Active B12 Test Market Share, Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

Active B12 Test Market Set to Reach USD 1.33 Billion by 2032

Market Estimation & Definition

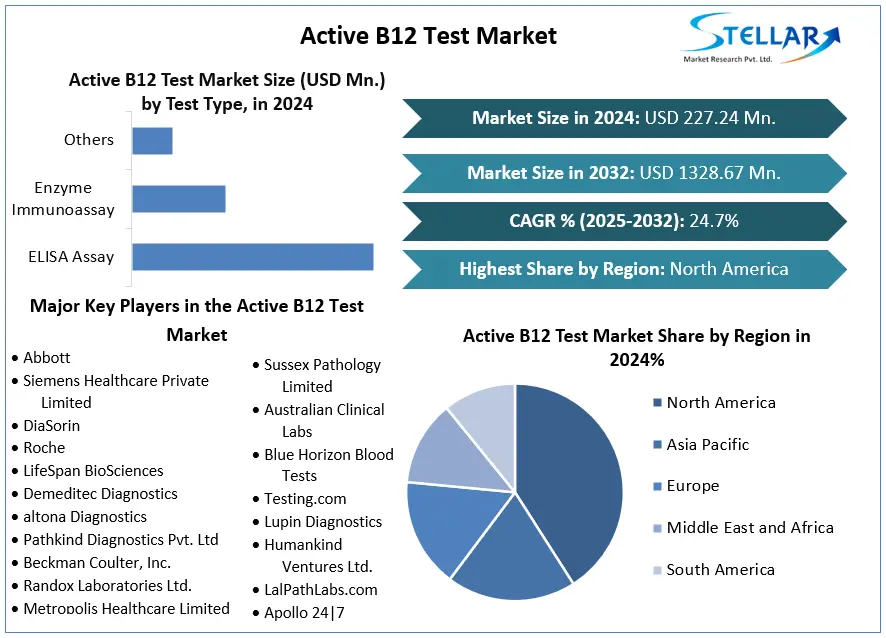

The global Active B12 Test Market was valued at approximately USD 227.24 million in 2024 and is projected to reach USD 1.33 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.7% from 2025 to 2032. Active B12 tests measure the biologically active form of vitamin B12, known as holotranscobalamin, in the bloodstream. Unlike total B12 tests, which measure all forms of vitamin B12, the Active B12 test provides a more accurate assessment of vitamin B12 status, enabling early detection of deficiencies that can lead to serious health issues such as neurological and hematological disorders.

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/Active-B12-Test-Market/2051

Market Growth Drivers & Opportunities

Several factors are driving the growth of the Active B12 Test Market:

Rising Incidence of Vitamin B12 Deficiency: The increasing prevalence of vitamin B12 deficiency, particularly among older adults, vegetarians, and individuals with malabsorption conditions, is fueling demand for accurate diagnostic tests.

Advancements in Diagnostic Technologies: Innovations in assay technologies, such as enzyme-linked immunosorbent assays (ELISA) and enzyme immunoassays, have enhanced the sensitivity and specificity of Active B12 tests, making them more reliable and accessible.

Growing Awareness and Preventive Healthcare: Increased awareness about the importance of vitamin B12 in maintaining overall health and the emphasis on preventive healthcare are encouraging individuals to undergo regular testing.

Aging Population: The global aging population is more susceptible to vitamin B12 deficiency, leading to a higher demand for diagnostic testing to manage age-related health issues.

Integration with Telehealth Services: The rise of telemedicine and home healthcare services has facilitated the adoption of Active B12 tests, allowing for convenient and remote monitoring of vitamin B12 levels.

What Lies Ahead: Emerging Trends Shaping the Future

The Active B12 Test Market is witnessing several emerging trends:

Home Testing Kits: The development of user-friendly home testing kits is empowering individuals to monitor their vitamin B12 levels conveniently, driving market growth.

Personalized Medicine: The shift towards personalized healthcare is increasing the demand for precise diagnostic tests like the Active B12 test, which can guide tailored treatment plans.

Digital Health Platforms: Integration of Active B12 testing with digital health platforms enables real-time tracking of vitamin B12 levels, enhancing patient engagement and management.

