Market Estimation & Definition

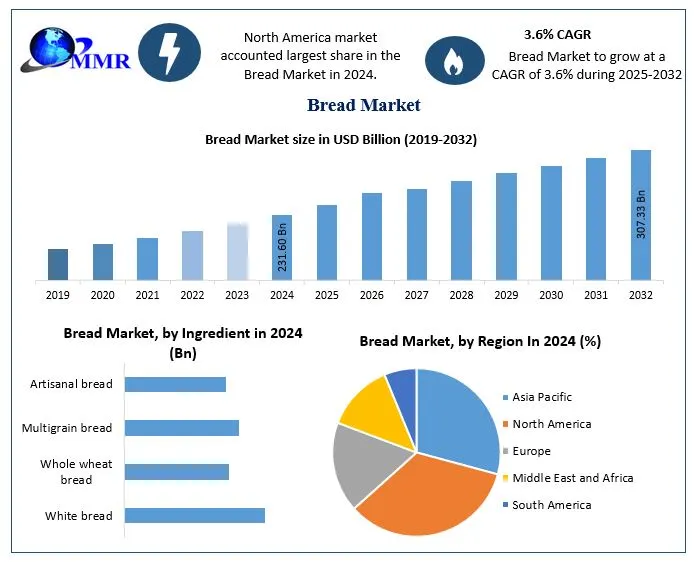

The Bread Industry was valued at approximately USD 231.6 billion in 2024 and is anticipated to grow at a steady CAGR of 3.6%, reaching around USD 307.3 billion by 2032. This market encompasses a wide range of bread products including packaged loaves, artisanal varieties, gluten-free alternatives, and organic options. Bread, as one of the most widely consumed staple foods globally, continues to evolve with changing dietary preferences and lifestyle trends.

Market Overview

The report includes market analysis, forecasts, industry segmentation and competitive analysis of top Bread manufacturers. The report also emphasises sustainability, innovation and consumer preferences, offering a global outlook with trends, drivers, challenges and opportunities. It will help industry stakeholders (manufacturers, distributors, retailers, investors) make informed decisions and capitalise on Bread market opportunities.

Ask for Sample to Know US Tariff Impacts on Bread Industry @ https://www.maximizemarketresearch.com/request-sample/201522/

Market Dynamics

Market Drivers:

The bread market is primarily driven by several factors that contribute to its sustained growth. Firstly, the increasing global population, coupled with urbanization, has resulted in higher demand for convenient and readily available food options like bread. Rising disposable incomes, particularly in developing economies, have also boosted the consumption of bread as an affordable staple food. For instance, the Bread Price Index, which tracks the cost of a loaf of bread in various countries, has shown steady growth in recent years, reflecting increased consumption.

Market Challenges:

The bread market also faces specific challenges that require strategic approaches. One major challenge is the need to address sustainability and environmental concerns. The production and distribution of bread involve significant energy consumption and carbon emissions, and companies should look forward to mitigating those.

Furthermore, fluctuating raw material prices, especially for wheat and other grains, can affect the profitability of bread manufacturers. Volatile commodity markets and weather conditions, such as droughts or floods, influence crop yields leading to price fluctuations.

Segmentation Analysis

The bread market is segmented by:

Based on Product type, the bread market is segmented into loaves, baguettes, rolls, burger buns, sandwich slices, ciabatta, frozen bread, and other product types. Among these, loaves hold the largest market share, being the most popular type of bread consumed worldwide. Baguettes have gained significant popularity in Europe, while rolls are commonly consumed in North America. Burger buns and sandwich slices cater to the sandwich market, offering convenient options for quick meals.

Based on ingredient, The bread market is segmented into white bread, whole wheat bread, multigrain bread, and artisanal bread. White bread, a traditional and widely consumed variety, is made from refined wheat flour and is often fortified with nutrients. Whole wheat bread has gained popularity due to the growing emphasis on health and wellness. Made from whole grain flour, it retains the fiber and nutrients present in the wheat kernel. Multigrain bread appeals to health-conscious consumers as it contains a combination of different grains, providing a diverse nutritional profile and texture.

Based on nutritional value, The bread market is segmented into high-fiber bread, low-carb bread, gluten-free bread, functional bread, and other nutritional values. High-fiber bread, rich in dietary fiber, plays a crucial role in regulating digestion and promoting heart health, making it a popular choice among health-conscious consumers. Low-carb bread caters to individuals following a low-carbohydrate diet, providing an alternative option with reduced carbohydrate content.

Based on Distribution Channel, The bread market is segmented into supermarkets and hypermarkets, convenience stores, specialist retailers, online retail, and other distribution channels. Among these segments, supermarkets and hypermarkets dominate the market, holding the largest market share. These retail giants provide a wide range of bread products, catering to the diverse preferences of consumers. Convenience stores serve as a popular distribution channel, offering a convenient option for consumers looking for quick and easy meals on the go.

Explore key trends, innovations & market forecasts: https://www.maximizemarketresearch.com/market-report/bread-market/201522/

Country-Level Analysis: USA and Germany

In the United States, demand for premium, health-driven bread options is rising. Multigrain, gluten-free, and organic breads are seeing strong growth, supported by evolving consumer tastes and increased health awareness.

In Germany, one of Europe’s most mature and culturally significant bread markets, the bakery products sector was valued at nearly USD 19.85 billion in 2023 and is projected to continue steady growth. Bread remains the largest product segment, driven by deep-rooted baking traditions and consumer preferences for high-quality, label-transparent products.

Competitive Landscape Analysis

1. Grupo Bimbo

2. Associated British Foods plc

3. Yamazaki Baking Co., Ltd.

4. Finsbury Food Group plc

5. Flowers Foods, Inc.

6. George Weston Limited

7. Premier Foods plc

8. Britannia Industries Limited

9. Warburtons Ltd.

10. Aryzta AG

11. Weston Foods

12. Barilla Group

13. Hostess Brands, Inc.

14. Grupo Lala

15. Almarai Company

Conclusion

The global bread market stands at the threshold of a transformative decade. With projected growth to over USD 307 billion by 2032, the market is driven by shifting consumer preferences toward health, quality, and convenience. Key markets like the USA and Germany exemplify this trend, as demand for specialty, organic, and functional breads continues to surge. Moving forward, success will belong to brands and bakers who combine heritage with health innovation, sustainability, and digital engagement.

About Us