Ceramic Capacitor Market Size To Grow At A CAGR Of 5.9% In The Forecast Period Of 2025-2032

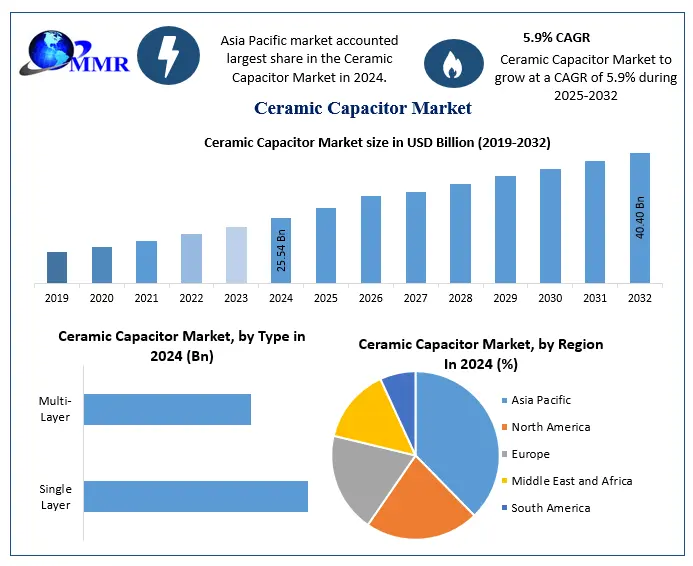

Ceramic capacitor market, valued at USD 25.54 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 5.9%, reaching approximately USD 40.40 billion by 2032. This growth is attributed to the increasing demand for compact, reliable, and high-performance components in various electronic applications.

Request free sample report:https://www.maximizemarketresearch.com/request-sample/250615/

Market Overview

Ceramic capacitors are electronic components that use ceramic materials as their dielectric. They are widely utilized due to their small size, reliability, and stability over time. These capacitors are integral in numerous electronic devices and systems, including smartphones, tablets, laptops, wearables, and automotive electronics.

Market Dynamics

Drivers:

Consumer Electronics: The proliferation of smartphones, tablets, and other portable devices has significantly increased the demand for compact and efficient capacitors.

Automotive Industry: The rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) necessitates the use of high-performance capacitors capable of withstanding harsh conditions.

Telecommunication: The expansion of 5G networks requires capacitors that can operate at higher frequencies and provide stable performance.

Industrial Applications: The growing automation and industrial equipment sectors demand capacitors that offer reliability and efficiency in various applications.

Restraints:

Manufacturing Challenges: The production of high-capacitance ceramic capacitors involves complex processes, including high-temperature sintering and precise layering techniques, which can increase manufacturing costs.

Market Competition: Intense competition among key players may lead to pricing pressures, affecting profitability.

Segmentation Analysis

By Type:

Multi-Layer Ceramic Capacitors (MLCCs): In 2024, MLCCs held the largest share of the ceramic capacitor market. Their high capacitance per unit volume, reliability, and efficiency make them suitable for various applications, including consumer electronics, automotive, telecommunications, and industrial equipment.

Single-Layer Ceramic Capacitors (SLCCs): SLCCs are typically used in less demanding applications where lower capacitance and voltage are sufficient.

By Application:

Consumer Electronics: The consumer electronics sector is the leading application area for ceramic capacitors, driven by the widespread use of smartphones, tablets, and other portable devices.

Automotive: The automotive industry, particularly the electric vehicle segment, requires capacitors that can withstand high temperatures and provide stable performance.

Telecommunication: The expansion of 5G networks necessitates capacitors capable of operating at higher frequencies and ensuring signal integrity.

Industrial Equipment: Industrial automation and equipment sectors demand capacitors that offer reliability and efficiency in various applications.

Regional Insights

Asia-Pacific: In 2024, the Asia-Pacific region led the ceramic capacitor manufacturing market, with countries such as China, Japan, and South Korea contributing significantly. The region's robust infrastructure, skilled workforce, and technological advancements in production methods have bolstered its dominance. Major manufacturers like Murata Manufacturing, Samsung Electro-Mechanics, Taiyo Yuden, and TDK Corporation are headquartered in this region, driving innovation and maintaining high-quality production standards.

North America and Europe: These regions are expected to witness steady growth in the ceramic capacitor market, driven by advancements in consumer electronics, automotive applications, and telecommunication infrastructure.

Competitive Landscape

The ceramic capacitor market is characterized by the presence of several key players, including:

Murata Manufacturing Co., Ltd.

TDK Corporation

Samsung Electro-Mechanics Co., Ltd.

Taiyo Yuden Co., Ltd.

Kyocera Corporation

Yageo Corporation

Walsin Technology Corporation

Rohm Co., Ltd.

