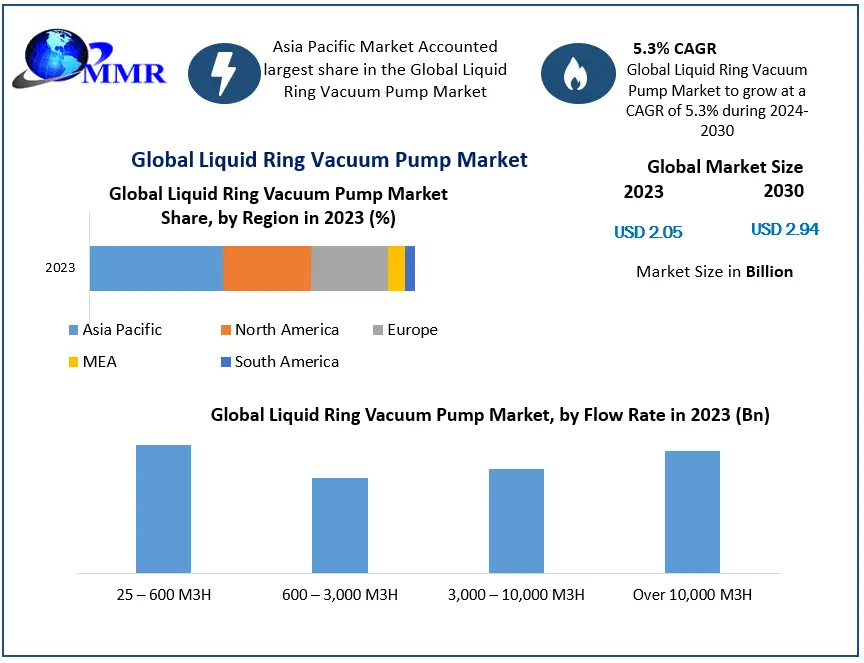

Liquid Ring Vacuum Pump Market Size To Grow At A CAGR Of 5.3% In The Forecast Period Of 2024-2030

Liquid Ring Vacuum Pump Market, valued at USD 2.05 billion in 2023, is projected to reach USD 2.94 billion by 2030, expanding at a Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period. This steady growth is driven by rising demand from chemical processing, power generation, food & beverage, and pharmaceutical industries, along with increasing emphasis on environmental compliance and energy efficiency.

Request Free Sample Report:

https://www.maximizemarketresearch.com/request-sample/221378/

Market Estimation, Growth Drivers & Opportunities

The liquid ring vacuum pump market is gaining traction due to its ability to handle wet, saturated gases and its relatively simple and durable design. These pumps operate with fewer moving parts and are ideal for applications involving vapor recovery, gas compression, and vacuum distillation.

Key Growth Drivers:

Industrial Expansion: The global rise in petrochemical, food processing, and pharmaceutical industries is creating significant demand for liquid ring vacuum pumps, which are critical to multiple production and handling processes.

Energy Efficiency and Sustainability: Increasing focus on energy conservation and environmentally friendly operations is boosting the use of vacuum systems that consume less power and water.

Strict Environmental Regulations: Governments worldwide are enforcing stricter pollution control norms, especially in the chemical and oil & gas sectors, driving adoption of emission-reducing technologies like vacuum pumps.

Technological Upgradation: Innovations such as smart vacuum pumps with IoT-enabled features for real-time monitoring and predictive maintenance are opening up new avenues for market growth.

Opportunities also lie in the development of corrosion-resistant pumps for aggressive fluids, high-vacuum systems for electronics and semiconductor manufacturing, and eco-friendly pumps that reduce water usage.

U.S. Market: 2024 Trends and Investment

In 2024, the U.S. market witnessed accelerated demand for liquid ring vacuum pumps due to rising investment in energy infrastructure, petrochemical processing, and wastewater treatment. The Environmental Protection Agency’s push for improved flare gas recovery systems has further fueled installations in refineries and chemical plants.

American manufacturers are focusing on digitally integrated pump systems that offer real-time diagnostics, remote performance monitoring, and enhanced energy optimization. Investments in clean technology and infrastructure modernization—particularly in oil refineries and chemical plants—have reinforced the U.S. position as a key market for high-capacity, low-maintenance vacuum systems.

Market Segmentation – Leading Share Holders

According to the latest market analysis, the following segments hold the largest shares in their respective categories:

By Type: The single-stage liquid ring vacuum pump segment leads the market due to its simplicity, lower cost, and suitability for a wide range of general industrial applications.

By Material: Cast iron vacuum pumps dominate the material segment owing to their cost-effectiveness and widespread use in applications that do not require high corrosion resistance.

