Global Food Supplement and Drink Market Size to Grow at a CAGR of 8.70% in the Forecast Period of 2025-2032

Food Supplement & Drink Market Forecast: Strong Growth Through 2032

Market Estimation & Definition

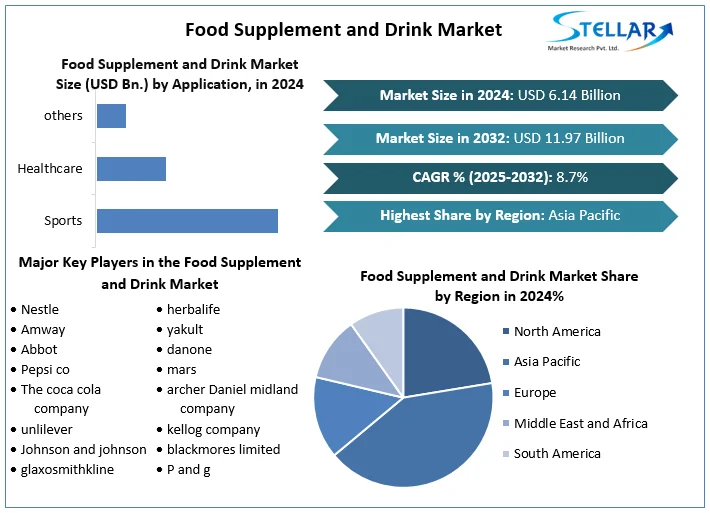

The global Food Supplement and Drink Market was valued at approximately USD 6.14 billion in 2024. It is forecast to nearly double by 2032, reaching about USD 11.97 billion, reflecting a healthy compound annual growth rate (CAGR) of 8.70% over the period 2025–2032.

This market encompasses dietary supplements, functional drinks (supplement nutrition drinks), and food supplements designed to deliver nutrients (vitamins, minerals, proteins, fats, etc.), often to support health, fill dietary gaps, or assist in treatment/prevention of nutritional deficiency. Supplemental drinks are formulated to supply extra calories, proteins or other nutrients when normal food intake is insufficient

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Food-Supplement-and-Drink-Market-/1466

Market Growth Drivers & Opportunities

Several factors are driving this growth:

Increasing Health Awareness and Wellness Trends: Consumers are more conscious about holistic health, immunity, and preventive healthcare. Interest in well-being is prompting higher demand for dietary supplements and functional drinks.

Personalized Nutrition: There is growing demand for individually tailored diets and nutraceuticals. Consumers want supplements or drinks that are aligned with their specific health needs, sometimes based on genetic, biometric, or lifestyle data.

Rise in Plant-Based & Vegan Products: The shift toward plant-based, clean label, non-animal derived ingredients is increasingly important. Supplementary products with plant-based proteins, vegan formulas, natural additives are gaining popularity.

Rising Disposable Incomes & Urbanization: As incomes rise in Asia-Pacific, more consumers are able to afford supplements and premium functional beverages. Urban populations with busier lifestyles favor convenient nutrition delivery forms (supplement drinks, easy-use supplements).

Product Innovation & Development: New formulations, better flavors, better stability, better delivery systems (e.g. ready-to-drink, specialized blends) provide opportunity. Also, regulatory compliance and labeling are becoming more important, pushing companies to innovate.

Challenges also exist: ingredient sourcing and sustainability, supply chain disruptions, market saturation in some mature regions, and the need to build and maintain consumer trust and regulatory approvals.

What Lies Ahead: Emerging Trends Shaping the Future

Customized & Precision Supplements: As data on individuals’ health, genetics, and lifestyle becomes more accessible, customized supplement and drink formulations will become more common.

Functional Drinks Expansion: Drinks offering more than hydration—immunity boosting, gut health (probiotics), adaptogens, performance enhancement—will continue to gain share.

Eco-Conscious & Clean Label Products: Demand for natural, organic, vegan, sustainable sourcing, reduced artificial additives will intensify. Transparent labeling and ethical sourcing will be competitive differentiators.

