Global Automotive Smart display market Size To Grow At A CAGR Of 7.4% In The Forecast Period Of 2025-2032

Automotive Smart Display Market: Driving the Digital Cockpit Revolution

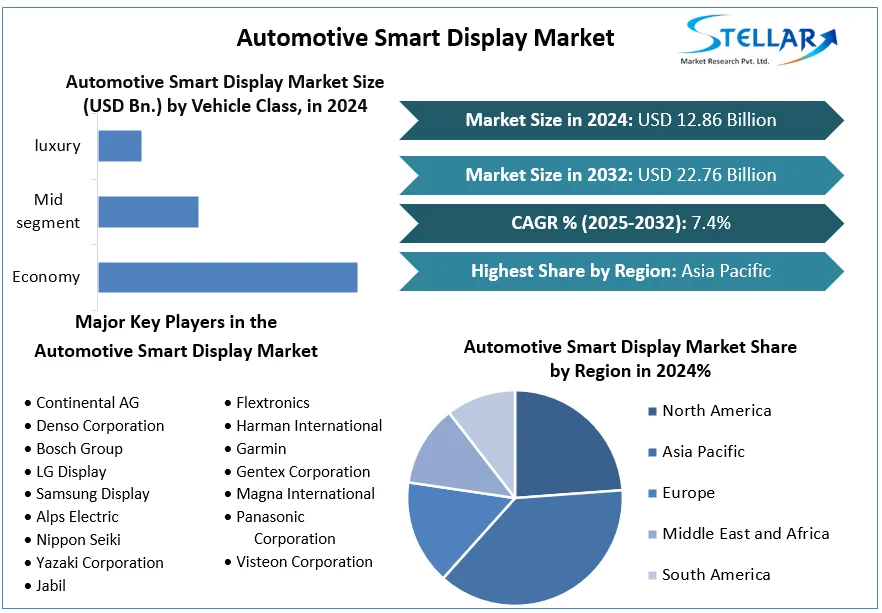

1. Market Estimation & Definition

The Automotive Smart Display Market, encompassing in-vehicle infotainment screens, digital instrument clusters, head-up displays, and rear-seat entertainment systems, is on an upward trajectory. Several reputable sources highlight the growth path:

Stellar Market Research estimates the market at USD 12.86 billion in 2024, rising to USD 22.76 billion by 2032, with a CAGR of 7.4%.

Grand View Research reports a base of USD 11.39 billion in 2022, projecting expansion to USD 20.07 billion by 2030 at a 7.7% CAGR.

Fortune Business Insights suggests growth from USD 15.59 billion in 2024 to USD 26.90 billion by 2032, at 7.1% CAGR.

Fact.MR estimates the market expanding from USD 8.2 billion in 2024 to USD 18.2 billion by 2035, at 7.8% CAGR.

All data indicate strong double-digit billion-dollar growth in the smart display segment across a range of CAGR forecasts from 7%–8%.

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/Automotive-Smart-Display-Market/1483

2. Market Growth Drivers & Opportunity

Connected & Autonomous Vehicles: Growing integration of ADAS, voice interface, and navigation systems is boosting demand for advanced displays.

In-cabin Infotainment: Consumers expect seamless infotainment experiences—navigation, media, connectivity—accelerating adoption of cockpit screens.

EV Cockpit Innovation: Electric vehicles increasingly feature digital dashboards and interactive displays, transforming vehicle interior experiences.

3. Emerging Trends Shaping the Future

Panoramic Dash Displays: At CES 2025, BMW unveiled its “Panoramic iDrive,” a sweeping dash-spanning interface combining HUD and central screen for immersive UX.

Advanced HUD Technologies: Companies like Hyundai Mobis and WayRay are pioneering holographic and retinopixel HUD systems that promise immersive, safer driving feedback.

Return to Physical Controls: Due to safety concerns, automakers are reintroducing physical buttons for essential functions, even as smart displays gain prominence. Europe’s Euro NCAP now rewards tactile controls over purely digital interfaces.

Escaping Distracted Touch: Mixed cloud-and-HUD systems are being designed to reduce driver distraction, blending digital and tactile interfaces.

4. Segmentation Analysis

Leading market research divides the smart display domain along these lines:

Display Size:

Less than 5″ (largest share)

5–10″ (widely adopted) — dominates volume from dashboards & clusters

Greater than 10″ (fastest growing)—exclusive/premium interfaces

Display Technology:

TFT-LCD (~50–54% share)

LCD, OLED (rapid growth with high resolution), microLED being piloted

Applications:

Center stack displays (largest share ~40–41%)

Digital instrument clusters

Head-up displays (growing faster)

Rear-seat entertainment

Regions:

Asia-Pacific leads with over 50% share, active in adoption and manufacturing.

North America and Europe contribute next-largest volume.

5. Country-Level Insights: United States & China

U.S. Market: Notably strong due to rapid adoption of advanced infotainment, EV penetration, and safety-integrated HUDs.

China & APAC: Leading growth region, with competitive OEMs and suppliers driving innovation and tray-in screens for EVs and apps like in-car gaming. Companies like Appotronics are introducing cinematic large-screen experiences in vehicles.

