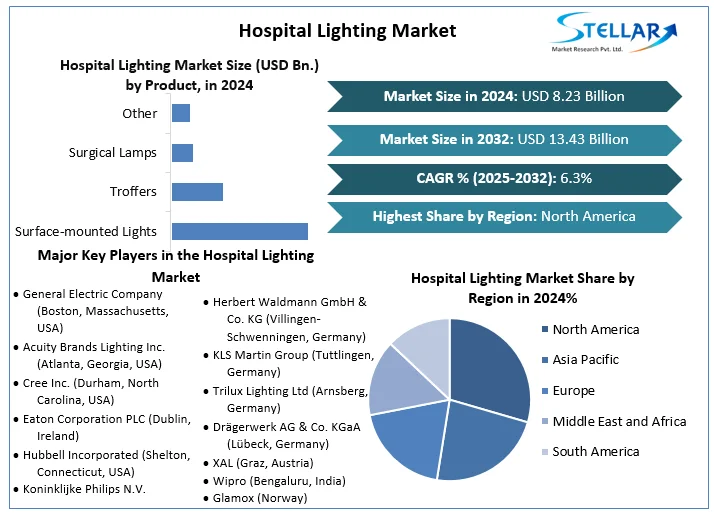

Hospital Lighting Market Size to Grow at a CAGR of 6.3% in the Forecast Period of 2025-2032

Hospital Lighting Market Set to Reach USD 12.45 Billion by 2030, Driven by Energy-Efficient Solutions and Smart Healthcare Infrastructure

Market Estimation, Growth Drivers & Opportunities

According to Stellar Market Research, the Hospital Lighting Market was valued at USD 7.9 billion in 2023 and is projected to reach USD 12.45 billion by 2030, growing at a CAGR of 6.7% during the forecast period. This growth is primarily fueled by the modernization of healthcare facilities, growing awareness of patient-centric environments, and the widespread adoption of LED and smart lighting systems in hospitals.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/hospital-lighting-market/2294

Key growth drivers include:

Rising healthcare infrastructure investment, particularly in developing economies.

Increasing focus on energy efficiency, encouraging the replacement of outdated fluorescent systems with sustainable LED solutions.

Enhanced regulatory standards and certifications mandating improved hospital lighting designs for safety and comfort.

Adoption of IoT-integrated and human-centric lighting, which supports circadian rhythms and enhances patient recovery rates and staff productivity.

Opportunities:

Integration of smart lighting systems with hospital management platforms for energy savings and automation.

Development of customized lighting solutions for patient wards, surgical suites, and ICUs.

Innovations in UV-based disinfection lighting systems for infection control.

U.S. Market Trends and Investment in 2024

In 2024, the U.S. hospital lighting segment witnessed significant traction due to the Biden administration’s ongoing investments in healthcare modernization and green infrastructure. Leading hospitals across states like California, New York, and Texas adopted energy-efficient LED retrofitting under the federal Energy Star and Infrastructure Investment and Jobs Act programs.

Healthcare groups like Kaiser Permanente and Mayo Clinic announced new investments in smart, adaptive lighting systems that are integrated with occupancy sensors and patient monitoring platforms. The trend of biologically tuned lighting has also grown in the U.S., enhancing circadian alignment and contributing to faster patient recovery and reduced staff fatigue.

Market Segmentation: Leading Segment by Market Share

Based on application, the Surgical Suite Lighting segment holds the largest market share. Surgical lighting is critical for visibility, precision, and infection control in operating rooms. Hospitals prioritize high-lumen, shadow-reducing, adjustable lighting systems with minimal heat emission and maximum color accuracy. The high demand for technologically advanced solutions like LED surgical lights with camera integration and sterile handle controls is driving this segment’s dominance.

Competitive Analysis: Top 5 Companies in Global Market

Acuity Brands, Inc.

Acuity continues to lead with its comprehensive portfolio of healthcare lighting systems. In 2024, it launched a new series of tunable white LED luminaires designed for behavioral health and recovery environments. The company also expanded its Distech Controls line, enabling seamless building automation and lighting integration.

Signify N.V. (Philips Lighting)

Signify remains a global innovator with its HealWell lighting system that supports patient sleep cycles. In 2024, the company introduced UV-C disinfection luminaires for hospital corridors and patient rooms. It also enhanced connectivity options in its Interact Pro platform to support energy monitoring and predictive maintenance.

GE Current, a Daintree Company

GE Current is focusing on IoT-driven lighting solutions tailored to hospital environments. In 2024, it expanded its Daintree Networked wireless controls for seamless integration with hospital IT infrastructure. Its UV-C LED products also gained traction as infection control remains a top priority.

