FEP-Coated Polyimide Film Market — Resilient, High-Performance Films Powering Innovation

1. Market Estimation & Definition

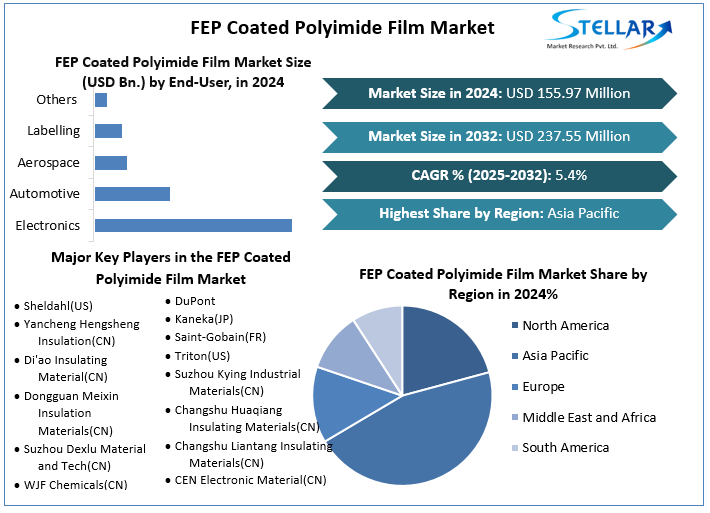

FEP-coated polyimide films—polyimide substrates enhanced by fluorinated ethylene propylene coatings—offer exceptional thermal stability, chemical resistance, and electrical insulation, making them indispensable in electronics, aerospace, automotive, and energy applications.

Estimated at USD 155.97 million in 2024, projected to reach USD 237.55 million by 2032, with a CAGR of 5.4%.

Alternate forecasts suggest a 2024 valuation of USD 250 million, growing to USD 500 million by 2033 at a stronger CAGR of 8.5%.

Another projection places the market at USD 450 million in 2024, anticipated to expand to USD 750 million by 2033, with a 7.3% CAGR.

Though estimates vary, they consistently point to a multi-hundred-million-dollar market with growth rates ranging from mid-single digits to nearly 9%.

Requset Free Sample Report:https://www.stellarmr.com/report/req_sample/FEP-Coated-Polyimide-Film-Market/1535

2. Market Growth Drivers & Opportunity

Technological Demand: The rise of miniaturized electronics, flexible circuits, and electric vehicles is driving use of thin, robust, and thermally stable films.

Aerospace & Energy Expansion: These films are vital in space-grade insulation (e.g., multi-layer blankets), solar PV modules, and high-reliability components in aircraft and satellites. Asia-Pacific Momentum: APAC leads in market share (over 40%), bolstered by China’s booming automotive, electronics, and manufacturing sectors.

3. What Lies Ahead: Emerging Trends

Ultra-Thin & Flexible Films: Industry trends favor thinner, more flexible substrates to support compact device designs, including emerging 3D-printing applications and advanced release surfaces.

Diverse Applications on the Rise: Beyond electronics and aerospace, demand from renewable energy, medical devices, and labeling sectors is accelerating.

4. Segmentation Overview

By Application:

Pressure-Sensitive Tapes hold the largest 2024 share, prized for adhesion and high-performance needs (e.g., in spacecraft).

Other formats include flexible printed circuits, wire & cable, specialty fabrications, and motor/generator components.

By End-User Industry:

Aerospace leads, especially for thermal insulation and optical reflectors.

Additional key sectors: electronics, automotive, labeling, medical, and drilling.

By Region:

Asia-Pacific dominates (~41%), followed by Europe and North America. China is the regional powerhouse.

5. Country-Level Insight — United States

While precise U.S. figures are not separately detailed, North America remains a key market alongside Europe and Asia—a reflection of strong aerospace investment and advanced electronics manufacturing.

7. Press-Release Conclusion

The FEP-Coated Polyimide Film Market is on track to grow significantly—from roughly USD 156–250 million in 2024 to between USD 500–750 million by 2032–2033, yielding CAGRs between 5.4% and 8.5%.

Fueled by demand in advanced electronics, aerospace, and energy sectors—particularly in APAC—this market is entering a dynamic growth phase. Companies leading the next wave will offer thinner, tailored films optimized for specific performance needs, while navigating raw material and regulatory pressures.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

1. Market Estimation & Definition

FEP-coated polyimide films—polyimide substrates enhanced by fluorinated ethylene propylene coatings—offer exceptional thermal stability, chemical resistance, and electrical insulation, making them indispensable in electronics, aerospace, automotive, and energy applications.

Estimated at USD 155.97 million in 2024, projected to reach USD 237.55 million by 2032, with a CAGR of 5.4%.

Alternate forecasts suggest a 2024 valuation of USD 250 million, growing to USD 500 million by 2033 at a stronger CAGR of 8.5%.

Another projection places the market at USD 450 million in 2024, anticipated to expand to USD 750 million by 2033, with a 7.3% CAGR.

Though estimates vary, they consistently point to a multi-hundred-million-dollar market with growth rates ranging from mid-single digits to nearly 9%.