Collaborations and Partnerships: Strategic collaborations between diagnostic companies and healthcare providers are expanding the availability and accessibility of Active B12 tests.

Segmentation Analysis

The Active B12 Test Market can be segmented based on test type, application, and region:

By Test Type:

ELISA Assay: Dominated the market in 2024 due to its high sensitivity and specificity.

Enzyme Immunoassay: Gaining popularity for its cost-effectiveness and ease of use.

Others: Including chemiluminescent immunoassays and liquid chromatography-mass spectrometry.

By Application:

Folate Deficiency Anemia: The largest application segment, accounting for a significant market share.

Pernicious Anemia: Increasing awareness and diagnosis are contributing to market growth.

Macrocytic Anemia: Rising prevalence is driving demand for Active B12 testing.

Others: Including neurological disorders and cognitive decline.

By Region:

North America: The largest market share in 2024, attributed to advanced healthcare infrastructure and high awareness levels.

Europe: Significant growth due to increasing healthcare expenditure and aging population.

Asia-Pacific: Rapidly growing market driven by improving healthcare facilities and rising awareness.

Latin America: Emerging market with increasing adoption of diagnostic tests.

Middle East & Africa: Gradual growth with expanding healthcare access.

Country-Level Analysis

United States: The U.S. Active B12 Test Market is experiencing significant growth, driven by an aging population and increasing prevalence of vitamin B12 deficiency. The market is expected to continue expanding as awareness and preventive healthcare initiatives increase.

Germany: Germany's well-established healthcare system and high awareness levels contribute to the steady demand for Active B12 tests. The market is supported by advancements in diagnostic technologies and a growing aging population.

India: In India, the Active B12 Test Market is witnessing rapid growth due to improving healthcare infrastructure, increasing awareness about vitamin deficiencies, and a large population at risk of B12 deficiency.

Competitive Landscape

Key players in the Active B12 Test Market include:

Abbott Laboratories: A leading player offering a range of diagnostic tests, including Active B12 assays, with a strong global presence.

Siemens Healthineers: Provides innovative diagnostic solutions, including Active B12 tests, leveraging advanced technologies.

DiaSorin: Specializes in immunodiagnostic systems, offering Active B12 testing solutions with high sensitivity.

Roche Diagnostics: Offers comprehensive diagnostic tests, including Active B12 assays, with a focus on accuracy and reliability.

Axis-Shield Diagnostics: Known for its specialized diagnostic tests, including Active B12 testing kits, catering to global markets.

These companies are focusing on product innovation, strategic partnerships, and expanding their market presence to strengthen their positions in the Active B12 Test Market.

Press Release Conclusion

The Active B12 Test Market is poised for significant growth, driven by increasing awareness of vitamin B12 deficiency, advancements in diagnostic technologies, and a growing emphasis on preventive healthcare. With a projected market size of USD 1.33 billion by 2032, stakeholders in the healthcare and diagnostics industry have ample opportunities to capitalize on this expanding market. Continued innovation, strategic partnerships, and a focus on accessibility will be key to meeting the rising demand for accurate and reliable Active B12 testing solutions.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]Active B12 Test Market Share, Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

Active B12 Test Market Set to Reach USD 1.33 Billion by 2032

Market Estimation & Definition

The global Active B12 Test Market was valued at approximately USD 227.24 million in 2024 and is projected to reach USD 1.33 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.7% from 2025 to 2032. Active B12 tests measure the biologically active form of vitamin B12, known as holotranscobalamin, in the bloodstream. Unlike total B12 tests, which measure all forms of vitamin B12, the Active B12 test provides a more accurate assessment of vitamin B12 status, enabling early detection of deficiencies that can lead to serious health issues such as neurological and hematological disorders.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Active-B12-Test-Market/2051

Market Growth Drivers & Opportunities

Several factors are driving the growth of the Active B12 Test Market:

Rising Incidence of Vitamin B12 Deficiency: The increasing prevalence of vitamin B12 deficiency, particularly among older adults, vegetarians, and individuals with malabsorption conditions, is fueling demand for accurate diagnostic tests.

Advancements in Diagnostic Technologies: Innovations in assay technologies, such as enzyme-linked immunosorbent assays (ELISA) and enzyme immunoassays, have enhanced the sensitivity and specificity of Active B12 tests, making them more reliable and accessible.

