Process Automation and Instrumentation Market to be Driven by increasing population in the Forecast Period of 2025-2032

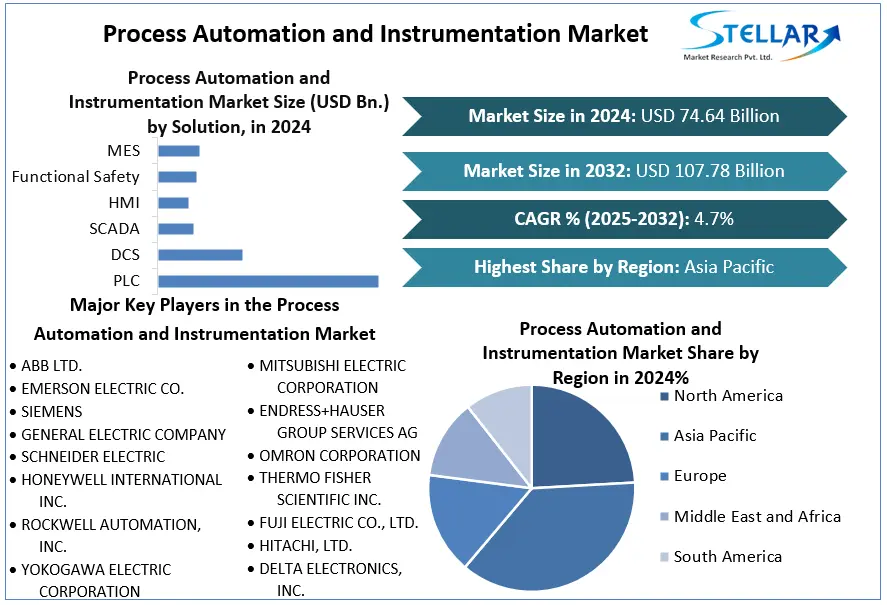

Global Process Automation and Instrumentation Market is set to expand from USD 63.52 billion in 2023 to USD 97.89 billion by 2032, growing at a CAGR of 4.94% during the forecast period. The market’s growth is fueled by the increasing need for energy efficiency, real-time production visibility, predictive maintenance, and tighter control of industrial processes through integrated automation technologies.

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/Process-Automation-and-Instrumentation-Market/313

Process automation and instrumentation refer to the use of control systems, sensors, and software to monitor and manage industrial processes across sectors like oil & gas, chemicals, pharmaceuticals, energy, and manufacturing. With Industry 4.0 adoption accelerating globally, the demand for intelligent process control is surging.

Market Estimation, Growth Drivers & Opportunities

The market for process automation and instrumentation is witnessing rapid evolution as manufacturers and utilities seek to enhance production efficiency, reduce downtime, and maintain compliance with stringent environmental and safety regulations.

Key growth drivers include:

Industry 4.0 and Smart Manufacturing: Factories are investing in connected systems that integrate PLCs, DCS, SCADA, and IIoT platforms to enable autonomous, data-driven operations.

Energy Optimization: The need to reduce energy consumption and carbon emissions in industrial processes is pushing adoption of precise instrumentation and control systems.

Predictive Maintenance: Real-time data from process instrumentation is being used to detect early signs of equipment wear, preventing costly unplanned outages.

Safety and Compliance: Automation systems enhance workplace safety by minimizing human intervention and ensuring adherence to global operational standards.

Emerging opportunities lie in AI-enabled analytics platforms, cloud-based monitoring, digital twins, and edge computing, which offer higher efficiency and intelligence in real-time decision-making.

.S. Market: Latest Trends and Investments

The United States continues to lead the global market in process automation and instrumentation, thanks to widespread adoption of smart factory initiatives, skilled workforce availability, and strong innovation in industrial tech.

In 2024, American industries made significant investments in cyber-secure automation systems, especially in sectors such as oil & gas, chemicals, and food processing. Federal incentives under the CHIPS and Science Act and support for digital manufacturing hubs have boosted demand for automation tools across both public and private sectors.

Major players like Emerson Electric and Rockwell Automation launched next-gen controllers integrated with AI and edge analytics, designed to enhance production line intelligence. Additionally, cloud-based SCADA platforms saw increased adoption for remote operations management, particularly in utilities and energy.

Market Segmentation: Leading Categories

Based on the segmentation in the report:

By Instrument, Field Instruments hold the largest market share. These include pressure, temperature, flow, and level sensors critical for real-time process monitoring across industries. Their widespread application in refining, pharmaceuticals, and water treatment plants drives their dominance.

By Solution, Supervisory Control and Data Acquisition (SCADA) systems dominate due to their ability to provide centralized monitoring and control of geographically dispersed assets—especially in oil & gas and power distribution.

