Apple Cider Vinegar Market Size to Grow at a CAGR of 7.57% in the Forecast Period of 2025-2032

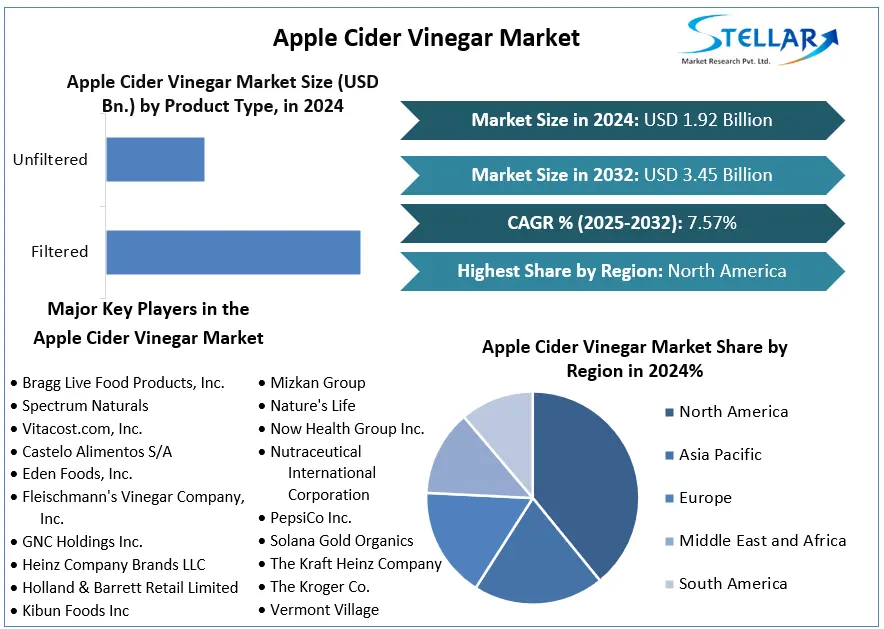

Apple Cider Vinegar (ACV) Market was valued at approximately USD 1.92 billion in 2024, and is forecast to grow to about USD 3.45 billion by 2032, reflecting a CAGR of ~7.6% during the 2025–2032 period

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Apple-Cider-Vinegar-Market/2081

Market Estimation, Growth Drivers & Opportunities

Leading market studies estimate ACV at USD 1.92 B in 2024, with projected growth rates between ~5.5% and 8.0% CAGR, yielding revenue of USD 2.5 B to 3.45 B by 2032–2033, depending on forecasting models

Key growth drivers include:

Rising consumer interest in functional wellness products, especially for weight management, blood sugar control, and digestive health—reinforced by clinical studies and medical recognition .

Expansion of organic and clean-label variants, attracting premium positioning and reflecting growing demand for natural ingredients

Format innovation—liquid, capsules, tablets, gummies, powders, and RTD beverages—enhancing convenience and consumer acceptance

Robust e-commerce and D2C distribution models that facilitate certified, subscription-based sales with educational content .

Opportunities lie in expanding supplement-grade offerings, RTD functional beverages, formulary integration into personal care and foodservice, and rapid geographic expansion in developing markets.

U.S. Market: Latest Trends & Investment

North America, led by the U.S., represented approximately 48.2% of global ACV revenue in 2024 (~USD 310.5 M)

Recent developments:

In March 2025, Bragg Live Food Products launched a Pineapple Turmeric ACV blend, signaling continued innovation in flavored wellness drinks and capsules

PepsiCo’s acquisition of Poppi (USD 1.95B) in 2025 demonstrates major beverage players embracing ACV-rooted functional sodas

Broad retail expansion: Bragg rolled out ACV capsules across 3,000 Sprouts Farmers Market stores in early 2025 for broader market penetration

The U.S. ACV market is projected to grow at around 5.1%–6% CAGR into the early 2030s, with health claims-driven demand and high consumption growth relative to other regions

Market Segmentation: Largest Segment by Share

By Form: Liquid ACV dominates market share (~72–75% in 2024), driven by tradition, culinary uses, and perceived authenticity; tablets and capsules are fastest-growing (~9–9.4% CAGR) as supplement formats gain traction .

