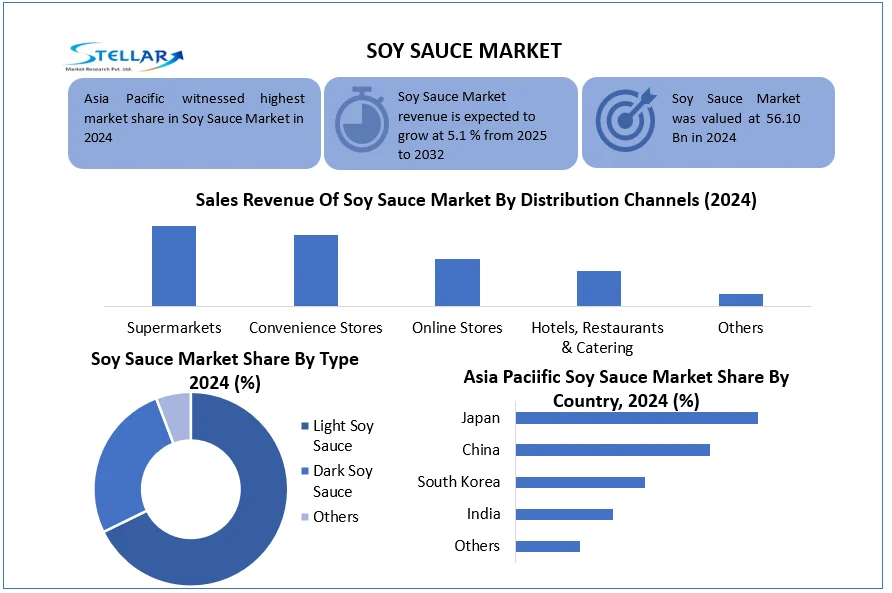

Soy Sauce Market Size to Grow at a CAGR of 5.1% in the Forecast Period of 2025-2032

Soy Sauce Market – A Global Flavor Staple Driving Culinary Traditions and Innovation

1. Market Estimation & Definition

Soy sauce is a liquid condiment made from fermented soybeans, wheat, salt, and water. With roots in East Asia, it has become a global staple for enhancing flavors in traditional and modern cuisines. Beyond culinary use, soy sauce is increasingly applied in marinades, ready-to-eat meals, and as an ingredient in food processing.

The Global Soy Sauce Market was valued at USD 45.1 billion in 2023 and is expected to reach USD 65.3 billion by 2030, expanding at a CAGR of 5.4% (2024–2030). The market’s growth reflects rising demand for Asian cuisines worldwide, expansion of the processed food industry, and growing interest in natural flavor enhancers.

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/soy-sauce-market/2676

2. Market Growth Drivers & Opportunities

Globalization of Cuisine: Increasing popularity of Asian dishes in North America, Europe, and other regions.

Rising Processed Food Demand: Soy sauce is widely used in instant noodles, snacks, sauces, and marinades.

Health Trends: Consumers are shifting toward low-sodium, organic, and naturally brewed soy sauce varieties.

E-commerce Expansion: Online platforms are driving sales of premium and specialty soy sauces.

Urbanization & Busy Lifestyles: Growing reliance on ready-to-cook and ready-to-eat meals supports soy sauce demand.

Opportunities: Product innovation (gluten-free and reduced-sodium versions), premiumization of artisanal soy sauces, and expansion in emerging markets with rising disposable incomes.

3. What Lies Ahead: Emerging Trends

Organic & Non-GMO Soy Sauce – Rising preference for clean-label and sustainable products.

Premiumization – Demand for artisanal, traditionally brewed soy sauces offering unique flavors.

Convenient Packaging – Sachets, squeeze bottles, and portion-controlled packs are growing popular.

Fusion Cuisine – Expansion into Western cooking and innovative recipes incorporating soy sauce.

Sustainability – Companies adopting eco-friendly production and packaging practices.

4. Segmentation Analysis

By Type:

Brewed Soy Sauce (dominant, naturally fermented)

Blended Soy Sauce (economical, widely used in processed foods)

Others (tamari, light, dark soy sauce varieties)

By Application:

Household (retail sales for direct use)

Foodservice (restaurants, catering, fast food chains)

Food Processing Industry (instant noodles, snacks, sauces, and marinades)

By Distribution Channel:

Supermarkets & Hypermarkets

Convenience Stores

Online Retail (fastest-growing segment)

5. Country-Level Analysis

United States: Rising consumption of Asian cuisines and expansion of international food chains driving demand.

Germany: Increasing consumer interest in exotic flavors and adoption of soy sauce in European recipes.

China: World’s largest producer and consumer, with both household and industrial demand dominating.

Japan: Traditional hub of soy sauce innovation, with high per capita consumption and premium artisanal products.

6. Competitor Analysis

The Soy Sauce Market is highly competitive, with multinational corporations and local producers catering to diverse consumer tastes.

Key companies include:

Kikkoman Corporation – Global leader with a wide portfolio of naturally brewed soy sauces.

Lee Kum Kee – Strong presence across Asia and expanding in Western markets.

Nestlé (Maggi) – Focuses on blended soy sauces and flavoring solutions.

