Writing Highlights

-

Manual tracking wastes time and lowers accuracy.

-

Consolidation improves audit readiness.

-

One file ensures cross-team clarity.

-

Deadlines reduce last-minute chaos.

-

Teams merge PDFs to pdf online to simplify workflows.

-

Consolidation speeds up reporting and reduces stress.

Version control is an ongoing issue for budget units and finance offices. As more than one individual works on budget documents that are frequently separated by time and space, the most current and correct version is hard to keep track of.

Miscommunication may easily occur when members refer to out-of-date files or develop parallel versions. This document sprawl causes inconsistent data, approval delays, and, in certain instances, wrong reporting that impacts higher-level financial decisions.

In order to avoid these problems, budget teams require effective strategies to streamline document workflows. Implementing easy tools and common habits that minimize version overlap, teams can keep accuracy intact, enhance collaboration, and eliminate expensive errors in financial planning.

Confusion from Multiple Versions: A Common Budgeting Headache

Budgeting usually involves contributions from multiple departments - each of which contributes its numbers, reasoning, and progress regularly. These inputs often pass along long email chains or are posted individually to shared drives. With no centralized way of managing revisions or summarizing updates, various versions of the same document end up circulating simultaneously, leading to confusion between the budget teams.

Misaligned Figures and Outdated Forecasts

When financial professionals try to assemble inputs from these fragmented documents, they frequently find themselves working with mismatched figures and inconsistencies. For instance, one department may have completed the update of operating expenses while another still works with obsolete cost projections. Such inconsistencies typically remain unresolved until the very last reviewing stage, by which time they have already distorted the accuracy and slowed the approvals.

The outcome is a cycle of second-guessing, double-checking, and backtracking to bring together numbers between departments. This doesn't only hamper reporting - it makes it more difficult to make accurate financial decisions based on current information.

The Price of Conflicting Approvals

The second problem is when leaders approve various drafts without knowing that updates have taken place. A manager may approve an older draft, not aware that key personnel have been altered since then. This breaks continuity during budget presentation, where approvals are doubted, and budget teams must explain which draft was reviewed.

Conflicting approvals can also lengthen reporting cycles, requiring teams to resubmit and rewrite documents. During hectic budgeting timeframes - like quarter-end planning - these delays have a major impact on progress.

Real Cost: Longer Hours, Lower Accuracy, Delayed Reporting

The cost of bad version control is frequently buried in the minutes spent by budget teams reviewing files, verifying data, and searching for the latest input. Version-related errors require additional explanation, add to meeting time, and increase the chances of failing to meet critical deadlines.

Finance teams that employ automated reconciliation solutions indicate a staggering 95% reduction in mistakes when compared with manual processes. This demonstrates the importance of version clarity - not only for data accuracy, but for time recovery and elimination of pointless back-and-forth.

Communication Breakdown Across Teams

Version coordination deficiencies also result in miscommunication across departments. With no file naming, timestamps, or change logs, teams can easily work on different versions without knowing. Misaligned assumptions during planning reviews cause delays in decision-making and redo efforts - even if all departments were working in good faith.

Audit Risk and Regulatory Exposure

For regulated organizations or those facing internal audit examinations, uneven documentation can be a flag-raiser. Without documented proof of document revisions, approval dates, and ownership, it becomes challenging to prove compliance or ensure decisions were made from accurate data.

Productivity Drag from Manual Processes

As soon as budget teams work with email attachments or local file folders, minor updates can confuse. Manual consolidation represents a point of maximum risk, leading to the possibility of oversight and resulting in duplication or stale material appearing in the final reports. Such an imbalance compounds, draining away time spent on strategic planning and financial analysis, and accrues.

