urea market is expanding rapidly: domestic consumption jumped over 30% year-on-year in 2024–2025. This surge is propelled by port regulations, particularly in heavily regulated zones such as the California coast, and enhanced SCR adoption across coastal fleets. Major ports have upgraded bunkering infrastructure, making AUS 40 accessible at roughly 60% of key US ports. Shipowners are allocating nearly 40% of their environmental retrofit budgets to emission-control technologies like SCR.

Germany

Germany, as part of the European Union and proximity to rigid ECAs, leads marine urea uptake in Europe. German-owned vessels and operators sustain high SCR penetration, especially in the North and Baltic Sea routes. Port hubs such as Hamburg and Bremen have witnessed annual urea consumption increases of 12–15% since 2020. German suppliers are investing heavily in high-purity grades, driven by both regulatory compliance and quality expectations.

Competitive (“Commutator”) Analysis

Market Structure

The marine urea sector exhibits moderate to high concentration among top suppliers. Leading players include Yara International, CF Industries, GreenChem, Guangzhou EverBlue Technology, AI Asqr Industries, Baluco, and Wärtsilä. The top five players account for approximately 70% of the market.

Barriers to Entry

-

Establishing urea production and purification capacities requires significant capital and technical know-how.

-

Compliance challenges around quality and traceability make new entrants less competitive.

Buyer-Supplier Dynamics

Ship operators and port authorities favor suppliers offering certified purity grades, storage, delivery reliability, and technical support. Long-term contracts are common, reducing spot-market price volatility exposure.

Supply Chain Constraints

-

Urea production costs are highly tied to natural gas and ammonia prices. Volatility in energy markets directly affects costs and supply stability.

-

Regional sourcing disparities and port infrastructure limitations can create price and availability gaps. For example, Asia-Pacific generally offers lower-cost urea, while Europe faces higher costs tied to imported energy.

Substitutes and Alternatives

Some operators opt for scrubbers or high-sulfur fuels in regions with lax regulation. However, with stricter emission laws, alternatives remain limited in the long term.

Industry Trends

-

Growing preference for higher-concentration AUS 40 grades

-

Automation and digital dosing systems integrated onboard and ashore

-

Emergence of green ammonia-based urea

-

Expansion of port bunkering and storage infrastructure

-

Strategic partnerships between suppliers and shipowners to ensure supply security

View Popular Topics Now :

Construction And Demolition Waste Market https://www.stellarmr.com/report/Construction-and-Demolition-Waste-Market/877

Pentaerythritol Market https://www.stellarmr.com/report/Pentaerythritol-Market/885

Press Release Conclusion

The global marine urea market, valued at USD 115.77 billion in 2024, is projected to expand at 7.7% CAGR, surpassing USD 200 billion by 2032. Growth is firmly rooted in IMO-driven emission standards, SCR adoption, retrofit cycles, and infrastructure development.

Regional Highlights:

-

Europe leads market share due to stringent regulation enforcement.

-

North America, especially the U.S., is investing heavily in port infrastructure and SCR adoption.

-

Asia Pacific emerges as the fastest-growing region, led by rising shipping volumes and retrofits.

-

Germany drives European demand through its major ports and fleet operations.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656