Paper Products Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

Global Paper Products Market Set for Steady Growth Through 2032

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Paper-Products-Market/1851

Market Estimation & Definition

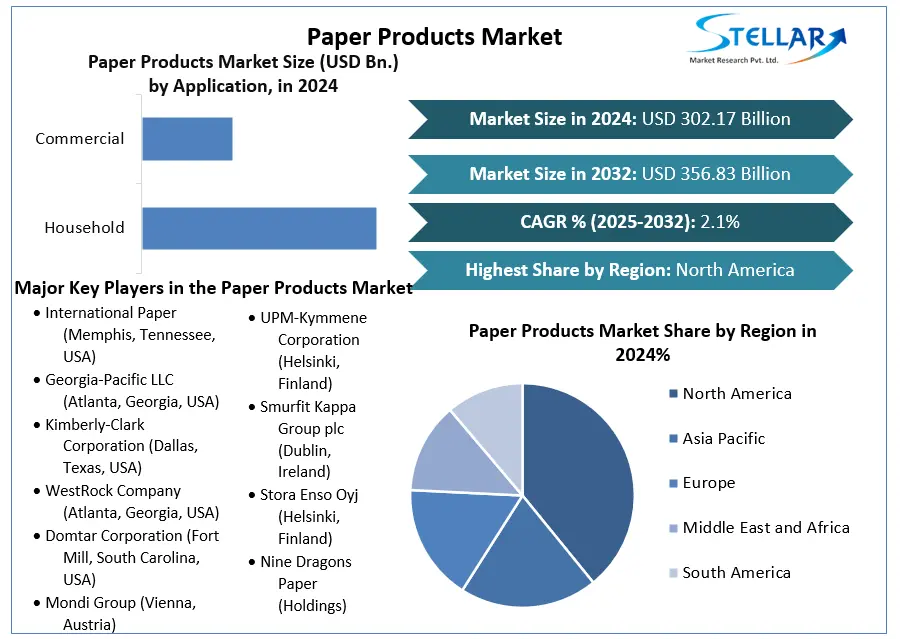

The global paper products market is witnessing consistent growth, driven by demand from residential, commercial, and industrial sectors. Paper products include tissue paper, writing and printing paper, packaging paper, and specialty paper used across various applications such as hygiene, education, packaging, and office use. The market’s growth is fueled by increasing literacy rates, e-commerce expansion, and rising consumption in packaging and hygiene-related segments, reflecting its essential role in daily life and business operations.

Market Growth Drivers & Opportunities

Several factors are driving growth in the paper products market:

Rising Demand in Packaging Industry: Growth of e-commerce and retail sectors fuels demand for paper-based packaging materials.

Hygiene and Sanitation Awareness: Increasing use of tissue, napkins, and disposable paper products drives consumer demand.

Educational and Office Use: Growth in schools, colleges, and corporate offices boosts demand for writing and printing paper.

Technological Advancements: Innovations in biodegradable and recycled paper products attract eco-conscious consumers.

E-commerce and Distribution Expansion: Online retail platforms enhance product accessibility globally.

Emerging Trends Shaping the Future

Key trends shaping the paper products market include:

Sustainable and Eco-Friendly Products: Increasing use of recycled fibers, FSC-certified paper, and biodegradable options.

Custom and Personalized Paper Products: Customized stationery, packaging, and promotional materials gain popularity among consumers and businesses.

Smart Packaging Solutions: Integration of QR codes, augmented reality, and digital labeling in paper packaging enhances consumer engagement.

Luxury and Premium Stationery: Growing interest in high-quality and aesthetically appealing paper products for personal and corporate use.

Segmentation Analysis

The paper products market is segmented based on type, application, and distribution channel:

By Type:

Tissue Paper Products: Toilet paper, facial tissues, napkins, and paper towels.

Writing & Printing Paper: Office stationery, notebooks, and specialty paper.

Packaging Paper Products: Corrugated paper, cartons, and paper bags.

Specialty Paper Products: Decorative, thermal, and industrial papers.

By Application:

Household: Tissue products, napkins, and kitchen use.

Commercial: Office stationery, printing, and corporate packaging.

Industrial: Packaging, labeling, and specialty paper for manufacturing purposes.

