Heavy Duty Engines Market Size, Growth, Trends and Forecast 2025–2032

Heavy Duty Engines Market Overview

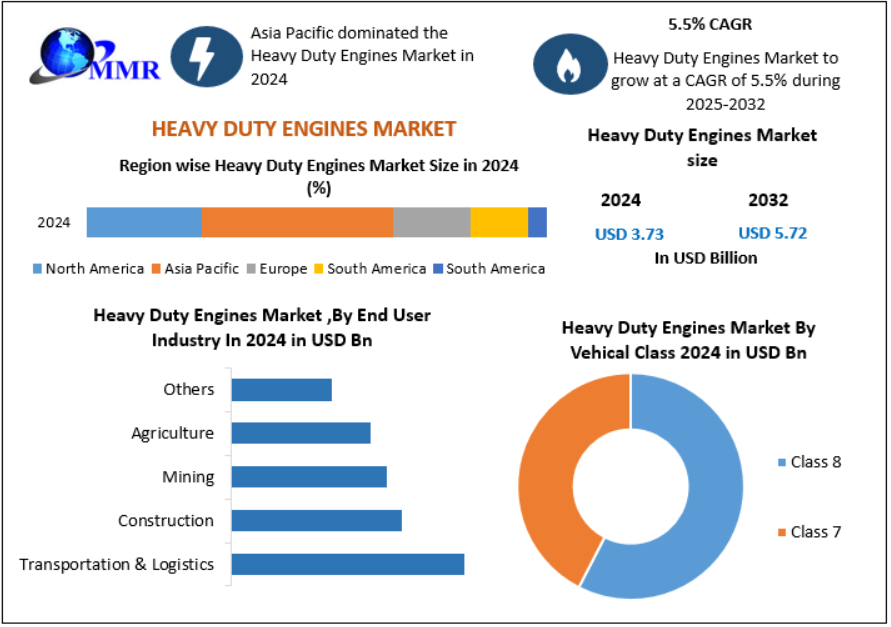

The Heavy Duty Engines Market was valued at USD 3.73 billion in 2024, and the total revenue is expected to grow at a CAGR of 5.5% from 2025 to 2032, reaching nearly USD 5.72 billion by 2032.

Heavy duty engines power trucks, construction machinery, mining vehicles, and agricultural equipment, serving as a backbone for industries reliant on freight and infrastructure development. Market growth is primarily driven by the rising demand for heavy-duty trucks in logistics and construction applications, alongside technological advancements such as Advanced Driver Assistance Systems (ADAS) integration.

Despite temporary setbacks caused by the COVID-19 pandemic, which disrupted supply chains and reduced demand in 2022, the market has rebounded strongly, supported by infrastructure investments, energy-efficient construction trends, and rising freight movement worldwide.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/124930/

Heavy Duty Engines Market Dynamics

Drivers

- Infrastructure and Logistics Growth

Increasing investments in infrastructure, freight transport, and construction projects are driving demand for heavy-duty trucks, thereby boosting engine sales. - Technological Advancements

Adoption of ADAS, IoT-based sensors, and fuel efficiency technologies is attracting fleet operators focused on safety and operational optimization. - Energy-Efficient Construction Trends

Global spending on energy-efficient buildings rose by 3% in 2022 to USD 152 billion, indirectly driving demand for heavy-duty vehicles and engines used in construction.

Restraints

- Fuel Consumption & Efficiency Concerns

High operating costs due to fuel inefficiency limit wider adoption in cost-sensitive markets. - Supply Chain Disruptions

The lingering effects of COVID-19 and global trade restrictions continue to pressure manufacturing and distribution networks.

Opportunities

- Decarbonization Initiatives

Growing government and industry focus on low-emission and energy-efficient heavy-duty vehicles is expected to spur innovation and demand for advanced engines. - Emerging Markets Growth

Rapid urbanization and industrial expansion in Asia Pacific, Africa, and Latin America present significant opportunities for market penetration.

