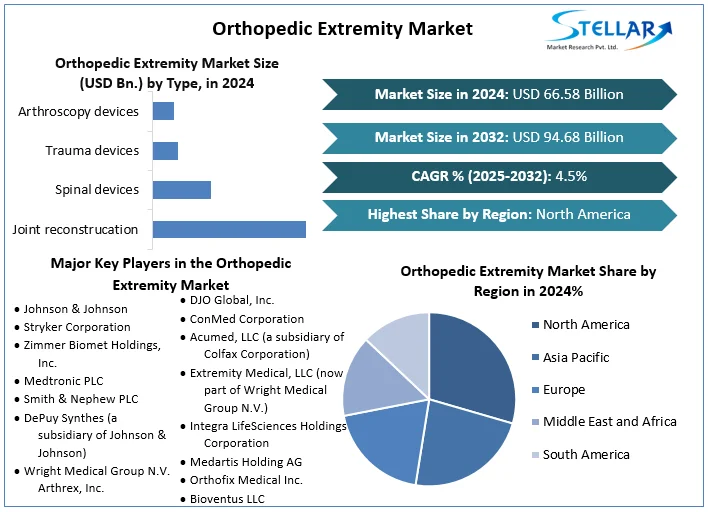

Orthopedic Extremity Market Size to Grow at a CAGR of 4.5% in the Forecast Period of 2025-2032

Orthopedic Extremity Market Projected to Reach USD 94.68 Billion by 2032

Market Estimation & Definition

The global Orthopedic Extremity Market was valued at approximately USD 66.58 billion in 2024. It is forecast to grow at a compound annual growth rate (CAGR) of 4.5% between 2025 and 2032, reaching roughly USD 94.68 billion by 2032.

“Orthopedic extremities” refers to medical devices, implants, surgical tools and related services aimed at treating musculoskeletal disorders, fractures, injuries, degenerative conditions, and joint problems affecting the limbs (upper and lower), joints, soft tissues, and peripheral bones. The market includes joint reconstruction, spinal devices, trauma devices, arthroscopy devices, plus the settings in which these are used (hospitals, outpatient clinics, ambulatory surgical centers).

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Orthopedic-Extremity-Market/1486

Market Growth Drivers & Opportunity

Several key factors are propelling the market forward, along with attractive opportunities:

Aging Global Population: As life expectancy increases, age-related degenerative diseases like osteoarthritis, joint degeneration, and bone-weakening conditions become more prevalent, creating sustained demand for joint reconstructive surgeries and related extremity treatments.

Rising Sports and Trauma-related Injuries: Higher participation in sports, more road accidents, and other forms of traumatic injuries drive demand for trauma devices, fracture fixation, and reconstructive surgeries.

Technological Innovation: Development of minimally invasive surgery techniques, use of better implant materials, advancements such as 3D printing, robotic assistance, and AI‐enabled diagnostics are improving patient outcomes, recovery times, and increasing patient acceptance.

Growth in Outpatient and Ambulatory Settings: There is a shift toward outpatient procedures and ambulatory surgical centers (ASCs), driven by demand for lower cost, shorter hospital stays, and greater convenience. This opens up markets for lighter, more efficient devices and implant systems appropriate for non-hospital settings.

Emerging Market Expansion: Healthcare infrastructure improving in regions like Asia-Pacific, Latin America, and Middle East & Africa. Increased affordability, rising middle classes, and growing awareness of orthopedic healthcare are providing new growth opportunities.

What Lies Ahead: Emerging Trends Shaping the Future

Minimally Invasive / Less Traumatic Surgery: Emphasis on techniques and device designs that reduce surgical trauma, speed healing, reduce complications (e.g. smaller incisions, arthroscopic methods).

Smart & Personalized Implants: Use of patient-specific implants (via 3D printing), implants with improved biomaterials for better integration and longevity, potentially sensors or smart materials in future.

Focus on Soft Tissue & Arthroscopy Devices: Alongside hard implants, devices and instruments for arthroscopic repair and soft tissue work are expected to gain more share as patients and surgeons prefer less-invasive options.

Robotic & Navigation Assistance: More use of robotics, image guidance, navigation in surgery to improve precision, reduce error, and improve outcomes.

Regulatory & Reimbursement Pressures: Demand for cost-effectiveness, value-based care, regulatory approvals, and pricing pressures will shape product design, materials used, and adoption pathways.