By Distribution Channel:

Online: E-commerce platforms offering convenience and variety.

Offline: Supermarkets, stationery stores, and wholesale distributors.

Country-Level Analysis

United States: The U.S. market is driven by high demand for hygiene products, packaging, and stationery in both consumer and business segments.

Germany: Germany shows steady growth due to industrial packaging demand, sustainability initiatives, and high adoption of eco-friendly paper products.

Competitive Landscape

Key players in the paper products market focus on innovation, quality, and sustainability:

International Paper Company: Leading producer of packaging and specialty paper products globally.

Kimberly-Clark Corporation: Known for hygiene and tissue paper products.

Procter & Gamble (P&G) – Paper Division: Offers premium tissue and household paper products.

Stora Enso: Specializes in sustainable packaging and industrial paper solutions.

Georgia-Pacific LLC: Provides diverse paper products across household, commercial, and industrial segments.

Press Release Conclusion

The global paper products market is poised for steady growth, driven by increasing demand for hygiene, packaging, and educational products. Emerging trends such as sustainable and eco-friendly materials, smart packaging, and premium stationery are shaping the market’s future. Stakeholders—including manufacturers, distributors, and investors—should focus on innovation, sustainability, and strategic expansion to capitalize on opportunities in this dynamic and evolving market.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Global Paper Products Market Set for Steady Growth Through 2032

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Paper-Products-Market/1851

Market Estimation & Definition

The global paper products market is witnessing consistent growth, driven by demand from residential, commercial, and industrial sectors. Paper products include tissue paper, writing and printing paper, packaging paper, and specialty paper used across various applications such as hygiene, education, packaging, and office use. The market’s growth is fueled by increasing literacy rates, e-commerce expansion, and rising consumption in packaging and hygiene-related segments, reflecting its essential role in daily life and business operations.

Market Growth Drivers & Opportunities

Several factors are driving growth in the paper products market:

Rising Demand in Packaging Industry: Growth of e-commerce and retail sectors fuels demand for paper-based packaging materials.

Hygiene and Sanitation Awareness: Increasing use of tissue, napkins, and disposable paper products drives consumer demand.

Educational and Office Use: Growth in schools, colleges, and corporate offices boosts demand for writing and printing paper.

Technological Advancements: Innovations in biodegradable and recycled paper products attract eco-conscious consumers.

E-commerce and Distribution Expansion: Online retail platforms enhance product accessibility globally.

Emerging Trends Shaping the Future

Key trends shaping the paper products market include:

Sustainable and Eco-Friendly Products: Increasing use of recycled fibers, FSC-certified paper, and biodegradable options.

Custom and Personalized Paper Products: Customized stationery, packaging, and promotional materials gain popularity among consumers and businesses.

Smart Packaging Solutions: Integration of QR codes, augmented reality, and digital labeling in paper packaging enhances consumer engagement.

Luxury and Premium Stationery: Growing interest in high-quality and aesthetically appealing paper products for personal and corporate use.

Segmentation Analysis

The paper products market is segmented based on type, application, and distribution channel:

By Type:

Tissue Paper Products: Toilet paper, facial tissues, napkins, and paper towels.

Writing & Printing Paper: Office stationery, notebooks, and specialty paper.

Packaging Paper Products: Corrugated paper, cartons, and paper bags.

Specialty Paper Products: Decorative, thermal, and industrial papers.

By Application:

Household: Tissue products, napkins, and kitchen use.

Commercial: Office stationery, printing, and corporate packaging.

Industrial: Packaging, labeling, and specialty paper for manufacturing purposes.

By Distribution Channel:

Online: E-commerce platforms offering convenience and variety.

Offline: Supermarkets, stationery stores, and wholesale distributors.

Country-Level Analysis

United States: The U.S. market is driven by high demand for hygiene products, packaging, and stationery in both consumer and business segments.

Germany: Germany shows steady growth due to industrial packaging demand, sustainability initiatives, and high adoption of eco-friendly paper products.

Competitive Landscape

Key players in the paper products market focus on innovation, quality, and sustainability:

International Paper Company: Leading producer of packaging and specialty paper products globally.

Kimberly-Clark Corporation: Known for hygiene and tissue paper products.

Procter & Gamble (P&G) – Paper Division: Offers premium tissue and household paper products.