Requset Free Sample Report:https://www.stellarmr.com/report/req_sample/FEP-Coated-Polyimide-Film-Market/1535

2. Market Growth Drivers & Opportunity

Technological Demand: The rise of miniaturized electronics, flexible circuits, and electric vehicles is driving use of thin, robust, and thermally stable films.

Aerospace & Energy Expansion: These films are vital in space-grade insulation (e.g., multi-layer blankets), solar PV modules, and high-reliability components in aircraft and satellites. Asia-Pacific Momentum: APAC leads in market share (over 40%), bolstered by China’s booming automotive, electronics, and manufacturing sectors.

3. What Lies Ahead: Emerging Trends

Ultra-Thin & Flexible Films: Industry trends favor thinner, more flexible substrates to support compact device designs, including emerging 3D-printing applications and advanced release surfaces.

Diverse Applications on the Rise: Beyond electronics and aerospace, demand from renewable energy, medical devices, and labeling sectors is accelerating.

4. Segmentation Overview

By Application:

Pressure-Sensitive Tapes hold the largest 2024 share, prized for adhesion and high-performance needs (e.g., in spacecraft).

Other formats include flexible printed circuits, wire & cable, specialty fabrications, and motor/generator components.

By End-User Industry:

Aerospace leads, especially for thermal insulation and optical reflectors.

Additional key sectors: electronics, automotive, labeling, medical, and drilling.

By Region:

Asia-Pacific dominates (~41%), followed by Europe and North America. China is the regional powerhouse.

5. Country-Level Insight — United States

While precise U.S. figures are not separately detailed, North America remains a key market alongside Europe and Asia—a reflection of strong aerospace investment and advanced electronics manufacturing.

7. Press-Release Conclusion

The FEP-Coated Polyimide Film Market is on track to grow significantly—from roughly USD 156–250 million in 2024 to between USD 500–750 million by 2032–2033, yielding CAGRs between 5.4% and 8.5%.

Fueled by demand in advanced electronics, aerospace, and energy sectors—particularly in APAC—this market is entering a dynamic growth phase. Companies leading the next wave will offer thinner, tailored films optimized for specific performance needs, while navigating raw material and regulatory pressures.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

FEP-Coated Polyimide Film Market — Resilient, High-Performance Films Powering Innovation

1. Market Estimation & Definition

FEP-coated polyimide films—polyimide substrates enhanced by fluorinated ethylene propylene coatings—offer exceptional thermal stability, chemical resistance, and electrical insulation, making them indispensable in electronics, aerospace, automotive, and energy applications.

Estimated at USD 155.97 million in 2024, projected to reach USD 237.55 million by 2032, with a CAGR of 5.4%.

Alternate forecasts suggest a 2024 valuation of USD 250 million, growing to USD 500 million by 2033 at a stronger CAGR of 8.5%.

Another projection places the market at USD 450 million in 2024, anticipated to expand to USD 750 million by 2033, with a 7.3% CAGR.

Though estimates vary, they consistently point to a multi-hundred-million-dollar market with growth rates ranging from mid-single digits to nearly 9%.

Requset Free Sample Report:https://www.stellarmr.com/report/req_sample/FEP-Coated-Polyimide-Film-Market/1535

2. Market Growth Drivers & Opportunity

Technological Demand: The rise of miniaturized electronics, flexible circuits, and electric vehicles is driving use of thin, robust, and thermally stable films.

Aerospace & Energy Expansion: These films are vital in space-grade insulation (e.g., multi-layer blankets), solar PV modules, and high-reliability components in aircraft and satellites. Asia-Pacific Momentum: APAC leads in market share (over 40%), bolstered by China’s booming automotive, electronics, and manufacturing sectors.

3. What Lies Ahead: Emerging Trends

Ultra-Thin & Flexible Films: Industry trends favor thinner, more flexible substrates to support compact device designs, including emerging 3D-printing applications and advanced release surfaces.

Diverse Applications on the Rise: Beyond electronics and aerospace, demand from renewable energy, medical devices, and labeling sectors is accelerating.

4. Segmentation Overview

By Application:

Pressure-Sensitive Tapes hold the largest 2024 share, prized for adhesion and high-performance needs (e.g., in spacecraft).

Other formats include flexible printed circuits, wire & cable, specialty fabrications, and motor/generator components.

By End-User Industry:

Aerospace leads, especially for thermal insulation and optical reflectors.

Additional key sectors: electronics, automotive, labeling, medical, and drilling.

By Region:

Asia-Pacific dominates (~41%), followed by Europe and North America. China is the regional powerhouse.

5. Country-Level Insight — United States

While precise U.S. figures are not separately detailed, North America remains a key market alongside Europe and Asia—a reflection of strong aerospace investment and advanced electronics manufacturing.

7. Press-Release Conclusion

The FEP-Coated Polyimide Film Market is on track to grow significantly—from roughly USD 156–250 million in 2024 to between USD 500–750 million by 2032–2033, yielding CAGRs between 5.4% and 8.5%.

Fueled by demand in advanced electronics, aerospace, and energy sectors—particularly in APAC—this market is entering a dynamic growth phase. Companies leading the next wave will offer thinner, tailored films optimized for specific performance needs, while navigating raw material and regulatory pressures.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

0 Bình luận

0 Chia sẻ

2953 Lượt xem