0 Reacties

0 aandelen

3678 Views

Bedrijvengids

- Please log in to like, share and comment!

- https://aajneeti.social/real-estate-lead-generation-in-bengaluru/0 Reacties 0 aandelen 1462 Views

- 0 Reacties 0 aandelen 566 Views

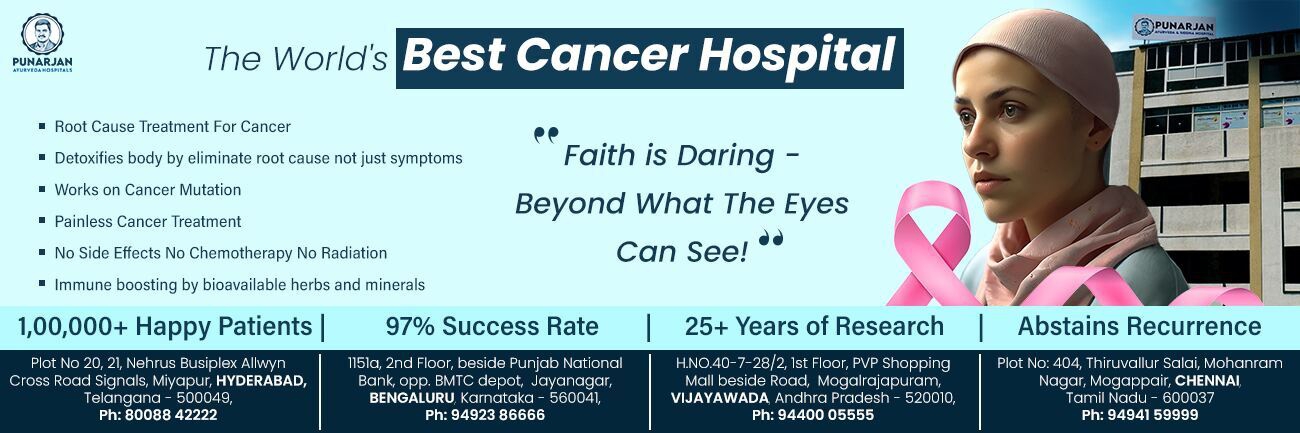

- Best Blood Cancer Treatment Hospitals in Hyderabad

Find the Best Blood Cancer Treatment Hospitals in Hyderabad with a dedicated cancer care team through ancient and effective Rasayana Ayurveda.

Visit us: https://www.punarjanayurveda.com/hyderabad/blood-cancer-treatment-hospitals/Best Blood Cancer Treatment Hospitals in Hyderabad Find the Best Blood Cancer Treatment Hospitals in Hyderabad with a dedicated cancer care team through ancient and effective Rasayana Ayurveda. Visit us: https://www.punarjanayurveda.com/hyderabad/blood-cancer-treatment-hospitals/WWW.PUNARJANAYURVEDA.COMBest Blood Cancer Treatment Hospitals - Punarjan AyurvedaPeople with blood cancer can get Rasayana Ayurveda treatments in Hyderabad. This type of treatment is built on immunology. Both building up the...0 Reacties 0 aandelen 1072 Views - What are glass door knobs?

https://designerhandle.co.uk/glass-door-knobs-elegant-timeless-hardware-for-any-space/

Glass door knobs are attractive and useful hardware for doors constructed of high-quality glass. They come in a variety of forms, sizes, and finishes, including clear, frosted, and coloured glass, and they are commonly placed on metal bases such as brass, chrome, or nickel.

