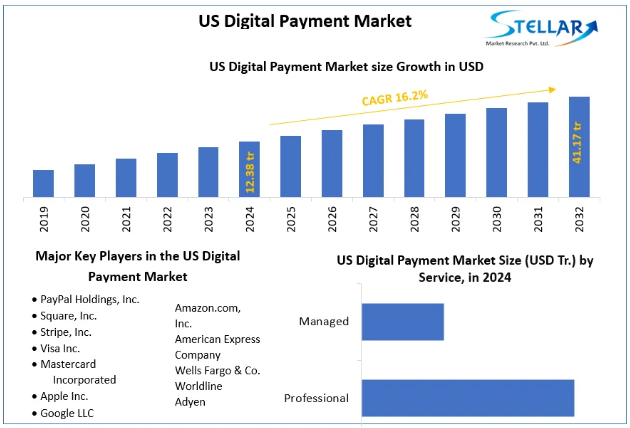

US Digital Payment Market size was valued at USD 12.38 trillion in 2024 and the total US Digital Payment revenue is expected to grow at a CAGR of 16.2% from 2025 to 2032, reaching nearly USD 41.17 trillion.

Market Estimation & Definition

The US Digital Payment Market was valued at USD 12.38 trillion in 2024. It is expected to grow at a compound annual growth rate (CAGR) of 16.2% from 2025 to 2032, reaching approximately USD 41.17 trillion by the end of the forecast period.

Digital payments are defined as transactions carried out electronically through platforms such as digital wallets, bank cards, net banking, point of sale (POS) systems, payment gateways, processing solutions, and fraud management systems. These methods replace traditional cash‐based or paper transactions with secure, fast, and convenient electronic alternatives.

Request your sample copy of this report now! https://www.stellarmr.com/report/req_sample/US-Digital-Payment-Market/1575

Market Growth Drivers & Opportunities

Key Growth Drivers:

-

Convenience & efficiency – Digital payments offer faster, smoother transactions compared to cash and checks, making them highly appealing to consumers and businesses alike.

-

Smart device adoption – Rising smartphone penetration and improved internet connectivity are expanding access to digital payment methods.

-

Security enhancements – Features like tokenization, encryption, and two-factor authentication are increasing trust and adoption rates.

-

E-commerce expansion – The growth of online retail and omni-channel business models is fueling digital payment demand across industries.

Opportunities:

-

Digital wallets: Already the leading mode in 2024 with about 35% share, wallets are expected to continue outpacing other modes in adoption and innovation.

-

SME-focused solutions: Small and medium enterprises often lack affordable infrastructure. Simplified, low-cost solutions for this segment could gain significant traction.

-

Security & fraud prevention: Rising transaction volumes bring higher risks. Providers offering advanced fraud detection and secure systems stand to benefit.

-

Cloud deployment: As businesses prioritize scalability and cost-efficiency, cloud-based payment solutions are expected to see accelerated adoption.

Challenges:

-

Limited access in certain populations due to device or internet gaps.

-

Ongoing concerns about data privacy and cybersecurity.

-

Infrastructure disparities across regions and demographics.

Segmentation Analysis

The market is segmented across multiple dimensions:

1. Mode of Payment

-

Bank Cards

-

Digital Wallets (dominant, fastest-growing)

-

Point of Sale (POS)

-

Net Banking

2. Solution vs. Service

-

Solutions: Payment gateway, processing, fraud management, security.

-

Services: Professional services, managed services.

3. Organization Size

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

4. Deployment Mode

-

Cloud

-

On-premises

5. Industry Verticals

-

Banking, Financial Services & Insurance (BFSI)

-

Healthcare

-

IT & Telecom

-

Retail & E-commerce

-

Transportation

Digital wallets, fraud management solutions, cloud deployment, and SME-focused offerings are projected to be the most dynamic growth areas.

For additional insights into this study, please refer to: https://www.stellarmr.com/report/US-Digital-Payment-Market/1575

Country-Level Focus: United States

The United States dominates the market both in value and innovation. Digital wallets are now the most widely used payment method, reflecting consumer preference for speed, ease, and mobile-first convenience. Large enterprises are investing heavily in advanced processing and security solutions, while SMEs are gradually adopting simplified, cost-effective systems.

Although the report focuses on the U.S., global trends indicate that other regions such as Europe and Asia are also witnessing rapid adoption. The U.S. growth rate of 16.2% remains one of the highest among developed markets.

Competitor Analysis

Major players shaping the US digital payment market include:

-

PayPal Holdings, Inc.

-

Square, Inc.

-

Stripe, Inc.

-

Visa Inc.

-

Mastercard Incorporated

-

Apple Inc.

-

Google LLC

-

Amazon.com, Inc.

-

American Express Company

-

Wells Fargo & Co.

-

Worldline

-

Adyen

Comparative Strengths:

-

Incumbents (Visa, Mastercard, Amex): Strong global networks, deep trust, established infrastructure.

-

Technology firms (Apple, Google, Amazon): Ecosystem integration, digital wallet leadership, consumer loyalty.

-

Specialists (Stripe, Square, PayPal): Innovation in online payments, SME solutions, developer-friendly APIs.

Competition is intensifying as incumbents expand into new technology-driven services and fintech players scale rapidly with niche innovations. Partnerships, ecosystem integrations, and trust-building around security are expected to shape the competitive landscape.

Uncover Trending Topics :

Foldable Smartphone Market https://www.stellarmr.com/report/Foldable-Smartphone-Market/1632

Maritime Sector Market https://www.stellarmr.com/report/Maritime-Sector-Market/1855

Conclusion

The US Digital Payment Market is entering a high-growth phase, with market value projected to more than triple between 2024 and 2032. Key growth is being driven by consumer demand for speed and convenience, the expansion of e-commerce, and rising smartphone adoption.

Digital wallets are set to lead the charge, supported by advanced fraud prevention systems and cloud-based solutions that enhance scalability and affordability. SMEs and underserved business segments present major opportunities for providers who can deliver low-cost, secure, and simple solutions.

With both established players and disruptive fintech firms competing, the winners will be those who can deliver seamless, secure, and trusted user experiences while scaling rapidly across industries and demographics.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656