Zumtobel Group AG

The Austrian lighting manufacturer continues to expand its presence in Europe and Asia. In 2024, Zumtobel launched a smart operating room lighting system equipped with CRI-enhancing LEDs, intuitive controls, and antimicrobial coatings. The company is also working on digital twin-based lighting layouts for new hospitals.

Cree Lighting (IDEAL Industries, Inc.)

Cree has been advancing human-centric lighting solutions tailored for patient recovery and clinical efficiency. In 2024, it introduced SmartCast Intelligence Platform updates to integrate adaptive lighting schedules based on hospital shift patterns and natural daylight cycles.

Regional Analysis

USA: The U.S. dominates the global market due to its well-established healthcare sector and supportive government policies for green buildings. The Department of Energy’s LED Lighting Facts Program continues to incentivize energy-efficient lighting in hospitals. The widespread adoption of smart and adaptive lighting systems is bolstered by leading healthcare chains prioritizing patient wellness.

UK: The UK is witnessing a push towards Net-Zero NHS Hospitals, with sustainability guidelines promoting the use of low-energy lighting. National Health Service Trusts are investing in LED retrofits and daylight-integrated systems, supporting market growth.

Germany: Germany’s commitment to digital hospitals through the Hospital Future Act (Krankenhauszukunftsgesetz) has catalyzed the adoption of smart lighting in new healthcare infrastructure. Focus is placed on energy-efficient and cyber-secure systems.

France: France’s Ministry of Health has set benchmarks for hospital sustainability under its Plan Hôpital Numérique, leading to large-scale deployment of eco-friendly lighting solutions. Recent hospital refurbishments prioritize tunable and modular lighting fixtures.

Japan: Japan, with its aging population, is heavily investing in elderly care hospitals with customized lighting solutions to prevent falls and promote healing. Government funding and innovations in hospital automation support market growth.

China: China is undergoing a boom in hospital construction as part of its national healthcare reform plan. The integration of LED lighting with smart hospital systems is promoted through local subsidies and eco-construction incentives.

Conclusion

The Hospital Lighting Market is evolving from traditional utility systems to integrated, smart, and patient-centric environments. As healthcare facilities prioritize operational efficiency, energy savings, and patient satisfaction, lighting plays a critical role in both infrastructure and care outcomes.

Looking forward, the major growth opportunities lie in:

Human-centric lighting designed to improve patient wellness and staff performance.

IoT-integrated lighting systems that offer data insights and reduce energy consumption.

Surgical lighting innovations that incorporate advanced visualization technologies.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Hospital Lighting Market Set to Reach USD 12.45 Billion by 2030, Driven by Energy-Efficient Solutions and Smart Healthcare Infrastructure

Market Estimation, Growth Drivers & Opportunities

According to Stellar Market Research, the Hospital Lighting Market was valued at USD 7.9 billion in 2023 and is projected to reach USD 12.45 billion by 2030, growing at a CAGR of 6.7% during the forecast period. This growth is primarily fueled by the modernization of healthcare facilities, growing awareness of patient-centric environments, and the widespread adoption of LED and smart lighting systems in hospitals.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/hospital-lighting-market/2294

Key growth drivers include:

Rising healthcare infrastructure investment, particularly in developing economies.

Increasing focus on energy efficiency, encouraging the replacement of outdated fluorescent systems with sustainable LED solutions.

Enhanced regulatory standards and certifications mandating improved hospital lighting designs for safety and comfort.

Adoption of IoT-integrated and human-centric lighting, which supports circadian rhythms and enhances patient recovery rates and staff productivity.

Opportunities:

Integration of smart lighting systems with hospital management platforms for energy savings and automation.

Development of customized lighting solutions for patient wards, surgical suites, and ICUs.

Innovations in UV-based disinfection lighting systems for infection control.

U.S. Market Trends and Investment in 2024

In 2024, the U.S. hospital lighting segment witnessed significant traction due to the Biden administration’s ongoing investments in healthcare modernization and green infrastructure. Leading hospitals across states like California, New York, and Texas adopted energy-efficient LED retrofitting under the federal Energy Star and Infrastructure Investment and Jobs Act programs.

Healthcare groups like Kaiser Permanente and Mayo Clinic announced new investments in smart, adaptive lighting systems that are integrated with occupancy sensors and patient monitoring platforms. The trend of biologically tuned lighting has also grown in the U.S., enhancing circadian alignment and contributing to faster patient recovery and reduced staff fatigue.

Market Segmentation: Leading Segment by Market Share

Based on application, the Surgical Suite Lighting segment holds the largest market share. Surgical lighting is critical for visibility, precision, and infection control in operating rooms. Hospitals prioritize high-lumen, shadow-reducing, adjustable lighting systems with minimal heat emission and maximum color accuracy. The high demand for technologically advanced solutions like LED surgical lights with camera integration and sterile handle controls is driving this segment’s dominance.

