Inspection Camera System Market to be Driven by increasing population in the Forecast Period of 2025-2032

Inspection Camera System Market: Steady Growth Driven by Safety, Automation, and Infrastructure Needs

1. Market Estimation & Definition

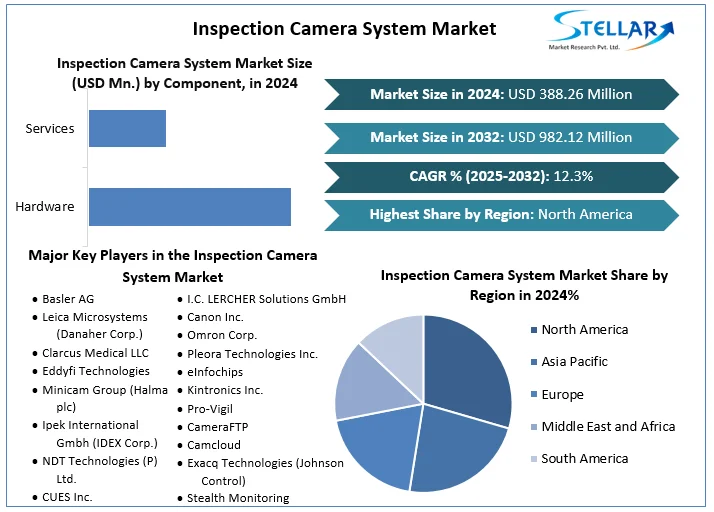

The Inspection Camera System Market—encompassing devices like borescopes, endoscopes, thermal imaging cameras, and associated inspection services across pipeline, drain, and industrial inspection—was valued at approximately USD 390 million in 2024 and is projected to grow to USD 729 million by 2030, with an estimated CAGR of 11.2%

Other forecasts support this growth trajectory: for instance, SNS Insider places the market at USD 352 million in 2023, rising to USD 933.5 million by 2032, with a CAGR of 11.5% . Spherical Insights projects even higher growth—from USD 317.3 million in 2022 to USD 1.08 billion by 2032 at 13% CAGR

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Inspection-Camera-System-Market-/1460

2. Market Growth Drivers & Opportunity

Preventive Maintenance & Safety Compliance: Industries such as oil & gas, construction, utilities, and manufacturing rely on inspection cameras for non-destructive testing, helping prevent failures and ensure regulatory compliance

Aging Infrastructure & Inspection Needs: Ongoing investments in infrastructure—pipelines, sewers, and urban assets—are driving demand for reliable inspection tools

Technological Advancements: The shift toward hardware systems, especially Full HD and 4K imaging, and intelligent services (AI-enabled and wireless systems) is significantly enhancing inspection precision and usability

3. What Lies Ahead: Emerging Trends

Resolution Upgrades: Full HD and 4K systems are rapidly growing—Full HD/4K cameras are forecasted to outpace SD/HD adoption, expected to grow at a 12.3% CAGR

Services Segment Growth: Alongside hardware, the services segment—covering diagnostics, maintenance, and training—is poised for strong expansion, with a projected CAGR of 11.9%

Fastest Growth in Pipeline Inspection: Pipeline inspections, especially in oil, gas, and utility sectors, continue to lead application-wise demand

4. Segmentation Overview

By Component: Hardware currently dominates (~65%+ share), including endoscopes, borescopes, thermal cameras; services are the fastest-growing component

By Video Quality: SD/HD systems remain widespread, but Full HD and 4K segments are gaining ground

By Application: Key segments include Pipeline, Drain, Tank, Medical, Safety & Surveillance; pipeline inspection leads due to industrial demand

By Region: North America leads (~35–36% share) with stringent safety standards and developed infrastructure; Asia-Pacific is the fastest-growing due to rapid industrialization and infrastructure expansion

5. Country-Level Highlights: North America & Asia-Pacific

North America: Holds the majority regional share (~35%), fueled by robust infrastructure, regulatory oversight (e.g., OSHA), and industrial automation adoption

Asia-Pacific: Expected to grow at the fastest pace due to infrastructure development in China, India, and Japan—particularly in public utilities and manufacturing sectors

6. Strategic Analysis (Porter's Five Forces)

Supplier Power: Moderate. Leading players like Canon, Olympus, Bosch, Leica, and Clarus Medical dominate through innovation and credibility

Buyer Power: High. End-users demand high resolution, reliability, and low operational costs across industries.

