EV DC Fast Charger Market Size, Growth, Trends and Forecast 2025–2032

EV DC Fast Charger Market Overview

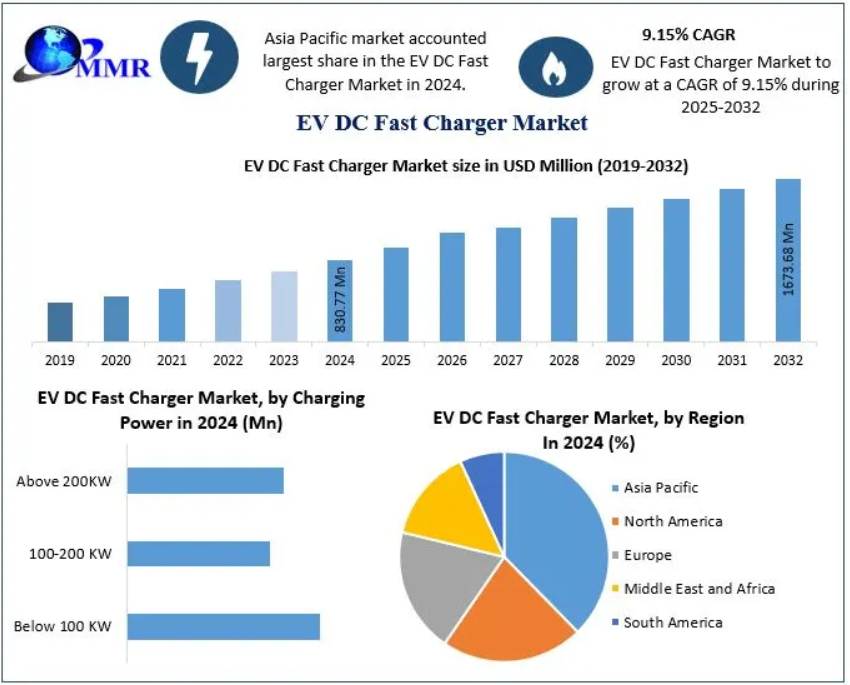

The Global EV DC Fast Charger Market size was valued at USD 830.77 million in 2024, and the total revenue is expected to grow at a CAGR of 9.15% from 2025 to 2032, reaching nearly USD 1673.68 million by 2032.

EV DC fast chargers play a critical role in the adoption of electric vehicles (EVs), enabling rapid recharging by converting AC power to direct current (DC) and supplying it directly to the vehicle’s battery. Unlike traditional AC chargers, which can take several hours, DC fast chargers can recharge an EV battery in 25–30 minutes, making them essential for long-distance travel and large-scale EV adoption.

The global shift toward clean mobility, stricter environmental regulations, and rising consumer demand for convenient charging infrastructure are accelerating the deployment of EV DC fast chargers. Governments, automakers, and private players are investing in expanding fast-charging networks across highways, urban hubs, and emerging EV markets.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/75599/

EV DC Fast Charger Market Dynamics

Drivers

- Rising EV Adoption for Sustainable Mobility

Growing concerns over climate change and carbon emissions are pushing governments and consumers toward electric vehicles. As EV adoption rises, so does the demand for fast-charging solutions, making EV DC fast chargers a key enabler of this transition. - Need for Rapid Charging Infrastructure

Long-distance travel requires high-power, quick-turnaround charging solutions. DC fast chargers address range anxiety by providing charging within minutes, encouraging wider EV acceptance among consumers. - Government Incentives and Policy Support

Subsidies, tax incentives, and government-led EV infrastructure projects are boosting DC fast charger installations worldwide. For example, the U.S. and EU are investing heavily in highway charging corridors, while China and India are rolling out aggressive EV adoption programs.

Restraints

- High Installation and Infrastructure Costs

Setting up DC fast-charging stations requires advanced grid connections, cooling systems, and insulation, significantly increasing upfront costs compared to AC chargers. This remains a barrier for smaller operators and developing nations. - Grid Load and Energy Management Challenges

Large-scale deployment of DC fast chargers puts pressure on existing grid infrastructure, requiring modernization and integration with renewable energy sources to maintain stability.

