The Gluten‑Free Tortillas Industry was valued at approximately US $30.5 billion in 2024 and is projected to grow to around US $44.5 billion by 2030, reflecting a CAGR of 6.5 % between 2024 and 2030. This niche segment falls within the larger tortilla category, which itself was estimated near US $53.5 billion in 2024. Gluten‑free tortillas are flatbreads produced using non‑gluten grains—such as corn, chickpea, coconut, cassava, or almond flour—geared toward individuals with celiac disease, gluten sensitivity, or dietary preferences favoring gluten-free products.

Ask for Sample to Know US Tariff Impacts on Gluten‑Free Tortillas Industry @ https://www.maximizemarketresearch.com/request-sample/114421/

Market Growth Drivers & Opportunity

-

Rise in health-conscious consumption: With about 1 % of the global population diagnosed with celiac disease and many more experiencing gluten sensitivity, demand for gluten-free alternatives has surged. Additionally, consumers seek gluten-free options as part of overall digestion and wellness strategies.

-

Clean-label and nutritional trends: There's a growing preference for tortillas featuring alternative, nutrient-rich flours (e.g., quinoa, chia, flaxseed, and ancient grains) that provide added fibers, proteins, and functional benefits.

-

Expansion in retail and foodservice channels: Availability has broadened across supermarkets, online grocery platforms, café chains, fast-casual restaurants, and meal-kit services.

-

Advancements in processing technologies: Innovations like hydrocolloids, improved gum blends, enzyme techniques, and modified-atmosphere packaging (MAP) have enhanced tortilla texture, shelf life, and pliability.

These factors open doors for brands to innovate in flavor profiles, nutritional value, and format, making inroads into both retail and foodservice channels.

What Lies Ahead: Emerging Trends Shaping the Future

-

Flavor and format innovation: Expect growth in Spanish-style tortillas, flavored wraps, mini tortillas, high-protein, and keto-friendly variations.

-

Fusion cuisine and functional foods: The trend of culinary fusion—such as global bowl-style wraps and tacos—encourages the use of tortillas that blend taste and nutrition.

-

Sustainability and clean-label focus: Organic, non-GMO, sustainably sourced, and allergen-friendly tortillas align with evolving consumer preferences.

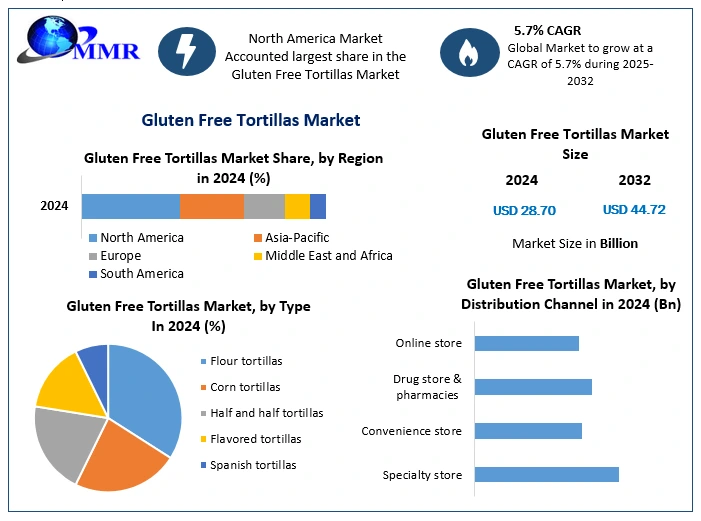

Segmentation Analysis

The market breaks down as follows:

-

By type: Corn, flour, Spanish-style, flavored, and exotic varieties.

-

By nature: Organic vs. conventional.

-

By processing: Fresh vs. frozen.

-

By grain source: Corn, wheat, and alternative gluten-free flours.

-

By distribution channel: Hypermarkets/supermarkets, convenience stores, online platforms, and foodservice.

Explore key trends, innovations & market forecasts: https://www.maximizemarketresearch.com/market-report/global-gluten-free-tortillas-market/114421/

Country-Level Analysis: USA & Germany

-

USA: The U.S. market is a leader due to its sizeable celiac and gluten-sensitive demographic, widespread health awareness, and strong presence in retail and foodservice sectors. The market was valued near US $7.9 billion in 2024.

-

Germany: A top European market for gluten-free bakery goods, with increasing popularity of flavored and corn-based tortillas as manufacturers expand into this category.

Competitor Analysis

Key players shaping the market include:

-

Global brands: Dr. Schär, Barilla, Farmo, Kraft Heinz, Hain Celestial, General Mills, Conagra, and PepsiCo, emphasizing R&D and gluten-free innovation.

-

Regional and niche brands: Siete, Mission Foods (gluten-free lines), Ole Mexican Foods, and Catallia Foods, focusing on corn-based and alternative flour offerings.

-

Startups: Small, agile companies creating premium, organic, non-GMO tortillas that cater to health-focused consumers.

Conclusion

The global gluten‑free tortillas market continues its strong upward trajectory—rising from about $30.5 billion in 2024 to around $44.5 billion by 2030 (6.5 % CAGR). Fueled by health and wellness trends, ingredient innovation, and wide distribution, the segment provides significant opportunities. As consumers increasingly seek functional, flavorful, clean-label tortillas, brands that respond with creative formulations, sustainable sourcing, and varied formats in both retail and foodservice will secure a competitive edge in this growing food sector.

About Us