Competitive Analysis: Top 5 Companies in Global Market

Acuity Brands, Inc.

Acuity continues to lead with its comprehensive portfolio of healthcare lighting systems. In 2024, it launched a new series of tunable white LED luminaires designed for behavioral health and recovery environments. The company also expanded its Distech Controls line, enabling seamless building automation and lighting integration.

Signify N.V. (Philips Lighting)

Signify remains a global innovator with its HealWell lighting system that supports patient sleep cycles. In 2024, the company introduced UV-C disinfection luminaires for hospital corridors and patient rooms. It also enhanced connectivity options in its Interact Pro platform to support energy monitoring and predictive maintenance.

GE Current, a Daintree Company

GE Current is focusing on IoT-driven lighting solutions tailored to hospital environments. In 2024, it expanded its Daintree Networked wireless controls for seamless integration with hospital IT infrastructure. Its UV-C LED products also gained traction as infection control remains a top priority.

Zumtobel Group AG

The Austrian lighting manufacturer continues to expand its presence in Europe and Asia. In 2024, Zumtobel launched a smart operating room lighting system equipped with CRI-enhancing LEDs, intuitive controls, and antimicrobial coatings. The company is also working on digital twin-based lighting layouts for new hospitals.

Cree Lighting (IDEAL Industries, Inc.)

Cree has been advancing human-centric lighting solutions tailored for patient recovery and clinical efficiency. In 2024, it introduced SmartCast Intelligence Platform updates to integrate adaptive lighting schedules based on hospital shift patterns and natural daylight cycles.

Regional Analysis

USA: The U.S. dominates the global market due to its well-established healthcare sector and supportive government policies for green buildings. The Department of Energy’s LED Lighting Facts Program continues to incentivize energy-efficient lighting in hospitals. The widespread adoption of smart and adaptive lighting systems is bolstered by leading healthcare chains prioritizing patient wellness.

UK: The UK is witnessing a push towards Net-Zero NHS Hospitals, with sustainability guidelines promoting the use of low-energy lighting. National Health Service Trusts are investing in LED retrofits and daylight-integrated systems, supporting market growth.

Germany: Germany’s commitment to digital hospitals through the Hospital Future Act (Krankenhauszukunftsgesetz) has catalyzed the adoption of smart lighting in new healthcare infrastructure. Focus is placed on energy-efficient and cyber-secure systems.

France: France’s Ministry of Health has set benchmarks for hospital sustainability under its Plan Hôpital Numérique, leading to large-scale deployment of eco-friendly lighting solutions. Recent hospital refurbishments prioritize tunable and modular lighting fixtures.

Japan: Japan, with its aging population, is heavily investing in elderly care hospitals with customized lighting solutions to prevent falls and promote healing. Government funding and innovations in hospital automation support market growth.

China: China is undergoing a boom in hospital construction as part of its national healthcare reform plan. The integration of LED lighting with smart hospital systems is promoted through local subsidies and eco-construction incentives.

Conclusion

The Hospital Lighting Market is evolving from traditional utility systems to integrated, smart, and patient-centric environments. As healthcare facilities prioritize operational efficiency, energy savings, and patient satisfaction, lighting plays a critical role in both infrastructure and care outcomes.

Looking forward, the major growth opportunities lie in:

Human-centric lighting designed to improve patient wellness and staff performance.

IoT-integrated lighting systems that offer data insights and reduce energy consumption.

Surgical lighting innovations that incorporate advanced visualization technologies.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Hospital Lighting Market Size to Grow at a CAGR of 6.3% in the Forecast Period of 2025-2032

Hospital Lighting Market Set to Reach USD 12.45 Billion by 2030, Driven by Energy-Efficient Solutions and Smart Healthcare Infrastructure

Market Estimation, Growth Drivers & Opportunities

According to Stellar Market Research, the Hospital Lighting Market was valued at USD 7.9 billion in 2023 and is projected to reach USD 12.45 billion by 2030, growing at a CAGR of 6.7% during the forecast period. This growth is primarily fueled by the modernization of healthcare facilities, growing awareness of patient-centric environments, and the widespread adoption of LED and smart lighting systems in hospitals.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/hospital-lighting-market/2294

Key growth drivers include:

Rising healthcare infrastructure investment, particularly in developing economies.

Increasing focus on energy efficiency, encouraging the replacement of outdated fluorescent systems with sustainable LED solutions.

Enhanced regulatory standards and certifications mandating improved hospital lighting designs for safety and comfort.

Adoption of IoT-integrated and human-centric lighting, which supports circadian rhythms and enhances patient recovery rates and staff productivity.

Opportunities:

Integration of smart lighting systems with hospital management platforms for energy savings and automation.