By Category: Conventional ACV held approx. 68–70% share in 2024, while the organic segment is growing faster (~9.8% CAGR) as clean-label premium demand rises

By Application: Food & beverages is the largest application (~44% share), followed by personal care and pharmaceuticals. Culinary and wellness usage dominates the revenue base

Competitive Analysis: Top 5 Companies

Leading players shaping the global ACV market include:

1. Bragg Live Food Products LLC – A U.S. pioneer expanding into capsules and flavored blends (e.g. Pineapple Turmeric ACV in 2025), increasing mass-retail visibility through Sprouts rollout

2. The Kraft Heinz Company – Offers branded vinegars including ACV; investing in flavored and value-added variants to maintain shelf presence

3. Carl Kühne KG (Germany) – European vinegar specialist, leveraging sustainability-led ACV options for foodservice and retail channels across Europe and Asia

4. Molson Coors Beverage Co. (Aspall brand) – Catering to RTD beverage segment and cider-based innovation; diversifying into functional ACV blends globally

5. Barnes Naturals Pty Ltd (Australia) – Growing ACV presence with unfiltered certified organic lines, expanding into Europe and North America

Additional notable players include PepsiCo (via Poppi), GNC, Vitacost, Marukan, Pompeian, NOW Foods—focusing on supplement formats and international distribution channels

Regional Analysis: USA, UK, Germany, France, Japan & China

United States: Leads globally with ~48% share in 2024 (~USD 310M). Growth driven by wellness awareness, retail innovation, and product expansion into health supplements and beverages

Europe (UK, Germany, France): Holds ~15% share (~USD 96.7M in 2024), led by Carl Kühne and Barnes entries. Demand is supported by stringent organic certification standards and consumer trust in fermented, natural products

Asia-Pacific (China & Japan): Grew strongest regionally with ~28% share in 2024 (~USD 180M). Rapid urban uptake, e-commerce platforms, and wellness culture in China and Japan fuel growth (~6–10% CAGR), influenced by product adaptations like RTD beverages and domestic branding .

Government and regulatory sway in Japan (~6.2% CAGR), Germany (~4.8%), and France (~5.3%) underscores stabilized yet premium ACV adoption rates in these OECD countries .

Conclusion

The Apple Cider Vinegar Market, valued at USD 1.92B in 2024, is projected to reach approximately USD 3.45B by 2032, growing at ~7.6% CAGR. Conservative modeling through 2034 suggests modest alternative growth estimates (~USD 2.5B at 6.5% CAGR), but consensus confirms strong upward momentum

Key growth opportunities include:

Continued diversification into wellness formats—capsules, gummies, RTD beverages—enhancing accessibility and multifaceted use.

Expansion of the organic ACV segment, which is outpacing conventional in growth rate and appealing to premium consumer segments.

Integration into foodservice, skincare, supplements, and functional beverages beyond traditional culinary uses.

Geographic expansion into Asia-Pacific, Latin America, and emerging urban markets via localized packaging and D2C channels.

Strategic partnerships and investment by major beverage and consumer goods players (e.g. PepsiCo/Poppi) to elevate market scale and visibility.

With major players like Bragg, Kraft Heinz, Carl Kühne, Molson Coors, PepsiCo, Barnes Naturals, and emerging supplement brands, the ACV market is positioned for sustained expansion. As consumer awareness of health, function, and transparency increases, apple cider vinegar remains a central ingredient in global wellness, nutrition, and lifestyle branding.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Apple Cider Vinegar (ACV) Market was valued at approximately USD 1.92 billion in 2024, and is forecast to grow to about USD 3.45 billion by 2032, reflecting a CAGR of ~7.6% during the 2025–2032 period

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Apple-Cider-Vinegar-Market/2081

Market Estimation, Growth Drivers & Opportunities

Leading market studies estimate ACV at USD 1.92 B in 2024, with projected growth rates between ~5.5% and 8.0% CAGR, yielding revenue of USD 2.5 B to 3.45 B by 2032–2033, depending on forecasting models

Key growth drivers include:

Rising consumer interest in functional wellness products, especially for weight management, blood sugar control, and digestive health—reinforced by clinical studies and medical recognition .

Expansion of organic and clean-label variants, attracting premium positioning and reflecting growing demand for natural ingredients

Format innovation—liquid, capsules, tablets, gummies, powders, and RTD beverages—enhancing convenience and consumer acceptance

Robust e-commerce and D2C distribution models that facilitate certified, subscription-based sales with educational content .

Opportunities lie in expanding supplement-grade offerings, RTD functional beverages, formulary integration into personal care and foodservice, and rapid geographic expansion in developing markets.

U.S. Market: Latest Trends & Investment

North America, led by the U.S., represented approximately 48.2% of global ACV revenue in 2024 (~USD 310.5 M)

Recent developments:

In March 2025, Bragg Live Food Products launched a Pineapple Turmeric ACV blend, signaling continued innovation in flavored wellness drinks and capsules

PepsiCo’s acquisition of Poppi (USD 1.95B) in 2025 demonstrates major beverage players embracing ACV-rooted functional sodas

Broad retail expansion: Bragg rolled out ACV capsules across 3,000 Sprouts Farmers Market stores in early 2025 for broader market penetration

The U.S. ACV market is projected to grow at around 5.1%–6% CAGR into the early 2030s, with health claims-driven demand and high consumption growth relative to other regions

Market Segmentation: Largest Segment by Share

By Form: Liquid ACV dominates market share (~72–75% in 2024), driven by tradition, culinary uses, and perceived authenticity; tablets and capsules are fastest-growing (~9–9.4% CAGR) as supplement formats gain traction .

