Foot and Ankle Devices Market Growth Forecast, Trends, and Developments (2024-2030)

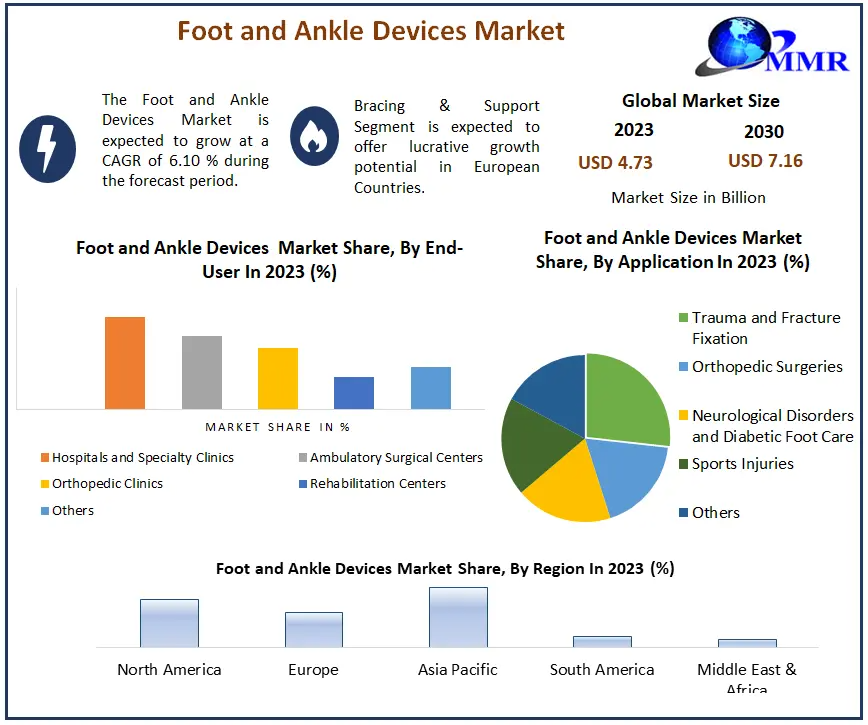

Foot and Ankle Devices Market Overview

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the “Foot and Ankle Devices Market”. The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The analysis in the report provides an in-depth aspect at the current status of the Foot and Ankle Devices Market, with forecasts outspreading to the year.

Gain Valuable Insights – Request Your Complimentary Sample Now @

https://www.maximizemarketresearch.com/request-sample/20919/

Foot and Ankle Devices Market Scope and Methodology:

The market research report for Foot and Ankle Devices provides comprehensive information on important factors, such as those that are expected to drive the industry growth and future obstacles. This report provides stakeholders with a thorough understanding of the investment opportunities, product offerings, and competitive landscape of the Foot and Ankle Devices industry. Furthermore, it is covered in the research are the sector quantitative and qualitative aspects. Within the framework of the MMR research, regional markets for the Foot and Ankle Devices Market are evaluated in great detail.

A full description of each of the major and some of the minor components is provided by the study. Using information from primary and secondary sources, the Foot and Ankle Devices Market was created. A number of experts and academics viewpoints, official websites, scientific publications, and annual reports.

Foot and Ankle Devices Market Segmentation

by Product

Bracing & Support Devices

Joint Implants

Soft Tissue Orthopedic Devices

Orthopedic Fixation

Prosthetics

by Application

Trauma

Diabetes

Neurological Disorders

Others

Feel free to request a complimentary sample copy or view a summary of the report @

https://www.maximizemarketresearch.com/request-sample/20919/

Foot and Ankle Devices Market Regional Insights

The market size, growth rate, import and export by region, and other relevant variables are all thoroughly analysed in this research. Understanding the Foot and Ankle Devices market conditions in different countries is feasible because to the researchs geographic examination. Africa, Latin America, the Middle East, Asia Pacific, and Europe put together make up the Foot and Ankle Devices market.

Foot and Ankle Devices Market Key Players

1. Stryker Corporation - Headquarters: Kalamazoo, Michigan, USA

2. Johnson & Johnson (DePuy Synthes) - Headquarters: New Brunswick, New Jersey, USA

3. Zimmer Biomet Holdings - Headquarters: Warsaw, Indiana, USA

4. Arthrex - Headquarters: Naples, Florida, USA

5. DJO Global - Headquarters: Vista, California, USA

6. Orthofix Medical Inc. - Headquarters: Lewisville, Texas, USA

7. Acumed Llc - Headquarters: Hillsboro, Oregon, USA

Key questions answered in the Foot and Ankle Devices Market are:

What is Foot and Ankle Devices Market?