6. Strategic Analysis—Porter’s Five Forces

Supplier Power: Moderate. Key hardware players include Continental, Bosch, LG Display, and Samsung, with strong tech portfolios.

Buyer Power: High—OEMs demand cost-effective, durable, and integrable solutions with strong support and upgrades.

Threat of Substitutes: Low—traditional analog dashboards are being phased out in favor of digital UX.

New Entrants: Moderate—technology firms can enter, though certification and deep automotive relationships are necessary.

Competitive Rivalry: High—competing on display tech (OLED, microLED), UX, integration with ADAS, and price.

7. Press-Release Conclusion

The Automotive Smart Display Market is poised for robust growth—from an estimated USD 12–15 billion in 2024 to USD 20–27 billion by 2032–2035, depending on forecast model—with CAGRs ranging from ~7% to 8%

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]Global Automotive Smart display market Size To Grow At A CAGR Of 7.4% In The Forecast Period Of 2025-2032

Automotive Smart Display Market: Driving the Digital Cockpit Revolution

1. Market Estimation & Definition

The Automotive Smart Display Market, encompassing in-vehicle infotainment screens, digital instrument clusters, head-up displays, and rear-seat entertainment systems, is on an upward trajectory. Several reputable sources highlight the growth path:

Stellar Market Research estimates the market at USD 12.86 billion in 2024, rising to USD 22.76 billion by 2032, with a CAGR of 7.4%.

Grand View Research reports a base of USD 11.39 billion in 2022, projecting expansion to USD 20.07 billion by 2030 at a 7.7% CAGR.

Fortune Business Insights suggests growth from USD 15.59 billion in 2024 to USD 26.90 billion by 2032, at 7.1% CAGR.

Fact.MR estimates the market expanding from USD 8.2 billion in 2024 to USD 18.2 billion by 2035, at 7.8% CAGR.

All data indicate strong double-digit billion-dollar growth in the smart display segment across a range of CAGR forecasts from 7%–8%.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Automotive-Smart-Display-Market/1483

2. Market Growth Drivers & Opportunity

Connected & Autonomous Vehicles: Growing integration of ADAS, voice interface, and navigation systems is boosting demand for advanced displays.

In-cabin Infotainment: Consumers expect seamless infotainment experiences—navigation, media, connectivity—accelerating adoption of cockpit screens.

EV Cockpit Innovation: Electric vehicles increasingly feature digital dashboards and interactive displays, transforming vehicle interior experiences.

3. Emerging Trends Shaping the Future

Panoramic Dash Displays: At CES 2025, BMW unveiled its “Panoramic iDrive,” a sweeping dash-spanning interface combining HUD and central screen for immersive UX.

Advanced HUD Technologies: Companies like Hyundai Mobis and WayRay are pioneering holographic and retinopixel HUD systems that promise immersive, safer driving feedback.

Return to Physical Controls: Due to safety concerns, automakers are reintroducing physical buttons for essential functions, even as smart displays gain prominence. Europe’s Euro NCAP now rewards tactile controls over purely digital interfaces.

Escaping Distracted Touch: Mixed cloud-and-HUD systems are being designed to reduce driver distraction, blending digital and tactile interfaces.

4. Segmentation Analysis

Leading market research divides the smart display domain along these lines:

Display Size:

Less than 5″ (largest share)

5–10″ (widely adopted) — dominates volume from dashboards & clusters

Greater than 10″ (fastest growing)—exclusive/premium interfaces

Display Technology:

TFT-LCD (~50–54% share)

LCD, OLED (rapid growth with high resolution), microLED being piloted

Applications:

Center stack displays (largest share ~40–41%)

Digital instrument clusters

Head-up displays (growing faster)

Rear-seat entertainment

Regions:

Asia-Pacific leads with over 50% share, active in adoption and manufacturing.

North America and Europe contribute next-largest volume.

5. Country-Level Insights: United States & China

U.S. Market: Notably strong due to rapid adoption of advanced infotainment, EV penetration, and safety-integrated HUDs.

China & APAC: Leading growth region, with competitive OEMs and suppliers driving innovation and tray-in screens for EVs and apps like in-car gaming. Companies like Appotronics are introducing cinematic large-screen experiences in vehicles.

6. Strategic Analysis—Porter’s Five Forces

Supplier Power: Moderate. Key hardware players include Continental, Bosch, LG Display, and Samsung, with strong tech portfolios.

Buyer Power: High—OEMs demand cost-effective, durable, and integrable solutions with strong support and upgrades.

Threat of Substitutes: Low—traditional analog dashboards are being phased out in favor of digital UX.

New Entrants: Moderate—technology firms can enter, though certification and deep automotive relationships are necessary.

Competitive Rivalry: High—competing on display tech (OLED, microLED), UX, integration with ADAS, and price.

7. Press-Release Conclusion

The Automotive Smart Display Market is poised for robust growth—from an estimated USD 12–15 billion in 2024 to USD 20–27 billion by 2032–2035, depending on forecast model—with CAGRs ranging from ~7% to 8%

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]