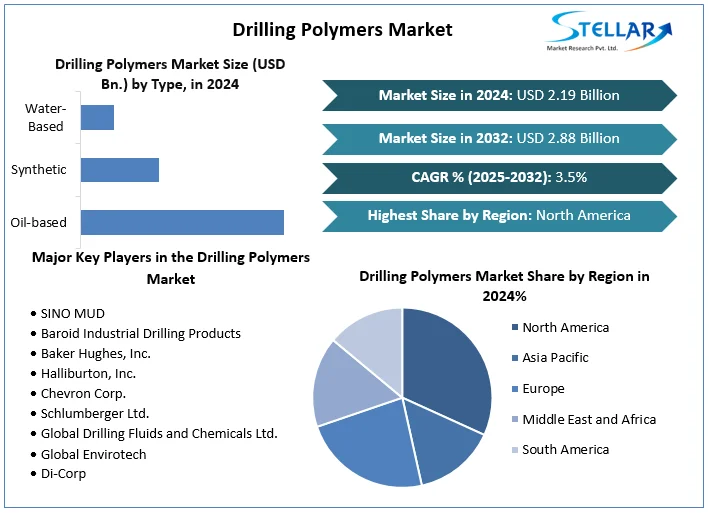

Drilling Polymers Market Size to Grow at a CAGR of 3.5% in the Forecast Period of 2025-2032

Global Tetrafluoroethane (R134A) Refrigerant Market — Market Size, Drivers, Trends and Competitive Outlook (2025–2032)

The global tetrafluoroethane (R134A) refrigerant market is poised for steady growth as demand across automotive, commercial and domestic refrigeration applications continues to expand. According to industry estimates, the market was valued at USD 177.85 million in 2024 and is forecast to reach approximately USD 249.08 million by 2032, growing at a CAGR of 4.3% during 2025–2032.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Drilling-Polymers-Market/1477

Market Estimation & Definition

Tetrafluoroethane (R134A) is an HFC refrigerant widely used as a replacement for R-12 (CFC) refrigerants. It is non-corrosive, non-toxic and non-flammable, existing as a gas at ambient conditions and commonly used in automotive air conditioning, commercial refrigeration, propellants and foam-blowing applications. The market scope in the referenced study includes historic data (2019–2024) and a forecast window (2025–2032).

Market Growth Drivers & Opportunity

Several factors are driving growth: (1) continued demand from automotive air-conditioning and commercial refrigeration as vehicle and cold-chain markets expand; (2) use as a propellant in aerosols and in foam-blowing agents; and (3) R&D and manufacturing scale that support broader industrial adoption. Moreover, the phaseout of ozone-depleting HCFCs/CFCs historically created opportunities for HFCs like R134A as replacements that do not deplete the ozone layer (despite global warming considerations), creating pockets of persistent demand. Investment in refrigerant technology and propellant manufacturing further underpin near-term growth. Constraints include the relatively higher cost of R134A and regulatory pressure toward lower-GWP alternatives over time.

What Lies Ahead: Emerging Trends Shaping the Future

Looking forward, the market will be shaped by two parallel trends: (1) efficiency and regulatory transition — regulators and OEMs are progressively testing and adopting lower-GWP refrigerants and blends, which will compress R134A demand in certain regions; and (2) niche durability and retrofit demand — legacy fleets, servicing networks and some industrial uses will continue to require R134A for years, offering near-term aftermarket and servicing opportunities. R&D that reduces leakage, improves charge efficiency, or creates cost-effective blends could prolong R134A’s commercial relevance in specific segments

Segmentation Analysis (from the report)

The report segments the market by application and end-use. Major application segments include: air conditioners (propellant, domestic, commercial), industrial, pharmaceutical, refrigerators, and chillers; the propellant segment held the dominant share in 2024. End-use segmentation covers automotive air-conditioning, commercial refrigeration equipment, domestic refrigeration equipment, and others. Regional segmentation covers North America, Europe (including Germany), Asia Pacific, Middle East & Africa, and South America. (All segmentation details above are taken from the referenced MMR report.)

Country-level analysis — USA & Germany

USA: The United States is treated as a primary country market within the North America chapter. Demand drivers in the U.S. include automotive production, strong aftermarket servicing, and commercial refrigeration demand; however, regulatory direction toward low-GWP alternatives will shape replacement and retrofit trends, making the U.S. a mixed outlook of steady aftermarket demand and gradual substitution.

Germany: As part of Europe’s market, Germany benefits from a mature automotive and refrigeration manufacturing base. Europe’s regulatory environment (eco-design, F-gas rules, and GWP-focused policy) creates pressure to move away from high-GWP HFCs over time, but Germany’s large industrial and automotive aftermarket also sustains demand for servicing and legacy systems—creating both substitution pressure and stable short-to-medium-term aftermarket revenue.