Threat of Substitutes: Low. Alternatives like visual inspection or manual methods lack comparable efficiency and data insights.

Threat of New Entrants: Moderate to Low. High technical expertise and compliance barriers deter new entrants.

Competitive Rivalry: High. Competition centers on image quality upgrades, wireless functionality, and expanding service offerings.

7. Press Release Conclusion

The Inspection Camera System Market is on a vigorous growth trajectory—from ~USD 390 million in 2024 to USD 933–1,080 million by 2032—with CAGR ranging between 11–13% Growth is propelled by rising preventive maintenance needs, technology enhancements, and regulatory pressures across diverse sectors.

North America leads in adoption, while Asia-Pacific presents substantial growth potential. Companies that focus on high-definition imaging, advanced services, and application-specific solutions are best positioned to lead in this evolving market.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Inspection Camera System Market: Steady Growth Driven by Safety, Automation, and Infrastructure Needs

1. Market Estimation & Definition

The Inspection Camera System Market—encompassing devices like borescopes, endoscopes, thermal imaging cameras, and associated inspection services across pipeline, drain, and industrial inspection—was valued at approximately USD 390 million in 2024 and is projected to grow to USD 729 million by 2030, with an estimated CAGR of 11.2%

Other forecasts support this growth trajectory: for instance, SNS Insider places the market at USD 352 million in 2023, rising to USD 933.5 million by 2032, with a CAGR of 11.5% . Spherical Insights projects even higher growth—from USD 317.3 million in 2022 to USD 1.08 billion by 2032 at 13% CAGR

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Inspection-Camera-System-Market-/1460

2. Market Growth Drivers & Opportunity

Preventive Maintenance & Safety Compliance: Industries such as oil & gas, construction, utilities, and manufacturing rely on inspection cameras for non-destructive testing, helping prevent failures and ensure regulatory compliance

Aging Infrastructure & Inspection Needs: Ongoing investments in infrastructure—pipelines, sewers, and urban assets—are driving demand for reliable inspection tools

Technological Advancements: The shift toward hardware systems, especially Full HD and 4K imaging, and intelligent services (AI-enabled and wireless systems) is significantly enhancing inspection precision and usability

3. What Lies Ahead: Emerging Trends

Resolution Upgrades: Full HD and 4K systems are rapidly growing—Full HD/4K cameras are forecasted to outpace SD/HD adoption, expected to grow at a 12.3% CAGR

Services Segment Growth: Alongside hardware, the services segment—covering diagnostics, maintenance, and training—is poised for strong expansion, with a projected CAGR of 11.9%

Fastest Growth in Pipeline Inspection: Pipeline inspections, especially in oil, gas, and utility sectors, continue to lead application-wise demand

4. Segmentation Overview

By Component: Hardware currently dominates (~65%+ share), including endoscopes, borescopes, thermal cameras; services are the fastest-growing component

By Video Quality: SD/HD systems remain widespread, but Full HD and 4K segments are gaining ground

By Application: Key segments include Pipeline, Drain, Tank, Medical, Safety & Surveillance; pipeline inspection leads due to industrial demand

By Region: North America leads (~35–36% share) with stringent safety standards and developed infrastructure; Asia-Pacific is the fastest-growing due to rapid industrialization and infrastructure expansion

5. Country-Level Highlights: North America & Asia-Pacific

North America: Holds the majority regional share (~35%), fueled by robust infrastructure, regulatory oversight (e.g., OSHA), and industrial automation adoption

Asia-Pacific: Expected to grow at the fastest pace due to infrastructure development in China, India, and Japan—particularly in public utilities and manufacturing sectors

6. Strategic Analysis (Porter's Five Forces)

Supplier Power: Moderate. Leading players like Canon, Olympus, Bosch, Leica, and Clarus Medical dominate through innovation and credibility

Buyer Power: High. End-users demand high resolution, reliability, and low operational costs across industries.

Threat of Substitutes: Low. Alternatives like visual inspection or manual methods lack comparable efficiency and data insights.

Threat of New Entrants: Moderate to Low. High technical expertise and compliance barriers deter new entrants.

Competitive Rivalry: High. Competition centers on image quality upgrades, wireless functionality, and expanding service offerings.