#satinchromedoorknobs #copperdoorknobs #antiquedoorknobs

What are glass door knobs? https://designerhandle.co.uk/glass-door-knobs-elegant-timeless-hardware-for-any-space/ Glass door knobs are attractive and useful hardware for doors constructed of high-quality glass. They come in a variety of forms, sizes, and finishes, including clear, frosted, and coloured glass, and they are commonly placed on metal bases such as brass, chrome, or nickel. #satinchromedoorknobs #copperdoorknobs #antiquedoorknobsDESIGNERHANDLE.CO.UKGlass Door Knobs: Elegant & Timeless Hardware for Any Space - Luxury Collections of Door HandlesDiscover timeless elegance with glass door knobs. Add charm and style to any room with our stunning, durable designs.0 Reacties 0 aandelen 6837 Views - ホルモン補充療法市場の需要は 2031年までに366.9億米ドルに達する見込み市場概要: Kings Researchの最新の調査研究によると、世界のホルモン補充療法市場の需要は、2023年の226億4,000万米ドルから2031年には366億9,000万米ドルに達し、2024年から2031年にかけて6.4%のCAGR成長が見込まれています。...0 Reacties 0 aandelen 3866 Views

- VPNs for Safe Pornhub Access – Stay Private OnlineVPNs for Safe Pornhub Access In today's digital age, many individuals prefer to keep their online habits private, particularly when it comes to visiting adult websites. Unfortunately, Pornhub is blocked in various regions, and recent legislation in several states across the U.S. mandates age verification through photo identification for accessing adult content. This approach not only...0 Reacties 0 aandelen 3733 Views

- ️エナジードリンク市場の需要は 2031年までに701.2億ドルから1284.5億ドルに達すると予測市場概要: Kings Researchの最新の調査研究によると、世界のエナジードリンク市場の需要は、 2023年の701.2億米ドルから2031年には1284.5億米ドルに達し、2024年から2031年にかけて7.99%のCAGRで成長すると予想されています。...0 Reacties 0 aandelen 3618 Views

- Enhancing Internet Speed: Top Tips to Boost PerformanceEnhancing Internet Speed Tips To enhance your internet performance, consider these handy suggestions. First, it's critical to determine your current connection speed. Begin by reviewing the service agreement with your Internet Service Provider (ISP) to understand the speeds you are paying for. For instance, if you subscribe to a package that promises up to 100 Mbps, be...0 Reacties 0 aandelen 3439 Views

- Innovative Music Streaming Solutions

Enhance your music experience with cutting-edge music streaming solutions tailored for seamless performance, high-quality audio, and personalized recommendations. Whether for startups or enterprises, our solutions offer cross-platform compatibility, AI-driven playlists, and robust security features. Elevate your streaming service with scalable and feature-rich technology designed for the modern listener.

For More Info:- https://tinyurl.com/yc3mf4us

#musicstreaming #streamingplatform #onlinemusicInnovative Music Streaming Solutions Enhance your music experience with cutting-edge music streaming solutions tailored for seamless performance, high-quality audio, and personalized recommendations. Whether for startups or enterprises, our solutions offer cross-platform compatibility, AI-driven playlists, and robust security features. Elevate your streaming service with scalable and feature-rich technology designed for the modern listener. For More Info:- https://tinyurl.com/yc3mf4us #musicstreaming #streamingplatform #onlinemusicTINYURL.COMMusic Streaming App Development Company - FullestopEngage music lovers with our custom music streaming app development services. Our team crafts personalized apps that resonate with music lovers everywhere.0 Reacties 0 aandelen 4189 Views - Rocket and Missiles Market Size, Share & Trends 2025-2034The rocket and missiles market is on the cusp of significant growth, driven by technological advancements and escalating defense spending. This market is expected to grow at a compound annual growth rate (CAGR) of 4.6% between 2025 and 2034. Governments worldwide are increasingly investing in modernizing and enhancing their defense capabilities with cutting-edge rocket and missile systems,...0 Reacties 0 aandelen 4397 Views

- The Ultimate Guide to Choosing the Best Brisbane Removalists for Your MoveThe Ultimate Guide to Choosing the Best Brisbane Removalists for Your Move Moving to a new home or office can be both exciting and stressful. If you are moving to Brisbane or another city, hiring professional removalists can help. This includes cities like Melbourne, Sydney, Gold Coast, and Canberra. They can make your move easy and stress-free. In this article, we will look at why Brisbane...0 Reacties 0 aandelen 4046 Views

