Ethiopia Spices Market to be Driven by increasing population in the Forecast Period of 2024-2030

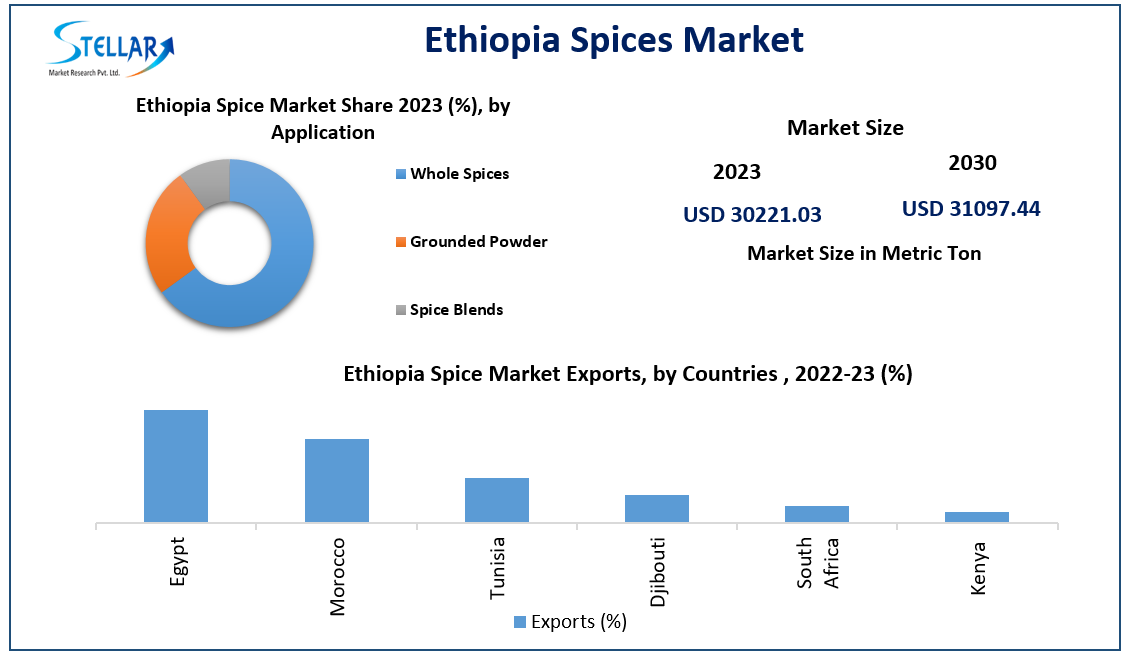

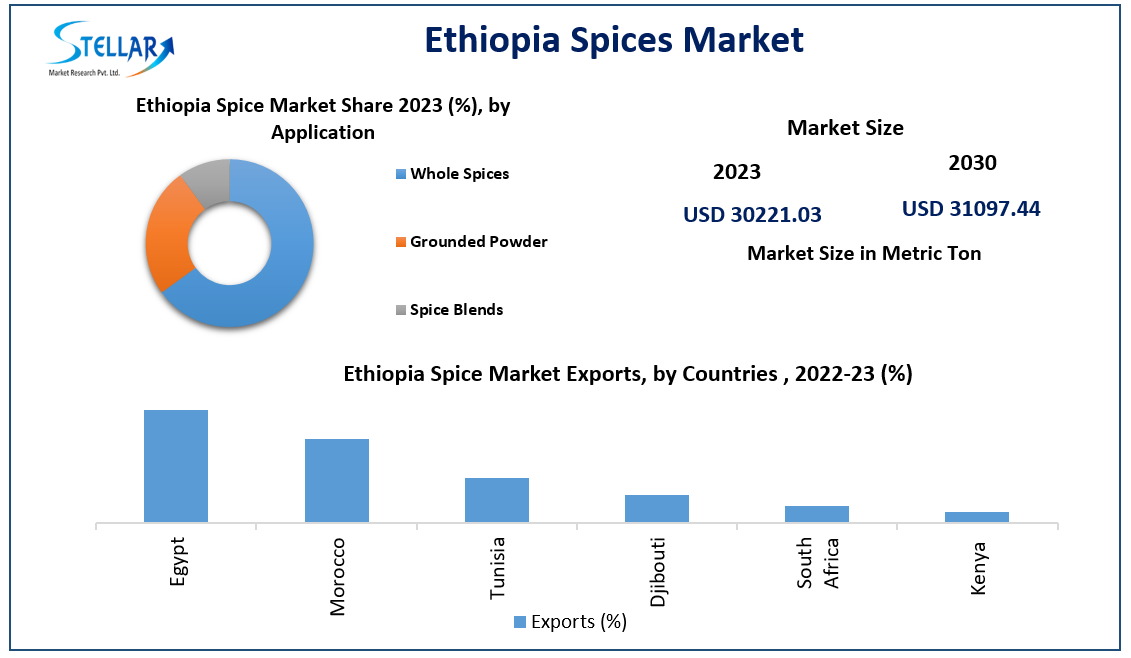

Ethiopia Spices Market, valued at USD 397.85 million in 2023, is projected to grow at a CAGR of 6.5%, reaching USD 618.24 million by 2030. As one of Africa's largest spice-producing countries, Ethiopia is experiencing strong domestic and international demand, driven by traditional food preferences, increased global appetite for ethnic cuisines, and expanding spice exports to Middle Eastern and European markets.

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/Ethiopia-Spices-Market/1684

Market Estimation, Growth Drivers & Opportunities

Ethiopia’s spice industry is rooted in centuries of tradition and biodiversity. The country is globally known for its unique spice blends such as Berbere, Mitmita, and Shiro powder, which are used in iconic dishes like Doro Wat and Injera-based platters. The growing popularity of Ethiopian cuisine worldwide and support for smallholder spice farmers are catalyzing market growth.

Key Growth Drivers:

Strong Domestic Consumption: Spices are integral to Ethiopian culture and daily cooking. From households to restaurants, spices are widely consumed across rural and urban areas.

Rising Global Demand for Organic & Ethnic Spices: Exporters from Ethiopia are finding new markets in the Middle East, Europe, and North America, driven by demand for authentic African flavors and organic products.

Agro-climatic Diversity: The varied climates across Ethiopia allow for cultivation of a wide range of spices, including ginger, turmeric, chili, black cumin, coriander, cardamom, and long pepper.

Government Support for Agribusiness: National initiatives under the Agriculture Development Strategy and GTP II focus on supporting high-value export crops, including spices.

