If you are an employee working in the UAE or an employer managing employee benefits, understanding the end-of-service gratuity calculation is crucial. The UAE Labor Law mandates gratuity payments as a reward for employees' dedicated service. However, manually calculating gratuity can sometimes be confusing due to the legal nuances involved.

This is where a Gratuity Calculator UAE comes in handy. It simplifies the process and ensures you receive or pay the correct amount based on your employment duration and salary. In this comprehensive guide, we will explain everything you need to know about gratuity calculations in the UAE and how to use a Gratuity Calculator online to make the process seamless.

What is Gratuity in the UAE?

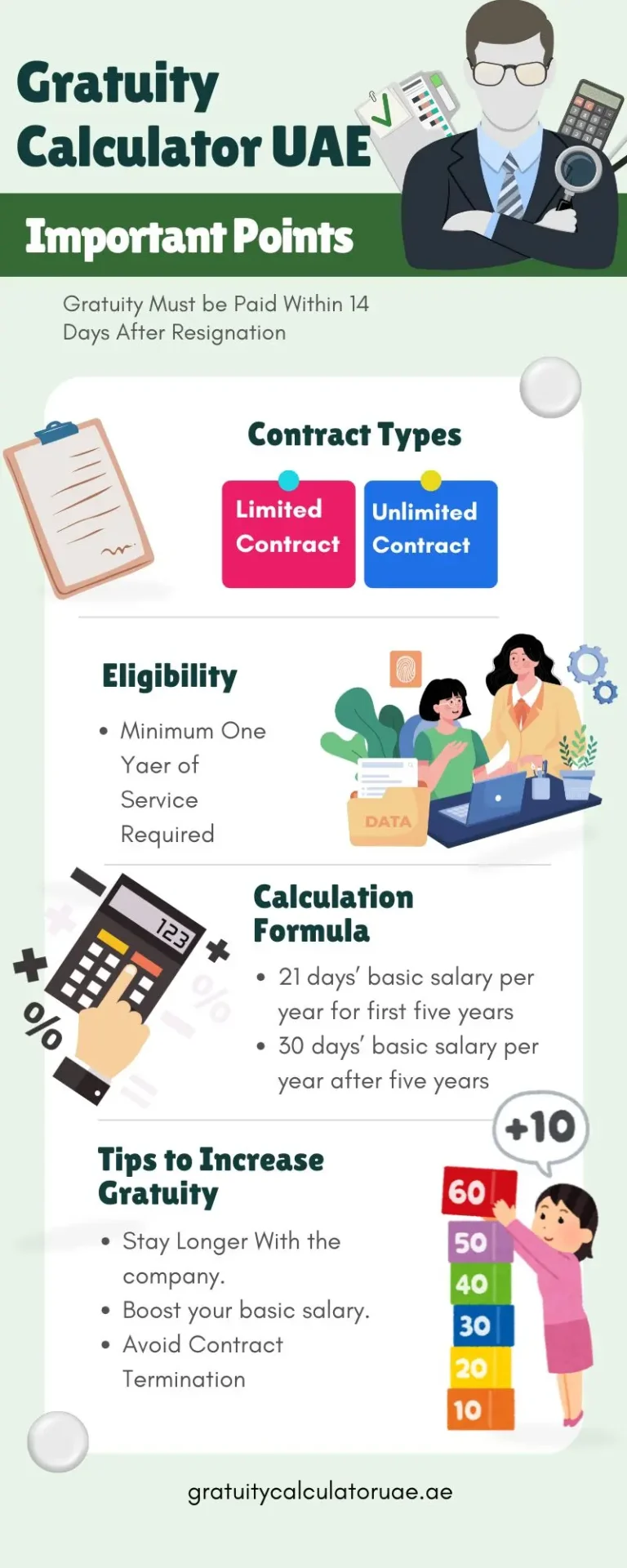

Gratuity is a lump sum payment given to an employee at the end of their employment contract as a token of appreciation for their service. It is regulated by the UAE Labor Law and is applicable to employees who have completed at least one year of continuous service.

The gratuity amount depends on the length of service and the employee’s last drawn basic salary. It is calculated differently for those who have worked less than 5 years and those who have served more.

Why Use a Gratuity Calculator UAE?

