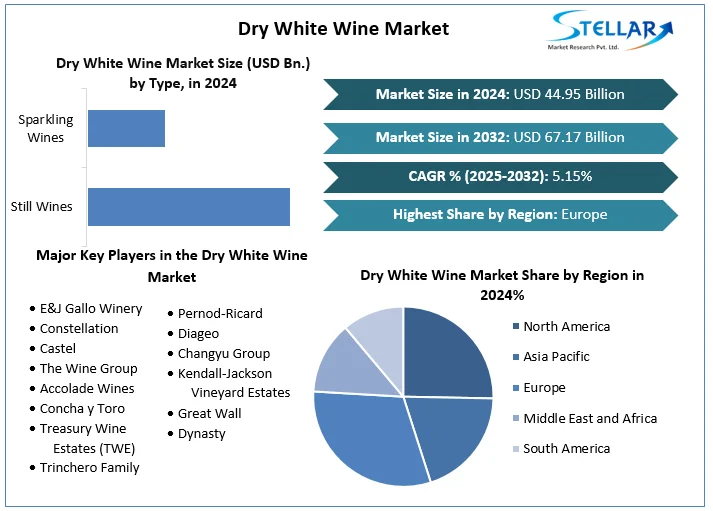

Dry White Wine Market Size To Grow At A CAGR Of 5.15% In The Forecast Period Of 2025-2032

Dry White Wine Market is experiencing a resurgence, projected to grow from USD 3.57 billion in 2024 to USD 5.56 billion by 2032, at a healthy CAGR of 5.7%. Factors such as increasing demand for low-alcohol beverages, the rise in health-conscious consumers, a growing appreciation for wine culture in emerging markets, and a shift toward sustainable and organic winemaking are driving growth.

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/Dry-White-Wine-Market/1507

Market Estimation, Growth Drivers & Opportunities

The dry white wine market is on an upward trajectory, with steady consumer demand, particularly for light, crisp wines like Sauvignon Blanc, Pinot Grigio, Riesling, and Chardonnay. Growth is being driven by:

Health-Conscious Consumption: Consumers are shifting toward lower-calorie, lower-alcohol drinks. Dry white wines, with their clean profiles and moderate ABV, are appealing to millennials and Gen Z.

Premiumization and Organic Trends: There is increasing demand for biodynamic, organic, and small-batch wines. Consumers are willing to pay more for quality, authenticity, and sustainability.

Culinary Integration: Dry white wines are popular pairings with seafood, poultry, salads, and cheese platters, boosting their role in both home and restaurant dining experiences.

Tourism and Experiences: Vineyard tourism and experiential tasting events are gaining popularity, particularly in regions like Napa Valley, Tuscany, and Bordeaux, encouraging direct-to-consumer wine sales.

Digital & E-Commerce Growth: Online wine retail is booming, supported by better logistics, subscription-based models, and targeted marketing.

Opportunities lie in expanding into non-traditional wine-drinking countries, launching new grape varietals and blends, sustainable packaging innovations, and leveraging digital storytelling to engage younger consumers.

U.S. Market Trends and Investments (2024–2025)

The United States remains one of the most significant contributors to global dry white wine demand, with key producing states including California, Oregon, and Washington. In 2024, the market saw increased demand for niche varietals like Albariño, Vermentino, and Chenin Blanc, alongside traditional favorites like Chardonnay and Sauvignon Blanc.

Key U.S. market trends include:

Sustainability Push: American wineries are increasingly adopting eco-friendly practices such as regenerative farming, water conservation, recyclable packaging, and carbon-neutral logistics.

Small-Batch & Boutique Wines: Micro-wineries and independent labels are growing in popularity, especially among younger, urban consumers looking for authenticity and unique flavor profiles.

Value-Driven Premiumization: While high-end wines remain strong, there's growing interest in mid-priced wines that offer premium taste without premium pricing.

Investment in Technology: From vineyard monitoring with drones to precision fermentation, U.S. producers are investing in tech to enhance quality, consistency, and sustainability.

Market Segmentation – Leading Segment

Based on the analysis, the still dry white wine segment leads the market by product type, due to its versatility, broad consumer appeal, and dominant presence in retail and restaurant menus.

By grape variety, the largest market share is held by:

Sauvignon Blanc – Known for its crisp, herbal profile.

Chardonnay – Offers a wide spectrum from buttery to mineral-driven styles.

Pinot Grigio – Light, zesty, and immensely popular across demographics.

Riesling – Valued for its floral notes and food-pairing flexibility.

The household consumption segment dominates in terms of end-use, supported by online purchasing and increased at-home wine consumption post-pandemic.