Growing Awareness and Preventive Healthcare: Increased awareness about the importance of vitamin B12 in maintaining overall health and the emphasis on preventive healthcare are encouraging individuals to undergo regular testing.

Aging Population: The global aging population is more susceptible to vitamin B12 deficiency, leading to a higher demand for diagnostic testing to manage age-related health issues.

Integration with Telehealth Services: The rise of telemedicine and home healthcare services has facilitated the adoption of Active B12 tests, allowing for convenient and remote monitoring of vitamin B12 levels.

What Lies Ahead: Emerging Trends Shaping the Future

The Active B12 Test Market is witnessing several emerging trends:

Home Testing Kits: The development of user-friendly home testing kits is empowering individuals to monitor their vitamin B12 levels conveniently, driving market growth.

Personalized Medicine: The shift towards personalized healthcare is increasing the demand for precise diagnostic tests like the Active B12 test, which can guide tailored treatment plans.

Digital Health Platforms: Integration of Active B12 testing with digital health platforms enables real-time tracking of vitamin B12 levels, enhancing patient engagement and management.

Collaborations and Partnerships: Strategic collaborations between diagnostic companies and healthcare providers are expanding the availability and accessibility of Active B12 tests.

Segmentation Analysis

The Active B12 Test Market can be segmented based on test type, application, and region:

By Test Type:

ELISA Assay: Dominated the market in 2024 due to its high sensitivity and specificity.

Enzyme Immunoassay: Gaining popularity for its cost-effectiveness and ease of use.

Others: Including chemiluminescent immunoassays and liquid chromatography-mass spectrometry.

By Application:

Folate Deficiency Anemia: The largest application segment, accounting for a significant market share.

Pernicious Anemia: Increasing awareness and diagnosis are contributing to market growth.

Macrocytic Anemia: Rising prevalence is driving demand for Active B12 testing.

Others: Including neurological disorders and cognitive decline.

By Region:

North America: The largest market share in 2024, attributed to advanced healthcare infrastructure and high awareness levels.

Europe: Significant growth due to increasing healthcare expenditure and aging population.

Asia-Pacific: Rapidly growing market driven by improving healthcare facilities and rising awareness.

Latin America: Emerging market with increasing adoption of diagnostic tests.

Middle East & Africa: Gradual growth with expanding healthcare access.

Country-Level Analysis

United States: The U.S. Active B12 Test Market is experiencing significant growth, driven by an aging population and increasing prevalence of vitamin B12 deficiency. The market is expected to continue expanding as awareness and preventive healthcare initiatives increase.

Germany: Germany's well-established healthcare system and high awareness levels contribute to the steady demand for Active B12 tests. The market is supported by advancements in diagnostic technologies and a growing aging population.

India: In India, the Active B12 Test Market is witnessing rapid growth due to improving healthcare infrastructure, increasing awareness about vitamin deficiencies, and a large population at risk of B12 deficiency.

Competitive Landscape

Key players in the Active B12 Test Market include:

Abbott Laboratories: A leading player offering a range of diagnostic tests, including Active B12 assays, with a strong global presence.

Siemens Healthineers: Provides innovative diagnostic solutions, including Active B12 tests, leveraging advanced technologies.

DiaSorin: Specializes in immunodiagnostic systems, offering Active B12 testing solutions with high sensitivity.

Roche Diagnostics: Offers comprehensive diagnostic tests, including Active B12 assays, with a focus on accuracy and reliability.

Axis-Shield Diagnostics: Known for its specialized diagnostic tests, including Active B12 testing kits, catering to global markets.

These companies are focusing on product innovation, strategic partnerships, and expanding their market presence to strengthen their positions in the Active B12 Test Market.

Press Release Conclusion

The Active B12 Test Market is poised for significant growth, driven by increasing awareness of vitamin B12 deficiency, advancements in diagnostic technologies, and a growing emphasis on preventive healthcare. With a projected market size of USD 1.33 billion by 2032, stakeholders in the healthcare and diagnostics industry have ample opportunities to capitalize on this expanding market. Continued innovation, strategic partnerships, and a focus on accessibility will be key to meeting the rising demand for accurate and reliable Active B12 testing solutions.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]