Heavy Duty Engines Market Segmentation Analysis

By Vehicle Class

- Class 7 – Accounted for over 20% of total volume in 2024. Valued for mobility, fuel efficiency, and integration of smart technologies. For example, Mack Trucks launched its MD7 medium-duty model in 2022 with enhanced safety and uptime technologies.

- Class 8 – Expected to grow at 5.8% CAGR through 2032, widely used in transportation trucks, agricultural machinery, and construction vehicles due to high torque delivery for heavy loads.

- Surface Haul Trucks & Articulated Dump Trucks – Significant in mining and construction applications.

By Horsepower

- Below 400 HP – Expected to grow at 3.5% CAGR, driven by fuel efficiency and low operational cost.

- 400–500 HP – Preferred in medium freight transport vehicles.

- 500–600 HP – Strong growth forecast, supported by demand in heavy freight and construction machinery.

- Above 600 HP – Specialized engines for mining trucks and high-capacity construction vehicles.

By End-Use Industry

- Transportation & Logistics – Largest consumer segment, fueled by the need for heavy trucks in freight.

- Construction – Driven by global infrastructure investment.

- Mining & Agriculture – Increasing mechanization and heavy-duty equipment adoption.

- Others – Including defense and industrial applications.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/124930/

Heavy Duty Engines Market Regional Insights

- Asia Pacific – Expected to grow at ~6% CAGR during the forecast period, led by China, India, Japan, and Indonesia, supported by rapid urbanization and a booming construction sector.

- North America – A major growth hub, with heavy-duty trucks transporting over 60% of freight. By 2032, the regional market is projected to exceed USD 14.5 billion. Presence of key OEMs like Kenworth, Freightliner, and Mack Trucks strengthens the region’s market.

- Europe – Focus on fuel efficiency, decarbonization policies, and smart vehicle integration is accelerating adoption of advanced heavy-duty engines.

- Middle East & Africa – Growth driven by oil & gas, mining, and large-scale infrastructure projects.

- South America – Brazil and Argentina showing steady demand for agricultural and construction machinery engines.

Heavy Duty Engines Market Competitive Landscape

The market is highly competitive, featuring global OEMs, engine specialists, and regional players. Strategies include technological innovation, product launches, partnerships, and expansion into emerging markets.

Key Players

- Caterpillar Inc.

- Cummins Inc.

- Volvo Group

- Komatsu Ltd.

- PACCAR (Kenworth, Peterbilt)

- Detroit Diesel

- Mack Trucks

- Mercedes-Benz

- Navistar

- Isuzu Motors Ltd.

- Hino Motors Ltd.

- Perkins Engines Company Limited

- Weichai Power Co. Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Scania AB (Volkswagen Group)

- Rolls-Royce Power Systems AG

- Deere & Company (John Deere)

- Liebherr Group

- YANMAR HOLDINGS CO. LTD.

- Ashok Leyland Ltd.

- Deutz AG

- Doosan Infracore

- China Yuchai International Limited

- MAN SE

- Tata Motors

- FPT Industrial (Fiat Group)

- SINOTRUK

Heavy Duty Engines Market Key Highlights

- Market size in 2024: USD 3.73 Bn

- Market size in 2032: USD 5.72 Bn

- CAGR (2025–2032): 5.5%

- Key Growth Driver: Infrastructure investment & freight expansion

- Fastest Growing Region: Asia Pacific (~6% CAGR)

- Major Players: Caterpillar, Cummins, Volvo, PACCAR, Scania, MAN, Tata Motors

Conclusion

The Heavy Duty Engines Market is set for steady growth as industries worldwide invest in infrastructure, logistics, and construction. With Class 8 trucks leading adoption and Asia-Pacific emerging as the fastest-growing region, the market is expected to reach nearly USD 6 billion by 2032.

While fuel efficiency concerns persist, technological advancements, ADAS integration, and decarbonization policies will drive innovation and strengthen long-term demand. Global OEMs like Caterpillar, Cummins, Volvo, and PACCAR are positioned to lead the market through advanced engine designs and sustainable powertrain solutions.