Competitor (Commutator) Analysis

Key players highlighted in the report include Daikin Applied Americas, Arkema, Chemours, Honeywell, Linde, Dongyue Group, Gujarat Fluorochemicals, SRF Limited, Navin Fluorine, and regional producers in Europe and Asia. These firms pursue strategies such as portfolio diversification (blends and low-GWP alternatives), capacity expansions, partnerships, and regional distribution agreements. Competitive pressure will favor players who can innovate lower-GWP solutions and offer integrated servicing and logistics for retrofit markets.

Press Release Conclusion

The R134A refrigerant market is on a steady growth trajectory driven by established end-use demand and servicing needs, yet it must navigate an evolving regulatory landscape and a technology shift toward lower-GWP refrigerants. Market participants that combine innovation (lower-GWP solutions), robust aftermarket support, and efficient supply chains will capture the most attractive opportunities through 2032. Investors and stakeholders should weigh near-term aftermarket resilience against longer-term transition risks when evaluating the sector.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Global Tetrafluoroethane (R134A) Refrigerant Market — Market Size, Drivers, Trends and Competitive Outlook (2025–2032)

The global tetrafluoroethane (R134A) refrigerant market is poised for steady growth as demand across automotive, commercial and domestic refrigeration applications continues to expand. According to industry estimates, the market was valued at USD 177.85 million in 2024 and is forecast to reach approximately USD 249.08 million by 2032, growing at a CAGR of 4.3% during 2025–2032.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Drilling-Polymers-Market/1477

Market Estimation & Definition

Tetrafluoroethane (R134A) is an HFC refrigerant widely used as a replacement for R-12 (CFC) refrigerants. It is non-corrosive, non-toxic and non-flammable, existing as a gas at ambient conditions and commonly used in automotive air conditioning, commercial refrigeration, propellants and foam-blowing applications. The market scope in the referenced study includes historic data (2019–2024) and a forecast window (2025–2032).

Market Growth Drivers & Opportunity

Several factors are driving growth: (1) continued demand from automotive air-conditioning and commercial refrigeration as vehicle and cold-chain markets expand; (2) use as a propellant in aerosols and in foam-blowing agents; and (3) R&D and manufacturing scale that support broader industrial adoption. Moreover, the phaseout of ozone-depleting HCFCs/CFCs historically created opportunities for HFCs like R134A as replacements that do not deplete the ozone layer (despite global warming considerations), creating pockets of persistent demand. Investment in refrigerant technology and propellant manufacturing further underpin near-term growth. Constraints include the relatively higher cost of R134A and regulatory pressure toward lower-GWP alternatives over time.

What Lies Ahead: Emerging Trends Shaping the Future

Looking forward, the market will be shaped by two parallel trends: (1) efficiency and regulatory transition — regulators and OEMs are progressively testing and adopting lower-GWP refrigerants and blends, which will compress R134A demand in certain regions; and (2) niche durability and retrofit demand — legacy fleets, servicing networks and some industrial uses will continue to require R134A for years, offering near-term aftermarket and servicing opportunities. R&D that reduces leakage, improves charge efficiency, or creates cost-effective blends could prolong R134A’s commercial relevance in specific segments

Segmentation Analysis (from the report)

The report segments the market by application and end-use. Major application segments include: air conditioners (propellant, domestic, commercial), industrial, pharmaceutical, refrigerators, and chillers; the propellant segment held the dominant share in 2024. End-use segmentation covers automotive air-conditioning, commercial refrigeration equipment, domestic refrigeration equipment, and others. Regional segmentation covers North America, Europe (including Germany), Asia Pacific, Middle East & Africa, and South America. (All segmentation details above are taken from the referenced MMR report.)

Country-level analysis — USA & Germany

USA: The United States is treated as a primary country market within the North America chapter. Demand drivers in the U.S. include automotive production, strong aftermarket servicing, and commercial refrigeration demand; however, regulatory direction toward low-GWP alternatives will shape replacement and retrofit trends, making the U.S. a mixed outlook of steady aftermarket demand and gradual substitution.

Germany: As part of Europe’s market, Germany benefits from a mature automotive and refrigeration manufacturing base. Europe’s regulatory environment (eco-design, F-gas rules, and GWP-focused policy) creates pressure to move away from high-GWP HFCs over time, but Germany’s large industrial and automotive aftermarket also sustains demand for servicing and legacy systems—creating both substitution pressure and stable short-to-medium-term aftermarket revenue.

Competitor (Commutator) Analysis

Key players highlighted in the report include Daikin Applied Americas, Arkema, Chemours, Honeywell, Linde, Dongyue Group, Gujarat Fluorochemicals, SRF Limited, Navin Fluorine, and regional producers in Europe and Asia. These firms pursue strategies such as portfolio diversification (blends and low-GWP alternatives), capacity expansions, partnerships, and regional distribution agreements. Competitive pressure will favor players who can innovate lower-GWP solutions and offer integrated servicing and logistics for retrofit markets.