Opportunities:

Export Market Expansion: Strengthening trade relationships with countries like the UAE, Saudi Arabia, Germany, and the U.S. could significantly increase foreign exchange earnings.

Organic Certification & Branding: Global markets demand traceability and organic certification. This presents an opportunity for Ethiopian producers to brand their spices and enter premium price segments.

Processing & Packaging: Most spices are currently exported raw or minimally processed. Investment in value-added processing facilities for grinding, blending, and packaging can boost earnings.

U.S. Market Trends & 2024 Investment Highlights (Comparative Insight)

In 2024, the U.S. spice market saw record demand for ethnic seasoning blends, with Ethiopian spice mixes entering specialty stores and online marketplaces like Amazon and Whole Foods. Several U.S.-based food companies partnered with Ethiopian spice cooperatives to ensure fair-trade sourcing and organic compliance. This trend encouraged Ethiopian exporters to adopt better packaging, traceability standards, and explore e-commerce avenues for retail spice sales.

Market Segmentation – Leading Segments by Share

By Type:

Turmeric holds the largest share in Ethiopia's spice production due to its wide use both domestically and for export. Known for its medicinal and culinary properties, turmeric is grown mainly in the southern regions.

Chili & Capsicum follows closely, given its importance in traditional spice mixes like Berbere. Demand remains high across households, food service, and international markets.

By Form:

Whole Spices dominate the market as the most common form consumed and exported. Traditional cooking methods prefer whole spices for grinding and roasting.

