Controlled Release Fertilizer Market to be Driven by increasing population in the Forecast Period of 2025-2032

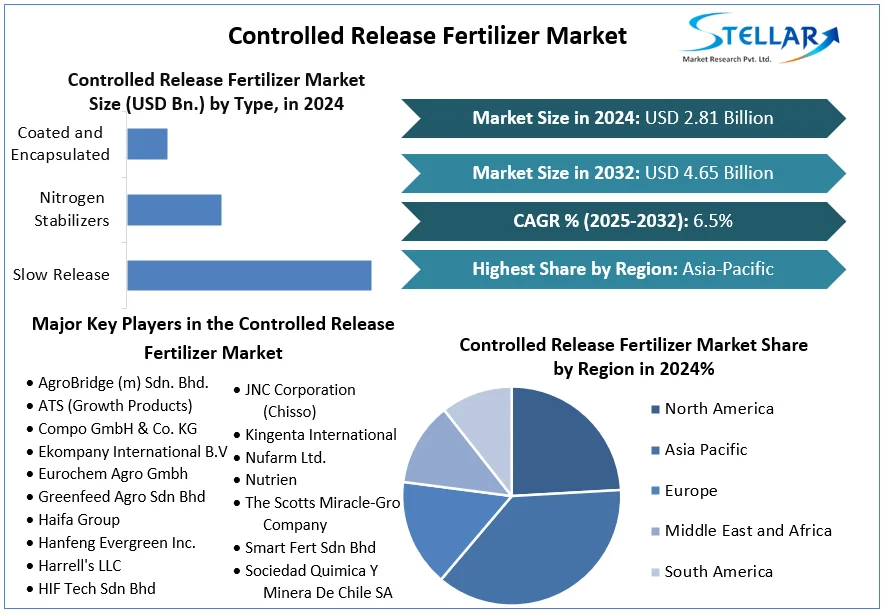

Controlled Release Fertilizer Market was valued at USD 2.8 billion in 2023 and is expected to grow at a CAGR of 10.2% to reach USD 5.6 billion by 2030. The rising demand for sustainable agriculture, enhanced crop yield, and nutrient efficiency is propelling the adoption of controlled release fertilizers across the globe.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Controlled-Release-Fertilizer-Market/336

Market Estimation, Growth Drivers & Opportunities

Controlled release fertilizers (CRFs) are specially engineered to release nutrients gradually into the soil, reducing nutrient leaching and improving absorption efficiency. Their use has gained popularity across horticulture, agriculture, and turf management due to environmental and economic benefits.

Key Growth Drivers:

Environmental Regulations: Increasing restrictions on conventional fertilizers due to groundwater contamination are fueling CRF demand.

Efficiency & Yield Improvement: CRFs offer higher nutrient use efficiency (NUE), reducing the number of applications and labor costs.

Climate-Resilient Agriculture: CRFs provide consistent nutrient supply even under unpredictable weather, supporting stable yields.

Opportunities:

Expansion in developing markets such as India, Brazil, and Southeast Asia.

Rising integration with smart irrigation and precision farming systems.

Growing demand for organic and biodegradable coatings for CRFs.

U.S. Market Trends & 2024 Investment Snapshot

In 2024, the U.S. witnessed a surge in CRF adoption among large-scale corn, soybean, and specialty crop farmers, driven by sustainability commitments and cost-efficiency. Companies like Nutrien and ICL Group invested in bio-based CRF technologies and AI-driven nutrient modeling tools, aligning with government-backed precision agriculture initiatives.

Market Segmentation – Leading Segments by Share

By Type:

Polymer-Coated Fertilizers held the largest market share in 2024, thanks to their controlled solubility and widespread field trials.

Sulfur-Coated Urea (SCU) is seeing steady growth due to lower cost and improved performance over traditional urea.

By Crop Type:

Cereals & Grains dominate the market, followed by fruits, vegetables, and turf grasses.

Horticultural crops are the fastest-growing segment, particularly in Europe and North America.

By Mode of Application:

Soil Application remains the leading method, while fertigation is gaining ground in high-value crops.

Competitive Analysis – Top 5 Players & Strategic Initiatives

1. Nutrien Ltd.

Expanded its CRF product line in 2024 by introducing biodegradable coatings, catering to demand from organic farmers and golf courses.

2. The Mosaic Company

Invested in research partnerships to develop next-gen controlled release blends customized by soil type and region.

3. ICL Group

Launched eqo.x, a new eco-friendly CRF targeting precision agriculture sectors, with pilot programs in the U.S. and Germany.