By Application: The chemical processing industry holds the largest share due to the necessity of vacuum systems in operations such as distillation, solvent recovery, and vapor handling.

Competitive Analysis – Top 5 Companies

The global liquid ring vacuum pump market is moderately consolidated with several key players dominating the space. The top five companies include:

Atlas Copco

Atlas Copco remains a global leader, offering high-performance liquid ring vacuum pumps with advanced water-saving and energy-efficient features. Recent expansions in Asia-Pacific and new product lines focused on IoT integration and remote monitoring have bolstered their market position.

Flowserve Corporation

A U.S.-based industrial equipment giant, Flowserve continues to focus on improving energy efficiency and system reliability. The company has expanded its vacuum pump portfolio to include models tailored for environmentally sensitive applications in the chemical and power sectors.

Busch Vacuum Solutions

Headquartered in Germany, Busch has a strong global footprint and offers a comprehensive range of vacuum systems. The company is investing in connected technologies, with new product launches aimed at predictive maintenance and automated system diagnostics.

Graham Corporation

Specializing in engineered vacuum and heat transfer systems, Graham Corporation remains a strong player in refineries and petrochemical markets. Their focus on custom-designed systems for complex industrial applications keeps them at the forefront of innovation.

Dekker Vacuum Technologies

Known for durable and efficient systems, Dekker continues to deliver vacuum pumps with reduced water consumption and maintenance requirements. Their Titan series and Vmax product lines are especially popular in food processing and pharmaceutical sectors.

These companies are competing through product innovation, regional expansion, and strategic investments aimed at aligning with sustainability trends and digital transformation.

Regional Analysis – USA, UK, Germany, France, Japan, China

USA: The U.S. leads the North American market with a significant share, driven by industrial automation, regulatory mandates for emissions control, and advancements in chemical processing technologies.

UK: The UK market benefits from modernization of manufacturing and growing investments in clean energy sectors, where vacuum pumps are essential for gas handling and processing.

Germany: As a hub of engineering and chemical manufacturing, Germany continues to drive demand for high-precision and efficient vacuum systems, aided by government support for Industry 4.0.

France: France’s strong pharmaceutical and food processing sectors are fueling demand for hygienic and corrosion-resistant vacuum systems.

Japan: With a strong focus on innovation and quality, Japan remains a top adopter of smart, compact, and energy-saving vacuum pumps, especially in electronics and automotive industries.

China: Rapid industrialization and the ongoing expansion of chemical, power, and food sectors have positioned China as one of the fastest-growing markets for liquid ring vacuum pumps. Government initiatives supporting green manufacturing are further propelling market growth.

Conclusion and Strategic Outlook

The global liquid ring vacuum pump market is poised for robust growth driven by sustainability, energy efficiency, and the digitization of industrial operations. The increasing integration of vacuum systems into critical applications, from gas recovery to pharmaceutical processing, underscores their strategic importance.

Related report:

Cybersecurity mesh market:

https://www.maximizemarketresearch.com/market-report/cybersecurity-mesh-market/200224/

Application performance monitoring market:

https://www.maximizemarketresearch.com/market-report/application-performance-monitoring-market/200134/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

[email protected]Liquid Ring Vacuum Pump Market Size To Grow At A CAGR Of 5.3% In The Forecast Period Of 2024-2030

Liquid Ring Vacuum Pump Market, valued at USD 2.05 billion in 2023, is projected to reach USD 2.94 billion by 2030, expanding at a Compound Annual Growth Rate (CAGR) of 5.3% during the forecast period. This steady growth is driven by rising demand from chemical processing, power generation, food & beverage, and pharmaceutical industries, along with increasing emphasis on environmental compliance and energy efficiency.

Request Free Sample Report:https://www.maximizemarketresearch.com/request-sample/221378/

Market Estimation, Growth Drivers & Opportunities

The liquid ring vacuum pump market is gaining traction due to its ability to handle wet, saturated gases and its relatively simple and durable design. These pumps operate with fewer moving parts and are ideal for applications involving vapor recovery, gas compression, and vacuum distillation.

Key Growth Drivers:

Industrial Expansion: The global rise in petrochemical, food processing, and pharmaceutical industries is creating significant demand for liquid ring vacuum pumps, which are critical to multiple production and handling processes.

Energy Efficiency and Sustainability: Increasing focus on energy conservation and environmentally friendly operations is boosting the use of vacuum systems that consume less power and water.

Strict Environmental Regulations: Governments worldwide are enforcing stricter pollution control norms, especially in the chemical and oil & gas sectors, driving adoption of emission-reducing technologies like vacuum pumps.