Competitive Landscape – Top 5 Global Players

Treasury Wine Estates (Australia)

A global giant with brands like Penfolds and 19 Crimes, Treasury has expanded its white wine range with organic and sustainably produced wines. Recent innovations include low-alcohol white variants targeting the health-conscious consumer.

Constellation Brands (USA)

Known for brands like Kim Crawford and Meiomi, the company is heavily invested in expanding its premium white wine portfolio. It is focusing on brand repositioning and increasing presence in the Asia-Pacific market.

Pernod Ricard (France)

Through its brands like Jacob’s Creek and Campo Viejo, Pernod Ricard has increased its focus on sustainable vineyards and climate-resilient grape cultivation to address future supply risks.

E. & J. Gallo Winery (USA)

The largest family-owned winery in the U.S., Gallo is innovating with recyclable and lightweight packaging, expanding into canned white wines, and investing in automation across its production facilities.

The Wine Group (USA)

With brands like Cupcake Vineyards and Franzia, The Wine Group has embraced sustainability and premiumization. In 2024, they introduced a new line of crisp, refreshing whites aimed at millennial women and eco-conscious buyers.

These players are adopting strategic measures such as acquisitions, varietal innovation, and branding efforts focused on lifestyle and sustainability.

Regional Analysis – Key Countries Driving Growth

United States

Holds a dominant share in North America. Government support for sustainable agriculture, a mature wine-drinking culture, and advanced supply chain logistics contribute to continued growth. California remains at the heart of white wine production and innovation.

United Kingdom

A significant importer of dry white wine. Consumer interest in low-sugar and natural wines is pushing retailers to increase shelf space for organic and vegan-certified options. UK producers in Sussex and Kent are also gaining momentum.

Germany

Germany remains a stronghold for Riesling and Pinot Gris. Sustainability is a core focus, with government subsidies encouraging biodynamic farming. Consumers favor crisp whites with lower alcohol content.

France

Home to some of the most iconic white wines (e.g., Burgundy Chardonnay, Loire Sauvignon Blanc), France is advancing its export capacity. Strong emphasis on terroir, vineyard preservation, and export to Asia-Pacific markets.

Japan

Health-focused consumers are increasingly shifting to dry white wines. Japanese vineyards in Yamanashi and Nagano are innovating with hybrids suited to local terroir. Government tourism and food pairings programs are promoting domestic consumption.

China

A rapidly growing market. Urban middle-class consumers are gravitating toward Western wines. Education campaigns and wine pairing culture are expanding. Imports from France, Australia, and Chile dominate, with white wines gaining ground due to lighter profiles.

Conclusion and Future Outlook

The global dry white wine market is evolving rapidly, driven by demographic shifts, eco-conscious values, and technological advancement. As sustainability becomes a market imperative and health-focused lifestyles take center stage, dry white wine is becoming the beverage of choice for modern consumers.

About us

Phase 3,Navale IT Zone,

S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]Dry White Wine Market Size To Grow At A CAGR Of 5.15% In The Forecast Period Of 2025-2032

Dry White Wine Market is experiencing a resurgence, projected to grow from USD 3.57 billion in 2024 to USD 5.56 billion by 2032, at a healthy CAGR of 5.7%. Factors such as increasing demand for low-alcohol beverages, the rise in health-conscious consumers, a growing appreciation for wine culture in emerging markets, and a shift toward sustainable and organic winemaking are driving growth.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Dry-White-Wine-Market/1507

Market Estimation, Growth Drivers & Opportunities

The dry white wine market is on an upward trajectory, with steady consumer demand, particularly for light, crisp wines like Sauvignon Blanc, Pinot Grigio, Riesling, and Chardonnay. Growth is being driven by:

Health-Conscious Consumption: Consumers are shifting toward lower-calorie, lower-alcohol drinks. Dry white wines, with their clean profiles and moderate ABV, are appealing to millennials and Gen Z.

Premiumization and Organic Trends: There is increasing demand for biodynamic, organic, and small-batch wines. Consumers are willing to pay more for quality, authenticity, and sustainability.

Culinary Integration: Dry white wines are popular pairings with seafood, poultry, salads, and cheese platters, boosting their role in both home and restaurant dining experiences.

Tourism and Experiences: Vineyard tourism and experiential tasting events are gaining popularity, particularly in regions like Napa Valley, Tuscany, and Bordeaux, encouraging direct-to-consumer wine sales.

Digital & E-Commerce Growth: Online wine retail is booming, supported by better logistics, subscription-based models, and targeted marketing.

