In-plant logistics has become a cornerstone for manufacturing competitiveness in today’s fast-paced industrial landscape. The ability to streamline the movement, storage, and handling of materials within factory and production environments directly impacts operational efficiency, cost reduction, and responsiveness to market demand. As manufacturing sectors globally accelerate adoption of automation, Industry 4.0 technologies, and data analytics, in-plant logistics solutions evolve to integrate these innovations, driving productivity and sustainability.

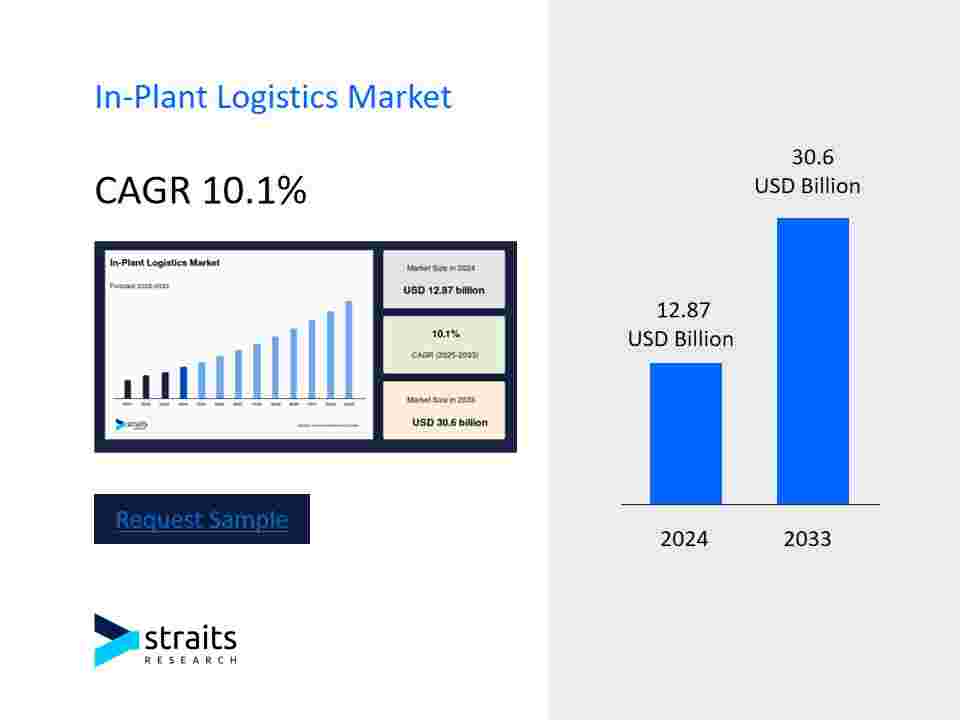

According to Straits Research, “The global in-plant logistics market size was valued at USD 12.87 billion in 2024 and is expected to grow from USD 14.17 billion in 2025 to reach USD 30.6 billion by 2033, growing at a CAGR of 10.1% during the forecast period (2025-2033).” This rapid expansion is fueled by increasing demand for automation, smart warehousing, and efficient material handling within growing manufacturing hubs worldwide.

Technological Innovations Driving In-Plant Logistics

The transformation of in-plant logistics in 2025 is underpinned by multiple technological advancements:

-

Industry 4.0 Integration: Smart factories leverage interconnected sensors, cyber-physical systems, and data analytics to track material flow, predict bottlenecks, and optimize in-house logistics chain management.

-

Autonomous Mobile Robots (AMRs): Increasing deployment of AMRs automates material transport and internal deliveries, reducing manual workloads and enhancing safety within manufacturing plants.

-

AI-Powered Predictive Analytics: Advanced analytics platforms anticipate maintenance needs for logistics equipment and forecast demand, enabling preemptive actions that reduce downtime and inventory costs.

-

Digital Twins: Virtual replicas of manufacturing layouts simulate and optimize warehouse and material handling scenarios, improving space utilization and process throughput.