Multi-Channel Distribution & E-Commerce Growth: Online channels will expand heavily; consumers increasingly purchase supplements and drinks online, through specialty stores, digital platforms. Speed, convenience, and trust will matter

Regulatory Focus & Compliance: Regulation around health claims, safety, labeling standards will increase. Companies will invest in quality control, evidence / studies, compliance to ensure consumer safety and trust.

Segmentation Analysis

From the report, the market is segmented by:

Parameters / Type:

• Vitamin profile

• Fat profile

• Protein profile

• Others

Applications:

• Sports

• Healthcare

• Others

Distribution Channels:

• Hypermarkets / Supermarkets

• Convenience stores

• Retail stores

• Online retail stores

• Others

Objectives:

• Product labelling

• New product development

• Regulation compliance

Product Types (Food & Drink forms):

• Beverages

• Snacks

• Condiments

• Meat & Poultry

• Bakery & Confectionery

• Dairy & Desserts

• Fruits & Vegetables

• Edible fats & oils

• Others

Country-Level Analysis: USA & Germany

United States: The U.S. is among the leading markets for food supplements and functional drinks. High awareness of health and wellness, strong incomes, robust regulations for dietary supplements, well-developed retail and online distribution channels, and a large base of fitness / preventive health consumers all drive demand. Companies offering innovation, clean labels, and evidence-backed claims tend to perform well.

Germany: In Europe, Germany plays a significant role due to its strict regulatory environment, consumer trust in food safety, high standards in labeling, and preference for quality products. German consumers often favor products with clean, sustainable, plant-based, or locally sourced ingredients. Regulatory compliance and product safety are key differentiators. As health and wellness trends grow in Germany, supplement and drink companies able to meet stringent regulations and deliver high quality stand to gain.

Competitor Analysis

Key players identified in the market include Nestlé, Amway, Abbott, PepsiCo, The Coca-Cola Company, Unilever, Johnson & Johnson, GlaxoSmithKline, Procter & Gamble, Herbalife, Yakult, Danone, Mars, Archer Daniels Midland, Kellogg Company, Blackmores, Swiss Wellness, Otsuka Pharmaceutical, Naturex, Suntory Beverage & Food, Reckitt Benckiser, among others.

These companies compete on multiple fronts:

Product innovation: novel ingredients, better taste, better nutritional profiles.

Regulatory compliance: safe, legitimate labeling, permitted health claims.

Quality and sourcing: natural/plant-based, sustainable, ethical sourcing.

Distribution reach: both offline (supermarkets, health stores) and strong online presence.

Branding and trust: consumers tend to favor brands with established reputations, transparent practices, and evidence or expert endorsements.

Press Release Conclusion

The Food Supplement and Drink Market is positioned for robust growth over the coming years. From a valuation of about USD 6.14 billion in 2024, the market is forecast to expand to nearly USD 11.97 billion by 2032, at an annual growth around 8.70%. With rising health awareness, a shift toward personalized and plant-based nutrition, innovation in product forms, stronger regulation, and evolving consumer preferences, the market offers strong opportunities for both established players and new entrants.

For companies willing to invest in innovation, clean and sustainable sourcing, regulatory compliance, and effective omnichannel distribution, the coming period represents a window to capture consumer trust and market share. Particularly in regions like the United States and Germany, meeting high standards will be crucial. As competition intensifies, those offering transparency, scientific backing, and product integrity will stand out.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Food Supplement & Drink Market Forecast: Strong Growth Through 2032

Market Estimation & Definition

The global Food Supplement and Drink Market was valued at approximately USD 6.14 billion in 2024. It is forecast to nearly double by 2032, reaching about USD 11.97 billion, reflecting a healthy compound annual growth rate (CAGR) of 8.70% over the period 2025–2032.