7. Press Release Conclusion

The Inspection Camera System Market is on a vigorous growth trajectory—from ~USD 390 million in 2024 to USD 933–1,080 million by 2032—with CAGR ranging between 11–13% Growth is propelled by rising preventive maintenance needs, technology enhancements, and regulatory pressures across diverse sectors.

North America leads in adoption, while Asia-Pacific presents substantial growth potential. Companies that focus on high-definition imaging, advanced services, and application-specific solutions are best positioned to lead in this evolving market.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Inspection Camera System Market to be Driven by increasing population in the Forecast Period of 2025-2032

Inspection Camera System Market: Steady Growth Driven by Safety, Automation, and Infrastructure Needs

1. Market Estimation & Definition

The Inspection Camera System Market—encompassing devices like borescopes, endoscopes, thermal imaging cameras, and associated inspection services across pipeline, drain, and industrial inspection—was valued at approximately USD 390 million in 2024 and is projected to grow to USD 729 million by 2030, with an estimated CAGR of 11.2%

Other forecasts support this growth trajectory: for instance, SNS Insider places the market at USD 352 million in 2023, rising to USD 933.5 million by 2032, with a CAGR of 11.5% . Spherical Insights projects even higher growth—from USD 317.3 million in 2022 to USD 1.08 billion by 2032 at 13% CAGR

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Inspection-Camera-System-Market-/1460

2. Market Growth Drivers & Opportunity

Preventive Maintenance & Safety Compliance: Industries such as oil & gas, construction, utilities, and manufacturing rely on inspection cameras for non-destructive testing, helping prevent failures and ensure regulatory compliance

Aging Infrastructure & Inspection Needs: Ongoing investments in infrastructure—pipelines, sewers, and urban assets—are driving demand for reliable inspection tools

Technological Advancements: The shift toward hardware systems, especially Full HD and 4K imaging, and intelligent services (AI-enabled and wireless systems) is significantly enhancing inspection precision and usability

3. What Lies Ahead: Emerging Trends

Resolution Upgrades: Full HD and 4K systems are rapidly growing—Full HD/4K cameras are forecasted to outpace SD/HD adoption, expected to grow at a 12.3% CAGR

Services Segment Growth: Alongside hardware, the services segment—covering diagnostics, maintenance, and training—is poised for strong expansion, with a projected CAGR of 11.9%

Fastest Growth in Pipeline Inspection: Pipeline inspections, especially in oil, gas, and utility sectors, continue to lead application-wise demand

4. Segmentation Overview

By Component: Hardware currently dominates (~65%+ share), including endoscopes, borescopes, thermal cameras; services are the fastest-growing component

By Video Quality: SD/HD systems remain widespread, but Full HD and 4K segments are gaining ground

By Application: Key segments include Pipeline, Drain, Tank, Medical, Safety & Surveillance; pipeline inspection leads due to industrial demand

By Region: North America leads (~35–36% share) with stringent safety standards and developed infrastructure; Asia-Pacific is the fastest-growing due to rapid industrialization and infrastructure expansion

5. Country-Level Highlights: North America & Asia-Pacific

North America: Holds the majority regional share (~35%), fueled by robust infrastructure, regulatory oversight (e.g., OSHA), and industrial automation adoption

Asia-Pacific: Expected to grow at the fastest pace due to infrastructure development in China, India, and Japan—particularly in public utilities and manufacturing sectors

6. Strategic Analysis (Porter's Five Forces)

Supplier Power: Moderate. Leading players like Canon, Olympus, Bosch, Leica, and Clarus Medical dominate through innovation and credibility

Buyer Power: High. End-users demand high resolution, reliability, and low operational costs across industries.

Threat of Substitutes: Low. Alternatives like visual inspection or manual methods lack comparable efficiency and data insights.

Threat of New Entrants: Moderate to Low. High technical expertise and compliance barriers deter new entrants.

Competitive Rivalry: High. Competition centers on image quality upgrades, wireless functionality, and expanding service offerings.

7. Press Release Conclusion

The Inspection Camera System Market is on a vigorous growth trajectory—from ~USD 390 million in 2024 to USD 933–1,080 million by 2032—with CAGR ranging between 11–13% Growth is propelled by rising preventive maintenance needs, technology enhancements, and regulatory pressures across diverse sectors.

North America leads in adoption, while Asia-Pacific presents substantial growth potential. Companies that focus on high-definition imaging, advanced services, and application-specific solutions are best positioned to lead in this evolving market.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

0 Σχόλια

0 Μοιράστηκε

141 Views