Global Stirling Engine Market Size To Grow At A CAGR Of 9.6% In The Forecast Period Of 2023-2030

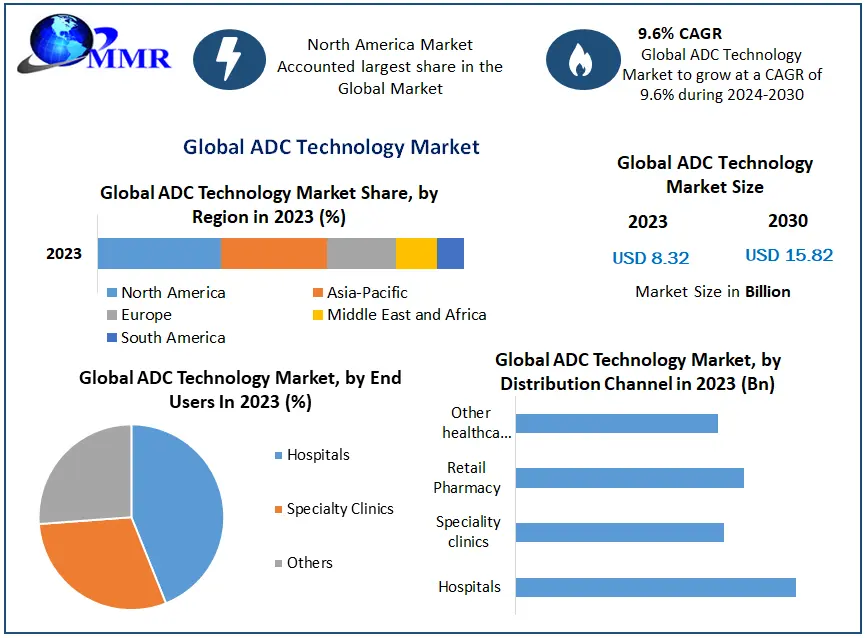

Antibody–Drug Conjugate (ADC) Technology Market is projected to expand from USD 6.5 billion in 2023 to USD 19.8 billion by 2029, growing at a CAGR of approximately 20.2% during the forecast period. This surge is fueled by the rising demand for targeted cancer therapies, expansion in oncology research, and breakthrough drug approvals, which are transforming the treatment landscape for solid tumors and hematologic malignancies.

Request Free Sample Report:

https://www.maximizemarketresearch.com/request-sample/216553/

Market Estimation, Growth Drivers & Opportunities

ADCs represent a sophisticated drug delivery platform that merges the precision of monoclonal antibodies with the potency of cytotoxic drugs. This targeted approach is enabling higher efficacy and lower toxicity in treating cancers, particularly breast, bladder, and hematologic malignancies.

Key Growth Drivers:

Increasing cancer burden globally, with a growing demand for effective and less harmful therapies.

High success rate of late-stage ADCs, particularly in HER2-positive and triple-negative breast cancer, driving physician and patient adoption.

Collaborative R&D and licensing deals between biotech startups and pharmaceutical giants, speeding up clinical development and commercialization.

Opportunities:

Expansion into non-oncology indications, such as autoimmune diseases.

Development of next-generation ADC linkers and site-specific conjugation technologies, enhancing stability and efficacy.

Rising demand in Asia-Pacific for innovative oncology treatments due to increasing access to biologics.U.S. Market Trends and 2024 Investments

The U.S. ADC market leads globally, accounting for over 40% of global revenue in 2024. Several trends and investments highlight the country's strategic focus:

Pfizer’s acquisition of Seagen in 2023, worth $43 billion, marked a pivotal moment for the ADC space. This move bolstered Pfizer’s oncology pipeline with four marketed ADCs and several candidates in Phase II/III trials.

FDA approvals of ADCs surged in 2023–2024, with significant attention to Enhertu (AstraZeneca/Daiichi Sankyo) and Elahere (ImmunoGen).

NIH and BARDA funding initiatives are also supporting translational research on ADC payload optimization and companion diagnostics.

This environment positions the U.S. as the primary innovation and commercialization hub for ADCs.

Market Segmentation – Leading Segments by Share

According to the segmentation analysis:

By Type: The monoclonal antibodies (mAbs) segment held the largest share due to the widespread use of FDA-approved antibodies like trastuzumab and rituximab as carriers for ADCs.

By Application: Breast cancer accounted for the largest share, driven by the success of HER2-targeted ADCs such as Enhertu and Kadcyla.