By Category: Conventional ACV held approx. 68–70% share in 2024, while the organic segment is growing faster (~9.8% CAGR) as clean-label premium demand rises

By Application: Food & beverages is the largest application (~44% share), followed by personal care and pharmaceuticals. Culinary and wellness usage dominates the revenue base

Competitive Analysis: Top 5 Companies

Leading players shaping the global ACV market include:

1. Bragg Live Food Products LLC – A U.S. pioneer expanding into capsules and flavored blends (e.g. Pineapple Turmeric ACV in 2025), increasing mass-retail visibility through Sprouts rollout

2. The Kraft Heinz Company – Offers branded vinegars including ACV; investing in flavored and value-added variants to maintain shelf presence

3. Carl Kühne KG (Germany) – European vinegar specialist, leveraging sustainability-led ACV options for foodservice and retail channels across Europe and Asia

4. Molson Coors Beverage Co. (Aspall brand) – Catering to RTD beverage segment and cider-based innovation; diversifying into functional ACV blends globally

5. Barnes Naturals Pty Ltd (Australia) – Growing ACV presence with unfiltered certified organic lines, expanding into Europe and North America

Additional notable players include PepsiCo (via Poppi), GNC, Vitacost, Marukan, Pompeian, NOW Foods—focusing on supplement formats and international distribution channels

Regional Analysis: USA, UK, Germany, France, Japan & China

United States: Leads globally with ~48% share in 2024 (~USD 310M). Growth driven by wellness awareness, retail innovation, and product expansion into health supplements and beverages

Europe (UK, Germany, France): Holds ~15% share (~USD 96.7M in 2024), led by Carl Kühne and Barnes entries. Demand is supported by stringent organic certification standards and consumer trust in fermented, natural products

Asia-Pacific (China & Japan): Grew strongest regionally with ~28% share in 2024 (~USD 180M). Rapid urban uptake, e-commerce platforms, and wellness culture in China and Japan fuel growth (~6–10% CAGR), influenced by product adaptations like RTD beverages and domestic branding .

Government and regulatory sway in Japan (~6.2% CAGR), Germany (~4.8%), and France (~5.3%) underscores stabilized yet premium ACV adoption rates in these OECD countries .

Conclusion

The Apple Cider Vinegar Market, valued at USD 1.92B in 2024, is projected to reach approximately USD 3.45B by 2032, growing at ~7.6% CAGR. Conservative modeling through 2034 suggests modest alternative growth estimates (~USD 2.5B at 6.5% CAGR), but consensus confirms strong upward momentum

Key growth opportunities include:

Continued diversification into wellness formats—capsules, gummies, RTD beverages—enhancing accessibility and multifaceted use.

Expansion of the organic ACV segment, which is outpacing conventional in growth rate and appealing to premium consumer segments.

Integration into foodservice, skincare, supplements, and functional beverages beyond traditional culinary uses.

Geographic expansion into Asia-Pacific, Latin America, and emerging urban markets via localized packaging and D2C channels.

Strategic partnerships and investment by major beverage and consumer goods players (e.g. PepsiCo/Poppi) to elevate market scale and visibility.

With major players like Bragg, Kraft Heinz, Carl Kühne, Molson Coors, PepsiCo, Barnes Naturals, and emerging supplement brands, the ACV market is positioned for sustained expansion. As consumer awareness of health, function, and transparency increases, apple cider vinegar remains a central ingredient in global wellness, nutrition, and lifestyle branding.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Apple Cider Vinegar Market Size to Grow at a CAGR of 7.57% in the Forecast Period of 2025-2032

Apple Cider Vinegar (ACV) Market was valued at approximately USD 1.92 billion in 2024, and is forecast to grow to about USD 3.45 billion by 2032, reflecting a CAGR of ~7.6% during the 2025–2032 period

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Apple-Cider-Vinegar-Market/2081

Market Estimation, Growth Drivers & Opportunities

Leading market studies estimate ACV at USD 1.92 B in 2024, with projected growth rates between ~5.5% and 8.0% CAGR, yielding revenue of USD 2.5 B to 3.45 B by 2032–2033, depending on forecasting models

Key growth drivers include:

Rising consumer interest in functional wellness products, especially for weight management, blood sugar control, and digestive health—reinforced by clinical studies and medical recognition .

Expansion of organic and clean-label variants, attracting premium positioning and reflecting growing demand for natural ingredients

Format innovation—liquid, capsules, tablets, gummies, powders, and RTD beverages—enhancing convenience and consumer acceptance

Robust e-commerce and D2C distribution models that facilitate certified, subscription-based sales with educational content .