Press Release Conclusion

The R134A refrigerant market is on a steady growth trajectory driven by established end-use demand and servicing needs, yet it must navigate an evolving regulatory landscape and a technology shift toward lower-GWP refrigerants. Market participants that combine innovation (lower-GWP solutions), robust aftermarket support, and efficient supply chains will capture the most attractive opportunities through 2032. Investors and stakeholders should weigh near-term aftermarket resilience against longer-term transition risks when evaluating the sector.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Drilling Polymers Market Size to Grow at a CAGR of 3.5% in the Forecast Period of 2025-2032

Global Tetrafluoroethane (R134A) Refrigerant Market — Market Size, Drivers, Trends and Competitive Outlook (2025–2032)

The global tetrafluoroethane (R134A) refrigerant market is poised for steady growth as demand across automotive, commercial and domestic refrigeration applications continues to expand. According to industry estimates, the market was valued at USD 177.85 million in 2024 and is forecast to reach approximately USD 249.08 million by 2032, growing at a CAGR of 4.3% during 2025–2032.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Drilling-Polymers-Market/1477

Market Estimation & Definition

Tetrafluoroethane (R134A) is an HFC refrigerant widely used as a replacement for R-12 (CFC) refrigerants. It is non-corrosive, non-toxic and non-flammable, existing as a gas at ambient conditions and commonly used in automotive air conditioning, commercial refrigeration, propellants and foam-blowing applications. The market scope in the referenced study includes historic data (2019–2024) and a forecast window (2025–2032).

Market Growth Drivers & Opportunity

Several factors are driving growth: (1) continued demand from automotive air-conditioning and commercial refrigeration as vehicle and cold-chain markets expand; (2) use as a propellant in aerosols and in foam-blowing agents; and (3) R&D and manufacturing scale that support broader industrial adoption. Moreover, the phaseout of ozone-depleting HCFCs/CFCs historically created opportunities for HFCs like R134A as replacements that do not deplete the ozone layer (despite global warming considerations), creating pockets of persistent demand. Investment in refrigerant technology and propellant manufacturing further underpin near-term growth. Constraints include the relatively higher cost of R134A and regulatory pressure toward lower-GWP alternatives over time.

What Lies Ahead: Emerging Trends Shaping the Future

Looking forward, the market will be shaped by two parallel trends: (1) efficiency and regulatory transition — regulators and OEMs are progressively testing and adopting lower-GWP refrigerants and blends, which will compress R134A demand in certain regions; and (2) niche durability and retrofit demand — legacy fleets, servicing networks and some industrial uses will continue to require R134A for years, offering near-term aftermarket and servicing opportunities. R&D that reduces leakage, improves charge efficiency, or creates cost-effective blends could prolong R134A’s commercial relevance in specific segments

Segmentation Analysis (from the report)

The report segments the market by application and end-use. Major application segments include: air conditioners (propellant, domestic, commercial), industrial, pharmaceutical, refrigerators, and chillers; the propellant segment held the dominant share in 2024. End-use segmentation covers automotive air-conditioning, commercial refrigeration equipment, domestic refrigeration equipment, and others. Regional segmentation covers North America, Europe (including Germany), Asia Pacific, Middle East & Africa, and South America. (All segmentation details above are taken from the referenced MMR report.)

Country-level analysis — USA & Germany

USA: The United States is treated as a primary country market within the North America chapter. Demand drivers in the U.S. include automotive production, strong aftermarket servicing, and commercial refrigeration demand; however, regulatory direction toward low-GWP alternatives will shape replacement and retrofit trends, making the U.S. a mixed outlook of steady aftermarket demand and gradual substitution.

Germany: As part of Europe’s market, Germany benefits from a mature automotive and refrigeration manufacturing base. Europe’s regulatory environment (eco-design, F-gas rules, and GWP-focused policy) creates pressure to move away from high-GWP HFCs over time, but Germany’s large industrial and automotive aftermarket also sustains demand for servicing and legacy systems—creating both substitution pressure and stable short-to-medium-term aftermarket revenue.

Competitor (Commutator) Analysis

Key players highlighted in the report include Daikin Applied Americas, Arkema, Chemours, Honeywell, Linde, Dongyue Group, Gujarat Fluorochemicals, SRF Limited, Navin Fluorine, and regional producers in Europe and Asia. These firms pursue strategies such as portfolio diversification (blends and low-GWP alternatives), capacity expansions, partnerships, and regional distribution agreements. Competitive pressure will favor players who can innovate lower-GWP solutions and offer integrated servicing and logistics for retrofit markets.

Press Release Conclusion

The R134A refrigerant market is on a steady growth trajectory driven by established end-use demand and servicing needs, yet it must navigate an evolving regulatory landscape and a technology shift toward lower-GWP refrigerants. Market participants that combine innovation (lower-GWP solutions), robust aftermarket support, and efficient supply chains will capture the most attractive opportunities through 2032. Investors and stakeholders should weigh near-term aftermarket resilience against longer-term transition risks when evaluating the sector.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

0 Comments

0 Shares

91 Views