This market encompasses dietary supplements, functional drinks (supplement nutrition drinks), and food supplements designed to deliver nutrients (vitamins, minerals, proteins, fats, etc.), often to support health, fill dietary gaps, or assist in treatment/prevention of nutritional deficiency. Supplemental drinks are formulated to supply extra calories, proteins or other nutrients when normal food intake is insufficient

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Food-Supplement-and-Drink-Market-/1466

Market Growth Drivers & Opportunities

Several factors are driving this growth:

Increasing Health Awareness and Wellness Trends: Consumers are more conscious about holistic health, immunity, and preventive healthcare. Interest in well-being is prompting higher demand for dietary supplements and functional drinks.

Personalized Nutrition: There is growing demand for individually tailored diets and nutraceuticals. Consumers want supplements or drinks that are aligned with their specific health needs, sometimes based on genetic, biometric, or lifestyle data.

Rise in Plant-Based & Vegan Products: The shift toward plant-based, clean label, non-animal derived ingredients is increasingly important. Supplementary products with plant-based proteins, vegan formulas, natural additives are gaining popularity.

Rising Disposable Incomes & Urbanization: As incomes rise in Asia-Pacific, more consumers are able to afford supplements and premium functional beverages. Urban populations with busier lifestyles favor convenient nutrition delivery forms (supplement drinks, easy-use supplements).

Product Innovation & Development: New formulations, better flavors, better stability, better delivery systems (e.g. ready-to-drink, specialized blends) provide opportunity. Also, regulatory compliance and labeling are becoming more important, pushing companies to innovate.

Challenges also exist: ingredient sourcing and sustainability, supply chain disruptions, market saturation in some mature regions, and the need to build and maintain consumer trust and regulatory approvals.

What Lies Ahead: Emerging Trends Shaping the Future

Customized & Precision Supplements: As data on individuals’ health, genetics, and lifestyle becomes more accessible, customized supplement and drink formulations will become more common.

Functional Drinks Expansion: Drinks offering more than hydration—immunity boosting, gut health (probiotics), adaptogens, performance enhancement—will continue to gain share.

Eco-Conscious & Clean Label Products: Demand for natural, organic, vegan, sustainable sourcing, reduced artificial additives will intensify. Transparent labeling and ethical sourcing will be competitive differentiators.

Multi-Channel Distribution & E-Commerce Growth: Online channels will expand heavily; consumers increasingly purchase supplements and drinks online, through specialty stores, digital platforms. Speed, convenience, and trust will matter

Regulatory Focus & Compliance: Regulation around health claims, safety, labeling standards will increase. Companies will invest in quality control, evidence / studies, compliance to ensure consumer safety and trust.

Segmentation Analysis

From the report, the market is segmented by:

Parameters / Type:

• Vitamin profile

• Fat profile

• Protein profile

• Others

Applications:

• Sports

• Healthcare

• Others

Distribution Channels:

• Hypermarkets / Supermarkets

• Convenience stores

• Retail stores

• Online retail stores

• Others

Objectives:

• Product labelling

• New product development

• Regulation compliance

Product Types (Food & Drink forms):

• Beverages

• Snacks

• Condiments

• Meat & Poultry

• Bakery & Confectionery

• Dairy & Desserts

• Fruits & Vegetables

• Edible fats & oils

• Others

Country-Level Analysis: USA & Germany

United States: The U.S. is among the leading markets for food supplements and functional drinks. High awareness of health and wellness, strong incomes, robust regulations for dietary supplements, well-developed retail and online distribution channels, and a large base of fitness / preventive health consumers all drive demand. Companies offering innovation, clean labels, and evidence-backed claims tend to perform well.

Germany: In Europe, Germany plays a significant role due to its strict regulatory environment, consumer trust in food safety, high standards in labeling, and preference for quality products. German consumers often favor products with clean, sustainable, plant-based, or locally sourced ingredients. Regulatory compliance and product safety are key differentiators. As health and wellness trends grow in Germany, supplement and drink companies able to meet stringent regulations and deliver high quality stand to gain.