Opportunities lie in expanding supplement-grade offerings, RTD functional beverages, formulary integration into personal care and foodservice, and rapid geographic expansion in developing markets.

U.S. Market: Latest Trends & Investment

North America, led by the U.S., represented approximately 48.2% of global ACV revenue in 2024 (~USD 310.5 M)

Recent developments:

In March 2025, Bragg Live Food Products launched a Pineapple Turmeric ACV blend, signaling continued innovation in flavored wellness drinks and capsules

PepsiCo’s acquisition of Poppi (USD 1.95B) in 2025 demonstrates major beverage players embracing ACV-rooted functional sodas

Broad retail expansion: Bragg rolled out ACV capsules across 3,000 Sprouts Farmers Market stores in early 2025 for broader market penetration

The U.S. ACV market is projected to grow at around 5.1%–6% CAGR into the early 2030s, with health claims-driven demand and high consumption growth relative to other regions

Market Segmentation: Largest Segment by Share

By Form: Liquid ACV dominates market share (~72–75% in 2024), driven by tradition, culinary uses, and perceived authenticity; tablets and capsules are fastest-growing (~9–9.4% CAGR) as supplement formats gain traction .

By Category: Conventional ACV held approx. 68–70% share in 2024, while the organic segment is growing faster (~9.8% CAGR) as clean-label premium demand rises

By Application: Food & beverages is the largest application (~44% share), followed by personal care and pharmaceuticals. Culinary and wellness usage dominates the revenue base

Competitive Analysis: Top 5 Companies

Leading players shaping the global ACV market include:

1. Bragg Live Food Products LLC – A U.S. pioneer expanding into capsules and flavored blends (e.g. Pineapple Turmeric ACV in 2025), increasing mass-retail visibility through Sprouts rollout

2. The Kraft Heinz Company – Offers branded vinegars including ACV; investing in flavored and value-added variants to maintain shelf presence

3. Carl Kühne KG (Germany) – European vinegar specialist, leveraging sustainability-led ACV options for foodservice and retail channels across Europe and Asia

4. Molson Coors Beverage Co. (Aspall brand) – Catering to RTD beverage segment and cider-based innovation; diversifying into functional ACV blends globally

5. Barnes Naturals Pty Ltd (Australia) – Growing ACV presence with unfiltered certified organic lines, expanding into Europe and North America

Additional notable players include PepsiCo (via Poppi), GNC, Vitacost, Marukan, Pompeian, NOW Foods—focusing on supplement formats and international distribution channels

Regional Analysis: USA, UK, Germany, France, Japan & China

United States: Leads globally with ~48% share in 2024 (~USD 310M). Growth driven by wellness awareness, retail innovation, and product expansion into health supplements and beverages

Europe (UK, Germany, France): Holds ~15% share (~USD 96.7M in 2024), led by Carl Kühne and Barnes entries. Demand is supported by stringent organic certification standards and consumer trust in fermented, natural products

Asia-Pacific (China & Japan): Grew strongest regionally with ~28% share in 2024 (~USD 180M). Rapid urban uptake, e-commerce platforms, and wellness culture in China and Japan fuel growth (~6–10% CAGR), influenced by product adaptations like RTD beverages and domestic branding .

Government and regulatory sway in Japan (~6.2% CAGR), Germany (~4.8%), and France (~5.3%) underscores stabilized yet premium ACV adoption rates in these OECD countries .

Conclusion

The Apple Cider Vinegar Market, valued at USD 1.92B in 2024, is projected to reach approximately USD 3.45B by 2032, growing at ~7.6% CAGR. Conservative modeling through 2034 suggests modest alternative growth estimates (~USD 2.5B at 6.5% CAGR), but consensus confirms strong upward momentum

Key growth opportunities include:

Continued diversification into wellness formats—capsules, gummies, RTD beverages—enhancing accessibility and multifaceted use.

Expansion of the organic ACV segment, which is outpacing conventional in growth rate and appealing to premium consumer segments.

Integration into foodservice, skincare, supplements, and functional beverages beyond traditional culinary uses.

Geographic expansion into Asia-Pacific, Latin America, and emerging urban markets via localized packaging and D2C channels.

Strategic partnerships and investment by major beverage and consumer goods players (e.g. PepsiCo/Poppi) to elevate market scale and visibility.

With major players like Bragg, Kraft Heinz, Carl Kühne, Molson Coors, PepsiCo, Barnes Naturals, and emerging supplement brands, the ACV market is positioned for sustained expansion. As consumer awareness of health, function, and transparency increases, apple cider vinegar remains a central ingredient in global wellness, nutrition, and lifestyle branding.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

0 Yorumlar

0 hisse senetleri

3579 Views