By End-User: Biopharmaceutical companies dominate due to their extensive investments in R&D and clinical trials, particularly in solid tumor oncology.

These segments are expected to maintain their dominance through 2029 due to sustained innovation and commercial success.

Competitive Landscape – Top 5 Companies

The global ADC market is shaped by a few key players with robust pipelines, partnerships, and product portfolios:

Seagen Inc. (now Pfizer)

Seagen’s Adcetris and Padcev continue to perform well commercially. Post-acquisition by Pfizer, the company is scaling ADC production and accelerating global clinical trials in lung and urothelial cancers.

AstraZeneca

In collaboration with Daiichi Sankyo, AstraZeneca launched Enhertu and Datopotamab deruxtecan (Dato-DXd), both of which have shown superior outcomes in breast and lung cancer. They are investing in linker technology to reduce off-target effects.

Roche Holding AG

A pioneer with Kadcyla, Roche is expanding into next-gen ADCs using novel payloads. It’s working on combining ADCs with checkpoint inhibitors to drive synergistic effects in immunotherapy.

Gilead Sciences (via Immunomedics acquisition)

Gilead’s Trodelvy is gaining traction in triple-negative breast cancer. The company is expanding trials in bladder, ovarian, and lung cancers and enhancing internal ADC R&D capability.

AbbVie

AbbVie acquired ImmunoGen in 2023 to secure Elahere, an approved ADC for ovarian cancer. The company is also investing in ADC-manufacturing facilities and exploring novel cytotoxic payloads beyond tubulin inhibitors.

These companies are redefining therapeutic delivery through innovation in linkers, payloads, and antibody engineering, creating a robust future pipeline.

Regional Analysis: USA, UK, Germany, France, Japan, China

United States: With the highest global share, the U.S. is supported by a pro-innovation regulatory environment, ample funding, and strong industry-academic partnerships.

United Kingdom: The UK government has made significant investments in personalized oncology. Regulatory flexibility via the MHRA supports accelerated access to ADCs.

Germany: Strong biotech infrastructure, including CDMO and GMP-compliant ADC manufacturing, is supporting robust clinical trial activity.

France: Home to rising biotech firms like Innate Pharma, France is benefiting from EU-backed oncology projects and early-phase ADC development.

Japan: Companies like Daiichi Sankyo are global leaders in ADC innovation. Regulatory fast-tracks for oncology drugs and international licensing deals contribute to Japan’s growing market share.

China: A rapidly developing player, China is promoting domestic ADC development through subsidies and fast-track approvals. Several homegrown companies, such as RemeGen and Bio-Thera, are in late-stage trials.

Conclusion and Analyst View

The ADC technology market is one of the most dynamic areas in biopharmaceutical innovation. As the burden of cancer rises globally, ADCs offer a targeted and effective treatment pathway, revolutionizing the standard of care. With over 150 ADCs in the clinical pipeline and continuous investments from global pharma leaders, the market is primed for exponential growth.

Related Report:

Biometric payment market:

https://www.maximizemarketresearch.com/market-report/biometric-payment-market/190525/

Next generation computing market:

https://www.maximizemarketresearch.com/market-report/next-generation-computing-market/190444/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

[email protected]Global Stirling Engine Market Size To Grow At A CAGR Of 9.6% In The Forecast Period Of 2023-2030

Antibody–Drug Conjugate (ADC) Technology Market is projected to expand from USD 6.5 billion in 2023 to USD 19.8 billion by 2029, growing at a CAGR of approximately 20.2% during the forecast period. This surge is fueled by the rising demand for targeted cancer therapies, expansion in oncology research, and breakthrough drug approvals, which are transforming the treatment landscape for solid tumors and hematologic malignancies.

Request Free Sample Report:https://www.maximizemarketresearch.com/request-sample/216553/

Market Estimation, Growth Drivers & Opportunities

ADCs represent a sophisticated drug delivery platform that merges the precision of monoclonal antibodies with the potency of cytotoxic drugs. This targeted approach is enabling higher efficacy and lower toxicity in treating cancers, particularly breast, bladder, and hematologic malignancies.

Key Growth Drivers:

Increasing cancer burden globally, with a growing demand for effective and less harmful therapies.

High success rate of late-stage ADCs, particularly in HER2-positive and triple-negative breast cancer, driving physician and patient adoption.

Collaborative R&D and licensing deals between biotech startups and pharmaceutical giants, speeding up clinical development and commercialization.

Opportunities:

Expansion into non-oncology indications, such as autoimmune diseases.

