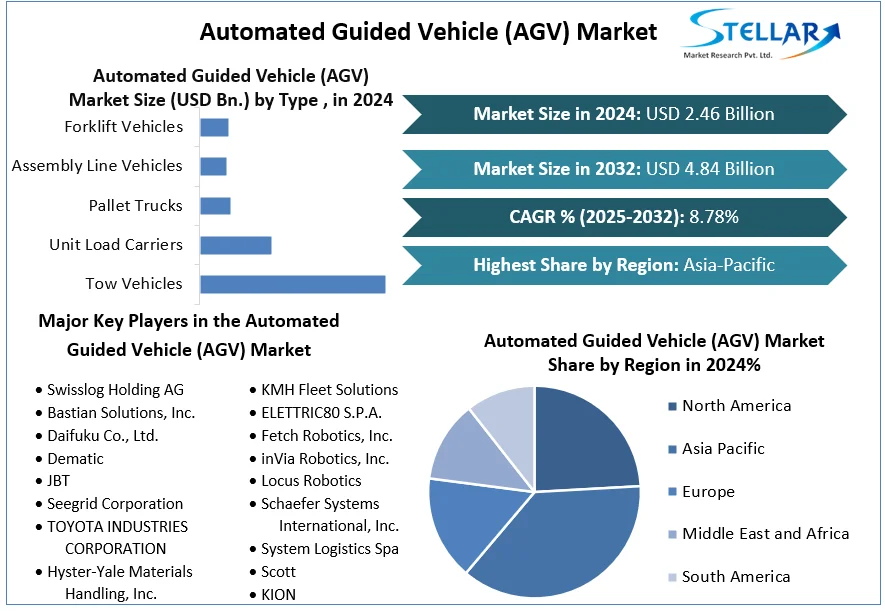

Automated Guided Vehicle (AGV) Market Size To Grow At A CAGR Of 8.78% In The Forecast Period Of 2025-2032

Automated Guided Vehicle (AGV) Market, valued at USD 3.98 billion in 2023, is projected to reach USD 7.62 billion by 2030, growing at a CAGR of 9.8% during the forecast period. The rapid adoption of Industry 4.0, the need for lean manufacturing, and the surge in e-commerce logistics are propelling the AGV market globally.

Request Free Sample report:

https://www.stellarmr.com/report/req_sample/Automated-Guided-Vehicle--AGV--Market/274

Market Estimation, Growth Drivers & Opportunities

Automated Guided Vehicles (AGVs) are material handling systems or load carriers that travel autonomously within a facility using sensors, navigation systems, and software. Their usage has grown exponentially across industries such as automotive, healthcare, food & beverage, logistics, and manufacturing.

Key Growth Drivers:

Rising Demand for Automation in Material Handling: The need for high-efficiency warehouse operations with minimal human intervention is driving AGV deployment.

E-Commerce Boom: The rapid growth of e-commerce platforms has heightened the demand for smart warehouses, which rely heavily on AGVs for order picking, sorting, and transport.

Labor Shortages & Safety Requirements: AGVs offer a cost-effective, safe, and scalable alternative to manual labor in hazardous or labor-intensive environments.

Integration with IoT and AI: Real-time tracking, dynamic routing, and data analytics capabilities have made AGVs more intelligent and adaptable in modern logistics ecosystems.

Opportunities:

Adoption in Healthcare and Pharmaceuticals: Hospitals are increasingly deploying AGVs for safe and sterile delivery of medication and supplies.

Growth in Emerging Economies: Manufacturing expansions in Asia-Pacific and Latin America offer vast potential for AGV integration.

Flexible and Customizable AGVs: Innovations in modular design, size customization, and payload adaptability are opening new use cases across industry verticals.

U.S. Market Trends & 2024 Investment Highlights

In 2024, the U.S. saw a significant uptick in AGV installations across fulfillment centers and smart factories. Retail giants like Walmart and Amazon expanded their automation capabilities with AGV fleets capable of autonomous pallet transport, bin picking, and high-density storage retrieval.

Additionally, automotive manufacturers like General Motors and Ford invested in collaborative AGVs (Co-AGVs) that work alongside humans on production lines, enhancing productivity and safety. Several tech startups also secured funding to develop AI-based navigation and vision systems tailored for smaller AGVs targeting SMEs.

Government initiatives supporting domestic manufacturing under the “Made in America” program further boosted AGV demand by incentivizing automation upgrades in traditional industries.

Market Segmentation – Largest Segments by Share

By Type:

Tow Vehicles dominate the AGV market due to their ability to pull multiple loads in assembly lines and warehouses.

Unit Load Carriers are also widely used in distribution centers and storage facilities for handling pallets and containers.

Forklift AGVs are gaining popularity as replacements for traditional manual forklifts in smart logistics.

By Navigation Technology:

Laser Guidance holds the largest share, offering high accuracy and flexibility in dynamic environments.

Vision Guidance is an emerging segment, especially for applications requiring advanced object detection and real-time decision-making.

Magnetic and Wired Guidance remain in use in structured facilities with fixed routes.