What is the growth rate of the Foot and Ankle Devices Market?

Which are the factors expected to drive the Foot and Ankle Devices Market growth?

What are the different segments of the Foot and Ankle Devices Market?

What growth strategies are the players considering to increase their presence in Foot and Ankle Devices Market?

What are the upcoming industry applications and trends for the Foot and Ankle Devices Market?

What are the recent industry trends that can be implemented to generate additional revenue streams for the Foot and Ankle Devices Market?

Who are the leading companies and what are their portfolios in Foot and Ankle Devices Market?

What segments are covered in the Foot and Ankle Devices Market?

Explore More Market Reports:

Global Coloured Polyurethane Foams Market

https://www.maximizemarketresearch.com/market-report/global-coloured-polyurethane-foams-market/54840/

Global Concrete Surface Retarders Market

https://www.maximizemarketresearch.com/market-report/global-concrete-surface-retarders-market/26828/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

[email protected]

+91 96071 95908, +91 9607365656

Foot and Ankle Devices Market Growth Forecast, Trends, and Developments (2024-2030)

Foot and Ankle Devices Market Overview

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the “Foot and Ankle Devices Market”. The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The analysis in the report provides an in-depth aspect at the current status of the Foot and Ankle Devices Market, with forecasts outspreading to the year.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/20919/

Foot and Ankle Devices Market Scope and Methodology:

The market research report for Foot and Ankle Devices provides comprehensive information on important factors, such as those that are expected to drive the industry growth and future obstacles. This report provides stakeholders with a thorough understanding of the investment opportunities, product offerings, and competitive landscape of the Foot and Ankle Devices industry. Furthermore, it is covered in the research are the sector quantitative and qualitative aspects. Within the framework of the MMR research, regional markets for the Foot and Ankle Devices Market are evaluated in great detail.

A full description of each of the major and some of the minor components is provided by the study. Using information from primary and secondary sources, the Foot and Ankle Devices Market was created. A number of experts and academics viewpoints, official websites, scientific publications, and annual reports.

Foot and Ankle Devices Market Segmentation

by Product

Bracing & Support Devices

Joint Implants

Soft Tissue Orthopedic Devices

Orthopedic Fixation

Prosthetics

by Application

Trauma

Diabetes

Neurological Disorders

Others

Feel free to request a complimentary sample copy or view a summary of the report @ https://www.maximizemarketresearch.com/request-sample/20919/

Foot and Ankle Devices Market Regional Insights

The market size, growth rate, import and export by region, and other relevant variables are all thoroughly analysed in this research. Understanding the Foot and Ankle Devices market conditions in different countries is feasible because to the researchs geographic examination. Africa, Latin America, the Middle East, Asia Pacific, and Europe put together make up the Foot and Ankle Devices market.

Foot and Ankle Devices Market Key Players

1. Stryker Corporation - Headquarters: Kalamazoo, Michigan, USA

2. Johnson & Johnson (DePuy Synthes) - Headquarters: New Brunswick, New Jersey, USA

3. Zimmer Biomet Holdings - Headquarters: Warsaw, Indiana, USA

4. Arthrex - Headquarters: Naples, Florida, USA

5. DJO Global - Headquarters: Vista, California, USA

6. Orthofix Medical Inc. - Headquarters: Lewisville, Texas, USA

7. Acumed Llc - Headquarters: Hillsboro, Oregon, USA

Key questions answered in the Foot and Ankle Devices Market are:

What is Foot and Ankle Devices Market?

What is the growth rate of the Foot and Ankle Devices Market?

Which are the factors expected to drive the Foot and Ankle Devices Market growth?

What are the different segments of the Foot and Ankle Devices Market?

What growth strategies are the players considering to increase their presence in Foot and Ankle Devices Market?

What are the upcoming industry applications and trends for the Foot and Ankle Devices Market?

What are the recent industry trends that can be implemented to generate additional revenue streams for the Foot and Ankle Devices Market?

Who are the leading companies and what are their portfolios in Foot and Ankle Devices Market?

What segments are covered in the Foot and Ankle Devices Market?

Explore More Market Reports:

Global Coloured Polyurethane Foams Market https://www.maximizemarketresearch.com/market-report/global-coloured-polyurethane-foams-market/54840/

Global Concrete Surface Retarders Market https://www.maximizemarketresearch.com/market-report/global-concrete-surface-retarders-market/26828/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

[email protected]

+91 96071 95908, +91 9607365656