Development of customized lighting solutions for patient wards, surgical suites, and ICUs.

Innovations in UV-based disinfection lighting systems for infection control.

U.S. Market Trends and Investment in 2024

In 2024, the U.S. hospital lighting segment witnessed significant traction due to the Biden administration’s ongoing investments in healthcare modernization and green infrastructure. Leading hospitals across states like California, New York, and Texas adopted energy-efficient LED retrofitting under the federal Energy Star and Infrastructure Investment and Jobs Act programs.

Healthcare groups like Kaiser Permanente and Mayo Clinic announced new investments in smart, adaptive lighting systems that are integrated with occupancy sensors and patient monitoring platforms. The trend of biologically tuned lighting has also grown in the U.S., enhancing circadian alignment and contributing to faster patient recovery and reduced staff fatigue.

Market Segmentation: Leading Segment by Market Share

Based on application, the Surgical Suite Lighting segment holds the largest market share. Surgical lighting is critical for visibility, precision, and infection control in operating rooms. Hospitals prioritize high-lumen, shadow-reducing, adjustable lighting systems with minimal heat emission and maximum color accuracy. The high demand for technologically advanced solutions like LED surgical lights with camera integration and sterile handle controls is driving this segment’s dominance.

Competitive Analysis: Top 5 Companies in Global Market

Acuity Brands, Inc.

Acuity continues to lead with its comprehensive portfolio of healthcare lighting systems. In 2024, it launched a new series of tunable white LED luminaires designed for behavioral health and recovery environments. The company also expanded its Distech Controls line, enabling seamless building automation and lighting integration.

Signify N.V. (Philips Lighting)

Signify remains a global innovator with its HealWell lighting system that supports patient sleep cycles. In 2024, the company introduced UV-C disinfection luminaires for hospital corridors and patient rooms. It also enhanced connectivity options in its Interact Pro platform to support energy monitoring and predictive maintenance.

GE Current, a Daintree Company

GE Current is focusing on IoT-driven lighting solutions tailored to hospital environments. In 2024, it expanded its Daintree Networked wireless controls for seamless integration with hospital IT infrastructure. Its UV-C LED products also gained traction as infection control remains a top priority.

Zumtobel Group AG

The Austrian lighting manufacturer continues to expand its presence in Europe and Asia. In 2024, Zumtobel launched a smart operating room lighting system equipped with CRI-enhancing LEDs, intuitive controls, and antimicrobial coatings. The company is also working on digital twin-based lighting layouts for new hospitals.

Cree Lighting (IDEAL Industries, Inc.)

Cree has been advancing human-centric lighting solutions tailored for patient recovery and clinical efficiency. In 2024, it introduced SmartCast Intelligence Platform updates to integrate adaptive lighting schedules based on hospital shift patterns and natural daylight cycles.

Regional Analysis

USA: The U.S. dominates the global market due to its well-established healthcare sector and supportive government policies for green buildings. The Department of Energy’s LED Lighting Facts Program continues to incentivize energy-efficient lighting in hospitals. The widespread adoption of smart and adaptive lighting systems is bolstered by leading healthcare chains prioritizing patient wellness.

UK: The UK is witnessing a push towards Net-Zero NHS Hospitals, with sustainability guidelines promoting the use of low-energy lighting. National Health Service Trusts are investing in LED retrofits and daylight-integrated systems, supporting market growth.

Germany: Germany’s commitment to digital hospitals through the Hospital Future Act (Krankenhauszukunftsgesetz) has catalyzed the adoption of smart lighting in new healthcare infrastructure. Focus is placed on energy-efficient and cyber-secure systems.

France: France’s Ministry of Health has set benchmarks for hospital sustainability under its Plan Hôpital Numérique, leading to large-scale deployment of eco-friendly lighting solutions. Recent hospital refurbishments prioritize tunable and modular lighting fixtures.

Japan: Japan, with its aging population, is heavily investing in elderly care hospitals with customized lighting solutions to prevent falls and promote healing. Government funding and innovations in hospital automation support market growth.

China: China is undergoing a boom in hospital construction as part of its national healthcare reform plan. The integration of LED lighting with smart hospital systems is promoted through local subsidies and eco-construction incentives.

Conclusion

The Hospital Lighting Market is evolving from traditional utility systems to integrated, smart, and patient-centric environments. As healthcare facilities prioritize operational efficiency, energy savings, and patient satisfaction, lighting plays a critical role in both infrastructure and care outcomes.

Looking forward, the major growth opportunities lie in:

Human-centric lighting designed to improve patient wellness and staff performance.

IoT-integrated lighting systems that offer data insights and reduce energy consumption.

Surgical lighting innovations that incorporate advanced visualization technologies.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

0 Yorumlar

0 hisse senetleri

2406 Views