Opportunities lie in expanding into non-traditional wine-drinking countries, launching new grape varietals and blends, sustainable packaging innovations, and leveraging digital storytelling to engage younger consumers.

U.S. Market Trends and Investments (2024–2025)

The United States remains one of the most significant contributors to global dry white wine demand, with key producing states including California, Oregon, and Washington. In 2024, the market saw increased demand for niche varietals like Albariño, Vermentino, and Chenin Blanc, alongside traditional favorites like Chardonnay and Sauvignon Blanc.

Key U.S. market trends include:

Sustainability Push: American wineries are increasingly adopting eco-friendly practices such as regenerative farming, water conservation, recyclable packaging, and carbon-neutral logistics.

Small-Batch & Boutique Wines: Micro-wineries and independent labels are growing in popularity, especially among younger, urban consumers looking for authenticity and unique flavor profiles.

Value-Driven Premiumization: While high-end wines remain strong, there's growing interest in mid-priced wines that offer premium taste without premium pricing.

Investment in Technology: From vineyard monitoring with drones to precision fermentation, U.S. producers are investing in tech to enhance quality, consistency, and sustainability.

Market Segmentation – Leading Segment

Based on the analysis, the still dry white wine segment leads the market by product type, due to its versatility, broad consumer appeal, and dominant presence in retail and restaurant menus.

By grape variety, the largest market share is held by:

Sauvignon Blanc – Known for its crisp, herbal profile.

Chardonnay – Offers a wide spectrum from buttery to mineral-driven styles.

Pinot Grigio – Light, zesty, and immensely popular across demographics.

Riesling – Valued for its floral notes and food-pairing flexibility.

The household consumption segment dominates in terms of end-use, supported by online purchasing and increased at-home wine consumption post-pandemic.

Competitive Landscape – Top 5 Global Players

Treasury Wine Estates (Australia)

A global giant with brands like Penfolds and 19 Crimes, Treasury has expanded its white wine range with organic and sustainably produced wines. Recent innovations include low-alcohol white variants targeting the health-conscious consumer.

Constellation Brands (USA)

Known for brands like Kim Crawford and Meiomi, the company is heavily invested in expanding its premium white wine portfolio. It is focusing on brand repositioning and increasing presence in the Asia-Pacific market.

Pernod Ricard (France)

Through its brands like Jacob’s Creek and Campo Viejo, Pernod Ricard has increased its focus on sustainable vineyards and climate-resilient grape cultivation to address future supply risks.

E. & J. Gallo Winery (USA)

The largest family-owned winery in the U.S., Gallo is innovating with recyclable and lightweight packaging, expanding into canned white wines, and investing in automation across its production facilities.

The Wine Group (USA)

With brands like Cupcake Vineyards and Franzia, The Wine Group has embraced sustainability and premiumization. In 2024, they introduced a new line of crisp, refreshing whites aimed at millennial women and eco-conscious buyers.

These players are adopting strategic measures such as acquisitions, varietal innovation, and branding efforts focused on lifestyle and sustainability.

Regional Analysis – Key Countries Driving Growth

United States

Holds a dominant share in North America. Government support for sustainable agriculture, a mature wine-drinking culture, and advanced supply chain logistics contribute to continued growth. California remains at the heart of white wine production and innovation.

United Kingdom

A significant importer of dry white wine. Consumer interest in low-sugar and natural wines is pushing retailers to increase shelf space for organic and vegan-certified options. UK producers in Sussex and Kent are also gaining momentum.

Germany

Germany remains a stronghold for Riesling and Pinot Gris. Sustainability is a core focus, with government subsidies encouraging biodynamic farming. Consumers favor crisp whites with lower alcohol content.

France

Home to some of the most iconic white wines (e.g., Burgundy Chardonnay, Loire Sauvignon Blanc), France is advancing its export capacity. Strong emphasis on terroir, vineyard preservation, and export to Asia-Pacific markets.

Japan

Health-focused consumers are increasingly shifting to dry white wines. Japanese vineyards in Yamanashi and Nagano are innovating with hybrids suited to local terroir. Government tourism and food pairings programs are promoting domestic consumption.

China

A rapidly growing market. Urban middle-class consumers are gravitating toward Western wines. Education campaigns and wine pairing culture are expanding. Imports from France, Australia, and Chile dominate, with white wines gaining ground due to lighter profiles.

Conclusion and Future Outlook

The global dry white wine market is evolving rapidly, driven by demographic shifts, eco-conscious values, and technological advancement. As sustainability becomes a market imperative and health-focused lifestyles take center stage, dry white wine is becoming the beverage of choice for modern consumers.

About us

Phase 3,Navale IT Zone,

S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]