Crypto Asset Management Market: Securing the Future of Digital Investments

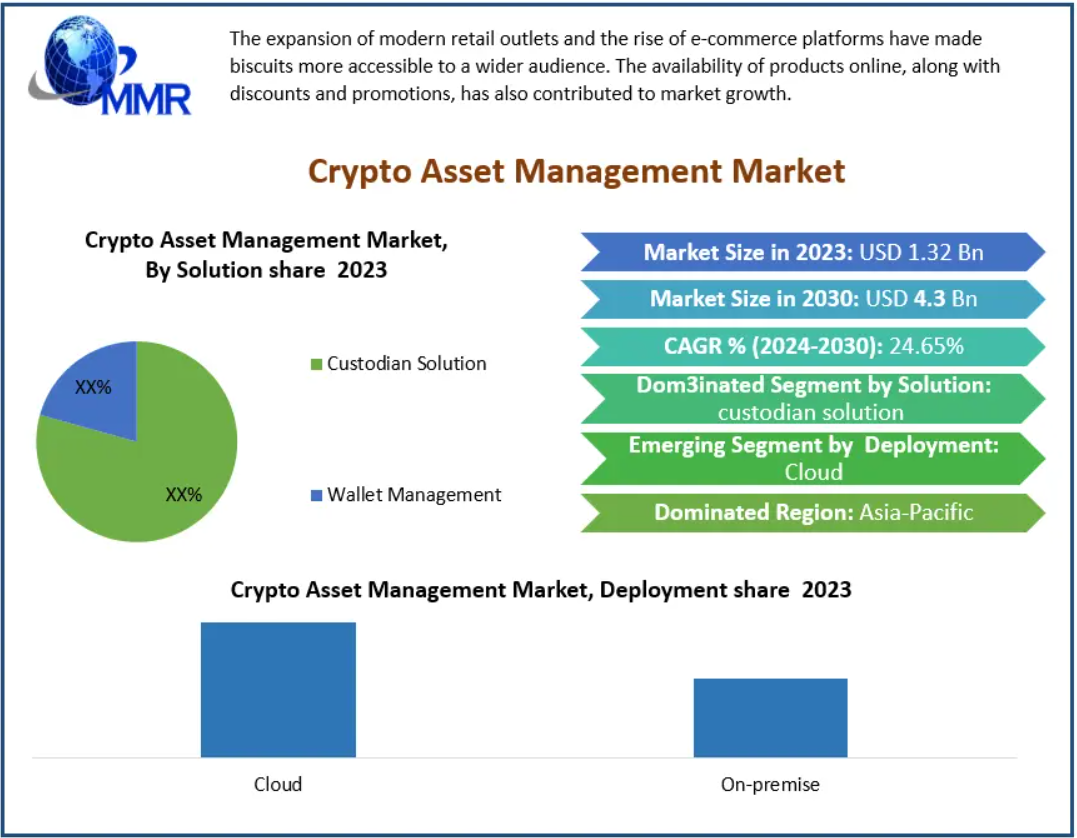

The Crypto Asset Management Market is on an accelerated growth trajectory, fueled by the widespread adoption of blockchain technology and the increasing institutionalization of cryptocurrency investments. Valued at USD 1.32 billion in 2023, the market is expected to grow at a CAGR of 24.65% from 2024 to 2030, reaching approximately USD 4.3 billion by 2030.

Market Overview

Crypto asset management involves the safe and efficient handling of digital assets, including cryptocurrencies, tokens, and blockchain-based financial instruments. As blockchain technology matures, its applications are extending beyond digital currencies to debt financing, supply chain management, healthcare, and more, highlighting the importance of sophisticated management systems. Advanced crypto asset management platforms provide enhanced security, transparency, and efficiency, making digital assets more attractive to investors.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report :https://www.maximizemarketresearch.com/request-sample/27361/

Key Market Drivers

1. Institutional Adoption

The growing participation of institutional investors is a major driver for market expansion. Leading financial institutions are increasingly integrating crypto assets into their portfolios, necessitating robust, secure, and compliant management solutions. This trend underscores cryptocurrency’s reliability while setting operational standards for asset management systems.

2. Expanding Investment Opportunities

The increasing recognition of cryptocurrencies as financial instruments has led to broader adoption among individual investors and enterprises. The growing complexity and volume of digital assets require advanced management tools to optimize portfolio performance and ensure asset security.

3. Integration with Traditional Finance

Integrating crypto asset management platforms with traditional banking and financial systems is driving market growth. This integration allows seamless management of crypto and conventional assets, enhancing user experience, boosting trust, and encouraging wider adoption among institutional and retail investors.

Market Segmentation

By Solution

-

Custodian Solutions: Ensures secure storage and protection of crypto assets for investors.

-

Wallet Management: Provides easy access, transaction management, and portfolio tracking.

By Deployment

-

Cloud: Dominates the market due to scalability, flexibility, and advanced security features.

-

On-Premises: Preferred by organizations requiring full control and customization of systems.

By Application

-

Mobile: Leads the market with growing smartphone penetration, offering convenience for managing digital assets on the go. Features like biometric authentication, secure enclaves, and integration with DeFi protocols have enhanced adoption.

-

Web-Based: Growing rapidly due to cross-platform accessibility, real-time tracking, and advanced analytics for portfolio optimization.

By End-Use

-

Individual investors

-

Enterprises and institutions

-

Retail & e-commerce

-

Healthcare

-

Travel & hospitality

-

Others

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report :https://www.maximizemarketresearch.com/request-sample/27361/

Regional Insights

-

North America: Accounts for 30.4% of the global market in 2023. The region benefits from regulatory clarity, institutional adoption, and technological innovation, making it a leading hub for crypto asset management.

-

Asia-Pacific: Expected to experience significant growth, driven by tech-savvy populations, startup ecosystems, and supportive regulations in countries like Japan, South Korea, Singapore, and Australia.

-

Europe: Emerging as a key market, with regulatory frameworks, technological advancements, and increasing institutional participation fostering adoption of crypto assets.

Recent Developments

-

Gemini Trust Company announced a $24 million investment to expand operations in India in September 2023, following the opening of its development center in Gurgaon earlier that year.

-

Amberdata expanded into the Asia-Pacific region with a new office in Hong Kong in June 2023, offering support for DeFi, spot trading, on-chain, and derivatives market data.

Leading Players in the Crypto Asset Management Market

Key companies driving growth and innovation include:

-

Coinbase Custody

-

Gemini Trust Company

-

BitGo

-

Binance

-

Fidelity Digital Assets

-

Anchorage

-

Grayscale Investments

-

BlockFi

-

Crypto Finance AG

-

Ledger

-

Galaxy Digital

-

Metaco

-

Alameda Research

-

SwissBorg

-

Paxos Trust Company

-

Zerion

-

Cobo

-

CoinShares

-

Bakkt

-

Trustology

These companies are expanding market presence through strategic partnerships, technological advancements, and regulatory compliance initiatives, catering to both institutional and retail investors.

Conclusion

The Crypto Asset Management Market is positioned for remarkable growth as cryptocurrencies continue to gain mainstream acceptance. With innovations in blockchain technology, cloud-based solutions, mobile platforms, and integration with traditional finance, the demand for secure, efficient, and scalable asset management tools is set to rise. As institutional and individual investors increasingly seek exposure to digital assets, the market offers significant opportunities for solution providers to shape the future of digital finance.