Tunnel Automation Market Size to Grow at a CAGR of 8.1% in the Forecast Period of 2025-2032

Tunnel Automation Market – Growth, Trends, and Strategic Outlook

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/Tunnel-Automation-Market/2177

Market Estimation & Definition

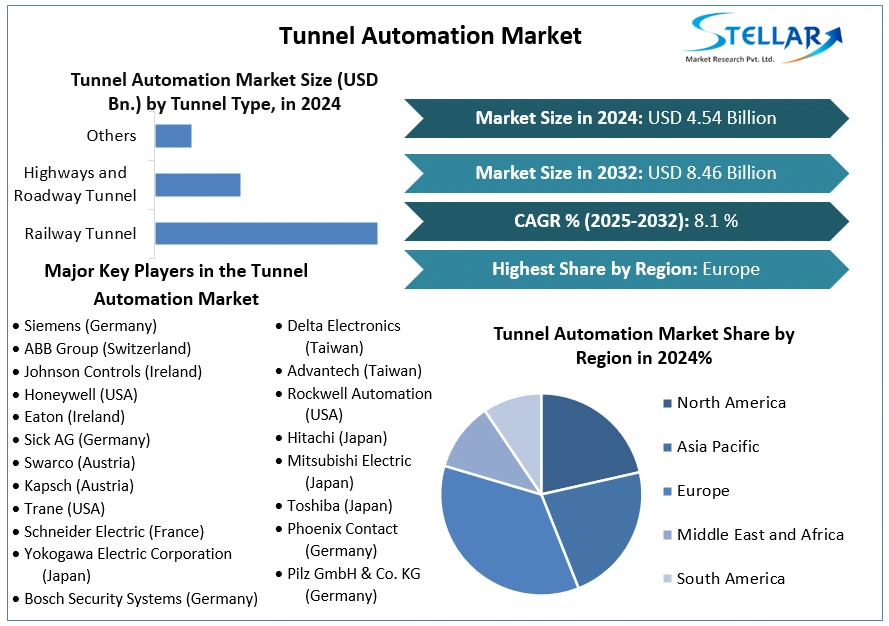

The global tunnel automation market is experiencing significant growth:

Databridge Market Research estimates the market was valued at USD 4.30 billion in 2023 and is projected to reach USD 8.41 billion by 2031, growing at a compound annual growth rate (CAGR) of 8.75% from 2024 to 2031.

Mordor Intelligence projects the market size will grow from USD 5.06 billion in 2025 to USD 7.62 billion by 2030, reflecting an 8.53% CAGR.

Credence Research forecasts the market will expand from USD 4.49 billion in 2024 to USD 8.19 billion by 2032, at a CAGR of 7.8%.

Spherical Insights projects the market will grow from USD 4.3 billion in 2021 to USD 6.2 billion by 2030, at a CAGR of 7.7%.

Tunnel automation systems are designed to enhance safety, efficiency, and operational effectiveness in tunnel infrastructure. These systems automate and monitor various operations such as ventilation, lighting, fire detection, traffic control, and surveillance, significantly reducing the risk of errors and accidents by minimizing human intervention.

Market Growth Drivers & Opportunities

Several factors are contributing to the growth of the tunnel automation market:

Infrastructure Upgrades: Ongoing modernization of aging tunnel infrastructure is driving the demand for automation solutions.

Strict Safety Norms: Increasing regulatory requirements for tunnel safety are prompting the adoption of automated systems.

Urbanization: Rapid urbanization is leading to the construction of new tunnels and the need for efficient management systems.

Technological Advancements: Integration of IoT and cloud technologies with tunnel automation systems is enhancing their capabilities and efficiency.

Emerging Trends Shaping the Future

The tunnel automation market is witnessing several emerging trends:

Artificial Intelligence (AI) Integration: AI is being incorporated into tunnel automation systems to improve predictive maintenance and real-time decision-making.

Energy Efficiency: There is a growing emphasis on energy-efficient solutions to reduce operational costs and environmental impact.

Smart Infrastructure: The development of smart tunnels equipped with advanced sensors and communication systems is enhancing operational efficiency.

Segmentation Analysis

The tunnel automation market can be segmented based on component, tunnel type, offering, and region:

Component: Includes HVAC, lighting & power supply, and signalization. The HVAC segment is expected to hold the largest share due to the necessity of providing forced ventilation inside tunnel enclosures.

Tunnel Type: Comprises railway tunnels and highway/roadway tunnels. Railway tunnels are anticipated to dominate the market, driven by increasing project allocations and the need for modernization.

Offering: Encompasses hardware, software, and services. The services segment is projected to grow at the highest CAGR, driven by the need for installation, maintenance, and upgrades of tunnel automation systems.

