Smart Contracts Market Overview:

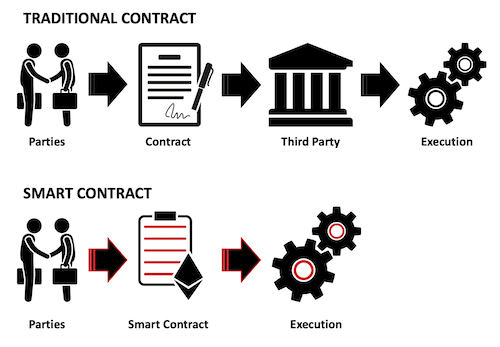

The smart contracts market has witnessed significant growth due to the increasing adoption of blockchain technology across various industries. Smart contracts, which are self-executing agreements with predefined conditions, have revolutionized financial transactions, supply chain management, and legal processes. The Smart Contracts market size is projected to grow USD 9.2 Billion by 2032, exhibiting a CAGR of 21.40% during the forecast period 2024 - 2032. The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has further propelled demand for smart contract solutions. With businesses seeking transparency, efficiency, and security, the market is expected to expand at a robust pace. Factors such as regulatory support, technological advancements, and increased adoption of blockchain platforms like Ethereum, Binance Smart Chain, and Solana are driving market growth.

Get a sample PDF of the report at –

https://www.marketresearchfuture.com/sample_request/4588

Major Players:

Several key players dominate the smart contracts market, including,

- Ethereum

- IBM

- Hyperledger

- R3

- Chainlink

- ConsenSys

Ethereum remains a leader due to its early adoption and extensive developer community. IBM and Hyperledger provide enterprise-grade blockchain solutions, while Chainlink enhances smart contract functionality through decentralized oracles. R3 focuses on financial applications with its Corda blockchain, and ConsenSys continues to drive innovation through Ethereum-based infrastructure. These companies are actively investing in research and development to enhance scalability, interoperability, and security in smart contract solutions.

Key Trends and Drivers:

The rapid expansion of DeFi platforms, NFT marketplaces, and enterprise blockchain solutions has fueled the smart contracts market. Businesses are increasingly integrating smart contracts to automate processes, reduce costs, and minimize human intervention. Regulatory frameworks are evolving to support blockchain adoption, boosting confidence among enterprises. Additionally, advancements in Layer 2 scaling solutions, cross-chain interoperability, and AI-driven smart contract auditing are emerging trends. The growing need for fraud prevention, transparency, and enhanced security in digital transactions further accelerates market demand.

Market Segmentation:

The smart contracts market is segmented based on blockchain type, end-user industry, and region. By blockchain type, the market is divided into public, private, and hybrid blockchains. Public blockchains, such as Ethereum and Binance Smart Chain, dominate due to their decentralized nature, while private blockchains cater to enterprise solutions. In terms of end-users, the market spans finance, healthcare, supply chain, government, and real estate sectors. Financial services lead in adoption, leveraging smart contracts for automated lending, insurance, and trading. Other industries, such as healthcare and supply chain, use smart contracts for data management and secure transactions.

Regional Analysis:

North America remains a dominant force in the smart contracts market, driven by strong blockchain adoption, favorable regulatory frameworks, and technological innovation. The United States leads with major blockchain companies, investment in R&D, and widespread DeFi adoption. Europe follows closely, with countries like Germany, Switzerland, and the UK actively promoting blockchain applications. The Asia-Pacific region is witnessing rapid growth, particularly in China, Japan, and South Korea, due to increasing government initiatives and blockchain investments. Latin America and the Middle East are also showing promising growth, with financial inclusion efforts and digital transformation strategies supporting market expansion.

Browse a Full Report –

https://www.marketresearchfuture.com/reports/smart-contracts-market-4588

Recent Developments:

The smart contracts market continues to evolve with notable advancements. Ethereum’s transition to Ethereum 2.0, featuring proof-of-stake (PoS) consensus, aims to enhance scalability and energy efficiency. Major financial institutions are exploring smart contracts for tokenized assets and digital securities. Additionally, AI-powered auditing tools are improving contract security, reducing vulnerabilities in DeFi applications. Cross-chain interoperability solutions are gaining traction, enabling seamless transactions across different blockchain networks. With continuous innovation and expanding use cases, the smart contracts market is poised for sustained growth in the coming years.

Top Trending Reports:

Optical Character Recognition Market

Contact

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: [email protected]

Website: https://www.marketresearchfuture.com