Europe Microtome Market to be Driven by increasing population in the Forecast Period of 2025-2032

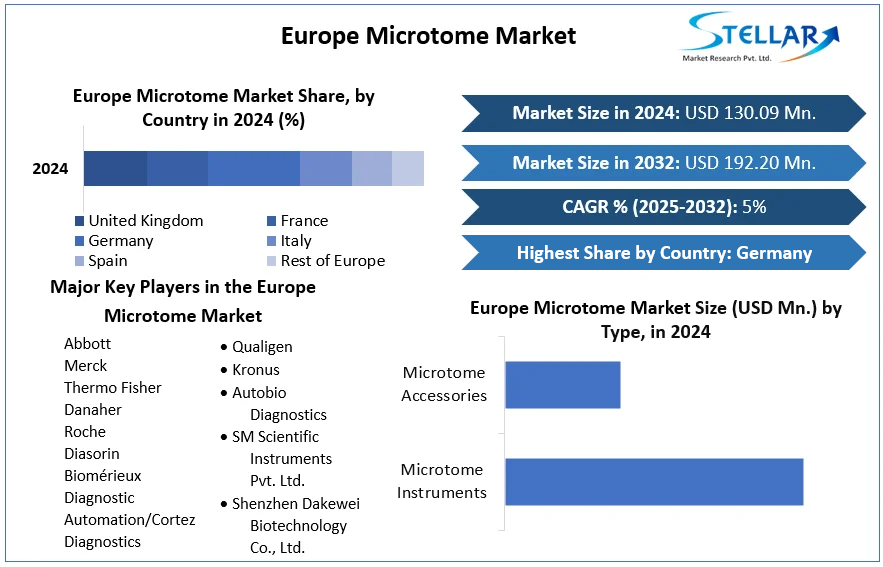

Europe Microtome Market is projected to grow from approximately USD 130.1 million in 2024 to about USD 192.2 million by 2032, representing a CAGR of around 5.0% over the period 2025–2032

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Europe-Microtome-Market/739

Market Estimation, Growth Drivers & Opportunities

Data from industry reports estimate the European microtome market at USD 130.1 million in 2024, growing to USD 192.2 million by 2032 at a 5% CAGR Other analyses suggest a slightly higher CAGR (e.g. 7.9%) and a projected value of USD 2,498 million by 2030 based on a 2023 base of USD 1,469.7 million—though differing segmentation makes direct comparison difficult.

Drivers of growth include:

Rising cancer incidence and diagnostic biopsy demand across Europe, fueling histopathology workflow—particularly in Germany and the UK

Increasing adoption of automated and semi‑automated microtomes in digital pathology labs to boost throughput and reduce technician strain

Digital pathology integration—scanning of sections and analytics pipelines—supporting investments in slide‑preparation instruments

Labor shortages and ergonomic concerns encourage the shift towards automation and smart microtomes providing predictive maintenance via IoT sensors

Opportunities exist in introducing AI‑enhanced microtomes, leveraging automation for high‑volume cancer screening labs, expanding into research-intensive applications (e.g. battery/semiconductor cross‑sectioning), and offering service‑based models to smaller clinics.

U.S. Market: (Omitted — Europe Focus)

This release focuses exclusively on the Europe market; U.S. trends are not included.

Market Segmentation: Largest Segment

Based on segmentation:

By Technology:

In Europe, fully automatic microtomes currently dominate due to demand for high throughput in clinical labs.

Semi-automatic microtomes are growing steadily as labs seek cost-effective automation

By Product Type:

Microtome instruments constitute the bulk of revenue, in particular rotary, cryostat, and vibrating microtomes.

Accessories segment is smaller but rising, especially consumables and blades

By End-User:

Hospitals and clinical laboratories are the dominant purchasers due to biopsy and diagnosis infrastructure requirements.

Research labs also use microtomes but represent a smaller share.

Competitive Analysis: Top 5 Companies in Europe

Key players operating across Europe include:

Leica Biosystems (Germany) – A long-standing leader in microtome and digital pathology equipment; now part of Danaher Corporation. Leica microtomes (e.g. RM series) are widely regarded for precision and durability .