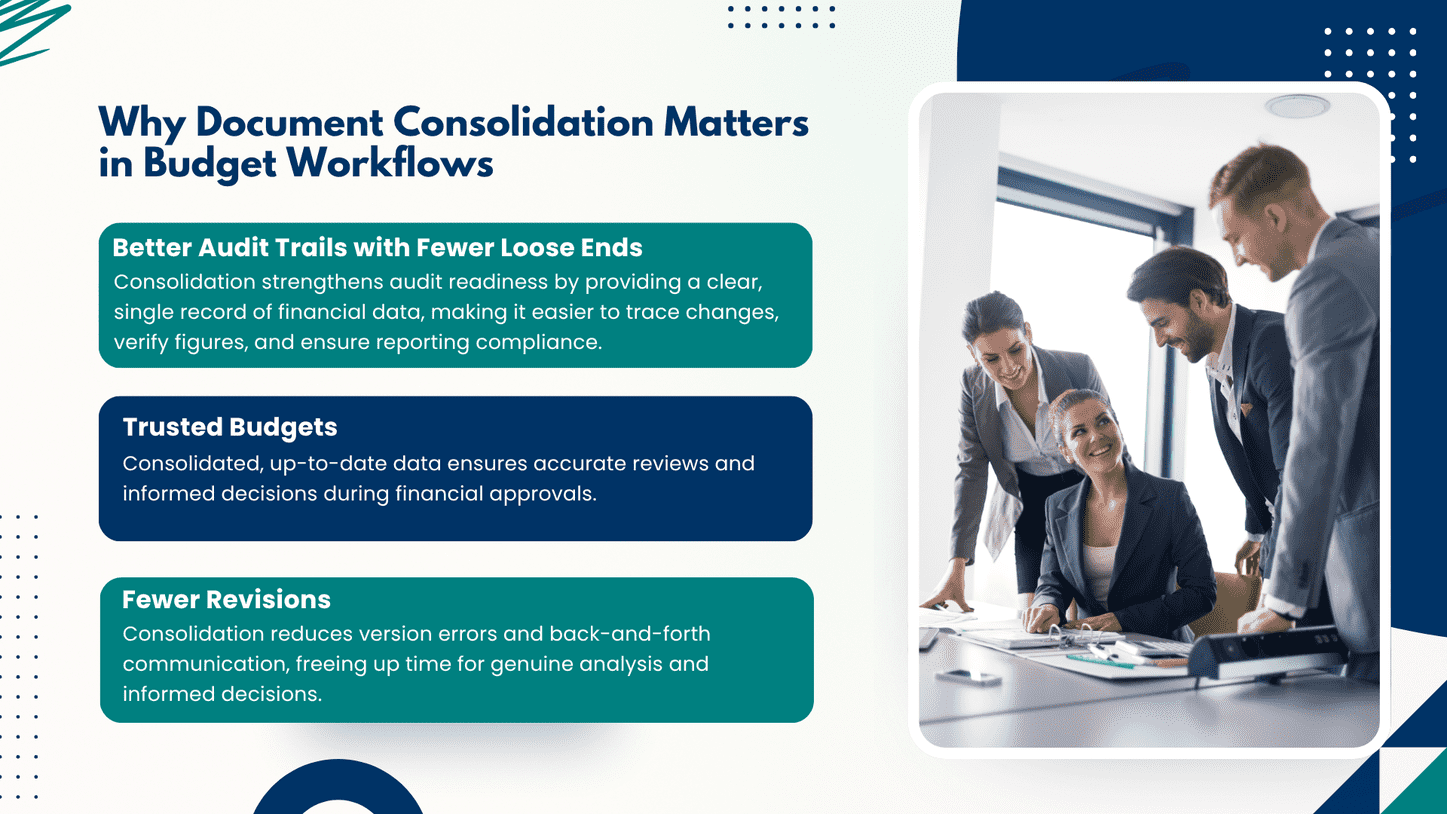

Why Document Consolidation Matters in Budget Workflows

Budget planning is not frequently done in a vacuum. It takes place with frequent interaction between departments like operations, finance, procurement, and project teams. Each department contributes its inputs, assumptions, and figures. In the absence of an understandable and consistent version of budget files, discrepancies arise - resulting in conflicting decisions and rework.

