Financial Advisory Service Market was valued at USD 90.18 Billion in 2024. The Total Financial Advisory Services Market revenue is expected to grow by CAGR 5.7% from 2025 to 2032 and reach nearly USD 130.51 Billion in 2032.

Market Estimation & Definition

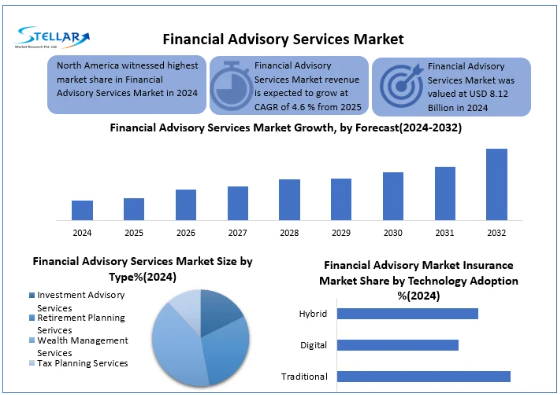

The Global Financial Advisory Services Market was valued at approximately USD 90.18 billion in 2024. Forecasts indicate robust growth through 2032, reaching nearly USD 130.51 billion, representing a compound annual growth rate (CAGR) of 5.7%.

Financial advisory services, delivered by both institutions and individual advisors, encompass wealth management, tax planning, retirement strategies, investment advice, and estate guidance—helping clients navigate increasingly complex financial landscapes.

Get instant access to your sample copy of this report! https://www.stellarmr.com/report/req_sample/financial-advisory-services-market/2762

Market Growth Drivers & Opportunity

Several factors are propelling market growth:

-

Growing Wealth Among High-Net-Worth Individuals (HNWIs): Rising global affluence is fueling demand for integrated wealth, tax, estate, and retirement planning.

-

Technological Transformation & Hybrid Models: Hybrid advisory—combining digital tools such as AI analytics and robo-advisors with human expertise—is reshaping client experiences. In 2024, hybrid models emerged as the leading service delivery format.

-

Digital Adoption Among Younger Investors: Over 60% of Millennials prefer accessing financial advice digitally, prompting advisory firms to invest in intuitive, mobile-first platforms.

-

Regulatory Complexity & Economic Uncertainty: Growing regulatory scrutiny, coupled with market volatility, is creating demand for expert advisory in risk mitigation and strategic planning.

Segmentation Analysis

By Service Type

-

Wealth Management Services dominate, accounting for over 40% of market share in 2024, driven by demand from HNWIs seeking personalized, holistic financial guidance.

By Billing Model

-

Commission-Based Services remain the most common and lucrative format in 2024, preferred for aligning advisor incentives with client performance.

By Technology Adoption

-

The Hybrid Advisory Model—leveraging both human interaction and digital tools—has overtaken traditional methods, offering scalability, personalization, and efficiency.

For additional insights into this study, please refer to: https://www.stellarmr.com/report/financial-advisory-services-market/2762

Country-Level Analysis: USA & Germany

United States

North America, led by the U.S., dominates the global market with a high concentration of HNWIs, advanced fintech adoption, and a mature financial ecosystem. Firms increasingly deploy hybrid advisory platforms offering AI-enhanced planning tools and real-time portfolio management, especially for affluent and tech-savvy clients.

Germany

Germany remains a leading European market. With strong regulatory frameworks and a robust banking sector, Germany supports dynamic financial advisory growth across wealth, tax, and corporate segments. Its status as a continental finance hub gives it strategic importance in shaping advisory trends.

Competitive Landscape (Commutator Analysis)

-

Industry Leaders: Global giants such as Morgan Stanley and Bank of America Merrill Lynch dominate the field. Morgan Stanley manages trillions in client assets and invests heavily in digital platforms. Merrill Lynch, backed by Bank of America, offers integrated, scalable hybrid advisory services.

-

Innovative Solutions: Firms like HSBC and Barclays are rolling out AI-enabled hybrid platforms tailored to younger investors, enhancing personalization and accessibility.

-

Fintech Challenge: New entrants are disrupting the market with agile, low-cost advisory platforms—pushing legacy institutions to modernize and adapt.

Explore Our Top Trends :

Chad Smart Cattle Market https://www.stellarmr.com/report/Chad-Smart-Cattle-Market/600

Switzerland Banking Compliance Solutions Market https://www.stellarmr.com/report/Switzerland-Banking-Compliance-Solutions-Market/609

Conclusion

The Financial Advisory Services Market is primed for sustained growth. With a 2024 valuation of approximately USD 90.18 billion, it is projected to reach nearly USD 130.51 billion by 2032, reflecting a 5.7% CAGR.

Key Strategic Focus Areas:

-

Invest in hybrid advisory models that combine human trust with digital scalability.

-

Expand AI-driven personalization and mobile advisory capabilities to meet evolving consumer expectations.

-

Target emerging investor segments, including Millennials and HNWIs across diverse regions.

-

Maintain agility in regulatory compliance and global risk management to support trust and resilience.

Firms that excel in technology integration, client personalization, and operational sophistication will be best positioned to lead in this dynamic, high-potential market.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656