Thermo Fisher Scientific / Sakura Finetek – Offers Thermo‑branded microtomes (formerly Microm/Epredia), widely used in Europe. Continues improving ergonomic design and expanding production capacity.

SLEE Medical (Germany) – Focuses on compact and specialized microtomes for clinical histology labs, serving European institutions.

Medite (Germany) – Supplies robust microtome models preferred in high-volume settings; strong presence in Germany and export to neighboring European countries

Diapath S.p.A (Italy) – Manufactures microtomes and blades, focused on consumable-driven differentiation and partnering with local European labs .

Other notable brands include Auxilab, BMS Microscopes, Orion Medic, Amos Scientific, and SM Scientific Instruments—many of which are targeting niche automation or regional customization.

Competitive strategies revolve around ergonomic improvements, AI analytics integration, dual sourcing of blade materials, and new finance-oriented service models with uptime guarantees .

Regional Analysis: Germany, UK, France, Italy, Spain

Germany: Largest national market in Europe, underpinned by a strong healthcare system, high cancer screening volumes, and institutional adoption of digital pathology. Germany continues to lead in product innovation and diagnostic instrumentation spend

United Kingdom: Growing share due to government-led cancer screening programs, NHS support for automated pathology equipment, and high demand for ergonomic and reliable instruments

France: Strong market driven by increasing pathology capacity in both public and private hospital systems. Rising per-capita healthcare spending sustains demand for microtomes and consumables

Italy & Spain: Moderate yet steady growth supported by expanding oncology diagnostics infrastructure and rising lab automation adoption. Shared trends include aging populations and increased disease burden

Other countries (Nordics, Benelux, Eastern Europe) contribute smaller revenue but show rising installation of automated pathology labs and imported instrument uptake.

Conclusion

The Europe Microtome Market is forecast to grow from USD 130.1 million in 2024 to approximately USD 192.2 million by 2032, at a 5% CAGR Market expansion is supported by rising biopsy volumes, automation trends, digital pathology integration, and demographic pressures across Europe.

Strategic opportunities include:

Scaling semi‑ and fully automatic microtomes to meet demand in high-throughput diagnostic labs.

Extending AI and IoT-enabled features for predictive maintenance, quality assurance, and remote diagnostics.

Expanding into non-biomedical sectors such as semiconductor cross sectioning, spatial-omics research, and lithium-ion battery fragment analysis

Emphasizing service-based models, leasing, and modular upgrades to reduce upfront cost barriers for mid-sized labs.

Addressing training shortages via ergonomic design and simplified automation for technician-limited settings.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Europe Microtome Market is projected to grow from approximately USD 130.1 million in 2024 to about USD 192.2 million by 2032, representing a CAGR of around 5.0% over the period 2025–2032

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Europe-Microtome-Market/739

Market Estimation, Growth Drivers & Opportunities

Data from industry reports estimate the European microtome market at USD 130.1 million in 2024, growing to USD 192.2 million by 2032 at a 5% CAGR Other analyses suggest a slightly higher CAGR (e.g. 7.9%) and a projected value of USD 2,498 million by 2030 based on a 2023 base of USD 1,469.7 million—though differing segmentation makes direct comparison difficult.

Drivers of growth include:

Rising cancer incidence and diagnostic biopsy demand across Europe, fueling histopathology workflow—particularly in Germany and the UK

Increasing adoption of automated and semi‑automated microtomes in digital pathology labs to boost throughput and reduce technician strain

Digital pathology integration—scanning of sections and analytics pipelines—supporting investments in slide‑preparation instruments

Labor shortages and ergonomic concerns encourage the shift towards automation and smart microtomes providing predictive maintenance via IoT sensors

Opportunities exist in introducing AI‑enhanced microtomes, leveraging automation for high‑volume cancer screening labs, expanding into research-intensive applications (e.g. battery/semiconductor cross‑sectioning), and offering service‑based models to smaller clinics.

U.S. Market: (Omitted — Europe Focus)

This release focuses exclusively on the Europe market; U.S. trends are not included.

Market Segmentation: Largest Segment

Based on segmentation:

By Technology:

In Europe, fully automatic microtomes currently dominate due to demand for high throughput in clinical labs.