Stora Enso: Specializes in sustainable packaging and industrial paper solutions.

Georgia-Pacific LLC: Provides diverse paper products across household, commercial, and industrial segments.

Press Release Conclusion

The global paper products market is poised for steady growth, driven by increasing demand for hygiene, packaging, and educational products. Emerging trends such as sustainable and eco-friendly materials, smart packaging, and premium stationery are shaping the market’s future. Stakeholders—including manufacturers, distributors, and investors—should focus on innovation, sustainability, and strategic expansion to capitalize on opportunities in this dynamic and evolving market.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Paper Products Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

Global Paper Products Market Set for Steady Growth Through 2032

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Paper-Products-Market/1851

Market Estimation & Definition

The global paper products market is witnessing consistent growth, driven by demand from residential, commercial, and industrial sectors. Paper products include tissue paper, writing and printing paper, packaging paper, and specialty paper used across various applications such as hygiene, education, packaging, and office use. The market’s growth is fueled by increasing literacy rates, e-commerce expansion, and rising consumption in packaging and hygiene-related segments, reflecting its essential role in daily life and business operations.

Market Growth Drivers & Opportunities

Several factors are driving growth in the paper products market:

Rising Demand in Packaging Industry: Growth of e-commerce and retail sectors fuels demand for paper-based packaging materials.

Hygiene and Sanitation Awareness: Increasing use of tissue, napkins, and disposable paper products drives consumer demand.

Educational and Office Use: Growth in schools, colleges, and corporate offices boosts demand for writing and printing paper.

Technological Advancements: Innovations in biodegradable and recycled paper products attract eco-conscious consumers.

E-commerce and Distribution Expansion: Online retail platforms enhance product accessibility globally.

Emerging Trends Shaping the Future

Key trends shaping the paper products market include:

Sustainable and Eco-Friendly Products: Increasing use of recycled fibers, FSC-certified paper, and biodegradable options.

Custom and Personalized Paper Products: Customized stationery, packaging, and promotional materials gain popularity among consumers and businesses.

Smart Packaging Solutions: Integration of QR codes, augmented reality, and digital labeling in paper packaging enhances consumer engagement.

Luxury and Premium Stationery: Growing interest in high-quality and aesthetically appealing paper products for personal and corporate use.

Segmentation Analysis

The paper products market is segmented based on type, application, and distribution channel:

By Type:

Tissue Paper Products: Toilet paper, facial tissues, napkins, and paper towels.

Writing & Printing Paper: Office stationery, notebooks, and specialty paper.

Packaging Paper Products: Corrugated paper, cartons, and paper bags.

Specialty Paper Products: Decorative, thermal, and industrial papers.

By Application:

Household: Tissue products, napkins, and kitchen use.

Commercial: Office stationery, printing, and corporate packaging.

Industrial: Packaging, labeling, and specialty paper for manufacturing purposes.

By Distribution Channel:

Online: E-commerce platforms offering convenience and variety.

Offline: Supermarkets, stationery stores, and wholesale distributors.

Country-Level Analysis

United States: The U.S. market is driven by high demand for hygiene products, packaging, and stationery in both consumer and business segments.

Germany: Germany shows steady growth due to industrial packaging demand, sustainability initiatives, and high adoption of eco-friendly paper products.

Competitive Landscape

Key players in the paper products market focus on innovation, quality, and sustainability:

International Paper Company: Leading producer of packaging and specialty paper products globally.

Kimberly-Clark Corporation: Known for hygiene and tissue paper products.

Procter & Gamble (P&G) – Paper Division: Offers premium tissue and household paper products.

Stora Enso: Specializes in sustainable packaging and industrial paper solutions.

Georgia-Pacific LLC: Provides diverse paper products across household, commercial, and industrial segments.

Press Release Conclusion

The global paper products market is poised for steady growth, driven by increasing demand for hygiene, packaging, and educational products. Emerging trends such as sustainable and eco-friendly materials, smart packaging, and premium stationery are shaping the market’s future. Stakeholders—including manufacturers, distributors, and investors—should focus on innovation, sustainability, and strategic expansion to capitalize on opportunities in this dynamic and evolving market.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

0 Commentaires

0 Parts

74 Vue