4. Yara International

Enhanced its digital farming platform, integrating CRF recommendations with soil analytics and weather forecasting tools.

5. Haifa Group

Focused on water-soluble CRFs compatible with modern irrigation systems, expanding its footprint in the Asia-Pacific region.

Regional Insights – USA, China, Germany, France, Japan, and India

USA:

Leads innovation in CRF with smart agriculture integration and environmentally compliant formulations.

China:

Government incentives for fertilizer efficiency and pollution control support rapid market expansion.

Germany:

Strong demand from horticulture and greenhouse crops, aligned with EU's Farm-to-Fork strategy.

France:

Focuses on CRFs for vineyards and specialty crops, with rising organic farming adoption.

Japan:

Technology-driven market with demand for precision farming and miniaturized CRF delivery systems.

India:

Government subsidies and low fertilizer efficiency are pushing the transition toward CRF in cereal and vegetable farming.

Conclusion & Outlook

The Controlled Release Fertilizer Market is poised for robust growth as agriculture transitions to more sustainable and efficient practices. The integration of CRFs into precision farming ecosystems and the rise of biodegradable, environment-friendly formulations are expected to shape the future landscape.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Controlled Release Fertilizer Market was valued at USD 2.8 billion in 2023 and is expected to grow at a CAGR of 10.2% to reach USD 5.6 billion by 2030. The rising demand for sustainable agriculture, enhanced crop yield, and nutrient efficiency is propelling the adoption of controlled release fertilizers across the globe.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Controlled-Release-Fertilizer-Market/336

Market Estimation, Growth Drivers & Opportunities

Controlled release fertilizers (CRFs) are specially engineered to release nutrients gradually into the soil, reducing nutrient leaching and improving absorption efficiency. Their use has gained popularity across horticulture, agriculture, and turf management due to environmental and economic benefits.

Key Growth Drivers:

Environmental Regulations: Increasing restrictions on conventional fertilizers due to groundwater contamination are fueling CRF demand.

Efficiency & Yield Improvement: CRFs offer higher nutrient use efficiency (NUE), reducing the number of applications and labor costs.

Climate-Resilient Agriculture: CRFs provide consistent nutrient supply even under unpredictable weather, supporting stable yields.

Opportunities:

Expansion in developing markets such as India, Brazil, and Southeast Asia.

Rising integration with smart irrigation and precision farming systems.

Growing demand for organic and biodegradable coatings for CRFs.

U.S. Market Trends & 2024 Investment Snapshot

In 2024, the U.S. witnessed a surge in CRF adoption among large-scale corn, soybean, and specialty crop farmers, driven by sustainability commitments and cost-efficiency. Companies like Nutrien and ICL Group invested in bio-based CRF technologies and AI-driven nutrient modeling tools, aligning with government-backed precision agriculture initiatives.

Market Segmentation – Leading Segments by Share

By Type:

Polymer-Coated Fertilizers held the largest market share in 2024, thanks to their controlled solubility and widespread field trials.

Sulfur-Coated Urea (SCU) is seeing steady growth due to lower cost and improved performance over traditional urea.

By Crop Type:

Cereals & Grains dominate the market, followed by fruits, vegetables, and turf grasses.

Horticultural crops are the fastest-growing segment, particularly in Europe and North America.

By Mode of Application:

Soil Application remains the leading method, while fertigation is gaining ground in high-value crops.

Competitive Analysis – Top 5 Players & Strategic Initiatives

1. Nutrien Ltd.

Expanded its CRF product line in 2024 by introducing biodegradable coatings, catering to demand from organic farmers and golf courses.

2. The Mosaic Company

Invested in research partnerships to develop next-gen controlled release blends customized by soil type and region.

3. ICL Group

Launched eqo.x, a new eco-friendly CRF targeting precision agriculture sectors, with pilot programs in the U.S. and Germany.

4. Yara International

Enhanced its digital farming platform, integrating CRF recommendations with soil analytics and weather forecasting tools.

5. Haifa Group

Focused on water-soluble CRFs compatible with modern irrigation systems, expanding its footprint in the Asia-Pacific region.

Regional Insights – USA, China, Germany, France, Japan, and India

USA:

Leads innovation in CRF with smart agriculture integration and environmentally compliant formulations.

China:

Government incentives for fertilizer efficiency and pollution control support rapid market expansion.

Germany:

Strong demand from horticulture and greenhouse crops, aligned with EU's Farm-to-Fork strategy.