Holy Stone Holdings Co., Ltd.

Nippon Chemi-Con Corporation

Viiyong

Dalicap Technology

Viking Tech

Fujian Torch Electron Technology Company

These companies are focusing on research and development to innovate and enhance the performance of ceramic capacitors, catering to the evolving demands of various industries.

Conclusion

The global ceramic capacitor market is poised for significant growth, driven by advancements in consumer electronics, automotive applications, and telecommunication infrastructure. As industries continue to demand compact, reliable, and high-performance components, the ceramic capacitor market is expected to expand, offering opportunities for manufacturers and stakeholders across the value chain.

Related report:

Cybersecurity mesh market:

https://www.maximizemarketresearch.com/market-report/cybersecurity-mesh-market/200224/

Application performance monitoring market:

https://www.maximizemarketresearch.com/market-report/application-performance-monitoring-market/200134/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

[email protected]

Ceramic capacitor market, valued at USD 25.54 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 5.9%, reaching approximately USD 40.40 billion by 2032. This growth is attributed to the increasing demand for compact, reliable, and high-performance components in various electronic applications.

Request free sample report:https://www.maximizemarketresearch.com/request-sample/250615/

Market Overview

Ceramic capacitors are electronic components that use ceramic materials as their dielectric. They are widely utilized due to their small size, reliability, and stability over time. These capacitors are integral in numerous electronic devices and systems, including smartphones, tablets, laptops, wearables, and automotive electronics.

Market Dynamics

Drivers:

Consumer Electronics: The proliferation of smartphones, tablets, and other portable devices has significantly increased the demand for compact and efficient capacitors.

Automotive Industry: The rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) necessitates the use of high-performance capacitors capable of withstanding harsh conditions.

Telecommunication: The expansion of 5G networks requires capacitors that can operate at higher frequencies and provide stable performance.

Industrial Applications: The growing automation and industrial equipment sectors demand capacitors that offer reliability and efficiency in various applications.

Restraints:

Manufacturing Challenges: The production of high-capacitance ceramic capacitors involves complex processes, including high-temperature sintering and precise layering techniques, which can increase manufacturing costs.

Market Competition: Intense competition among key players may lead to pricing pressures, affecting profitability.

Segmentation Analysis

By Type:

Multi-Layer Ceramic Capacitors (MLCCs): In 2024, MLCCs held the largest share of the ceramic capacitor market. Their high capacitance per unit volume, reliability, and efficiency make them suitable for various applications, including consumer electronics, automotive, telecommunications, and industrial equipment.

Single-Layer Ceramic Capacitors (SLCCs): SLCCs are typically used in less demanding applications where lower capacitance and voltage are sufficient.

By Application:

Consumer Electronics: The consumer electronics sector is the leading application area for ceramic capacitors, driven by the widespread use of smartphones, tablets, and other portable devices.

Automotive: The automotive industry, particularly the electric vehicle segment, requires capacitors that can withstand high temperatures and provide stable performance.

Telecommunication: The expansion of 5G networks necessitates capacitors capable of operating at higher frequencies and ensuring signal integrity.

Industrial Equipment: Industrial automation and equipment sectors demand capacitors that offer reliability and efficiency in various applications.

Regional Insights

Asia-Pacific: In 2024, the Asia-Pacific region led the ceramic capacitor manufacturing market, with countries such as China, Japan, and South Korea contributing significantly. The region's robust infrastructure, skilled workforce, and technological advancements in production methods have bolstered its dominance. Major manufacturers like Murata Manufacturing, Samsung Electro-Mechanics, Taiyo Yuden, and TDK Corporation are headquartered in this region, driving innovation and maintaining high-quality production standards.

North America and Europe: These regions are expected to witness steady growth in the ceramic capacitor market, driven by advancements in consumer electronics, automotive applications, and telecommunication infrastructure.

Competitive Landscape

The ceramic capacitor market is characterized by the presence of several key players, including:

Murata Manufacturing Co., Ltd.

TDK Corporation

Samsung Electro-Mechanics Co., Ltd.

Taiyo Yuden Co., Ltd.

Kyocera Corporation

Yageo Corporation

Walsin Technology Corporation

Rohm Co., Ltd.

Holy Stone Holdings Co., Ltd.

Nippon Chemi-Con Corporation

Viiyong

Dalicap Technology

Viking Tech

Fujian Torch Electron Technology Company

These companies are focusing on research and development to innovate and enhance the performance of ceramic capacitors, catering to the evolving demands of various industries.

Conclusion

The global ceramic capacitor market is poised for significant growth, driven by advancements in consumer electronics, automotive applications, and telecommunication infrastructure. As industries continue to demand compact, reliable, and high-performance components, the ceramic capacitor market is expected to expand, offering opportunities for manufacturers and stakeholders across the value chain.