Technological Upgradation: Innovations such as smart vacuum pumps with IoT-enabled features for real-time monitoring and predictive maintenance are opening up new avenues for market growth.

Opportunities also lie in the development of corrosion-resistant pumps for aggressive fluids, high-vacuum systems for electronics and semiconductor manufacturing, and eco-friendly pumps that reduce water usage.

U.S. Market: 2024 Trends and Investment

In 2024, the U.S. market witnessed accelerated demand for liquid ring vacuum pumps due to rising investment in energy infrastructure, petrochemical processing, and wastewater treatment. The Environmental Protection Agency’s push for improved flare gas recovery systems has further fueled installations in refineries and chemical plants.

American manufacturers are focusing on digitally integrated pump systems that offer real-time diagnostics, remote performance monitoring, and enhanced energy optimization. Investments in clean technology and infrastructure modernization—particularly in oil refineries and chemical plants—have reinforced the U.S. position as a key market for high-capacity, low-maintenance vacuum systems.

Market Segmentation – Leading Share Holders

According to the latest market analysis, the following segments hold the largest shares in their respective categories:

By Type: The single-stage liquid ring vacuum pump segment leads the market due to its simplicity, lower cost, and suitability for a wide range of general industrial applications.

By Material: Cast iron vacuum pumps dominate the material segment owing to their cost-effectiveness and widespread use in applications that do not require high corrosion resistance.

By Application: The chemical processing industry holds the largest share due to the necessity of vacuum systems in operations such as distillation, solvent recovery, and vapor handling.

Competitive Analysis – Top 5 Companies

The global liquid ring vacuum pump market is moderately consolidated with several key players dominating the space. The top five companies include:

Atlas Copco

Atlas Copco remains a global leader, offering high-performance liquid ring vacuum pumps with advanced water-saving and energy-efficient features. Recent expansions in Asia-Pacific and new product lines focused on IoT integration and remote monitoring have bolstered their market position.

Flowserve Corporation

A U.S.-based industrial equipment giant, Flowserve continues to focus on improving energy efficiency and system reliability. The company has expanded its vacuum pump portfolio to include models tailored for environmentally sensitive applications in the chemical and power sectors.

Busch Vacuum Solutions

Headquartered in Germany, Busch has a strong global footprint and offers a comprehensive range of vacuum systems. The company is investing in connected technologies, with new product launches aimed at predictive maintenance and automated system diagnostics.

Graham Corporation

Specializing in engineered vacuum and heat transfer systems, Graham Corporation remains a strong player in refineries and petrochemical markets. Their focus on custom-designed systems for complex industrial applications keeps them at the forefront of innovation.

Dekker Vacuum Technologies

Known for durable and efficient systems, Dekker continues to deliver vacuum pumps with reduced water consumption and maintenance requirements. Their Titan series and Vmax product lines are especially popular in food processing and pharmaceutical sectors.

These companies are competing through product innovation, regional expansion, and strategic investments aimed at aligning with sustainability trends and digital transformation.

Regional Analysis – USA, UK, Germany, France, Japan, China

USA: The U.S. leads the North American market with a significant share, driven by industrial automation, regulatory mandates for emissions control, and advancements in chemical processing technologies.

UK: The UK market benefits from modernization of manufacturing and growing investments in clean energy sectors, where vacuum pumps are essential for gas handling and processing.

Germany: As a hub of engineering and chemical manufacturing, Germany continues to drive demand for high-precision and efficient vacuum systems, aided by government support for Industry 4.0.

France: France’s strong pharmaceutical and food processing sectors are fueling demand for hygienic and corrosion-resistant vacuum systems.

Japan: With a strong focus on innovation and quality, Japan remains a top adopter of smart, compact, and energy-saving vacuum pumps, especially in electronics and automotive industries.

China: Rapid industrialization and the ongoing expansion of chemical, power, and food sectors have positioned China as one of the fastest-growing markets for liquid ring vacuum pumps. Government initiatives supporting green manufacturing are further propelling market growth.

Conclusion and Strategic Outlook

The global liquid ring vacuum pump market is poised for robust growth driven by sustainability, energy efficiency, and the digitization of industrial operations. The increasing integration of vacuum systems into critical applications, from gas recovery to pharmaceutical processing, underscores their strategic importance.

Related report:

Cybersecurity mesh market:

https://www.maximizemarketresearch.com/market-report/cybersecurity-mesh-market/200224/

Application performance monitoring market:

https://www.maximizemarketresearch.com/market-report/application-performance-monitoring-market/200134/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

[email protected]