Region: Asia Pacific is estimated to hold the largest share of the global tunnel automation market during the forecast period, owing to rapid urbanization and infrastructure development.

Competitive Landscape

Key players in the tunnel automation market include:

Siemens AG: Offers a range of tunnel automation solutions, including traffic control and ventilation systems.

ABB Ltd.: Provides automation and electrification solutions for tunnel infrastructure.

Honeywell International Inc.: Specializes in safety and control systems for tunnel operations.

SICK AG: Develops sensor-based solutions for tunnel monitoring and automation.

Johnson Controls: Offers integrated building management systems for tunnel infrastructure.

Press Release Conclusion

The tunnel automation market is poised for substantial growth, driven by the need for enhanced safety, efficiency, and operational effectiveness in tunnel infrastructure. Companies focusing on innovation, integration of advanced technologies, and adherence to safety regulations will be well-positioned to capitalize on the growing demand for tunnel automation solutions.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]Tunnel Automation Market Size to Grow at a CAGR of 8.1% in the Forecast Period of 2025-2032

Tunnel Automation Market – Growth, Trends, and Strategic Outlook

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Tunnel-Automation-Market/2177

Market Estimation & Definition

The global tunnel automation market is experiencing significant growth:

Databridge Market Research estimates the market was valued at USD 4.30 billion in 2023 and is projected to reach USD 8.41 billion by 2031, growing at a compound annual growth rate (CAGR) of 8.75% from 2024 to 2031.

Mordor Intelligence projects the market size will grow from USD 5.06 billion in 2025 to USD 7.62 billion by 2030, reflecting an 8.53% CAGR.

Credence Research forecasts the market will expand from USD 4.49 billion in 2024 to USD 8.19 billion by 2032, at a CAGR of 7.8%.

Spherical Insights projects the market will grow from USD 4.3 billion in 2021 to USD 6.2 billion by 2030, at a CAGR of 7.7%.

Tunnel automation systems are designed to enhance safety, efficiency, and operational effectiveness in tunnel infrastructure. These systems automate and monitor various operations such as ventilation, lighting, fire detection, traffic control, and surveillance, significantly reducing the risk of errors and accidents by minimizing human intervention.

Market Growth Drivers & Opportunities

Several factors are contributing to the growth of the tunnel automation market:

Infrastructure Upgrades: Ongoing modernization of aging tunnel infrastructure is driving the demand for automation solutions.

Strict Safety Norms: Increasing regulatory requirements for tunnel safety are prompting the adoption of automated systems.

Urbanization: Rapid urbanization is leading to the construction of new tunnels and the need for efficient management systems.

Technological Advancements: Integration of IoT and cloud technologies with tunnel automation systems is enhancing their capabilities and efficiency.

Emerging Trends Shaping the Future

The tunnel automation market is witnessing several emerging trends:

Artificial Intelligence (AI) Integration: AI is being incorporated into tunnel automation systems to improve predictive maintenance and real-time decision-making.

Energy Efficiency: There is a growing emphasis on energy-efficient solutions to reduce operational costs and environmental impact.

Smart Infrastructure: The development of smart tunnels equipped with advanced sensors and communication systems is enhancing operational efficiency.

Segmentation Analysis

The tunnel automation market can be segmented based on component, tunnel type, offering, and region:

Component: Includes HVAC, lighting & power supply, and signalization. The HVAC segment is expected to hold the largest share due to the necessity of providing forced ventilation inside tunnel enclosures.

Tunnel Type: Comprises railway tunnels and highway/roadway tunnels. Railway tunnels are anticipated to dominate the market, driven by increasing project allocations and the need for modernization.

Offering: Encompasses hardware, software, and services. The services segment is projected to grow at the highest CAGR, driven by the need for installation, maintenance, and upgrades of tunnel automation systems.

Region: Asia Pacific is estimated to hold the largest share of the global tunnel automation market during the forecast period, owing to rapid urbanization and infrastructure development.

Competitive Landscape

Key players in the tunnel automation market include:

Siemens AG: Offers a range of tunnel automation solutions, including traffic control and ventilation systems.

ABB Ltd.: Provides automation and electrification solutions for tunnel infrastructure.

Honeywell International Inc.: Specializes in safety and control systems for tunnel operations.

SICK AG: Develops sensor-based solutions for tunnel monitoring and automation.

Johnson Controls: Offers integrated building management systems for tunnel infrastructure.

Press Release Conclusion

The tunnel automation market is poised for substantial growth, driven by the need for enhanced safety, efficiency, and operational effectiveness in tunnel infrastructure. Companies focusing on innovation, integration of advanced technologies, and adherence to safety regulations will be well-positioned to capitalize on the growing demand for tunnel automation solutions.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]