Coconut Market Forecast: Sustainability Trends and Eco-Friendly Packaging Influence

Market Overview

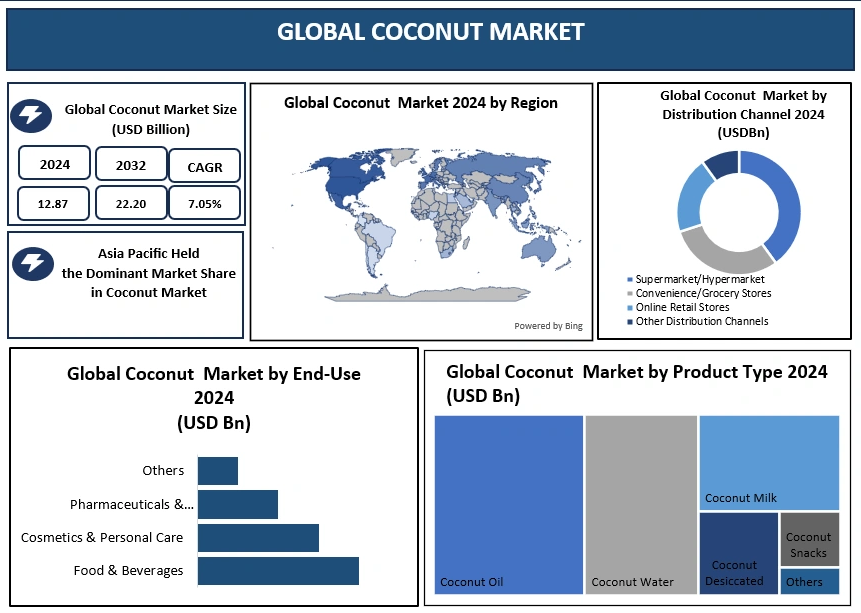

The global Coconut Market is witnessing steady expansion, driven by rising consumer awareness toward health, nutrition, and plant-based lifestyles. Coconut and its derivatives have become an important part of daily diets, beauty routines, and wellness applications across the world. With growing demand for natural ingredients, functional foods, and dairy-free alternatives, coconuts are increasingly used in food & beverages, cosmetics, pharmaceuticals, and personal care products. The market is supported by strong production in tropical regions and rising consumption in developed economies, where clean-label and organic food trends continue to gain traction.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/29399/

Market Segmentation

The coconut market is segmented based on product type, application, distribution channel, and end-use industries.

By product type, the market includes coconut oil, coconut milk, coconut water, desiccated coconut, coconut snacks, and other value-added products. Coconut oil holds the largest share due to its extensive usage in cooking, cosmetics, and pharmaceutical formulations. Coconut milk is rapidly gaining popularity as a dairy substitute in vegan and lactose-free diets.

By application, the market is dominated by the food & beverage segment, which accounts for the majority of global demand. Additional applications include personal care, cosmetics, pharmaceuticals, and wellness products.

Distribution channels include supermarkets, hypermarkets, convenience stores, specialty stores, and online retail platforms, with e-commerce showing significant growth.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/29399/

Regional Insights

Asia-Pacific remains the backbone of the global coconut market due to its strong production base, favorable climate conditions, and traditional use of coconut in daily cuisine. Countries in Southeast Asia play a major role in raw coconut supply and processing.

North America holds a strong position in terms of consumption and product innovation. The region has seen rising demand for coconut water, dairy-free beverages, natural oils, and plant-based snacks. Europe is also emerging as a significant market, supported by increasing preference for organic foods and natural cosmetic ingredients. Meanwhile, demand in South America, the Middle East, and Africa continues to grow steadily.

Market Highlights

Rising popularity of plant-based diets is fueling demand for coconut milk, water, and oil.

Coconut oil remains the most widely used product due to its multifunctional benefits.

Food & beverage applications account for the majority of overall market demand.

Growing use of coconut in cosmetics and personal care products is boosting market value.

Expansion of online retail is improving global accessibility of coconut-based products.