Competitor Analysis

Key players identified in the market include Nestlé, Amway, Abbott, PepsiCo, The Coca-Cola Company, Unilever, Johnson & Johnson, GlaxoSmithKline, Procter & Gamble, Herbalife, Yakult, Danone, Mars, Archer Daniels Midland, Kellogg Company, Blackmores, Swiss Wellness, Otsuka Pharmaceutical, Naturex, Suntory Beverage & Food, Reckitt Benckiser, among others.

These companies compete on multiple fronts:

Product innovation: novel ingredients, better taste, better nutritional profiles.

Regulatory compliance: safe, legitimate labeling, permitted health claims.

Quality and sourcing: natural/plant-based, sustainable, ethical sourcing.

Distribution reach: both offline (supermarkets, health stores) and strong online presence.

Branding and trust: consumers tend to favor brands with established reputations, transparent practices, and evidence or expert endorsements.

Press Release Conclusion

The Food Supplement and Drink Market is positioned for robust growth over the coming years. From a valuation of about USD 6.14 billion in 2024, the market is forecast to expand to nearly USD 11.97 billion by 2032, at an annual growth around 8.70%. With rising health awareness, a shift toward personalized and plant-based nutrition, innovation in product forms, stronger regulation, and evolving consumer preferences, the market offers strong opportunities for both established players and new entrants.

For companies willing to invest in innovation, clean and sustainable sourcing, regulatory compliance, and effective omnichannel distribution, the coming period represents a window to capture consumer trust and market share. Particularly in regions like the United States and Germany, meeting high standards will be crucial. As competition intensifies, those offering transparency, scientific backing, and product integrity will stand out.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Global Food Supplement and Drink Market Size to Grow at a CAGR of 8.70% in the Forecast Period of 2025-2032

Food Supplement & Drink Market Forecast: Strong Growth Through 2032

Market Estimation & Definition

The global Food Supplement and Drink Market was valued at approximately USD 6.14 billion in 2024. It is forecast to nearly double by 2032, reaching about USD 11.97 billion, reflecting a healthy compound annual growth rate (CAGR) of 8.70% over the period 2025–2032.

This market encompasses dietary supplements, functional drinks (supplement nutrition drinks), and food supplements designed to deliver nutrients (vitamins, minerals, proteins, fats, etc.), often to support health, fill dietary gaps, or assist in treatment/prevention of nutritional deficiency. Supplemental drinks are formulated to supply extra calories, proteins or other nutrients when normal food intake is insufficient

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Food-Supplement-and-Drink-Market-/1466

Market Growth Drivers & Opportunities

Several factors are driving this growth:

Increasing Health Awareness and Wellness Trends: Consumers are more conscious about holistic health, immunity, and preventive healthcare. Interest in well-being is prompting higher demand for dietary supplements and functional drinks.

Personalized Nutrition: There is growing demand for individually tailored diets and nutraceuticals. Consumers want supplements or drinks that are aligned with their specific health needs, sometimes based on genetic, biometric, or lifestyle data.

Rise in Plant-Based & Vegan Products: The shift toward plant-based, clean label, non-animal derived ingredients is increasingly important. Supplementary products with plant-based proteins, vegan formulas, natural additives are gaining popularity.

Rising Disposable Incomes & Urbanization: As incomes rise in Asia-Pacific, more consumers are able to afford supplements and premium functional beverages. Urban populations with busier lifestyles favor convenient nutrition delivery forms (supplement drinks, easy-use supplements).

Product Innovation & Development: New formulations, better flavors, better stability, better delivery systems (e.g. ready-to-drink, specialized blends) provide opportunity. Also, regulatory compliance and labeling are becoming more important, pushing companies to innovate.

Challenges also exist: ingredient sourcing and sustainability, supply chain disruptions, market saturation in some mature regions, and the need to build and maintain consumer trust and regulatory approvals.

