In today’s uncertain economic environment, many investors are turning to gold as a tangible and reliable store of value. If you're planning to buy bar of gold, you're making a smart move toward financial security. Gold bars are one buy bar of gold of the most efficient ways to invest in physical gold, offering low premiums, easy storage, and global recognition.

In this article, we'll explore the essentials of buying gold bars—what to consider, where to buy them, and how to ensure you're making a wise investment.

🟨 Why Buy Bar of Gold?

Buying a bar of gold offers several benefits that make it an ideal investment for both beginners and seasoned investors:

✅ 1. Wealth Preservation

Gold is known to maintain its value over time. Unlike fiat currency, it is not subject to inflation or government manipulation.

✅ 2. High Liquidity

Gold bars are easily sold anywhere in the world. When you buy a bar of gold, you're investing in a globally accepted asset.

✅ 3. Lower Premiums

Compared to gold coins, gold bars typically come with lower premiums per gram or ounce, making them more cost-effective.

✅ 4. Portfolio Diversification

Physical gold helps reduce portfolio volatility and provides a hedge against market downturns and economic uncertainty.

📏 Types and Sizes When You Buy Bar of Gold

Gold bars come in various sizes to suit different budgets and investment goals. Common options include:

| Weight | Approx. Grams | Best For |

|---|---|---|

| 1 gram | 1 g | Gifts, entry-level investment |

| 10 grams | 10 g | Small savings |

| 1 ounce | 31.1 g | Balanced investing |

| 100 grams | 100 g | Long-term holding |

| 1 kilogram | 1,000 g | High-net-worth investors |

💡 Tip: If you're just starting, consider a 10g or 1 oz gold bar for affordability and liquidity.

🛒 Where to Buy Bar of Gold

When deciding to buy bar of gold, it’s crucial to choose a trusted source to avoid counterfeit products and overpricing.

✅ Reputable Online Dealers

-

APMEX (USA)

-

JM Bullion

-

Kitco

-

BullionByPost (UK)

-

Malabar Gold & Diamonds (Middle East, India)

✅ Local Bullion Shops

Visit local gold dealers with a good reputation. Always ask for:

-

Proper hallmarking

-

Purity certification

-

Invoice or purchase receipt

✅ Banks & Financial Institutions

Some banks sell gold bars with official certification, offering peace of mind and secure transactions.

🛡️ What to Look for When Buying a Gold Bar

1. Purity

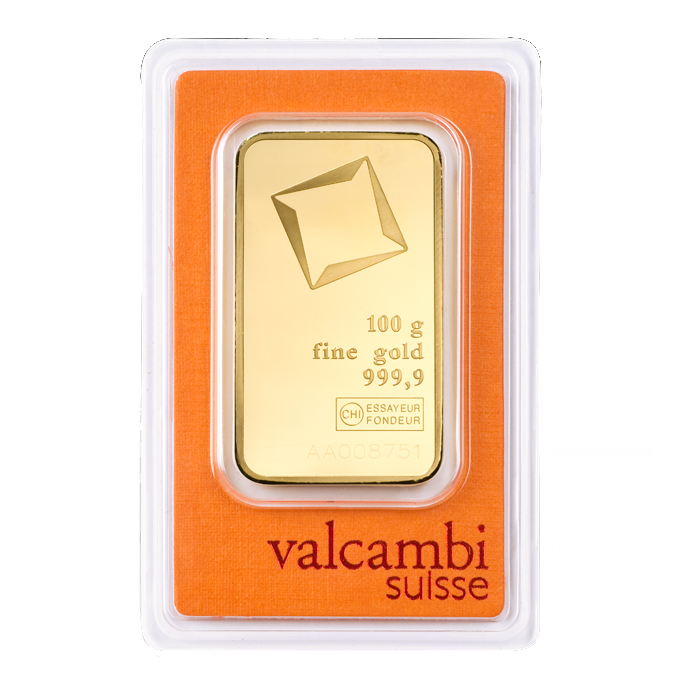

Always buy gold bars with at least 99.9% purity (also labeled as 999 or 24 karat gold).

2. Assay Certificate

This verifies the gold’s weight, purity, and origin. It adds value during resale.

3. Trusted Refiners

Choose bars from LBMA-approved refiners like:

-

PAMP Suisse

-

Valcambi

-

Perth Mint

-

Heraeus

-

Royal Canadian Mint

4. Packaging

Sealed packaging with tamper-proof security adds a layer of safety and resale value.

💼 Storage Options After You Buy a Bar of Gold

Storing gold securely is vital to protecting buy bar of gold your investment.

🔐 Home Safe

-

Fireproof and theft-resistant

-

Quick access

-

Ideal for small to medium investments

🏦 Bank Safe Deposit Box

-

High security

-

Suitable for larger holdings

-

Minimal risk but may incur annual fees

🏢 Professional Vault Storage

-

Fully insured

-

Third-party security

-

Often available through gold dealers

🔄 Selling Your Gold Bar

When you're ready to sell:

-

Check the current spot price

-

Compare offers from multiple buyers

-

Have your assay certificate ready

You can sell to:

-

Bullion dealers

-

Jewelry stores

-

Online marketplaces (if certified)

📌 Final Thoughts

To buy bar of gold is to invest in a time-tested asset that has preserved wealth across centuries. Whether you're preparing for the future, protecting against inflation, or simply diversifying your investments, gold bars provide a secure and sensible option.

Start with a size that fits your budget, choose a trusted dealer, and store your gold wisely. As the saying goes, “He who owns the gold, makes the rules.”