Cross-Departmental Clarity Avoids Conflicting Assumptions

When departments operate off versions of the same budget, misalignment is likely to happen. For instance, procurement could approve spending based on one projection, while finance works on another. Having all departmental inputs combined into one confirmed document prevents ambiguity, particularly with multiple revisions over time.

Current Budgets Enable Trustworthy Reviews and Approvals

Financial reviews, approvals by the board, and presentations to leadership all require the presumption that the figures being discussed are up to date and accurate. If version control is not strong, reviewers will inadvertently make decisions based on outdated numbers. Consolidated documents guarantee everyone is working with the same data set - enhancing the quality and integrity of budget discussions.

Better Audit Trails with Fewer Loose Ends

Consolidation also makes audit readiness more robust. External and internal auditors need an unambiguous record of how financial numbers were computed and sanctioned. If data is fragmented across numerous versions of documents, tracing changes is tedious and erroneous. Consolidation in a single version facilitates easier checking of figures, who made the changes, and showing conformity to reporting levels.

Decreased Rework and Less Communication Loops

One of the more subtle yet serious effects of inefficient document handling is time spent fixing version-related mistakes. Groups constantly go back and forth through explaining what version is correct or re-checking information. Consolidation minimizes unnecessary follow-ups, allowing for analysis and decision-making time instead of administrative cleanup.

From Chaos to Clarity in Monthly Reporting

"We were drowning in budget file versions - until we made one change."

Background

I work in the financial planning unit of a mid-sized logistics company. Every month, it was our job to prepare rolling forecasts by gathering inputs from five departments-operations, procurement, human resources, sales, and IT. Every team had its spreadsheet template, so it was left to us to bring all their data into one single budget report.

Recurring Challenges We Faced

The largest problem wasn't the quantity - it was the versions. Two to three updated files per cycle, usually with vague file titles such as "final_update2" or "latest-latest.xlsx," came from each department. These duplicate files made it tricky to determine which one was final. We sometimes missed important updates or accidentally combined outdated numbers into the master report.

This iteration chaos created issues within senior management meetings. Numbers wouldn't add up from slide to slide, forecast assumptions were different between departments, and we spent more time justifying inconsistencies than outcomes.

The Turning Point

The final straw occurred during a quarterly review meeting. We had reported figures more than two weeks out of date for one department, while using fresh figures for the others. The inconsistencies were glaring - and humiliating.

That's when we realized we needed to revamp how we managed submissions. Rather than sending the latest spreadsheet versions out separately, we prompted all departments to wrap up their input by a shared deadline and produce a single PDF version. Before combining them, we would merge PDF to PDF online so everything was in one location and nothing was missed. It was an easy change, but it put us in charge of the documentation process.

What Made the New Process Work

Three specific changes worked:

-

Standardized Submission Format: We asked budget teams to submit their final budget updates as PDFs, eliminating random edits and version conflicts.

-

One Consolidated File: We utilized a merging tool to combine all department inputs into a single PDF, making it easier to review and monitor all submissions in one place.

-

Clear Cutoff Time: We implemented a single timeline for submissions, which eliminated last-minute changes to versions and back-and-forth revisions.

The Outcome

Version-related problems fell by nearly 80% after the new system implementation in our organization. We no longer needed to confirm which file was current or cross-check spreadsheets for omitted updates. All teams could examine the complete submission package before meetings, and discussions were more productive and data-based.

Our total reporting cycle also got faster. What took us two whole days - cleaning, merging, validating - now takes a few hours at most. It is more transparent, and the stress levels during the forecast week are much lower.

Bottom Line

Version confusion is more than a workflow inconvenience - it has a direct impact on financial accuracy, team efficiency, and decision-confidence. As budget cycles become more team-oriented and accelerated, the capability to consolidate and manage document versions becomes critical.

By standardizing submission types, synchronizing deadlines, and consolidating inputs into one file, budget teams can minimize mistakes, enhance communication, and take control of their reporting processes again. Plain, orderly changes to document handling can significantly head off detours and keep financial operations on track.