Condensed Coconut Milk Market Size to Grow at a CAGR of 9.57% in the Forecast Period of 2025-2032

Condensed Coconut Milk Market: Strategic Insights

Market Overview

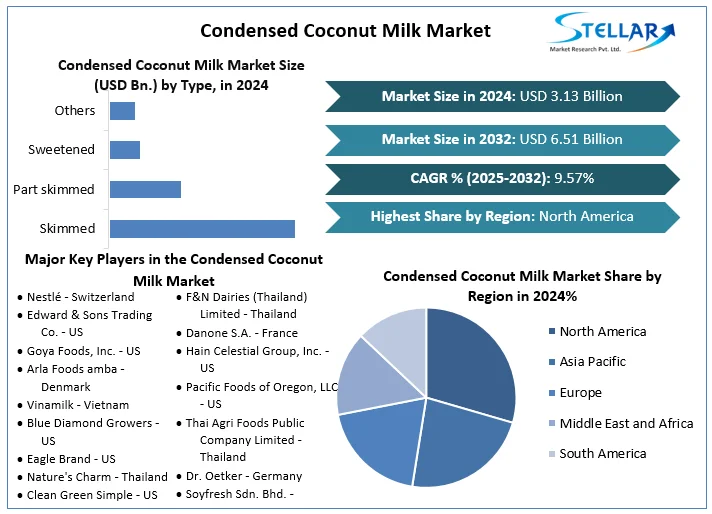

The global condensed coconut milk market is experiencing significant growth, driven by increasing consumer demand for plant-based and lactose-free alternatives. As of 2024, the market was valued at approximately USD 3.13 billion, with projections indicating it will reach USD 6.51 billion by 2032, reflecting a compound annual growth rate (CAGR) of 9.57% during the forecast period from 2025 to 2032.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Condensed-Coconut-Milk-Market/1893

Key Market Drivers

Health and Dietary Trends: Rising health consciousness among consumers is leading to increased adoption of plant-based diets, boosting the demand for dairy alternatives like condensed coconut milk.

Culinary Versatility: Condensed coconut milk's rich flavor and creamy texture make it a popular ingredient in various culinary applications, including desserts, beverages, and savory dishes.

Lactose Intolerance Awareness: With a growing awareness of lactose intolerance, consumers are seeking lactose-free options, further driving the demand for coconut-based products.

Market Segmentation

By Type: The market is segmented into sweetened, skimmed, part-skimmed, and others. The sweetened segment holds the largest market share, attributed to its widespread use in desserts and beverages.

By Application: Key applications include bakery, confectionery, foods and beverages, and others. The foods and beverages segment leads in market share, driven by the increasing incorporation of condensed coconut milk in various food products.

By Packaging: Packaging options include cans, tubes, and bottles, with cans being the most preferred due to their convenience and longer shelf life.

Regional Insights

North America: Dominates the market, driven by a high adoption rate of plant-based diets and increasing health-consciousness among consumers.

Europe: Experiences steady growth, with countries like Germany and the UK showing significant demand for plant-based alternatives.

Asia-Pacific: Expected to witness the fastest growth, owing to the traditional use of coconut in regional cuisines and a rising trend towards plant-based diets.

Competitive Landscape

Key players in the condensed coconut milk market include:

Nestlé: A global leader in the food and beverage industry, offering a range of dairy and plant-based products.

Edward & Sons Trading Co.: Known for its organic and vegan-friendly products.

Goya Foods, Inc.: A major supplier of Latin American food products, including coconut-based items.

Pacific Natural Foods: Specializes in organic and plant-based food products.

Tetra Pak: Provides packaging solutions for various food and beverage products.

Conclusion

The condensed coconut milk market is poised for substantial growth, driven by changing consumer preferences towards healthier and plant-based dietary options. With its versatility in culinary applications and alignment with current health trends, condensed coconut milk presents significant opportunities for manufacturers and investors in the coming years.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Condensed Coconut Milk Market: Strategic Insights

Market Overview

The global condensed coconut milk market is experiencing significant growth, driven by increasing consumer demand for plant-based and lactose-free alternatives. As of 2024, the market was valued at approximately USD 3.13 billion, with projections indicating it will reach USD 6.51 billion by 2032, reflecting a compound annual growth rate (CAGR) of 9.57% during the forecast period from 2025 to 2032.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Condensed-Coconut-Milk-Market/1893

Key Market Drivers

Health and Dietary Trends: Rising health consciousness among consumers is leading to increased adoption of plant-based diets, boosting the demand for dairy alternatives like condensed coconut milk.