Ground & Blended Spices are gaining traction, especially among urban households and export markets that favor ready-to-use spice mixes.

Competitive Analysis – Top 5 Companies and Strategic Developments

1. Ethio Agri-CEFT:

A leading agribusiness firm, Ethio Agri-CEFT has invested in spice cultivation and processing. In 2024, the company expanded its turmeric and ginger farms and introduced modern drying and grading systems to enhance quality.

2. Beza Mar Agro Industry PLC:

Known for its organic spice exports, Beza Mar has focused on EU and Middle East markets. The company recently acquired ISO and organic certifications, positioning itself as a premium Ethiopian spice brand.

3. Sidama Spice Exporters Cooperative:

A cooperative of smallholder farmers specializing in chili and coriander. With support from NGOs, they have adopted sustainable farming and solar drying technologies, helping increase export volume.

4. Tepi Spice Plantation:

Located in southwestern Ethiopia, Tepi is one of the oldest spice estates. The government revived operations in 2024 through public-private partnerships to boost production of cardamom and long pepper.

5. Abyssinia Exports:

A key exporter specializing in value-added spice blends. The company launched its own line of spice jars for the U.S. and Europe under the “Taste of Ethiopia” brand, enhancing global visibility of Ethiopian cuisine.

These companies are leveraging Ethiopia’s natural spice wealth with improved post-harvest practices, compliance with global standards, and increased access to international markets.

Regional Insights within Ethiopia

Southern Nations, Nationalities, and Peoples' Region (SNNPR):

This region is the country’s spice belt, producing ginger, turmeric, and chili. Government programs here promote organic farming and link farmers to processing facilities.

Oromia Region:

Oromia is emerging as a major spice-producing region, especially for black cumin and coriander. The development of spice clusters near Addis Ababa has improved transportation and market access.

Amhara & Tigray:

These northern regions focus on dryland spices like fenugreek and long pepper. Rehabilitation programs post-conflict are supporting spice farming as a means of rural income restoration.

Government Initiatives:

The Ethiopian Agricultural Transformation Agency (ATA) and Ministry of Agriculture are working on projects to provide high-yield seeds, improve irrigation, and train farmers on post-harvest handling of spices.6. Conclusion & Strategic Outlook

Ethiopia’s spice market is primed for sustainable growth, anchored in deep cultural roots and increasing global appreciation for its distinct flavor profiles. The intersection of tradition, biodiversity, and economic opportunity makes the sector a key pillar of the country’s agribusiness future.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 41041

+91 96073656561

[email protected]Ethiopia Spices Market to be Driven by increasing population in the Forecast Period of 2024-2030

Ethiopia Spices Market, valued at USD 397.85 million in 2023, is projected to grow at a CAGR of 6.5%, reaching USD 618.24 million by 2030. As one of Africa's largest spice-producing countries, Ethiopia is experiencing strong domestic and international demand, driven by traditional food preferences, increased global appetite for ethnic cuisines, and expanding spice exports to Middle Eastern and European markets.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Ethiopia-Spices-Market/1684

Market Estimation, Growth Drivers & Opportunities

Ethiopia’s spice industry is rooted in centuries of tradition and biodiversity. The country is globally known for its unique spice blends such as Berbere, Mitmita, and Shiro powder, which are used in iconic dishes like Doro Wat and Injera-based platters. The growing popularity of Ethiopian cuisine worldwide and support for smallholder spice farmers are catalyzing market growth.

Key Growth Drivers:

Strong Domestic Consumption: Spices are integral to Ethiopian culture and daily cooking. From households to restaurants, spices are widely consumed across rural and urban areas.

Rising Global Demand for Organic & Ethnic Spices: Exporters from Ethiopia are finding new markets in the Middle East, Europe, and North America, driven by demand for authentic African flavors and organic products.

Agro-climatic Diversity: The varied climates across Ethiopia allow for cultivation of a wide range of spices, including ginger, turmeric, chili, black cumin, coriander, cardamom, and long pepper.

Government Support for Agribusiness: National initiatives under the Agriculture Development Strategy and GTP II focus on supporting high-value export crops, including spices.

