Mordor Intelligence's new study on the "Melamine Market" presents a thorough evaluation of the market's trajectory, including major trends and future outlook.

Introduction

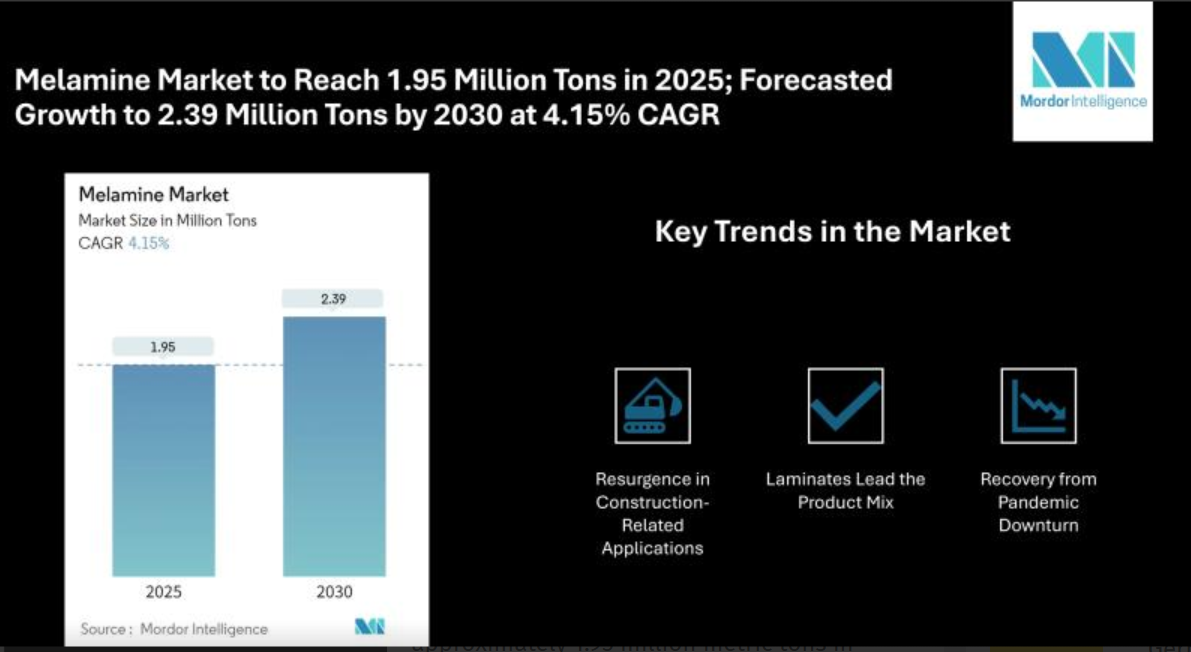

The global melamine market is poised at approximately 1.95 million metric tons in 2025, with expectations to grow steadily to 2.39 million tons by 2030. This steady expansion at a compound annual growth rate of 4.15% reflects recovering industrial activity, particularly in construction and manufacturing sectors.

Melamine, a high‐nitrogen chemical used extensively in formaldehyde‐based resins, laminates, adhesives and coatings, has seen demand rebound strongly after declines during the 2020 global slowdown. As construction and automotive production bounce back, demand for melamine-based products has surged, driving long-term market momentum.

The report covers historical data from 2019 through 2024 and presents forecasts through 2030, offering a comprehensive view of key drivers and segmentation across product types, applications and regions.

Voluntary Carbon Credit Market - 50% CAGR for 2025-2030 Driven by Expanding Corporate Net-Zero Commitments, Reports Mordor Intelligence

Top Key Trends

Resurgence in Construction-Related Applications

The construction sector has resumed growth post-pandemic, with rising activity in residential, commercial and infrastructure projects fueling use of melamine-formaldehyde resins-especially in laminates, decorative panels and wood adhesives. As global building activity expands, especially in countries such as China, India and the U.S., demand from surface finishes and modular furniture rises.

Laminates Lead the Product Mix

Laminated furniture and panels account for nearly 50% of total melamine formaldehyde industry volume in 2024. Melamine laminates are prized for hardness, scratch resistance, and heat tolerance in ready‐to‐assemble (RTA) furniture, kitchen surfaces, wall shelves and cabinetry. This dominant share underlines how critical laminates remain in driving overall melamine demand.

Recovery from Pandemic Downturn

The melamine market was hit hard in 2020, particularly in construction, automotive and adhesives sectors. However, rebound through 2021 and beyond has led to steady upward momentum. Growth in RTA furniture production and rising infrastructure investment have supported sustained market recovery.

Explore the full report for in-depth insights and market forecasts: https://www.mordorintelligence.com/industry-reports/melamine-market?utm_source=tcteamcorp

Market Segmentation

Mordor Intelligence breaks down the melamine market into meaningful categories across product form, application and geography.

By Product/Form

Melamine-formaldehyde resins (including laminates and adhesives)

Other forms (e.g. melamine pigments, superplasticizers)

The resin segment, in particular laminates and adhesives, dominates overall volume, accounting for roughly half of market share as of 2024.

By Application

Decorative laminates and flooring

Ready-to-assemble (RTA) furniture

Wood adhesives in panel bonding

Surface coatings and paint additives

Specialty chemicals (e.g. concrete superplasticizers)

Laminates and adhesives in construction-related end‐use dominate, with broad application across modular furniture, wall panels, kitchen units and floor coverings.

By Geography

Asia-Pacific: largest regional volume and fastest growing, driven by China, India and Southeast Asia

Europe: steady demand from automotive interiors and housing renovation

North America: growing use in furniture and cabinetry

Latin America, Middle East & Africa: smaller but gradually expanding markets

Asia-Pacific leads the market, accounting for the highest share of total melamine volume, and is expected to maintain the fastest growth rate across 2025-2030.

Top Key Players:

Nissan Chemical Corporation

Borealis Agrolinz Melamine GmbH

Mitsui Chemicals Asia‐Pacific Ltd

Wakomas Chemical Sdn. Bhd.

Petronas Chemicals Group Berhad (PCG)

These are noted particularly within the Southeast Asia region, but they also have international operations supplying melamine resins globally. They lead in volume, technology and distribution in both raw melamine and downstream products.

Conclusion:

The dominance of melamine-formaldehyde resins-especially laminate surfaces and adhesives-continues to define this industry. Their unique physical properties, durability and versatility make them a preferred choice for interior construction, kitchen and wall finishes, and furniture.