Flame Retardants for Aerospace Plastics Market Size to Grow at a CAGR of 7.2% in the Forecast Period of 2025-2032

Global Flame Retardants for Aerospace Plastics Market Poised for Robust Growth Amid Safety Regulations and Technological Advancements

Market Overview

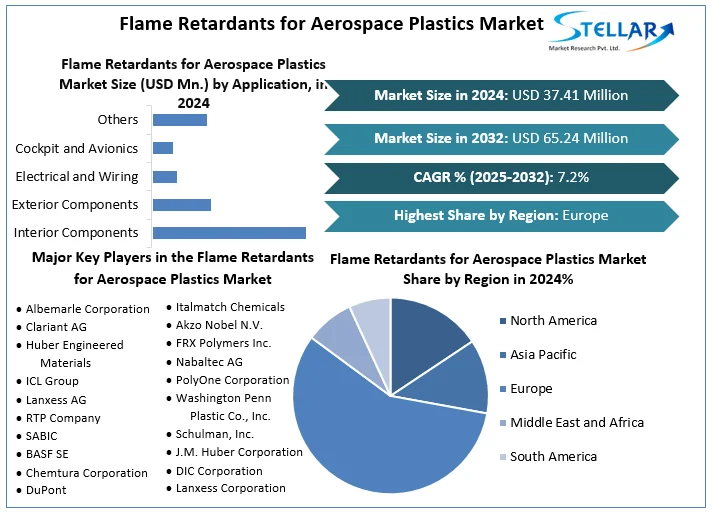

The global flame retardants for aerospace plastics market is experiencing significant growth, driven by stringent safety regulations and the increasing demand for lightweight materials in aircraft manufacturing. Valued at approximately USD 37.41 million in 2024, the market is projected to reach USD 65.24 million by 2032, growing at a CAGR of 7.2% during the forecast period

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Flame-Retardants-for-Aerospace-Plastics-Market/1544

Market Drivers

Stringent Safety Regulations: The aerospace industry enforces rigorous fire safety standards, necessitating the use of flame-retardant materials in aircraft components to ensure passenger and crew safety.

Demand for Lightweight Materials: The push for fuel efficiency and reduced emissions has led to an increased adoption of lightweight polymers and composites in aircraft manufacturing, driving the demand for effective flame retardants.

Technological Advancements: Innovations in flame retardant formulations, such as non-halogenated and eco-friendly additives, are expanding the application scope and performance of flame-retardant plastics in aerospace applications.

Market Segmentation

By Product Type: Key flame retardants used in aerospace plastics include aluminum trihydrate (ATH), antimony oxide, organophosphates, and boron compounds. ATH is anticipated to hold the majority share in 2025 due to its effectiveness and cost-efficiency.

By Polymer Type: Carbon fiber-reinforced polymers (CFRP) lead the market, accounting for approximately 41.46% of the polymer demand, owing to their high strength-to-weight ratio. Other polymers such as polyether-ether-ketone (PEEK) are also gaining traction for high-temperature applications.

By Application: Flame-retardant plastics are utilized in various aerospace components, including interior parts, structural elements, electrical wiring, and cockpit avionics, to meet safety and performance standards.

By Region: Europe is expected to dominate the market with a 47.5% revenue share in 2025, driven by leading aircraft manufacturers and stringent regulatory standards. The Asia-Pacific region is anticipated to witness the highest growth rate during the forecast period, fueled by increasing aerospace manufacturing activities and infrastructure development.

Competitive Landscape

Key players in the global flame retardants for aerospace plastics market include:

Albemarle Corporation

Clariant AG

Huber Engineered Materials

ICL Group

Lanxess AG

RTP Company

SABIC

BASF SE

These companies are focusing on product innovation, strategic partnerships, and expanding their global presence to strengthen their market position.

Conclusion

The flame retardants for aerospace plastics market is set for substantial growth, driven by the confluence of stringent safety regulations, the demand for lightweight materials, and technological advancements in flame retardant formulations. As the aerospace industry continues to evolve, the need for effective and sustainable flame-retardant solutions will remain paramount, presenting significant opportunities for industry players to innovate and cater to the evolving market demands.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Global Flame Retardants for Aerospace Plastics Market Poised for Robust Growth Amid Safety Regulations and Technological Advancements

Market Overview

The global flame retardants for aerospace plastics market is experiencing significant growth, driven by stringent safety regulations and the increasing demand for lightweight materials in aircraft manufacturing. Valued at approximately USD 37.41 million in 2024, the market is projected to reach USD 65.24 million by 2032, growing at a CAGR of 7.2% during the forecast period

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Flame-Retardants-for-Aerospace-Plastics-Market/1544

Market Drivers

Stringent Safety Regulations: The aerospace industry enforces rigorous fire safety standards, necessitating the use of flame-retardant materials in aircraft components to ensure passenger and crew safety.