Semi-automatic microtomes are growing steadily as labs seek cost-effective automation

By Product Type:

Microtome instruments constitute the bulk of revenue, in particular rotary, cryostat, and vibrating microtomes.

Accessories segment is smaller but rising, especially consumables and blades

By End-User:

Hospitals and clinical laboratories are the dominant purchasers due to biopsy and diagnosis infrastructure requirements.

Research labs also use microtomes but represent a smaller share.

Competitive Analysis: Top 5 Companies in Europe

Key players operating across Europe include:

Leica Biosystems (Germany) – A long-standing leader in microtome and digital pathology equipment; now part of Danaher Corporation. Leica microtomes (e.g. RM series) are widely regarded for precision and durability .

Thermo Fisher Scientific / Sakura Finetek – Offers Thermo‑branded microtomes (formerly Microm/Epredia), widely used in Europe. Continues improving ergonomic design and expanding production capacity.

SLEE Medical (Germany) – Focuses on compact and specialized microtomes for clinical histology labs, serving European institutions.

Medite (Germany) – Supplies robust microtome models preferred in high-volume settings; strong presence in Germany and export to neighboring European countries

Diapath S.p.A (Italy) – Manufactures microtomes and blades, focused on consumable-driven differentiation and partnering with local European labs .

Other notable brands include Auxilab, BMS Microscopes, Orion Medic, Amos Scientific, and SM Scientific Instruments—many of which are targeting niche automation or regional customization.

Competitive strategies revolve around ergonomic improvements, AI analytics integration, dual sourcing of blade materials, and new finance-oriented service models with uptime guarantees .

Regional Analysis: Germany, UK, France, Italy, Spain

Germany: Largest national market in Europe, underpinned by a strong healthcare system, high cancer screening volumes, and institutional adoption of digital pathology. Germany continues to lead in product innovation and diagnostic instrumentation spend

United Kingdom: Growing share due to government-led cancer screening programs, NHS support for automated pathology equipment, and high demand for ergonomic and reliable instruments

France: Strong market driven by increasing pathology capacity in both public and private hospital systems. Rising per-capita healthcare spending sustains demand for microtomes and consumables

Italy & Spain: Moderate yet steady growth supported by expanding oncology diagnostics infrastructure and rising lab automation adoption. Shared trends include aging populations and increased disease burden

Other countries (Nordics, Benelux, Eastern Europe) contribute smaller revenue but show rising installation of automated pathology labs and imported instrument uptake.

Conclusion

The Europe Microtome Market is forecast to grow from USD 130.1 million in 2024 to approximately USD 192.2 million by 2032, at a 5% CAGR Market expansion is supported by rising biopsy volumes, automation trends, digital pathology integration, and demographic pressures across Europe.

Strategic opportunities include:

Scaling semi‑ and fully automatic microtomes to meet demand in high-throughput diagnostic labs.

Extending AI and IoT-enabled features for predictive maintenance, quality assurance, and remote diagnostics.

Expanding into non-biomedical sectors such as semiconductor cross sectioning, spatial-omics research, and lithium-ion battery fragment analysis

Emphasizing service-based models, leasing, and modular upgrades to reduce upfront cost barriers for mid-sized labs.

Addressing training shortages via ergonomic design and simplified automation for technician-limited settings.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Europe Microtome Market to be Driven by increasing population in the Forecast Period of 2025-2032

Europe Microtome Market is projected to grow from approximately USD 130.1 million in 2024 to about USD 192.2 million by 2032, representing a CAGR of around 5.0% over the period 2025–2032

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Europe-Microtome-Market/739

Market Estimation, Growth Drivers & Opportunities

Data from industry reports estimate the European microtome market at USD 130.1 million in 2024, growing to USD 192.2 million by 2032 at a 5% CAGR Other analyses suggest a slightly higher CAGR (e.g. 7.9%) and a projected value of USD 2,498 million by 2030 based on a 2023 base of USD 1,469.7 million—though differing segmentation makes direct comparison difficult.