Yamasa Corporation – Known for premium, traditional brewing methods.

Haitian Group – Dominant player in China with large-scale production.

La Choy, Pearl River Bridge, ABC Sauces – Expanding their reach through innovative products and retail presence.

Competition is centered around innovation, regional tastes, healthier alternatives, and branding strategies.

7. Press Release Conclusion

The Global Soy Sauce Market is poised for steady growth, fueled by the globalization of cuisines, rising processed food consumption, and consumer preference for natural flavor enhancers. As manufacturers innovate with organic, low-sodium, and premium artisanal varieties, soy sauce will continue to strengthen its role in both household and industrial food applications.

With strong demand from Asia-Pacific and growing traction in Western markets, soy sauce is not just a condiment—it is an essential bridge between tradition and modern food innovation. The future of the market lies in premium quality, sustainable production, and diverse applications across global cuisines.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected] Soy Sauce Market Size to Grow at a CAGR of 5.1% in the Forecast Period of 2025-2032

Soy Sauce Market – A Global Flavor Staple Driving Culinary Traditions and Innovation

1. Market Estimation & Definition

Soy sauce is a liquid condiment made from fermented soybeans, wheat, salt, and water. With roots in East Asia, it has become a global staple for enhancing flavors in traditional and modern cuisines. Beyond culinary use, soy sauce is increasingly applied in marinades, ready-to-eat meals, and as an ingredient in food processing.

The Global Soy Sauce Market was valued at USD 45.1 billion in 2023 and is expected to reach USD 65.3 billion by 2030, expanding at a CAGR of 5.4% (2024–2030). The market’s growth reflects rising demand for Asian cuisines worldwide, expansion of the processed food industry, and growing interest in natural flavor enhancers.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/soy-sauce-market/2676

2. Market Growth Drivers & Opportunities

Globalization of Cuisine: Increasing popularity of Asian dishes in North America, Europe, and other regions.

Rising Processed Food Demand: Soy sauce is widely used in instant noodles, snacks, sauces, and marinades.

Health Trends: Consumers are shifting toward low-sodium, organic, and naturally brewed soy sauce varieties.

E-commerce Expansion: Online platforms are driving sales of premium and specialty soy sauces.

Urbanization & Busy Lifestyles: Growing reliance on ready-to-cook and ready-to-eat meals supports soy sauce demand.

Opportunities: Product innovation (gluten-free and reduced-sodium versions), premiumization of artisanal soy sauces, and expansion in emerging markets with rising disposable incomes.

3. What Lies Ahead: Emerging Trends

Organic & Non-GMO Soy Sauce – Rising preference for clean-label and sustainable products.

Premiumization – Demand for artisanal, traditionally brewed soy sauces offering unique flavors.

Convenient Packaging – Sachets, squeeze bottles, and portion-controlled packs are growing popular.

Fusion Cuisine – Expansion into Western cooking and innovative recipes incorporating soy sauce.

Sustainability – Companies adopting eco-friendly production and packaging practices.

4. Segmentation Analysis

By Type:

Brewed Soy Sauce (dominant, naturally fermented)

Blended Soy Sauce (economical, widely used in processed foods)

Others (tamari, light, dark soy sauce varieties)

By Application:

Household (retail sales for direct use)

Foodservice (restaurants, catering, fast food chains)

Food Processing Industry (instant noodles, snacks, sauces, and marinades)

By Distribution Channel:

Supermarkets & Hypermarkets

Convenience Stores

Online Retail (fastest-growing segment)

5. Country-Level Analysis

United States: Rising consumption of Asian cuisines and expansion of international food chains driving demand.

Germany: Increasing consumer interest in exotic flavors and adoption of soy sauce in European recipes.

China: World’s largest producer and consumer, with both household and industrial demand dominating.

Japan: Traditional hub of soy sauce innovation, with high per capita consumption and premium artisanal products.

6. Competitor Analysis

The Soy Sauce Market is highly competitive, with multinational corporations and local producers catering to diverse consumer tastes.

Key companies include:

Kikkoman Corporation – Global leader with a wide portfolio of naturally brewed soy sauces.

Lee Kum Kee – Strong presence across Asia and expanding in Western markets.

Nestlé (Maggi) – Focuses on blended soy sauces and flavoring solutions.

Yamasa Corporation – Known for premium, traditional brewing methods.

Haitian Group – Dominant player in China with large-scale production.

La Choy, Pearl River Bridge, ABC Sauces – Expanding their reach through innovative products and retail presence.

Competition is centered around innovation, regional tastes, healthier alternatives, and branding strategies.

7. Press Release Conclusion

The Global Soy Sauce Market is poised for steady growth, fueled by the globalization of cuisines, rising processed food consumption, and consumer preference for natural flavor enhancers. As manufacturers innovate with organic, low-sodium, and premium artisanal varieties, soy sauce will continue to strengthen its role in both household and industrial food applications.

With strong demand from Asia-Pacific and growing traction in Western markets, soy sauce is not just a condiment—it is an essential bridge between tradition and modern food innovation. The future of the market lies in premium quality, sustainable production, and diverse applications across global cuisines.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]