Natural and organic product trends continue to strengthen long-term market growth.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/29399/

Competitive Landscape

Coconut Key Players

1. ZICO BEVERAGES

2. Ducoco Alimentos SA

3. THE VITA COCO COMPANY, INC.

4. PT. Pulau Sambu

5. Coco do Vale

6. Dabur Company

7. Coco Colima SA

8. The Coconut Company

9. Celebes Coconut Corporation

10. Danone

11. Eco Biscuits

12. Creative Snacks

13. Goindiaorganic

14. So Delicious

15. PT. Global Coconut

16. Maverick Brands

17. Dangfoods

18. Renuka Foods

19. Dutch Plantin

20. Viva Labs

21. Marico Limited

Conclusion

The global coconut market is positioned for consistent growth driven by evolving dietary habits, increasing health awareness, and rising demand for natural, plant-based ingredients. Coconut oil continues to dominate the product segment, while coconut milk and water are emerging as high-growth categories. Asia-Pacific leads in production, while North America and Europe remain key consumption hubs. Despite challenges related to climate conditions and cultivation risks, the market outlook remains positive. With continued innovation, expanding retail channels, and sustainable agricultural practices, the coconut industry is expected to offer strong opportunities across food, beverage, cosmetics, and wellness sectors in the coming years.

More Related Reports

Freshwater Fish Market https://www.maximizemarketresearch.com/market-report/freshwater-fish-market/213841/

Global Coffee Market https://www.maximizemarketresearch.com/market-report/global-coffee-market/110762/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

[email protected]

Market Overview

The global Coconut Market is witnessing steady expansion, driven by rising consumer awareness toward health, nutrition, and plant-based lifestyles. Coconut and its derivatives have become an important part of daily diets, beauty routines, and wellness applications across the world. With growing demand for natural ingredients, functional foods, and dairy-free alternatives, coconuts are increasingly used in food & beverages, cosmetics, pharmaceuticals, and personal care products. The market is supported by strong production in tropical regions and rising consumption in developed economies, where clean-label and organic food trends continue to gain traction.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/29399/

Market Segmentation

The coconut market is segmented based on product type, application, distribution channel, and end-use industries.

By product type, the market includes coconut oil, coconut milk, coconut water, desiccated coconut, coconut snacks, and other value-added products. Coconut oil holds the largest share due to its extensive usage in cooking, cosmetics, and pharmaceutical formulations. Coconut milk is rapidly gaining popularity as a dairy substitute in vegan and lactose-free diets.

By application, the market is dominated by the food & beverage segment, which accounts for the majority of global demand. Additional applications include personal care, cosmetics, pharmaceuticals, and wellness products.

Distribution channels include supermarkets, hypermarkets, convenience stores, specialty stores, and online retail platforms, with e-commerce showing significant growth.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/29399/

Regional Insights

Asia-Pacific remains the backbone of the global coconut market due to its strong production base, favorable climate conditions, and traditional use of coconut in daily cuisine. Countries in Southeast Asia play a major role in raw coconut supply and processing.

North America holds a strong position in terms of consumption and product innovation. The region has seen rising demand for coconut water, dairy-free beverages, natural oils, and plant-based snacks. Europe is also emerging as a significant market, supported by increasing preference for organic foods and natural cosmetic ingredients. Meanwhile, demand in South America, the Middle East, and Africa continues to grow steadily.

Market Highlights

Rising popularity of plant-based diets is fueling demand for coconut milk, water, and oil.

Coconut oil remains the most widely used product due to its multifunctional benefits.

Food & beverage applications account for the majority of overall market demand.

Growing use of coconut in cosmetics and personal care products is boosting market value.

Expansion of online retail is improving global accessibility of coconut-based products.

Natural and organic product trends continue to strengthen long-term market growth.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/29399/

Competitive Landscape

Coconut Key Players

1. ZICO BEVERAGES

2. Ducoco Alimentos SA

3. THE VITA COCO COMPANY, INC.

4. PT. Pulau Sambu

5. Coco do Vale

6. Dabur Company

7. Coco Colima SA

8. The Coconut Company

9. Celebes Coconut Corporation

10. Danone

11. Eco Biscuits

12. Creative Snacks

13. Goindiaorganic

14. So Delicious

15. PT. Global Coconut

16. Maverick Brands

17. Dangfoods

18. Renuka Foods

19. Dutch Plantin

20. Viva Labs

21. Marico Limited

Conclusion

The global coconut market is positioned for consistent growth driven by evolving dietary habits, increasing health awareness, and rising demand for natural, plant-based ingredients. Coconut oil continues to dominate the product segment, while coconut milk and water are emerging as high-growth categories. Asia-Pacific leads in production, while North America and Europe remain key consumption hubs. Despite challenges related to climate conditions and cultivation risks, the market outlook remains positive. With continued innovation, expanding retail channels, and sustainable agricultural practices, the coconut industry is expected to offer strong opportunities across food, beverage, cosmetics, and wellness sectors in the coming years.