Calculating gratuity manually can be tricky. Several factors affect the calculation, including:

-

Length of service

-

Basic salary (excluding allowances)

-

Type of contract (limited or unlimited)

-

Whether the employee resigned or was terminated

Using a Gratuity Calculator UAE helps avoid errors and misunderstandings. It provides a quick, accurate, and legally compliant estimate of the gratuity amount based on your inputs. This way, both employers and employees can have clarity on the end-of-service benefits.

How Does the Gratuity Calculator UAE Work?

A Gratuity Calculator online requires you to enter a few key details such as:

-

Employee’s last basic salary

-

Total years and months of service

-

Nature of contract (limited or unlimited)

-

Reason for leaving the job (resignation, termination, or end of contract)

Based on this data, the calculator applies the UAE Labor Law formula to compute the gratuity amount. It also accounts for partial years and adjusts the calculation accordingly.

UAE Gratuity Calculation Rules at a Glance

To better understand the calculation, here are the key rules set by the UAE Labor Law:

-

Less than 1 year: No gratuity entitlement.

-

1 to 5 years: 21 days’ basic salary for each year of service.

-

More than 5 years: 21 days’ salary for the first 5 years and 30 days’ salary for each additional year.

-

The total gratuity cannot exceed 2 years’ salary.

-

If an employee resigns before completing 5 years, the gratuity is reduced proportionally.

-

Employees terminated for gross misconduct may lose gratuity rights.

Step-by-Step Guide to Calculate Gratuity Using the Calculator Online

-

Gather Your Employment Information: Know your last basic salary and exact length of service.

-

Open a Reliable Gratuity Calculator UAE: There are several online calculators available on websites offering HR and legal services.

-

Enter Your Details: Fill in your salary, tenure, contract type, and leaving reason.

-

Submit the Information: Click on ‘Calculate’ to get your gratuity amount instantly.

-

Review and Save Results: Keep a record for future reference or use it during your end-of-service settlement.

Benefits of Using a Gratuity Calculator Online

-

Accuracy: Avoid human errors and ensure compliance with current UAE labor laws.

-

Convenience: Calculate gratuity anytime without consulting a lawyer or accountant.

-

Transparency: Helps employees understand their benefits clearly.

-

Time-Saving: Instant results compared to manual calculations.

-

Free or Low Cost: Most online gratuity calculators are free or low cost.

Common Questions About Gratuity Calculator UAE

Q1: Is gratuity calculated on the total salary or just basic salary?

Gratuity is calculated based on the basic salary only, excluding allowances and bonuses.

Q2: Can I use a gratuity calculator online for free?

Yes, many websites offer free Gratuity Calculator UAE tools that are easy to use and reliable.

Q3: What if my contract is limited or unlimited?

The gratuity calculation is similar for both, but termination conditions and notice periods may affect the final settlement.

Q4: Does the gratuity calculator account for partial years?

Yes, most calculators take partial months or years into account and prorate the gratuity accordingly.

Q5: What happens if I resign before completing 5 years?

Your gratuity will be calculated on a reduced basis—usually one-third or two-thirds of the full gratuity depending on your length of service.

Conclusion

Understanding your end-of-service benefits is vital for both employees and employers in the UAE. The Gratuity Calculator UAE is an invaluable tool that simplifies this often-complex process, providing an accurate, quick, and transparent calculation of your gratuity pay.

Using a Gratuity Calculator online ensures you can plan your finances better and avoid disputes related to incorrect gratuity payments. Whether you are resigning, terminating, or completing your contract, the calculator gives you a reliable estimate that complies with the UAE Labor Law.

Make sure to use trustworthy and updated calculators for the most accurate results, and always keep your employment records handy for smooth calculations.

Frequently Asked Questions (FAQs)

Q1: How is the gratuity amount calculated for an employee with more than 10 years of service?

For the first 5 years, the employee is entitled to 21 days’ salary for each year. For the years beyond 5, the employee receives 30 days’ salary for each additional year, capped at a maximum of 2 years’ total salary.

Q2: Can an employer withhold gratuity payment?

Employers must pay gratuity unless the employee was terminated for gross misconduct or other legal exceptions.

Q3: Is it mandatory to pay gratuity in UAE?

Yes, gratuity payment is mandatory under UAE Labor Law for employees who have completed at least one year of continuous service.

Q4: Can I calculate my gratuity if I am still employed?

Yes, you can use a Gratuity Calculator online anytime to estimate your end-of-service benefits based on your current salary and tenure.

Q5: Are there any deductions from the gratuity amount?

Generally, gratuity is paid in full without deductions unless otherwise stated in your employment contract or if the employee resigns before completing one year.