By Application:

Logistics & Warehousing accounts for the highest market share, particularly for order fulfillment, cross-docking, and goods movement.

Manufacturing is also a key segment, especially in automotive and electronics sectors that require consistent and efficient material flow.

Competitive Analysis – Top 5 Players and Strategic Developments

1. Daifuku Co., Ltd. (Japan):

One of the global leaders in intralogistics automation, Daifuku expanded its AGV product line in 2024 with high-speed vehicles designed for pharmaceutical and semiconductor clean rooms. The company also enhanced its WMS integration and cloud-based fleet monitoring capabilities.

2. KUKA AG (Germany):

KUKA continues to lead in modular AGV systems integrated with robotic arms. In 2024, the company launched its latest generation of AGVs with collaborative capabilities, machine learning for dynamic navigation, and smart obstacle avoidance.

3. JBT Corporation (USA):

JBT specializes in AGV solutions for food processing and airport logistics. Its 2024 innovations included temperature-controlled AGVs and systems designed for cold chain logistics, targeting high-growth segments like pharma and fresh food delivery.

4. Toyota Industries Corporation (Japan):

Toyota Material Handling, under Toyota Industries, ramped up production of lithium-ion battery-powered AGVs. Their focus on sustainability, fleet interoperability, and AGV-as-a-Service business models gave them a competitive edge in global markets.

5. Swisslog Holding AG (Switzerland):

A key player in e-commerce warehouse automation, Swisslog partnered with leading grocery and retail chains in 2024 to deploy automated picking AGVs integrated with AI-based inventory systems. The company’s robotics-as-a-service (RaaS) model continues to attract SME clients.

These companies are emphasizing innovation in smart navigation, energy efficiency, and integration with broader warehouse management ecosystems. Mergers, tech partnerships, and regional expansion strategies are central to their market leadership.

Regional Analysis – U.S., UK, Germany, France, Japan & China

United States:

The U.S. AGV market is booming due to a skilled labor shortage, rising wages, and surging e-commerce fulfillment needs. Government tax incentives for manufacturing automation and local production initiatives are further driving adoption.

United Kingdom:

UK warehouses are rapidly transitioning to automation post-Brexit, with AGVs playing a key role in enhancing supply chain resilience. Retail and cold storage sectors are primary adopters, driven by labor constraints and sustainability goals.

Germany:

Germany leads in smart factory innovation, and AGVs are a cornerstone of its Industry 4.0 blueprint. Home to global giants like KUKA and STILL, the country is investing heavily in flexible AGV platforms and edge computing integration.

France:

With government support for industrial automation and green energy transition, French manufacturing facilities are increasingly deploying AGVs. Sectors like aerospace and food & beverage are investing in intelligent and hygienic transport systems.

Japan:

Japan’s aging workforce and robotics leadership make it a mature AGV market. Advanced AGVs are being used in hospitals, airports, and dense urban logistics environments. Companies are pioneering ultra-compact and AI-driven navigation technologies.

China:

As the world’s largest manufacturing hub, China continues to dominate AGV deployment in electronics, automotive, and e-commerce sectors. Government-backed smart factory programs and rapid tech innovation are fueling explosive market growth.

Conclusion & Strategic Outlook

The AGV market is rapidly evolving from traditional factory-floor vehicles to intelligent, connected systems at the heart of smart supply chains. As industries seek efficiency, scalability, and real-time control, AGVs are becoming a strategic necessity rather than a luxury.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]Automated Guided Vehicle (AGV) Market Size To Grow At A CAGR Of 8.78% In The Forecast Period Of 2025-2032

Automated Guided Vehicle (AGV) Market, valued at USD 3.98 billion in 2023, is projected to reach USD 7.62 billion by 2030, growing at a CAGR of 9.8% during the forecast period. The rapid adoption of Industry 4.0, the need for lean manufacturing, and the surge in e-commerce logistics are propelling the AGV market globally.

Request Free Sample report:https://www.stellarmr.com/report/req_sample/Automated-Guided-Vehicle--AGV--Market/274

Market Estimation, Growth Drivers & Opportunities

Automated Guided Vehicles (AGVs) are material handling systems or load carriers that travel autonomously within a facility using sensors, navigation systems, and software. Their usage has grown exponentially across industries such as automotive, healthcare, food & beverage, logistics, and manufacturing.

Key Growth Drivers:

Rising Demand for Automation in Material Handling: The need for high-efficiency warehouse operations with minimal human intervention is driving AGV deployment.

E-Commerce Boom: The rapid growth of e-commerce platforms has heightened the demand for smart warehouses, which rely heavily on AGVs for order picking, sorting, and transport.

Labor Shortages & Safety Requirements: AGVs offer a cost-effective, safe, and scalable alternative to manual labor in hazardous or labor-intensive environments.

Integration with IoT and AI: Real-time tracking, dynamic routing, and data analytics capabilities have made AGVs more intelligent and adaptable in modern logistics ecosystems.

Opportunities:

Adoption in Healthcare and Pharmaceuticals: Hospitals are increasingly deploying AGVs for safe and sterile delivery of medication and supplies.