- Best VPNs for Craigslist - Bypass Bans SecurelyTop VPNs for Craigslist Navigating Craigslist can sometimes be a frustrating experience for both sellers and recruiters. Many users encounter unexpected challenges, such as sudden bans due to frequent postings or listing items that are not allowed. Additionally, using public Wi-Fi for these activities poses its own set of risks, including slow speeds and compromised security....0 Reacties 0 aandelen 3874 Views

- What are glass door knobs?

https://designerhandle.co.uk/glass-door-knobs-elegant-timeless-hardware-for-any-space/

Glass door knobs are attractive and useful hardware for doors constructed of high-quality glass. They come in a variety of forms, sizes, and finishes, including clear, frosted, and coloured glass, and they are commonly placed on metal bases such as brass, chrome, or nickel.

#satinchromedoorknobs #copperdoorknobs #antiquedoorknobs

What are glass door knobs? https://designerhandle.co.uk/glass-door-knobs-elegant-timeless-hardware-for-any-space/ Glass door knobs are attractive and useful hardware for doors constructed of high-quality glass. They come in a variety of forms, sizes, and finishes, including clear, frosted, and coloured glass, and they are commonly placed on metal bases such as brass, chrome, or nickel. #satinchromedoorknobs #copperdoorknobs #antiquedoorknobsDESIGNERHANDLE.CO.UKGlass Door Knobs: Elegant & Timeless Hardware for Any Space - Luxury Collections of Door HandlesDiscover timeless elegance with glass door knobs. Add charm and style to any room with our stunning, durable designs.0 Reacties 0 aandelen 7050 Views -

- Alfa Cytology Unveils Advanced Cancer Immunotherapy Development ServicesAlfa Cytology u nveils a dvanced c ancer i mmunotherapy d evelopment s ervices . Alfa Cytology, a renowned services supplier in oncology, has recently introduced its groundbreaking cancer immunotherapy development services. This initiative signifies a major leap forward in the development of more effective cancer therapies, aiming to increase both...0 Reacties 0 aandelen 5408 Views

- Alfa Cytology Unveils Advanced Ovarian Cancer Therapy Development ServicesAlfa Cytology has launched ovarian cancer therapy development services. Alfa Cytology, a prominent services provider in oncology, has launched its cutting-edge ovarian cancer therapy development services. This significant advancement represents a vital leap in the quest for more precise and effective treatments for ovarian cancer. With the...0 Reacties 0 aandelen 5189 Views

- Best Overseas education consultants in HyderabadIVY Overseas is the "Best overseas education consultants in Hyderabad", IVY Overseas mission is to help the student community with the right advice to help them find a destination, a university and a program that fits into their academic needs and career aspirations. We have been doing this since 2011 and till date we have helped more than 20000+ students to realize their dream of studying...0 Reacties 0 aandelen 5186 Views

- Net Neutrality & VPNs: Challenges Post-2017Net Neutrality and VPNs In late 2017, net neutrality supporters in the United States encountered a significant challenge. Despite widespread backing for regulations ensuring equal treatment of all internet traffic by Internet Service Providers (ISPs), corporate priorities overshadowed public interest. On December 14, the FCC voted to roll back regulations that prevented ISPs from...0 Reacties 0 aandelen 3504 Views

- Best study abroad consultants in HyderabadIVY Overseas is the " Best study abroad consultants in Hyderabad ", IVY Overseas mission is to help the student community with the right advice to help them find a destination, a university and a program that fits into their academic needs and career aspirations. We have been doing this since 2011 and till date we have helped more than 20000+ students to realize their dream of studying abroad...0 Reacties 0 aandelen 4950 Views

Sponsor

Liện Hệ Quảng Cáo