Related report:

Cybersecurity mesh market:

https://www.maximizemarketresearch.com/market-report/cybersecurity-mesh-market/200224/

Application performance monitoring market:

https://www.maximizemarketresearch.com/market-report/application-performance-monitoring-market/200134/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

[email protected]

Ceramic Capacitor Market Size To Grow At A CAGR Of 5.9% In The Forecast Period Of 2025-2032

Ceramic capacitor market, valued at USD 25.54 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 5.9%, reaching approximately USD 40.40 billion by 2032. This growth is attributed to the increasing demand for compact, reliable, and high-performance components in various electronic applications.

Request free sample report:https://www.maximizemarketresearch.com/request-sample/250615/

Market Overview

Ceramic capacitors are electronic components that use ceramic materials as their dielectric. They are widely utilized due to their small size, reliability, and stability over time. These capacitors are integral in numerous electronic devices and systems, including smartphones, tablets, laptops, wearables, and automotive electronics.

Market Dynamics

Drivers:

Consumer Electronics: The proliferation of smartphones, tablets, and other portable devices has significantly increased the demand for compact and efficient capacitors.

Automotive Industry: The rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) necessitates the use of high-performance capacitors capable of withstanding harsh conditions.

Telecommunication: The expansion of 5G networks requires capacitors that can operate at higher frequencies and provide stable performance.

Industrial Applications: The growing automation and industrial equipment sectors demand capacitors that offer reliability and efficiency in various applications.

Restraints:

Manufacturing Challenges: The production of high-capacitance ceramic capacitors involves complex processes, including high-temperature sintering and precise layering techniques, which can increase manufacturing costs.

Market Competition: Intense competition among key players may lead to pricing pressures, affecting profitability.

Segmentation Analysis

By Type:

Multi-Layer Ceramic Capacitors (MLCCs): In 2024, MLCCs held the largest share of the ceramic capacitor market. Their high capacitance per unit volume, reliability, and efficiency make them suitable for various applications, including consumer electronics, automotive, telecommunications, and industrial equipment.

Single-Layer Ceramic Capacitors (SLCCs): SLCCs are typically used in less demanding applications where lower capacitance and voltage are sufficient.

By Application:

Consumer Electronics: The consumer electronics sector is the leading application area for ceramic capacitors, driven by the widespread use of smartphones, tablets, and other portable devices.

Automotive: The automotive industry, particularly the electric vehicle segment, requires capacitors that can withstand high temperatures and provide stable performance.

Telecommunication: The expansion of 5G networks necessitates capacitors capable of operating at higher frequencies and ensuring signal integrity.

Industrial Equipment: Industrial automation and equipment sectors demand capacitors that offer reliability and efficiency in various applications.

Regional Insights

Asia-Pacific: In 2024, the Asia-Pacific region led the ceramic capacitor manufacturing market, with countries such as China, Japan, and South Korea contributing significantly. The region's robust infrastructure, skilled workforce, and technological advancements in production methods have bolstered its dominance. Major manufacturers like Murata Manufacturing, Samsung Electro-Mechanics, Taiyo Yuden, and TDK Corporation are headquartered in this region, driving innovation and maintaining high-quality production standards.

North America and Europe: These regions are expected to witness steady growth in the ceramic capacitor market, driven by advancements in consumer electronics, automotive applications, and telecommunication infrastructure.

Competitive Landscape

The ceramic capacitor market is characterized by the presence of several key players, including:

Murata Manufacturing Co., Ltd.

TDK Corporation

Samsung Electro-Mechanics Co., Ltd.

Taiyo Yuden Co., Ltd.

Kyocera Corporation

Yageo Corporation

Walsin Technology Corporation

Rohm Co., Ltd.

Holy Stone Holdings Co., Ltd.

Nippon Chemi-Con Corporation

Viiyong

Dalicap Technology

Viking Tech

Fujian Torch Electron Technology Company

These companies are focusing on research and development to innovate and enhance the performance of ceramic capacitors, catering to the evolving demands of various industries.

Conclusion

The global ceramic capacitor market is poised for significant growth, driven by advancements in consumer electronics, automotive applications, and telecommunication infrastructure. As industries continue to demand compact, reliable, and high-performance components, the ceramic capacitor market is expected to expand, offering opportunities for manufacturers and stakeholders across the value chain.

Related report:

Cybersecurity mesh market:

https://www.maximizemarketresearch.com/market-report/cybersecurity-mesh-market/200224/

Application performance monitoring market:

https://www.maximizemarketresearch.com/market-report/application-performance-monitoring-market/200134/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

[email protected]

0 Bình luận

0 Chia sẻ

11065 Lượt xem