Development of next-generation ADC linkers and site-specific conjugation technologies, enhancing stability and efficacy.

Rising demand in Asia-Pacific for innovative oncology treatments due to increasing access to biologics.U.S. Market Trends and 2024 Investments

The U.S. ADC market leads globally, accounting for over 40% of global revenue in 2024. Several trends and investments highlight the country's strategic focus:

Pfizer’s acquisition of Seagen in 2023, worth $43 billion, marked a pivotal moment for the ADC space. This move bolstered Pfizer’s oncology pipeline with four marketed ADCs and several candidates in Phase II/III trials.

FDA approvals of ADCs surged in 2023–2024, with significant attention to Enhertu (AstraZeneca/Daiichi Sankyo) and Elahere (ImmunoGen).

NIH and BARDA funding initiatives are also supporting translational research on ADC payload optimization and companion diagnostics.

This environment positions the U.S. as the primary innovation and commercialization hub for ADCs.

Market Segmentation – Leading Segments by Share

According to the segmentation analysis:

By Type: The monoclonal antibodies (mAbs) segment held the largest share due to the widespread use of FDA-approved antibodies like trastuzumab and rituximab as carriers for ADCs.

By Application: Breast cancer accounted for the largest share, driven by the success of HER2-targeted ADCs such as Enhertu and Kadcyla.

By End-User: Biopharmaceutical companies dominate due to their extensive investments in R&D and clinical trials, particularly in solid tumor oncology.

These segments are expected to maintain their dominance through 2029 due to sustained innovation and commercial success.

Competitive Landscape – Top 5 Companies

The global ADC market is shaped by a few key players with robust pipelines, partnerships, and product portfolios:

Seagen Inc. (now Pfizer)

Seagen’s Adcetris and Padcev continue to perform well commercially. Post-acquisition by Pfizer, the company is scaling ADC production and accelerating global clinical trials in lung and urothelial cancers.

AstraZeneca

In collaboration with Daiichi Sankyo, AstraZeneca launched Enhertu and Datopotamab deruxtecan (Dato-DXd), both of which have shown superior outcomes in breast and lung cancer. They are investing in linker technology to reduce off-target effects.

Roche Holding AG

A pioneer with Kadcyla, Roche is expanding into next-gen ADCs using novel payloads. It’s working on combining ADCs with checkpoint inhibitors to drive synergistic effects in immunotherapy.

Gilead Sciences (via Immunomedics acquisition)

Gilead’s Trodelvy is gaining traction in triple-negative breast cancer. The company is expanding trials in bladder, ovarian, and lung cancers and enhancing internal ADC R&D capability.

AbbVie

AbbVie acquired ImmunoGen in 2023 to secure Elahere, an approved ADC for ovarian cancer. The company is also investing in ADC-manufacturing facilities and exploring novel cytotoxic payloads beyond tubulin inhibitors.

These companies are redefining therapeutic delivery through innovation in linkers, payloads, and antibody engineering, creating a robust future pipeline.

Regional Analysis: USA, UK, Germany, France, Japan, China

United States: With the highest global share, the U.S. is supported by a pro-innovation regulatory environment, ample funding, and strong industry-academic partnerships.

United Kingdom: The UK government has made significant investments in personalized oncology. Regulatory flexibility via the MHRA supports accelerated access to ADCs.

Germany: Strong biotech infrastructure, including CDMO and GMP-compliant ADC manufacturing, is supporting robust clinical trial activity.

France: Home to rising biotech firms like Innate Pharma, France is benefiting from EU-backed oncology projects and early-phase ADC development.

Japan: Companies like Daiichi Sankyo are global leaders in ADC innovation. Regulatory fast-tracks for oncology drugs and international licensing deals contribute to Japan’s growing market share.

China: A rapidly developing player, China is promoting domestic ADC development through subsidies and fast-track approvals. Several homegrown companies, such as RemeGen and Bio-Thera, are in late-stage trials.

Conclusion and Analyst View

The ADC technology market is one of the most dynamic areas in biopharmaceutical innovation. As the burden of cancer rises globally, ADCs offer a targeted and effective treatment pathway, revolutionizing the standard of care. With over 150 ADCs in the clinical pipeline and continuous investments from global pharma leaders, the market is primed for exponential growth.

Related Report:

Biometric payment market:https://www.maximizemarketresearch.com/market-report/biometric-payment-market/190525/

Next generation computing market:https://www.maximizemarketresearch.com/market-report/next-generation-computing-market/190444/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

[email protected]