Segmentation Analysis (from the Report)

According to the report, the market is segmented as follows:

By Type: Joint reconstruction, spinal devices, trauma devices, arthroscopy devices.

By End-Use: Hospitals; Orthopedic clinics; Ambulatory surgical centers (ASCs).

By Region: North America; Europe; Asia-Pacific; Latin America; Middle East & Africa.

Country-Level Analysis: USA & Germany

United States: The U.S. is the dominant market in North America for orthopedic extremity devices. Strong healthcare infrastructure, high procedural volumes (joint replacements, trauma surgeries), rapid adoption of new technology (robotics, navigation, minimally invasive implants) and high spending per patient characterize the U.S. market. Reimbursement mechanisms, regulatory approvals, and high awareness also support growth.

Germany: Among European leaders, Germany benefits from an aging demographic, well-established medical device regulation, strong hospitals, and surgeons experienced in advanced orthopedic procedures. German demand particularly for joint reconstruction (knee, hip) is strong. However, value-based purchasing and cost considerations are more prominent, pushing manufacturers to deliver high quality at competitive cost.

Competitor Analysis

Key players in the global orthopedic extremity market include:

Johnson & Johnson

Stryker Corporation

Zimmer Biomet Holdings, Inc.

Medtronic PLC

Smith & Nephew PLC

DePuy Synthes (a J&J subsidiary)

Wright Medical Group (now part of Stryker)

Arthrex, Inc.

NuVasive, Inc.

Globus Medical, Inc.

DJO Global, Inc. (Colfax)

ConMed Corporation

Acumed LLC

Extremity Medical LLC (now under Wright Medical)

Integra LifeSciences Holdings AG

These competitors are focusing on: improving implant designs and materials; expanding into minimally invasive and outpatient applications; investing in R&D (robotics, smart implants); improving manufacturing methods to reduce cost; widening global footprint, particularly in emerging economies; and ensuring regulatory compliance and strong post-operative outcomes.

Press Release Conclusion

The Orthopedic Extremity Market is headed for consistent growth through 2032, rising from about USD 66.58 billion in 2024 to nearly USD 94.68 billion at a CAGR of 4.5%. Aging populations, rising prevalence of joint and bone disorders, increasing sports/trauma cases, and adoption of advanced, less invasive techniques form the core growth engine.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Orthopedic Extremity Market Projected to Reach USD 94.68 Billion by 2032

Market Estimation & Definition

The global Orthopedic Extremity Market was valued at approximately USD 66.58 billion in 2024. It is forecast to grow at a compound annual growth rate (CAGR) of 4.5% between 2025 and 2032, reaching roughly USD 94.68 billion by 2032.

“Orthopedic extremities” refers to medical devices, implants, surgical tools and related services aimed at treating musculoskeletal disorders, fractures, injuries, degenerative conditions, and joint problems affecting the limbs (upper and lower), joints, soft tissues, and peripheral bones. The market includes joint reconstruction, spinal devices, trauma devices, arthroscopy devices, plus the settings in which these are used (hospitals, outpatient clinics, ambulatory surgical centers).

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Orthopedic-Extremity-Market/1486

Market Growth Drivers & Opportunity

Several key factors are propelling the market forward, along with attractive opportunities:

Aging Global Population: As life expectancy increases, age-related degenerative diseases like osteoarthritis, joint degeneration, and bone-weakening conditions become more prevalent, creating sustained demand for joint reconstructive surgeries and related extremity treatments.

Rising Sports and Trauma-related Injuries: Higher participation in sports, more road accidents, and other forms of traumatic injuries drive demand for trauma devices, fracture fixation, and reconstructive surgeries.

Technological Innovation: Development of minimally invasive surgery techniques, use of better implant materials, advancements such as 3D printing, robotic assistance, and AI‐enabled diagnostics are improving patient outcomes, recovery times, and increasing patient acceptance.

Growth in Outpatient and Ambulatory Settings: There is a shift toward outpatient procedures and ambulatory surgical centers (ASCs), driven by demand for lower cost, shorter hospital stays, and greater convenience. This opens up markets for lighter, more efficient devices and implant systems appropriate for non-hospital settings.

Emerging Market Expansion: Healthcare infrastructure improving in regions like Asia-Pacific, Latin America, and Middle East & Africa. Increased affordability, rising middle classes, and growing awareness of orthopedic healthcare are providing new growth opportunities.