Drivers of growth include:

Rising cancer incidence and diagnostic biopsy demand across Europe, fueling histopathology workflow—particularly in Germany and the UK

Increasing adoption of automated and semi‑automated microtomes in digital pathology labs to boost throughput and reduce technician strain

Digital pathology integration—scanning of sections and analytics pipelines—supporting investments in slide‑preparation instruments

Labor shortages and ergonomic concerns encourage the shift towards automation and smart microtomes providing predictive maintenance via IoT sensors

Opportunities exist in introducing AI‑enhanced microtomes, leveraging automation for high‑volume cancer screening labs, expanding into research-intensive applications (e.g. battery/semiconductor cross‑sectioning), and offering service‑based models to smaller clinics.

U.S. Market: (Omitted — Europe Focus)

This release focuses exclusively on the Europe market; U.S. trends are not included.

Market Segmentation: Largest Segment

Based on segmentation:

By Technology:

In Europe, fully automatic microtomes currently dominate due to demand for high throughput in clinical labs.

Semi-automatic microtomes are growing steadily as labs seek cost-effective automation

By Product Type:

Microtome instruments constitute the bulk of revenue, in particular rotary, cryostat, and vibrating microtomes.

Accessories segment is smaller but rising, especially consumables and blades

By End-User:

Hospitals and clinical laboratories are the dominant purchasers due to biopsy and diagnosis infrastructure requirements.

Research labs also use microtomes but represent a smaller share.

Competitive Analysis: Top 5 Companies in Europe

Key players operating across Europe include:

Leica Biosystems (Germany) – A long-standing leader in microtome and digital pathology equipment; now part of Danaher Corporation. Leica microtomes (e.g. RM series) are widely regarded for precision and durability .

Thermo Fisher Scientific / Sakura Finetek – Offers Thermo‑branded microtomes (formerly Microm/Epredia), widely used in Europe. Continues improving ergonomic design and expanding production capacity.

SLEE Medical (Germany) – Focuses on compact and specialized microtomes for clinical histology labs, serving European institutions.

Medite (Germany) – Supplies robust microtome models preferred in high-volume settings; strong presence in Germany and export to neighboring European countries

Diapath S.p.A (Italy) – Manufactures microtomes and blades, focused on consumable-driven differentiation and partnering with local European labs .

Other notable brands include Auxilab, BMS Microscopes, Orion Medic, Amos Scientific, and SM Scientific Instruments—many of which are targeting niche automation or regional customization.

Competitive strategies revolve around ergonomic improvements, AI analytics integration, dual sourcing of blade materials, and new finance-oriented service models with uptime guarantees .

Regional Analysis: Germany, UK, France, Italy, Spain

Germany: Largest national market in Europe, underpinned by a strong healthcare system, high cancer screening volumes, and institutional adoption of digital pathology. Germany continues to lead in product innovation and diagnostic instrumentation spend

United Kingdom: Growing share due to government-led cancer screening programs, NHS support for automated pathology equipment, and high demand for ergonomic and reliable instruments

France: Strong market driven by increasing pathology capacity in both public and private hospital systems. Rising per-capita healthcare spending sustains demand for microtomes and consumables

Italy & Spain: Moderate yet steady growth supported by expanding oncology diagnostics infrastructure and rising lab automation adoption. Shared trends include aging populations and increased disease burden

Other countries (Nordics, Benelux, Eastern Europe) contribute smaller revenue but show rising installation of automated pathology labs and imported instrument uptake.

Conclusion

The Europe Microtome Market is forecast to grow from USD 130.1 million in 2024 to approximately USD 192.2 million by 2032, at a 5% CAGR Market expansion is supported by rising biopsy volumes, automation trends, digital pathology integration, and demographic pressures across Europe.

Strategic opportunities include:

Scaling semi‑ and fully automatic microtomes to meet demand in high-throughput diagnostic labs.

Extending AI and IoT-enabled features for predictive maintenance, quality assurance, and remote diagnostics.

Expanding into non-biomedical sectors such as semiconductor cross sectioning, spatial-omics research, and lithium-ion battery fragment analysis

Emphasizing service-based models, leasing, and modular upgrades to reduce upfront cost barriers for mid-sized labs.

Addressing training shortages via ergonomic design and simplified automation for technician-limited settings.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

0 Σχόλια

0 Μοιράστηκε

1253 Views