France:

Focuses on CRFs for vineyards and specialty crops, with rising organic farming adoption.

Japan:

Technology-driven market with demand for precision farming and miniaturized CRF delivery systems.

India:

Government subsidies and low fertilizer efficiency are pushing the transition toward CRF in cereal and vegetable farming.

Conclusion & Outlook

The Controlled Release Fertilizer Market is poised for robust growth as agriculture transitions to more sustainable and efficient practices. The integration of CRFs into precision farming ecosystems and the rise of biodegradable, environment-friendly formulations are expected to shape the future landscape.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Controlled Release Fertilizer Market to be Driven by increasing population in the Forecast Period of 2025-2032

Controlled Release Fertilizer Market was valued at USD 2.8 billion in 2023 and is expected to grow at a CAGR of 10.2% to reach USD 5.6 billion by 2030. The rising demand for sustainable agriculture, enhanced crop yield, and nutrient efficiency is propelling the adoption of controlled release fertilizers across the globe.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Controlled-Release-Fertilizer-Market/336

Market Estimation, Growth Drivers & Opportunities

Controlled release fertilizers (CRFs) are specially engineered to release nutrients gradually into the soil, reducing nutrient leaching and improving absorption efficiency. Their use has gained popularity across horticulture, agriculture, and turf management due to environmental and economic benefits.

Key Growth Drivers:

Environmental Regulations: Increasing restrictions on conventional fertilizers due to groundwater contamination are fueling CRF demand.

Efficiency & Yield Improvement: CRFs offer higher nutrient use efficiency (NUE), reducing the number of applications and labor costs.

Climate-Resilient Agriculture: CRFs provide consistent nutrient supply even under unpredictable weather, supporting stable yields.

Opportunities:

Expansion in developing markets such as India, Brazil, and Southeast Asia.

Rising integration with smart irrigation and precision farming systems.

Growing demand for organic and biodegradable coatings for CRFs.

U.S. Market Trends & 2024 Investment Snapshot

In 2024, the U.S. witnessed a surge in CRF adoption among large-scale corn, soybean, and specialty crop farmers, driven by sustainability commitments and cost-efficiency. Companies like Nutrien and ICL Group invested in bio-based CRF technologies and AI-driven nutrient modeling tools, aligning with government-backed precision agriculture initiatives.

Market Segmentation – Leading Segments by Share

By Type:

Polymer-Coated Fertilizers held the largest market share in 2024, thanks to their controlled solubility and widespread field trials.

Sulfur-Coated Urea (SCU) is seeing steady growth due to lower cost and improved performance over traditional urea.

By Crop Type:

Cereals & Grains dominate the market, followed by fruits, vegetables, and turf grasses.

Horticultural crops are the fastest-growing segment, particularly in Europe and North America.

By Mode of Application:

Soil Application remains the leading method, while fertigation is gaining ground in high-value crops.

Competitive Analysis – Top 5 Players & Strategic Initiatives

1. Nutrien Ltd.

Expanded its CRF product line in 2024 by introducing biodegradable coatings, catering to demand from organic farmers and golf courses.

2. The Mosaic Company

Invested in research partnerships to develop next-gen controlled release blends customized by soil type and region.

3. ICL Group

Launched eqo.x, a new eco-friendly CRF targeting precision agriculture sectors, with pilot programs in the U.S. and Germany.

4. Yara International

Enhanced its digital farming platform, integrating CRF recommendations with soil analytics and weather forecasting tools.

5. Haifa Group

Focused on water-soluble CRFs compatible with modern irrigation systems, expanding its footprint in the Asia-Pacific region.

Regional Insights – USA, China, Germany, France, Japan, and India

USA:

Leads innovation in CRF with smart agriculture integration and environmentally compliant formulations.

China:

Government incentives for fertilizer efficiency and pollution control support rapid market expansion.

Germany:

Strong demand from horticulture and greenhouse crops, aligned with EU's Farm-to-Fork strategy.

France:

Focuses on CRFs for vineyards and specialty crops, with rising organic farming adoption.

Japan:

Technology-driven market with demand for precision farming and miniaturized CRF delivery systems.

India:

Government subsidies and low fertilizer efficiency are pushing the transition toward CRF in cereal and vegetable farming.

Conclusion & Outlook

The Controlled Release Fertilizer Market is poised for robust growth as agriculture transitions to more sustainable and efficient practices. The integration of CRFs into precision farming ecosystems and the rise of biodegradable, environment-friendly formulations are expected to shape the future landscape.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

0 Comments

0 Shares

5704 Views