-

Sustainability Initiatives: Growing emphasis on energy-efficient electric forklift trucks, automated guided vehicles (AGVs), and waste reduction practices align in-plant logistics with corporate environmental goals.

-

Modular and Scalable Solutions: Customizable logistics frameworks adapt dynamically to fluctuating production volumes and product mix changes becoming essential for agile manufacturing.

Major Players and Regional Highlights

Key companies advancing in-plant logistics capabilities include:

-

KION Group AG (Germany): A leader in material handling equipment and automation solutions, heavily investing in robotics, digital warehouse management systems (WMS), and e-mobility logistics technologies to serve global manufacturing clients.

-

Jungheinrich AG (Germany): Focuses on automation and AGV deployment integrating IoT-enabled remote monitoring systems to enhance operational visibility and reduce total cost of ownership.

-

Honeywell International Inc. (US): Providing intelligent warehouse control software and advanced sensor technology, Honeywell supports in-plant logistics efficiency and safety improvements worldwide.

-

BEUMER Group GmbH & Co. KG (Germany): Recently strengthened capabilities via acquisition, BEUMER offers solutions specialized for sectors including cement, mining, and industrial manufacturing with a global footprint.

-

Daifuku Co., Ltd. (Japan): Offering automated material handling systems and robotics, Daifuku leads in Asia-Pacific, serving electronics, automotive, and food processing industries.

-

Mahindra Logistics (India): Expanding in-plant logistics service offerings in India, emphasizing automation and integrated supply chain solutions for automotive, electronics, and FMCG sectors.

-

Regionally, Asia-Pacific exhibits the fastest growth driven by expanding manufacturing sectors, government initiatives promoting smart factories, and increased automation adoption.

-

North America and Europe maintain strong growth trajectories driven by Industry 4.0 adoption, sustainability frameworks, and retrofitting older plants with modern logistics technologies.

-

Latin America & Middle East/Africa present emerging opportunities with investments in manufacturing infrastructure modernization bolstering in-plant logistics demand.

Current Trends and Growth Drivers

-

The shift towards digitization and data-driven logistics execution enables near real-time inventory tracking, workspace optimization, and faster production cycles.

-

Robotics and automation reduce human error, improve throughput, and mitigate labor shortages, critical in high-volume manufacturing environments.

-

Collaborative robots (cobots) working alongside human operators improve flexibility and safety on factory floors, aiding in complex material handling tasks.

-

Modular logistics systems provide agility to manufacturing lines adjusting rapidly to product customization and seasonal demand fluctuations.

-

Environmental goals compel manufacturers to invest in electric material handling vehicles and optimize energy consumption, reflecting corporate social responsibility.

-

Enterprises increasingly rely on third-party specialists and managed services to implement and maintain complex in-plant logistics systems.

Recent News and Strategic Developments

-

BEUMER Group acquired U.S.-based Hendrik Group Inc. in 2023, aiming to expand innovative in-plant logistics in cement and mining plants, demonstrating heightened industrial sector focus.

-

SSI SCHAEFER launched an advanced automated roaming shuttle integrated with high-density storage systems in Dubai, enhancing warehouse space utilization and operational efficiency.

-

Honeywell International acquired Compressor Controls Corporation to bolster asset performance management solutions, enhancing reliability and predictive maintenance for logistics facilities globally.

-

Mahindra Logistics expanded in-plant logistics services in automotive manufacturing plants in India, deploying AGV fleets and AI-powered scheduling solutions.

-

KION Group continues to innovate with AGVs and smart logistics software, investing significantly in European and Asian production hubs for enhanced operational control.

-

Industry adoption of digital twins and AI-enhanced supply chain tools escalates, with notable growth in Europe and Asia, enabling streamlined facility layouts and improved flow management.

Summary

In-plant logistics is at the heart of manufacturing productivity and flexibility, driven by robotics, AI, and digital twin technologies. Investment in sustainable and modular automation enhances competitiveness across industries globally. Rapid adoption in Asia-Pacific and modernization in mature markets ensure strong, continued demand for innovative in-plant logistics solutions through 2033.