Growth in Emerging Economies: Manufacturing expansions in Asia-Pacific and Latin America offer vast potential for AGV integration.

Flexible and Customizable AGVs: Innovations in modular design, size customization, and payload adaptability are opening new use cases across industry verticals.

U.S. Market Trends & 2024 Investment Highlights

In 2024, the U.S. saw a significant uptick in AGV installations across fulfillment centers and smart factories. Retail giants like Walmart and Amazon expanded their automation capabilities with AGV fleets capable of autonomous pallet transport, bin picking, and high-density storage retrieval.

Additionally, automotive manufacturers like General Motors and Ford invested in collaborative AGVs (Co-AGVs) that work alongside humans on production lines, enhancing productivity and safety. Several tech startups also secured funding to develop AI-based navigation and vision systems tailored for smaller AGVs targeting SMEs.

Government initiatives supporting domestic manufacturing under the “Made in America” program further boosted AGV demand by incentivizing automation upgrades in traditional industries.

Market Segmentation – Largest Segments by Share

By Type:

Tow Vehicles dominate the AGV market due to their ability to pull multiple loads in assembly lines and warehouses.

Unit Load Carriers are also widely used in distribution centers and storage facilities for handling pallets and containers.

Forklift AGVs are gaining popularity as replacements for traditional manual forklifts in smart logistics.

By Navigation Technology:

Laser Guidance holds the largest share, offering high accuracy and flexibility in dynamic environments.

Vision Guidance is an emerging segment, especially for applications requiring advanced object detection and real-time decision-making.

Magnetic and Wired Guidance remain in use in structured facilities with fixed routes.

By Application:

Logistics & Warehousing accounts for the highest market share, particularly for order fulfillment, cross-docking, and goods movement.

Manufacturing is also a key segment, especially in automotive and electronics sectors that require consistent and efficient material flow.

Competitive Analysis – Top 5 Players and Strategic Developments

1. Daifuku Co., Ltd. (Japan):

One of the global leaders in intralogistics automation, Daifuku expanded its AGV product line in 2024 with high-speed vehicles designed for pharmaceutical and semiconductor clean rooms. The company also enhanced its WMS integration and cloud-based fleet monitoring capabilities.

2. KUKA AG (Germany):

KUKA continues to lead in modular AGV systems integrated with robotic arms. In 2024, the company launched its latest generation of AGVs with collaborative capabilities, machine learning for dynamic navigation, and smart obstacle avoidance.

3. JBT Corporation (USA):

JBT specializes in AGV solutions for food processing and airport logistics. Its 2024 innovations included temperature-controlled AGVs and systems designed for cold chain logistics, targeting high-growth segments like pharma and fresh food delivery.

4. Toyota Industries Corporation (Japan):

Toyota Material Handling, under Toyota Industries, ramped up production of lithium-ion battery-powered AGVs. Their focus on sustainability, fleet interoperability, and AGV-as-a-Service business models gave them a competitive edge in global markets.

5. Swisslog Holding AG (Switzerland):

A key player in e-commerce warehouse automation, Swisslog partnered with leading grocery and retail chains in 2024 to deploy automated picking AGVs integrated with AI-based inventory systems. The company’s robotics-as-a-service (RaaS) model continues to attract SME clients.

These companies are emphasizing innovation in smart navigation, energy efficiency, and integration with broader warehouse management ecosystems. Mergers, tech partnerships, and regional expansion strategies are central to their market leadership.

Regional Analysis – U.S., UK, Germany, France, Japan & China

United States:

The U.S. AGV market is booming due to a skilled labor shortage, rising wages, and surging e-commerce fulfillment needs. Government tax incentives for manufacturing automation and local production initiatives are further driving adoption.

United Kingdom:

UK warehouses are rapidly transitioning to automation post-Brexit, with AGVs playing a key role in enhancing supply chain resilience. Retail and cold storage sectors are primary adopters, driven by labor constraints and sustainability goals.

Germany:

Germany leads in smart factory innovation, and AGVs are a cornerstone of its Industry 4.0 blueprint. Home to global giants like KUKA and STILL, the country is investing heavily in flexible AGV platforms and edge computing integration.

France:

With government support for industrial automation and green energy transition, French manufacturing facilities are increasingly deploying AGVs. Sectors like aerospace and food & beverage are investing in intelligent and hygienic transport systems.

Japan:

Japan’s aging workforce and robotics leadership make it a mature AGV market. Advanced AGVs are being used in hospitals, airports, and dense urban logistics environments. Companies are pioneering ultra-compact and AI-driven navigation technologies.

China:

As the world’s largest manufacturing hub, China continues to dominate AGV deployment in electronics, automotive, and e-commerce sectors. Government-backed smart factory programs and rapid tech innovation are fueling explosive market growth.

Conclusion & Strategic Outlook

The AGV market is rapidly evolving from traditional factory-floor vehicles to intelligent, connected systems at the heart of smart supply chains. As industries seek efficiency, scalability, and real-time control, AGVs are becoming a strategic necessity rather than a luxury.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]