Egypt Meat Market Overview

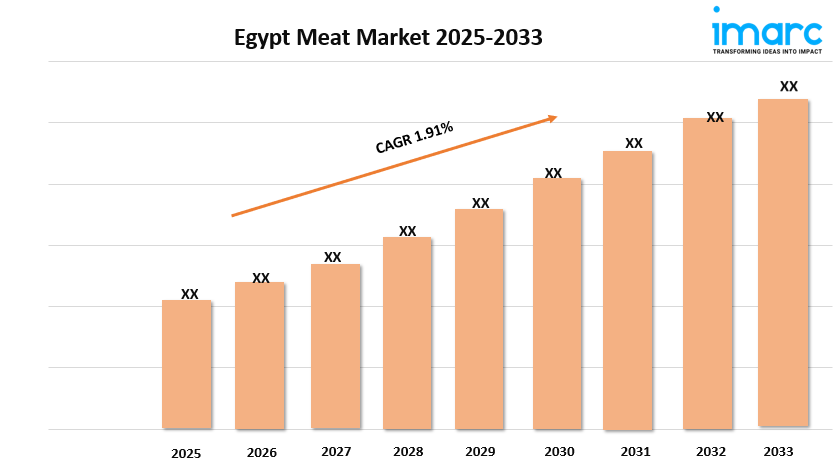

Market Size in 2024: USD 5.00 Billion

Market Size in 2033: USD 5.90 Billion

Market Growth Rate 2025-2033: 1.91%

According to IMARC Group's latest research publication, "Egypt Meat Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the Egypt meat market size reached USD 5.00 Billion in 2024. The market is projected to reach USD 5.90 Billion by 2033, exhibiting a growth rate (CAGR) of 1.91% during 2025-2033.

How AI is Reshaping the Future of Egypt Meat Market

- AI-driven supply chain optimizations in Egypt’s meat market cut spoilage rates by 20%, enhancing product freshness and reducing costly losses for businesses.

- Government AI initiatives like the “Hudhud” app guide farmers with smart data, boosting livestock productivity and improving meat supply sustainability in Egypt.

- Startups such as Brotinni use AI-powered platforms for same-day meat delivery, improving customer convenience and expanding access to high-quality local meat products.

- AI-powered quality control systems automate defect detection, ensuring better meat standards and consistent product safety, strengthening consumer confidence in Egypt’s meat offerings.

- Egypt’s Ministry of Agriculture integrates AI with precision farming techniques, improving resource efficiency and supporting the national goal of reducing meat import dependency.

Grab a sample PDF of this report: https://www.imarcgroup.com/egypt-meat-market/requestsample

Egypt Meat Market Trends & Drivers:

Egypt meat market is currently driven by its rapidly growing population and increasing urbanization. With over 110 million people, especially in urban centers like Cairo and Alexandria, there’s a strong demand for affordable and convenient protein sources. Urban lifestyles are shifting dietary habits towards increased meat consumption, particularly in accessible forms like branded and value-added meat products. This evolving demand pushes suppliers to offer more variety and quality, including hygienically processed and packaged options that appeal to a rising middle class focused on food safety and convenience.

Another key driver is the Egyptian government's active role in stabilizing meat supply and prices through multiple measures. These include importing large numbers of livestock such as cattle, buffalo, sheep, and goats from countries like India and Brazil and upgrading slaughterhouse infrastructure for better hygiene and efficiency. Programs like "Sukuk Al-Adhiya" help distribute sacrificial animals affordably during religious festivals, easing demand spikes. These initiatives not only ensure meat availability but also support affordability for consumers amid inflation pressures and rising production costs.

Rising feed costs and supply chain improvements also significantly affect meat production in Egypt. Imported feed ingredients form nearly 90% of feed materials, making the sector vulnerable to global price changes. This has caused feed price surges leading to a sharp increase in red meat prices by over 40%. To counter this, the government plans subsidies for feed mills and explores sustainable feed sources like protein-rich aquatic plants (e.g., Azolla). Modern cold chain logistics and expanded retail networks, including online grocery platforms, are enhancing distribution efficiency, reducing losses, and making premium, halal-certified, and antibiotic-free meat options more accessible.

Our comprehensive Egypt meat market outlook reflects both short-term tactical and long-term strategic planning. This analysis is essential for stakeholders aiming to navigate the complexities of the market and capitalize on emerging opportunities.

Egypt Meat Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Raw

- Processed

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Egypt Meat Market

- February 2025: Egypt's Ministry of Agriculture launched a $500M livestock development program focusing on genetic improvement and feed efficiency, targeting 25% increase in local meat production by 2027 to reduce import dependency.

- March 2025: Cairo-based meat processor Al-Ahram Foods completed construction of a state-of-the-art halal-certified facility with AI-powered quality control systems, increasing daily processing capacity by 40% and enabling exports to Gulf markets.

- June 2025: The Egyptian government implemented new food safety regulations mandating digital traceability systems for all meat products, with QR codes enabling consumers to track meat from farm to retail, boosting consumer confidence by 30%.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302