What Lies Ahead: Emerging Trends Shaping the Future

Customized & Precision Supplements: As data on individuals’ health, genetics, and lifestyle becomes more accessible, customized supplement and drink formulations will become more common.

Functional Drinks Expansion: Drinks offering more than hydration—immunity boosting, gut health (probiotics), adaptogens, performance enhancement—will continue to gain share.

Eco-Conscious & Clean Label Products: Demand for natural, organic, vegan, sustainable sourcing, reduced artificial additives will intensify. Transparent labeling and ethical sourcing will be competitive differentiators.

Multi-Channel Distribution & E-Commerce Growth: Online channels will expand heavily; consumers increasingly purchase supplements and drinks online, through specialty stores, digital platforms. Speed, convenience, and trust will matter

Regulatory Focus & Compliance: Regulation around health claims, safety, labeling standards will increase. Companies will invest in quality control, evidence / studies, compliance to ensure consumer safety and trust.

Segmentation Analysis

From the report, the market is segmented by:

Parameters / Type:

• Vitamin profile

• Fat profile

• Protein profile

• Others

Applications:

• Sports

• Healthcare

• Others

Distribution Channels:

• Hypermarkets / Supermarkets

• Convenience stores

• Retail stores

• Online retail stores

• Others

Objectives:

• Product labelling

• New product development

• Regulation compliance

Product Types (Food & Drink forms):

• Beverages

• Snacks

• Condiments

• Meat & Poultry

• Bakery & Confectionery

• Dairy & Desserts

• Fruits & Vegetables

• Edible fats & oils

• Others

Country-Level Analysis: USA & Germany

United States: The U.S. is among the leading markets for food supplements and functional drinks. High awareness of health and wellness, strong incomes, robust regulations for dietary supplements, well-developed retail and online distribution channels, and a large base of fitness / preventive health consumers all drive demand. Companies offering innovation, clean labels, and evidence-backed claims tend to perform well.

Germany: In Europe, Germany plays a significant role due to its strict regulatory environment, consumer trust in food safety, high standards in labeling, and preference for quality products. German consumers often favor products with clean, sustainable, plant-based, or locally sourced ingredients. Regulatory compliance and product safety are key differentiators. As health and wellness trends grow in Germany, supplement and drink companies able to meet stringent regulations and deliver high quality stand to gain.

Competitor Analysis

Key players identified in the market include Nestlé, Amway, Abbott, PepsiCo, The Coca-Cola Company, Unilever, Johnson & Johnson, GlaxoSmithKline, Procter & Gamble, Herbalife, Yakult, Danone, Mars, Archer Daniels Midland, Kellogg Company, Blackmores, Swiss Wellness, Otsuka Pharmaceutical, Naturex, Suntory Beverage & Food, Reckitt Benckiser, among others.

These companies compete on multiple fronts:

Product innovation: novel ingredients, better taste, better nutritional profiles.

Regulatory compliance: safe, legitimate labeling, permitted health claims.

Quality and sourcing: natural/plant-based, sustainable, ethical sourcing.

Distribution reach: both offline (supermarkets, health stores) and strong online presence.

Branding and trust: consumers tend to favor brands with established reputations, transparent practices, and evidence or expert endorsements.

Press Release Conclusion

The Food Supplement and Drink Market is positioned for robust growth over the coming years. From a valuation of about USD 6.14 billion in 2024, the market is forecast to expand to nearly USD 11.97 billion by 2032, at an annual growth around 8.70%. With rising health awareness, a shift toward personalized and plant-based nutrition, innovation in product forms, stronger regulation, and evolving consumer preferences, the market offers strong opportunities for both established players and new entrants.

For companies willing to invest in innovation, clean and sustainable sourcing, regulatory compliance, and effective omnichannel distribution, the coming period represents a window to capture consumer trust and market share. Particularly in regions like the United States and Germany, meeting high standards will be crucial. As competition intensifies, those offering transparency, scientific backing, and product integrity will stand out.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

0 التعليقات

0 المشاركات

6 مشاهدة