Demand for Lightweight Materials: The push for fuel efficiency and reduced emissions has led to an increased adoption of lightweight polymers and composites in aircraft manufacturing, driving the demand for effective flame retardants.

Technological Advancements: Innovations in flame retardant formulations, such as non-halogenated and eco-friendly additives, are expanding the application scope and performance of flame-retardant plastics in aerospace applications.

Market Segmentation

By Product Type: Key flame retardants used in aerospace plastics include aluminum trihydrate (ATH), antimony oxide, organophosphates, and boron compounds. ATH is anticipated to hold the majority share in 2025 due to its effectiveness and cost-efficiency.

By Polymer Type: Carbon fiber-reinforced polymers (CFRP) lead the market, accounting for approximately 41.46% of the polymer demand, owing to their high strength-to-weight ratio. Other polymers such as polyether-ether-ketone (PEEK) are also gaining traction for high-temperature applications.

By Application: Flame-retardant plastics are utilized in various aerospace components, including interior parts, structural elements, electrical wiring, and cockpit avionics, to meet safety and performance standards.

By Region: Europe is expected to dominate the market with a 47.5% revenue share in 2025, driven by leading aircraft manufacturers and stringent regulatory standards. The Asia-Pacific region is anticipated to witness the highest growth rate during the forecast period, fueled by increasing aerospace manufacturing activities and infrastructure development.

Competitive Landscape

Key players in the global flame retardants for aerospace plastics market include:

Albemarle Corporation

Clariant AG

Huber Engineered Materials

ICL Group

Lanxess AG

RTP Company

SABIC

BASF SE

These companies are focusing on product innovation, strategic partnerships, and expanding their global presence to strengthen their market position.

Conclusion

The flame retardants for aerospace plastics market is set for substantial growth, driven by the confluence of stringent safety regulations, the demand for lightweight materials, and technological advancements in flame retardant formulations. As the aerospace industry continues to evolve, the need for effective and sustainable flame-retardant solutions will remain paramount, presenting significant opportunities for industry players to innovate and cater to the evolving market demands.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Flame Retardants for Aerospace Plastics Market Size to Grow at a CAGR of 7.2% in the Forecast Period of 2025-2032

Global Flame Retardants for Aerospace Plastics Market Poised for Robust Growth Amid Safety Regulations and Technological Advancements

Market Overview

The global flame retardants for aerospace plastics market is experiencing significant growth, driven by stringent safety regulations and the increasing demand for lightweight materials in aircraft manufacturing. Valued at approximately USD 37.41 million in 2024, the market is projected to reach USD 65.24 million by 2032, growing at a CAGR of 7.2% during the forecast period

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Flame-Retardants-for-Aerospace-Plastics-Market/1544

Market Drivers

Stringent Safety Regulations: The aerospace industry enforces rigorous fire safety standards, necessitating the use of flame-retardant materials in aircraft components to ensure passenger and crew safety.

Demand for Lightweight Materials: The push for fuel efficiency and reduced emissions has led to an increased adoption of lightweight polymers and composites in aircraft manufacturing, driving the demand for effective flame retardants.

Technological Advancements: Innovations in flame retardant formulations, such as non-halogenated and eco-friendly additives, are expanding the application scope and performance of flame-retardant plastics in aerospace applications.

Market Segmentation

By Product Type: Key flame retardants used in aerospace plastics include aluminum trihydrate (ATH), antimony oxide, organophosphates, and boron compounds. ATH is anticipated to hold the majority share in 2025 due to its effectiveness and cost-efficiency.

By Polymer Type: Carbon fiber-reinforced polymers (CFRP) lead the market, accounting for approximately 41.46% of the polymer demand, owing to their high strength-to-weight ratio. Other polymers such as polyether-ether-ketone (PEEK) are also gaining traction for high-temperature applications.

By Application: Flame-retardant plastics are utilized in various aerospace components, including interior parts, structural elements, electrical wiring, and cockpit avionics, to meet safety and performance standards.

By Region: Europe is expected to dominate the market with a 47.5% revenue share in 2025, driven by leading aircraft manufacturers and stringent regulatory standards. The Asia-Pacific region is anticipated to witness the highest growth rate during the forecast period, fueled by increasing aerospace manufacturing activities and infrastructure development.

Competitive Landscape

Key players in the global flame retardants for aerospace plastics market include:

Albemarle Corporation

Clariant AG

Huber Engineered Materials

ICL Group

Lanxess AG

RTP Company

SABIC

BASF SE

These companies are focusing on product innovation, strategic partnerships, and expanding their global presence to strengthen their market position.

Conclusion

The flame retardants for aerospace plastics market is set for substantial growth, driven by the confluence of stringent safety regulations, the demand for lightweight materials, and technological advancements in flame retardant formulations. As the aerospace industry continues to evolve, the need for effective and sustainable flame-retardant solutions will remain paramount, presenting significant opportunities for industry players to innovate and cater to the evolving market demands.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

0 Comentários

0 Compartilhamentos

1587 Visualizações