Opportunities

- Integration with Renewable Energy

The rise of solar, wind, and battery storage solutions offers opportunities to make EV fast charging greener and more cost-effective. - Smart Charging & Vehicle-to-Grid (V2G)

Advanced features like AI-driven energy management, predictive maintenance, and V2G systems will enhance efficiency and open new revenue streams for charging operators.

EV DC Fast Charger Market Segment Analysis

By Type

- CHAdeMO – Expected to grow at the highest CAGR due to compatibility with multiple EV brands and quick charging capabilities.

- SAE Combo Charging System (CCS) – Gaining dominance in Europe and North America due to regulatory push and automaker adoption.

- Supercharger – Proprietary to Tesla, expanding rapidly but limited to Tesla ecosystem (with gradual opening for other EVs in select regions).

By Charging Power

- Below 100 kW – Suitable for urban setups, but adoption is slowing compared to higher-capacity systems.

- 100–200 kW – Leading segment, balancing cost efficiency with rapid charging, widely deployed in highways and commercial hubs.

- Above 200 kW – Emerging as the fastest-growing category, catering to next-gen EVs with larger battery capacities.

By End User

- Home Charging Units – Limited adoption due to high cost and infrastructure requirements.

- Public Charging Stations – Dominant segment, driven by highway networks, city hubs, and fleet electrification projects.

EV DC Fast Charger Market Regional Insights

- Asia-Pacific – The largest and fastest-growing region, led by China, Japan, and India. Government initiatives, EV subsidies, and rapid urbanization fuel demand. China’s push for EV infrastructure underpins regional leadership.

- Europe – Strong growth driven by EU’s Green Deal, aggressive carbon neutrality targets, and automaker partnerships with charging providers.

- North America – Significant growth due to U.S. federal investments in EV corridors and Tesla’s expanding Supercharger network.

- Latin America & Middle East – Emerging adoption, supported by renewable energy integration and initial government EV infrastructure projects.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/75599/

EV DC Fast Charger Market Competitive Landscape

The market is highly competitive, with global tech giants, automakers, and specialized charging solution providers vying for market share. Companies are focusing on innovation, partnerships, and regional expansion to strengthen their position.

Key Players

- Tesla Motors, Inc.

- Siemens AG

- Bosch Automotive Service Solutions Inc.

- ABB Ltd.

- BYD Auto

- Alfen N.V.

- Allego B.V.

- NEC Corporation

- Tritium Pty Ltd

- Circontrol

- DBT

- Signet EV

- Schneider Electric

- Efacec Electric Mobility

- GS Yuasa Corporation

- Nichicon Corporation

- XCharge

- YKCharge

- China Southern Power Grid

- Energy Absolute

- Star Charge

- BTC Power

EV DC Fast Charger Market Key Developments

- Tesla (2025) – Expanding Supercharger network to support non-Tesla EVs in Europe and North America.

- ABB (2024) – Launched ultra-fast chargers above 350 kW to serve next-generation EVs.

- India (2025) – Government partnerships with Siemens and Tata Power to deploy high-speed charging stations on national highways.

- China (2024) – China Southern Power Grid accelerated installation of high-capacity DC chargers across major urban centers.

EV DC Fast Charger Market Key Highlights

- Market size in 2024: USD 830.77 Mn

- Forecast market size by 2032: USD 1673.68 Mn

- CAGR (2025–2032): 9.15%

- Segmentation: By Type, Charging Power, End User, and Region

- Key Regions: Asia-Pacific, Europe, North America

- Competitive Landscape: Includes Tesla, Siemens, ABB, Bosch, BYD, and Tritium

Conclusion

The EV DC Fast Charger Market is entering a rapid growth phase, driven by global EV adoption, environmental policies, and technological advancements. While high infrastructure costs and grid challenges remain, the integration of smart charging, renewable energy, and next-generation high-power solutions present massive opportunities. Asia-Pacific leads the market, but Europe and North America are catching up with large-scale government and private sector investments.