What Lies Ahead: Emerging Trends Shaping the Future

Minimally Invasive / Less Traumatic Surgery: Emphasis on techniques and device designs that reduce surgical trauma, speed healing, reduce complications (e.g. smaller incisions, arthroscopic methods).

Smart & Personalized Implants: Use of patient-specific implants (via 3D printing), implants with improved biomaterials for better integration and longevity, potentially sensors or smart materials in future.

Focus on Soft Tissue & Arthroscopy Devices: Alongside hard implants, devices and instruments for arthroscopic repair and soft tissue work are expected to gain more share as patients and surgeons prefer less-invasive options.

Robotic & Navigation Assistance: More use of robotics, image guidance, navigation in surgery to improve precision, reduce error, and improve outcomes.

Regulatory & Reimbursement Pressures: Demand for cost-effectiveness, value-based care, regulatory approvals, and pricing pressures will shape product design, materials used, and adoption pathways.

Segmentation Analysis (from the Report)

According to the report, the market is segmented as follows:

By Type: Joint reconstruction, spinal devices, trauma devices, arthroscopy devices.

By End-Use: Hospitals; Orthopedic clinics; Ambulatory surgical centers (ASCs).

By Region: North America; Europe; Asia-Pacific; Latin America; Middle East & Africa.

Country-Level Analysis: USA & Germany

United States: The U.S. is the dominant market in North America for orthopedic extremity devices. Strong healthcare infrastructure, high procedural volumes (joint replacements, trauma surgeries), rapid adoption of new technology (robotics, navigation, minimally invasive implants) and high spending per patient characterize the U.S. market. Reimbursement mechanisms, regulatory approvals, and high awareness also support growth.

Germany: Among European leaders, Germany benefits from an aging demographic, well-established medical device regulation, strong hospitals, and surgeons experienced in advanced orthopedic procedures. German demand particularly for joint reconstruction (knee, hip) is strong. However, value-based purchasing and cost considerations are more prominent, pushing manufacturers to deliver high quality at competitive cost.

Competitor Analysis

Key players in the global orthopedic extremity market include:

Johnson & Johnson

Stryker Corporation

Zimmer Biomet Holdings, Inc.

Medtronic PLC

Smith & Nephew PLC

DePuy Synthes (a J&J subsidiary)

Wright Medical Group (now part of Stryker)

Arthrex, Inc.

NuVasive, Inc.

Globus Medical, Inc.

DJO Global, Inc. (Colfax)

ConMed Corporation

Acumed LLC

Extremity Medical LLC (now under Wright Medical)

Integra LifeSciences Holdings AG

These competitors are focusing on: improving implant designs and materials; expanding into minimally invasive and outpatient applications; investing in R&D (robotics, smart implants); improving manufacturing methods to reduce cost; widening global footprint, particularly in emerging economies; and ensuring regulatory compliance and strong post-operative outcomes.

Press Release Conclusion

The Orthopedic Extremity Market is headed for consistent growth through 2032, rising from about USD 66.58 billion in 2024 to nearly USD 94.68 billion at a CAGR of 4.5%. Aging populations, rising prevalence of joint and bone disorders, increasing sports/trauma cases, and adoption of advanced, less invasive techniques form the core growth engine.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Orthopedic Extremity Market Size to Grow at a CAGR of 4.5% in the Forecast Period of 2025-2032

Orthopedic Extremity Market Projected to Reach USD 94.68 Billion by 2032

Market Estimation & Definition

The global Orthopedic Extremity Market was valued at approximately USD 66.58 billion in 2024. It is forecast to grow at a compound annual growth rate (CAGR) of 4.5% between 2025 and 2032, reaching roughly USD 94.68 billion by 2032.

“Orthopedic extremities” refers to medical devices, implants, surgical tools and related services aimed at treating musculoskeletal disorders, fractures, injuries, degenerative conditions, and joint problems affecting the limbs (upper and lower), joints, soft tissues, and peripheral bones. The market includes joint reconstruction, spinal devices, trauma devices, arthroscopy devices, plus the settings in which these are used (hospitals, outpatient clinics, ambulatory surgical centers).

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Orthopedic-Extremity-Market/1486

Market Growth Drivers & Opportunity

Several key factors are propelling the market forward, along with attractive opportunities:

Aging Global Population: As life expectancy increases, age-related degenerative diseases like osteoarthritis, joint degeneration, and bone-weakening conditions become more prevalent, creating sustained demand for joint reconstructive surgeries and related extremity treatments.