Culinary Versatility: Condensed coconut milk's rich flavor and creamy texture make it a popular ingredient in various culinary applications, including desserts, beverages, and savory dishes.

Lactose Intolerance Awareness: With a growing awareness of lactose intolerance, consumers are seeking lactose-free options, further driving the demand for coconut-based products.

Market Segmentation

By Type: The market is segmented into sweetened, skimmed, part-skimmed, and others. The sweetened segment holds the largest market share, attributed to its widespread use in desserts and beverages.

By Application: Key applications include bakery, confectionery, foods and beverages, and others. The foods and beverages segment leads in market share, driven by the increasing incorporation of condensed coconut milk in various food products.

By Packaging: Packaging options include cans, tubes, and bottles, with cans being the most preferred due to their convenience and longer shelf life.

Regional Insights

North America: Dominates the market, driven by a high adoption rate of plant-based diets and increasing health-consciousness among consumers.

Europe: Experiences steady growth, with countries like Germany and the UK showing significant demand for plant-based alternatives.

Asia-Pacific: Expected to witness the fastest growth, owing to the traditional use of coconut in regional cuisines and a rising trend towards plant-based diets.

Competitive Landscape

Key players in the condensed coconut milk market include:

Nestlé: A global leader in the food and beverage industry, offering a range of dairy and plant-based products.

Edward & Sons Trading Co.: Known for its organic and vegan-friendly products.

Goya Foods, Inc.: A major supplier of Latin American food products, including coconut-based items.

Pacific Natural Foods: Specializes in organic and plant-based food products.

Tetra Pak: Provides packaging solutions for various food and beverage products.

Conclusion

The condensed coconut milk market is poised for substantial growth, driven by changing consumer preferences towards healthier and plant-based dietary options. With its versatility in culinary applications and alignment with current health trends, condensed coconut milk presents significant opportunities for manufacturers and investors in the coming years.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Condensed Coconut Milk Market Size to Grow at a CAGR of 9.57% in the Forecast Period of 2025-2032

Condensed Coconut Milk Market: Strategic Insights

Market Overview

The global condensed coconut milk market is experiencing significant growth, driven by increasing consumer demand for plant-based and lactose-free alternatives. As of 2024, the market was valued at approximately USD 3.13 billion, with projections indicating it will reach USD 6.51 billion by 2032, reflecting a compound annual growth rate (CAGR) of 9.57% during the forecast period from 2025 to 2032.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Condensed-Coconut-Milk-Market/1893

Key Market Drivers

Health and Dietary Trends: Rising health consciousness among consumers is leading to increased adoption of plant-based diets, boosting the demand for dairy alternatives like condensed coconut milk.

Culinary Versatility: Condensed coconut milk's rich flavor and creamy texture make it a popular ingredient in various culinary applications, including desserts, beverages, and savory dishes.

Lactose Intolerance Awareness: With a growing awareness of lactose intolerance, consumers are seeking lactose-free options, further driving the demand for coconut-based products.

Market Segmentation

By Type: The market is segmented into sweetened, skimmed, part-skimmed, and others. The sweetened segment holds the largest market share, attributed to its widespread use in desserts and beverages.

By Application: Key applications include bakery, confectionery, foods and beverages, and others. The foods and beverages segment leads in market share, driven by the increasing incorporation of condensed coconut milk in various food products.

By Packaging: Packaging options include cans, tubes, and bottles, with cans being the most preferred due to their convenience and longer shelf life.

Regional Insights

North America: Dominates the market, driven by a high adoption rate of plant-based diets and increasing health-consciousness among consumers.

Europe: Experiences steady growth, with countries like Germany and the UK showing significant demand for plant-based alternatives.

Asia-Pacific: Expected to witness the fastest growth, owing to the traditional use of coconut in regional cuisines and a rising trend towards plant-based diets.

Competitive Landscape

Key players in the condensed coconut milk market include:

Nestlé: A global leader in the food and beverage industry, offering a range of dairy and plant-based products.

Edward & Sons Trading Co.: Known for its organic and vegan-friendly products.

Goya Foods, Inc.: A major supplier of Latin American food products, including coconut-based items.

Pacific Natural Foods: Specializes in organic and plant-based food products.

Tetra Pak: Provides packaging solutions for various food and beverage products.

Conclusion

The condensed coconut milk market is poised for substantial growth, driven by changing consumer preferences towards healthier and plant-based dietary options. With its versatility in culinary applications and alignment with current health trends, condensed coconut milk presents significant opportunities for manufacturers and investors in the coming years.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

0 Комментарии

0 Поделились

1605 Просмотры