More Related Reports

Freshwater Fish Market https://www.maximizemarketresearch.com/market-report/freshwater-fish-market/213841/

Global Coffee Market https://www.maximizemarketresearch.com/market-report/global-coffee-market/110762/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

[email protected]

Coconut Market Forecast: Sustainability Trends and Eco-Friendly Packaging Influence

Market Overview

The global Coconut Market is witnessing steady expansion, driven by rising consumer awareness toward health, nutrition, and plant-based lifestyles. Coconut and its derivatives have become an important part of daily diets, beauty routines, and wellness applications across the world. With growing demand for natural ingredients, functional foods, and dairy-free alternatives, coconuts are increasingly used in food & beverages, cosmetics, pharmaceuticals, and personal care products. The market is supported by strong production in tropical regions and rising consumption in developed economies, where clean-label and organic food trends continue to gain traction.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/29399/

Market Segmentation

The coconut market is segmented based on product type, application, distribution channel, and end-use industries.

By product type, the market includes coconut oil, coconut milk, coconut water, desiccated coconut, coconut snacks, and other value-added products. Coconut oil holds the largest share due to its extensive usage in cooking, cosmetics, and pharmaceutical formulations. Coconut milk is rapidly gaining popularity as a dairy substitute in vegan and lactose-free diets.

By application, the market is dominated by the food & beverage segment, which accounts for the majority of global demand. Additional applications include personal care, cosmetics, pharmaceuticals, and wellness products.

Distribution channels include supermarkets, hypermarkets, convenience stores, specialty stores, and online retail platforms, with e-commerce showing significant growth.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/29399/

Regional Insights

Asia-Pacific remains the backbone of the global coconut market due to its strong production base, favorable climate conditions, and traditional use of coconut in daily cuisine. Countries in Southeast Asia play a major role in raw coconut supply and processing.

North America holds a strong position in terms of consumption and product innovation. The region has seen rising demand for coconut water, dairy-free beverages, natural oils, and plant-based snacks. Europe is also emerging as a significant market, supported by increasing preference for organic foods and natural cosmetic ingredients. Meanwhile, demand in South America, the Middle East, and Africa continues to grow steadily.

Market Highlights

Rising popularity of plant-based diets is fueling demand for coconut milk, water, and oil.

Coconut oil remains the most widely used product due to its multifunctional benefits.

Food & beverage applications account for the majority of overall market demand.

Growing use of coconut in cosmetics and personal care products is boosting market value.

Expansion of online retail is improving global accessibility of coconut-based products.

Natural and organic product trends continue to strengthen long-term market growth.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/29399/

Competitive Landscape

Coconut Key Players

1. ZICO BEVERAGES

2. Ducoco Alimentos SA

3. THE VITA COCO COMPANY, INC.

4. PT. Pulau Sambu

5. Coco do Vale

6. Dabur Company

7. Coco Colima SA

8. The Coconut Company

9. Celebes Coconut Corporation

10. Danone

11. Eco Biscuits

12. Creative Snacks

13. Goindiaorganic

14. So Delicious

15. PT. Global Coconut

16. Maverick Brands

17. Dangfoods

18. Renuka Foods

19. Dutch Plantin

20. Viva Labs

21. Marico Limited

Conclusion

The global coconut market is positioned for consistent growth driven by evolving dietary habits, increasing health awareness, and rising demand for natural, plant-based ingredients. Coconut oil continues to dominate the product segment, while coconut milk and water are emerging as high-growth categories. Asia-Pacific leads in production, while North America and Europe remain key consumption hubs. Despite challenges related to climate conditions and cultivation risks, the market outlook remains positive. With continued innovation, expanding retail channels, and sustainable agricultural practices, the coconut industry is expected to offer strong opportunities across food, beverage, cosmetics, and wellness sectors in the coming years.

More Related Reports

Freshwater Fish Market https://www.maximizemarketresearch.com/market-report/freshwater-fish-market/213841/

Global Coffee Market https://www.maximizemarketresearch.com/market-report/global-coffee-market/110762/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Maximize Market Research

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

[email protected]

0 Commentaires

0 Parts

1250 Vue