By Industry, the Oil & Gas sector commands the largest share. Automation and instrumentation are vital for upstream, midstream, and downstream operations, ensuring precision, safety, and real-time control in highly volatile environments.

These segments are expected to remain dominant through 2032, supported by modernization efforts and the growing need for operational excellence.

Competitive Analysis: Top 5 Players

The Process Automation and Instrumentation Market is highly consolidated, with major players consistently investing in digital innovation, product upgrades, and strategic partnerships. The five leading companies include:

1. Siemens AG

Siemens continues to lead with its wide portfolio of automation products including SIMATIC controllers and the TIA (Totally Integrated Automation) portal. In 2024, Siemens expanded its edge computing capabilities and introduced AI-enabled digital twins for better process simulation and control.

2. ABB Ltd.

ABB offers advanced distributed control systems (DCS), field instruments, and SCADA platforms. The company’s latest innovation involves sustainability-focused automation, helping industries cut emissions and energy waste. ABB has also launched modular automation packages for flexible plant operations.

3. Emerson Electric Co.

Emerson specializes in process control and instrumentation solutions for critical industries. In 2024, Emerson launched a new line of AI-embedded control valves and predictive maintenance solutions. Its Plantweb™ digital ecosystem continues to gain traction among global clients.

4. Honeywell International Inc.

Honeywell provides end-to-end automation and process safety systems. The company is expanding its cloud-native process control systems to support hybrid and remote operations. Investments in cybersecurity and data analytics platforms are central to its growth strategy.

5. Rockwell Automation Inc.

Rockwell’s FactoryTalk® suite and Allen-Bradley controllers remain industry standards. The company recently partnered with Microsoft to deliver cloud-integrated automation and AI capabilities. Its focus on connected enterprise solutions has driven strong adoption in North America and Europe.

These companies dominate due to their deep industry knowledge, global presence, and ability to integrate hardware and software into scalable, intelligent automation systems.

Regional Analysis

USA: Holds a dominant share in the global market, backed by technological leadership, federal digital manufacturing programs, and robust private-sector investment. U.S. industries are early adopters of edge computing, IIoT, and AI in process control.

UK: Process automation is rising across the chemical and energy sectors, supported by government initiatives targeting net-zero emissions. The UK’s innovation clusters in industrial automation are attracting increased R&D investment.

Germany: As a hub for manufacturing and engineering, Germany is a strong market for automation systems. Industry 4.0 adoption is accelerated by government-backed programs that encourage digital transformation across SMEs.

France: Investment in automation in the nuclear, aerospace, and food industries is propelling the market. Government incentives for decarbonization and energy efficiency have catalyzed the use of intelligent process control systems.

Japan: Japan’s aging workforce and demand for productivity enhancement are driving automation. Japanese firms are pioneering compact, energy-efficient instruments and robot-integrated control platforms.

China: A rapidly expanding market driven by massive investments in industrial upgrades and smart manufacturing under the "Made in China 2025" initiative. The Chinese government supports automation in heavy industries and utilities to reduce energy use and emissions.

Conclusion

The Process Automation and Instrumentation Market is undergoing a transformative shift as global industries prioritize efficiency, safety, and digitalization. From oil refineries to water treatment plants, organizations are leveraging advanced automation tools to gain real-time insights, reduce operational risks, and boost productivity.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]Process Automation and Instrumentation Market to be Driven by increasing population in the Forecast Period of 2025-2032

Global Process Automation and Instrumentation Market is set to expand from USD 63.52 billion in 2023 to USD 97.89 billion by 2032, growing at a CAGR of 4.94% during the forecast period. The market’s growth is fueled by the increasing need for energy efficiency, real-time production visibility, predictive maintenance, and tighter control of industrial processes through integrated automation technologies.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Process-Automation-and-Instrumentation-Market/313

Process automation and instrumentation refer to the use of control systems, sensors, and software to monitor and manage industrial processes across sectors like oil & gas, chemicals, pharmaceuticals, energy, and manufacturing. With Industry 4.0 adoption accelerating globally, the demand for intelligent process control is surging.

Market Estimation, Growth Drivers & Opportunities

The market for process automation and instrumentation is witnessing rapid evolution as manufacturers and utilities seek to enhance production efficiency, reduce downtime, and maintain compliance with stringent environmental and safety regulations.

Key growth drivers include:

Industry 4.0 and Smart Manufacturing: Factories are investing in connected systems that integrate PLCs, DCS, SCADA, and IIoT platforms to enable autonomous, data-driven operations.

Energy Optimization: The need to reduce energy consumption and carbon emissions in industrial processes is pushing adoption of precise instrumentation and control systems.

Predictive Maintenance: Real-time data from process instrumentation is being used to detect early signs of equipment wear, preventing costly unplanned outages.