Opportunities:

Export Market Expansion: Strengthening trade relationships with countries like the UAE, Saudi Arabia, Germany, and the U.S. could significantly increase foreign exchange earnings.

Organic Certification & Branding: Global markets demand traceability and organic certification. This presents an opportunity for Ethiopian producers to brand their spices and enter premium price segments.

Processing & Packaging: Most spices are currently exported raw or minimally processed. Investment in value-added processing facilities for grinding, blending, and packaging can boost earnings.

U.S. Market Trends & 2024 Investment Highlights (Comparative Insight)

In 2024, the U.S. spice market saw record demand for ethnic seasoning blends, with Ethiopian spice mixes entering specialty stores and online marketplaces like Amazon and Whole Foods. Several U.S.-based food companies partnered with Ethiopian spice cooperatives to ensure fair-trade sourcing and organic compliance. This trend encouraged Ethiopian exporters to adopt better packaging, traceability standards, and explore e-commerce avenues for retail spice sales.

Market Segmentation – Leading Segments by Share

By Type:

Turmeric holds the largest share in Ethiopia's spice production due to its wide use both domestically and for export. Known for its medicinal and culinary properties, turmeric is grown mainly in the southern regions.

Chili & Capsicum follows closely, given its importance in traditional spice mixes like Berbere. Demand remains high across households, food service, and international markets.

By Form:

Whole Spices dominate the market as the most common form consumed and exported. Traditional cooking methods prefer whole spices for grinding and roasting.

Ground & Blended Spices are gaining traction, especially among urban households and export markets that favor ready-to-use spice mixes.

Competitive Analysis – Top 5 Companies and Strategic Developments

1. Ethio Agri-CEFT:

A leading agribusiness firm, Ethio Agri-CEFT has invested in spice cultivation and processing. In 2024, the company expanded its turmeric and ginger farms and introduced modern drying and grading systems to enhance quality.

2. Beza Mar Agro Industry PLC:

Known for its organic spice exports, Beza Mar has focused on EU and Middle East markets. The company recently acquired ISO and organic certifications, positioning itself as a premium Ethiopian spice brand.

3. Sidama Spice Exporters Cooperative:

A cooperative of smallholder farmers specializing in chili and coriander. With support from NGOs, they have adopted sustainable farming and solar drying technologies, helping increase export volume.

4. Tepi Spice Plantation:

Located in southwestern Ethiopia, Tepi is one of the oldest spice estates. The government revived operations in 2024 through public-private partnerships to boost production of cardamom and long pepper.

5. Abyssinia Exports:

A key exporter specializing in value-added spice blends. The company launched its own line of spice jars for the U.S. and Europe under the “Taste of Ethiopia” brand, enhancing global visibility of Ethiopian cuisine.

These companies are leveraging Ethiopia’s natural spice wealth with improved post-harvest practices, compliance with global standards, and increased access to international markets.

Regional Insights within Ethiopia

Southern Nations, Nationalities, and Peoples' Region (SNNPR):

This region is the country’s spice belt, producing ginger, turmeric, and chili. Government programs here promote organic farming and link farmers to processing facilities.

Oromia Region:

Oromia is emerging as a major spice-producing region, especially for black cumin and coriander. The development of spice clusters near Addis Ababa has improved transportation and market access.

Amhara & Tigray:

These northern regions focus on dryland spices like fenugreek and long pepper. Rehabilitation programs post-conflict are supporting spice farming as a means of rural income restoration.

Government Initiatives:

The Ethiopian Agricultural Transformation Agency (ATA) and Ministry of Agriculture are working on projects to provide high-yield seeds, improve irrigation, and train farmers on post-harvest handling of spices.6. Conclusion & Strategic Outlook

Ethiopia’s spice market is primed for sustainable growth, anchored in deep cultural roots and increasing global appreciation for its distinct flavor profiles. The intersection of tradition, biodiversity, and economic opportunity makes the sector a key pillar of the country’s agribusiness future.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 41041

+91 96073656561

[email protected]