North America Chlorotoluene Market: Strategic Outlook

1. Market Overview

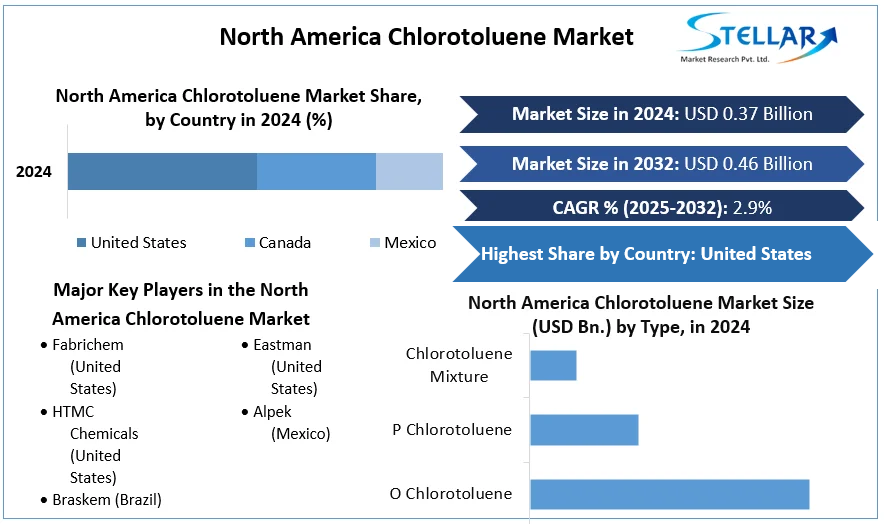

The North America Chlorotoluene Market was valued at USD 370 million in 2024 and is projected to reach USD 460 million by 2032, growing at a CAGR of 2.9% over the forecast period from 2025 to 2032 .

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/North-America-Chlorotoluene-Market/953

2. Market Drivers & Opportunities

Robust Chemical Manufacturing Infrastructure: North America's well-established chemical manufacturing infrastructure supports the production and demand for chlorotoluene derivatives.

Demand from Agrochemicals and Pharmaceuticals: Chlorotoluene serves as a key intermediate in the production of agrochemicals and pharmaceuticals, driving its demand in these sectors.

Sustainable Production Practices: The industry's focus on sustainable production practices and green chemistry principles is influencing manufacturers to seek chlorotoluene, which serves as an important building block for various chemical formulations .

3. Emerging Trends

Advancements in Chemical Synthesis: Ongoing advancements in chemical synthesis are enhancing the efficiency and yield of chlorotoluene production.

Integration with Green Chemistry: The integration of chlorotoluene in green chemistry initiatives is gaining traction, aligning with environmental sustainability goals.

4. Market Segmentation

By Type:

O-Chlorotoluene: Utilized in the production of pharmaceuticals and agrochemicals.

P-Chlorotoluene: Used in the synthesis of dyes and as a chemical intermediate.

Chlorotoluene Mixture: A combination of isomers used in various chemical applications.

By Application:

Agrochemicals: Chlorotoluene is used in the production of herbicides and pesticides.

Pharmaceuticals: Serves as an intermediate in the synthesis of active pharmaceutical ingredients.

Paints & Coatings: Employed in the formulation of certain coatings and paints.

Chemicals: Used in the production of various chemical intermediates

5. Competitive Landscape

Key players in the North America Chlorotoluene Market include:

Eastman Chemical Company (United States): A leading producer of specialty chemicals, including chlorotoluene derivatives.

Braskem (Brazil): A global petrochemical company with operations in North America, producing chlorotoluene and other chemicals.

Alpek (Mexico): A major producer of petrochemicals and polyester, involved in the production of chlorotoluene.

Fabrichem (United States): Specializes in the production of various chemical intermediates, including chlorotoluene.

HTMC Chemicals (United States): Provides a range of chemical products, including chlorotoluene derivatives.

6. Conclusion

The North America Chlorotoluene Market is poised for steady growth, driven by advancements in chemical manufacturing, increasing demand from agrochemical and pharmaceutical sectors, and a focus on sustainable production practices. With a projected market size of USD 460 million by 2032, stakeholders have opportunities to invest in and capitalize on the evolving landscape of chlorotoluene applications in the region.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

1. Market Overview

The North America Chlorotoluene Market was valued at USD 370 million in 2024 and is projected to reach USD 460 million by 2032, growing at a CAGR of 2.9% over the forecast period from 2025 to 2032 .