Safety and Compliance: Automation systems enhance workplace safety by minimizing human intervention and ensuring adherence to global operational standards.

Emerging opportunities lie in AI-enabled analytics platforms, cloud-based monitoring, digital twins, and edge computing, which offer higher efficiency and intelligence in real-time decision-making.

.S. Market: Latest Trends and Investments

The United States continues to lead the global market in process automation and instrumentation, thanks to widespread adoption of smart factory initiatives, skilled workforce availability, and strong innovation in industrial tech.

In 2024, American industries made significant investments in cyber-secure automation systems, especially in sectors such as oil & gas, chemicals, and food processing. Federal incentives under the CHIPS and Science Act and support for digital manufacturing hubs have boosted demand for automation tools across both public and private sectors.

Major players like Emerson Electric and Rockwell Automation launched next-gen controllers integrated with AI and edge analytics, designed to enhance production line intelligence. Additionally, cloud-based SCADA platforms saw increased adoption for remote operations management, particularly in utilities and energy.

Market Segmentation: Leading Categories

Based on the segmentation in the report:

By Instrument, Field Instruments hold the largest market share. These include pressure, temperature, flow, and level sensors critical for real-time process monitoring across industries. Their widespread application in refining, pharmaceuticals, and water treatment plants drives their dominance.

By Solution, Supervisory Control and Data Acquisition (SCADA) systems dominate due to their ability to provide centralized monitoring and control of geographically dispersed assets—especially in oil & gas and power distribution.

By Industry, the Oil & Gas sector commands the largest share. Automation and instrumentation are vital for upstream, midstream, and downstream operations, ensuring precision, safety, and real-time control in highly volatile environments.

These segments are expected to remain dominant through 2032, supported by modernization efforts and the growing need for operational excellence.

Competitive Analysis: Top 5 Players

The Process Automation and Instrumentation Market is highly consolidated, with major players consistently investing in digital innovation, product upgrades, and strategic partnerships. The five leading companies include:

1. Siemens AG

Siemens continues to lead with its wide portfolio of automation products including SIMATIC controllers and the TIA (Totally Integrated Automation) portal. In 2024, Siemens expanded its edge computing capabilities and introduced AI-enabled digital twins for better process simulation and control.

2. ABB Ltd.

ABB offers advanced distributed control systems (DCS), field instruments, and SCADA platforms. The company’s latest innovation involves sustainability-focused automation, helping industries cut emissions and energy waste. ABB has also launched modular automation packages for flexible plant operations.

3. Emerson Electric Co.

Emerson specializes in process control and instrumentation solutions for critical industries. In 2024, Emerson launched a new line of AI-embedded control valves and predictive maintenance solutions. Its Plantweb™ digital ecosystem continues to gain traction among global clients.

4. Honeywell International Inc.

Honeywell provides end-to-end automation and process safety systems. The company is expanding its cloud-native process control systems to support hybrid and remote operations. Investments in cybersecurity and data analytics platforms are central to its growth strategy.

5. Rockwell Automation Inc.

Rockwell’s FactoryTalk® suite and Allen-Bradley controllers remain industry standards. The company recently partnered with Microsoft to deliver cloud-integrated automation and AI capabilities. Its focus on connected enterprise solutions has driven strong adoption in North America and Europe.

These companies dominate due to their deep industry knowledge, global presence, and ability to integrate hardware and software into scalable, intelligent automation systems.

Regional Analysis

USA: Holds a dominant share in the global market, backed by technological leadership, federal digital manufacturing programs, and robust private-sector investment. U.S. industries are early adopters of edge computing, IIoT, and AI in process control.

UK: Process automation is rising across the chemical and energy sectors, supported by government initiatives targeting net-zero emissions. The UK’s innovation clusters in industrial automation are attracting increased R&D investment.

Germany: As a hub for manufacturing and engineering, Germany is a strong market for automation systems. Industry 4.0 adoption is accelerated by government-backed programs that encourage digital transformation across SMEs.

France: Investment in automation in the nuclear, aerospace, and food industries is propelling the market. Government incentives for decarbonization and energy efficiency have catalyzed the use of intelligent process control systems.

Japan: Japan’s aging workforce and demand for productivity enhancement are driving automation. Japanese firms are pioneering compact, energy-efficient instruments and robot-integrated control platforms.

China: A rapidly expanding market driven by massive investments in industrial upgrades and smart manufacturing under the "Made in China 2025" initiative. The Chinese government supports automation in heavy industries and utilities to reduce energy use and emissions.

Conclusion

The Process Automation and Instrumentation Market is undergoing a transformative shift as global industries prioritize efficiency, safety, and digitalization. From oil refineries to water treatment plants, organizations are leveraging advanced automation tools to gain real-time insights, reduce operational risks, and boost productivity.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]