Rising Sports and Trauma-related Injuries: Higher participation in sports, more road accidents, and other forms of traumatic injuries drive demand for trauma devices, fracture fixation, and reconstructive surgeries.

Technological Innovation: Development of minimally invasive surgery techniques, use of better implant materials, advancements such as 3D printing, robotic assistance, and AI‐enabled diagnostics are improving patient outcomes, recovery times, and increasing patient acceptance.

Growth in Outpatient and Ambulatory Settings: There is a shift toward outpatient procedures and ambulatory surgical centers (ASCs), driven by demand for lower cost, shorter hospital stays, and greater convenience. This opens up markets for lighter, more efficient devices and implant systems appropriate for non-hospital settings.

Emerging Market Expansion: Healthcare infrastructure improving in regions like Asia-Pacific, Latin America, and Middle East & Africa. Increased affordability, rising middle classes, and growing awareness of orthopedic healthcare are providing new growth opportunities.

What Lies Ahead: Emerging Trends Shaping the Future

Minimally Invasive / Less Traumatic Surgery: Emphasis on techniques and device designs that reduce surgical trauma, speed healing, reduce complications (e.g. smaller incisions, arthroscopic methods).

Smart & Personalized Implants: Use of patient-specific implants (via 3D printing), implants with improved biomaterials for better integration and longevity, potentially sensors or smart materials in future.

Focus on Soft Tissue & Arthroscopy Devices: Alongside hard implants, devices and instruments for arthroscopic repair and soft tissue work are expected to gain more share as patients and surgeons prefer less-invasive options.

Robotic & Navigation Assistance: More use of robotics, image guidance, navigation in surgery to improve precision, reduce error, and improve outcomes.

Regulatory & Reimbursement Pressures: Demand for cost-effectiveness, value-based care, regulatory approvals, and pricing pressures will shape product design, materials used, and adoption pathways.

Segmentation Analysis (from the Report)

According to the report, the market is segmented as follows:

By Type: Joint reconstruction, spinal devices, trauma devices, arthroscopy devices.

By End-Use: Hospitals; Orthopedic clinics; Ambulatory surgical centers (ASCs).

By Region: North America; Europe; Asia-Pacific; Latin America; Middle East & Africa.

Country-Level Analysis: USA & Germany

United States: The U.S. is the dominant market in North America for orthopedic extremity devices. Strong healthcare infrastructure, high procedural volumes (joint replacements, trauma surgeries), rapid adoption of new technology (robotics, navigation, minimally invasive implants) and high spending per patient characterize the U.S. market. Reimbursement mechanisms, regulatory approvals, and high awareness also support growth.

Germany: Among European leaders, Germany benefits from an aging demographic, well-established medical device regulation, strong hospitals, and surgeons experienced in advanced orthopedic procedures. German demand particularly for joint reconstruction (knee, hip) is strong. However, value-based purchasing and cost considerations are more prominent, pushing manufacturers to deliver high quality at competitive cost.

Competitor Analysis

Key players in the global orthopedic extremity market include:

Johnson & Johnson

Stryker Corporation

Zimmer Biomet Holdings, Inc.

Medtronic PLC

Smith & Nephew PLC

DePuy Synthes (a J&J subsidiary)

Wright Medical Group (now part of Stryker)

Arthrex, Inc.

NuVasive, Inc.

Globus Medical, Inc.

DJO Global, Inc. (Colfax)

ConMed Corporation

Acumed LLC

Extremity Medical LLC (now under Wright Medical)

Integra LifeSciences Holdings AG

These competitors are focusing on: improving implant designs and materials; expanding into minimally invasive and outpatient applications; investing in R&D (robotics, smart implants); improving manufacturing methods to reduce cost; widening global footprint, particularly in emerging economies; and ensuring regulatory compliance and strong post-operative outcomes.

Press Release Conclusion

The Orthopedic Extremity Market is headed for consistent growth through 2032, rising from about USD 66.58 billion in 2024 to nearly USD 94.68 billion at a CAGR of 4.5%. Aging populations, rising prevalence of joint and bone disorders, increasing sports/trauma cases, and adoption of advanced, less invasive techniques form the core growth engine.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

0 Commentarios

0 Acciones

54 Views