Market Estimation & Definition

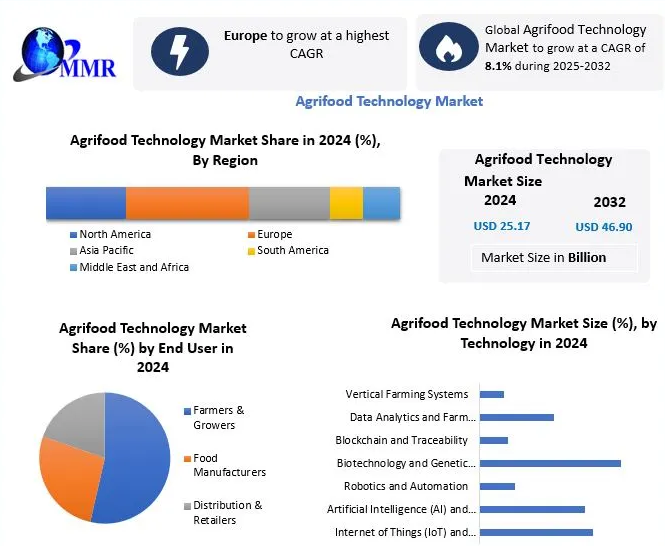

The Agrifood Technology Market was valued at USD 25.17 billion in 2024 and is projected to grow at a CAGR of 8.1% between 2025 and 2032, reaching approximately USD 46.90 billion by the end of the forecast period.

Agrifood technology refers to the application of advanced technologies and innovations across agriculture and food production value chains. These encompass tools and approaches that enhance productivity, efficiency, stability, food safety, transparency, and sustainability—ranging from seed and crop management, resource optimization, food processing, packaging, traceability, and automation.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/211686/

Market Growth Drivers & Opportunity

The market is being propelled by several key factors:

-

Rising global food demand and shrinking resources. With increasing populations, limited arable land, water scarcity, and climate pressures, farmers and food processors are adopting more efficient, data-driven, and resilient technologies.

-

Labor shortages in agriculture. Automation, robotics, sensors, and AI tools are filling workforce gaps and improving operational efficiency.

-

Traceability, safety, and sustainability demands. Consumers and regulators insist on food quality and supply chain transparency, driving adoption of blockchain, IoT, biotechnology, and monitoring systems.

-

Government incentives. Subsidies, supportive policies, and R&D investment are accelerating technological adoption.

Opportunities exist particularly in emerging economies where agritech adoption is still at an early stage. Investments in vertical and urban farming, advanced manufacturing, and smart food processing systems offer strong potential.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/211686/

What Lies Ahead: Emerging Trends Shaping the Future

-

Precision farming & smart processing. Wider use of AI, IoT, robotics, and automated packaging to monitor environmental factors and optimize resources.

-

Blockchain for supply chain trust. Increasing reliance on distributed ledger systems to ensure traceability and authenticity from farm to table.

-

Biotechnology & genetic engineering. Development of crops with enhanced resistance to pests, drought, and climate stress to protect yields.

-

Urban & vertical farming. Controlled-environment agriculture is expected to rise as cities look to meet food demand while land availability shrinks.

Segmentation Analysis

-

By Industry (End Use): Animal, Agriculture, Cold Chain, Food & Beverage, Others. The Agriculture segment dominated with around 42% market share in 2024, fueled by precision farming technologies, sensors, and AI-based crop monitoring.

-

By Technology: Internet of Things & Sensors; Artificial Intelligence & Machine Learning; Robotics & Automation; Biotechnology & Genetic Engineering; Blockchain & Traceability; Data Analytics & Farm Management Software; Vertical Farming Systems.

-

By End-User: Farmers & Growers; Food Manufacturers; Distributors & Retailers. These groups reflect where technology integration delivers the most value.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/211686/

Country-Level Analysis: USA & Germany

-

United States: A global leader, the U.S. has robust infrastructure, strong R&D capacity, and major players in autonomous machinery, AI-driven crop management, and robotics. The presence of large-scale farms further supports widespread adoption of agrifood technologies.

-

Germany: Germany is recognized as a hub for agrifood innovation and patents in Europe. With strong research networks and early adoption culture, German companies are prominent in biotechnology, digital farming, and precision agriculture, helping Europe maintain technological leadership.

Competitive Analysis

The market is shaped by global players such as BASF SE, Yara International ASA, CNH Industrial N.V., John Deere, and Trimble Inc.

-

Strengths: Heavy R&D investment, global footprints, strong innovation pipelines, and the ability to provide integrated solutions that combine hardware, software, and services.

-

Challenges: High upfront investment costs, regulatory complexities, and lack of infrastructure in some regions. Adoption barriers remain for smaller farmers due to limited technical know-how and affordability issues.

-

Comparative positioning: BASF SE is strong in biotechnology and crop protection; John Deere and CNH Industrial lead in precision farming machinery; Yara International focuses on digital solutions for fertilizer optimization. Strategic partnerships and acquisitions are expanding portfolios and market reach.

Conclusion

The Agrifood Technology Market is entering a transformative growth phase through 2032, driven by global challenges such as food security, resource scarcity, and climate change. Advances in AI, IoT, robotics, biotechnology, and blockchain are creating opportunities for farmers, food manufacturers, and supply chain stakeholders to operate more efficiently, sustainably, and transparently.

For investors and policymakers, the message is clear: this sector presents an urgent opportunity to invest in solutions that ensure future food security. The U.S. and Germany serve as models of how strong infrastructure and R&D can accelerate adoption, while emerging economies represent the next frontier for scalable and affordable agritech solutions.

As technologies converge and adoption accelerates, companies that deliver integrated, sustainable, and adaptive solutions will shape the future of global agriculture and food production.

About Us