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/North-America-Chlorotoluene-Market/953

2. Market Drivers & Opportunities

Robust Chemical Manufacturing Infrastructure: North America's well-established chemical manufacturing infrastructure supports the production and demand for chlorotoluene derivatives.

Demand from Agrochemicals and Pharmaceuticals: Chlorotoluene serves as a key intermediate in the production of agrochemicals and pharmaceuticals, driving its demand in these sectors.

Sustainable Production Practices: The industry's focus on sustainable production practices and green chemistry principles is influencing manufacturers to seek chlorotoluene, which serves as an important building block for various chemical formulations .

3. Emerging Trends

Advancements in Chemical Synthesis: Ongoing advancements in chemical synthesis are enhancing the efficiency and yield of chlorotoluene production.

Integration with Green Chemistry: The integration of chlorotoluene in green chemistry initiatives is gaining traction, aligning with environmental sustainability goals.

4. Market Segmentation

By Type:

O-Chlorotoluene: Utilized in the production of pharmaceuticals and agrochemicals.

P-Chlorotoluene: Used in the synthesis of dyes and as a chemical intermediate.

Chlorotoluene Mixture: A combination of isomers used in various chemical applications.

By Application:

Agrochemicals: Chlorotoluene is used in the production of herbicides and pesticides.

Pharmaceuticals: Serves as an intermediate in the synthesis of active pharmaceutical ingredients.

Paints & Coatings: Employed in the formulation of certain coatings and paints.

Chemicals: Used in the production of various chemical intermediates

5. Competitive Landscape

Key players in the North America Chlorotoluene Market include:

Eastman Chemical Company (United States): A leading producer of specialty chemicals, including chlorotoluene derivatives.

Braskem (Brazil): A global petrochemical company with operations in North America, producing chlorotoluene and other chemicals.

Alpek (Mexico): A major producer of petrochemicals and polyester, involved in the production of chlorotoluene.

Fabrichem (United States): Specializes in the production of various chemical intermediates, including chlorotoluene.

HTMC Chemicals (United States): Provides a range of chemical products, including chlorotoluene derivatives.

6. Conclusion

The North America Chlorotoluene Market is poised for steady growth, driven by advancements in chemical manufacturing, increasing demand from agrochemical and pharmaceutical sectors, and a focus on sustainable production practices. With a projected market size of USD 460 million by 2032, stakeholders have opportunities to invest in and capitalize on the evolving landscape of chlorotoluene applications in the region.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

North America Chlorotoluene Market: Strategic Outlook

1. Market Overview

The North America Chlorotoluene Market was valued at USD 370 million in 2024 and is projected to reach USD 460 million by 2032, growing at a CAGR of 2.9% over the forecast period from 2025 to 2032 .

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/North-America-Chlorotoluene-Market/953

2. Market Drivers & Opportunities

Robust Chemical Manufacturing Infrastructure: North America's well-established chemical manufacturing infrastructure supports the production and demand for chlorotoluene derivatives.

Demand from Agrochemicals and Pharmaceuticals: Chlorotoluene serves as a key intermediate in the production of agrochemicals and pharmaceuticals, driving its demand in these sectors.

Sustainable Production Practices: The industry's focus on sustainable production practices and green chemistry principles is influencing manufacturers to seek chlorotoluene, which serves as an important building block for various chemical formulations .

3. Emerging Trends

Advancements in Chemical Synthesis: Ongoing advancements in chemical synthesis are enhancing the efficiency and yield of chlorotoluene production.

Integration with Green Chemistry: The integration of chlorotoluene in green chemistry initiatives is gaining traction, aligning with environmental sustainability goals.

4. Market Segmentation

By Type:

O-Chlorotoluene: Utilized in the production of pharmaceuticals and agrochemicals.

P-Chlorotoluene: Used in the synthesis of dyes and as a chemical intermediate.

Chlorotoluene Mixture: A combination of isomers used in various chemical applications.

By Application:

Agrochemicals: Chlorotoluene is used in the production of herbicides and pesticides.

Pharmaceuticals: Serves as an intermediate in the synthesis of active pharmaceutical ingredients.

Paints & Coatings: Employed in the formulation of certain coatings and paints.

Chemicals: Used in the production of various chemical intermediates

5. Competitive Landscape

Key players in the North America Chlorotoluene Market include:

Eastman Chemical Company (United States): A leading producer of specialty chemicals, including chlorotoluene derivatives.

Braskem (Brazil): A global petrochemical company with operations in North America, producing chlorotoluene and other chemicals.

Alpek (Mexico): A major producer of petrochemicals and polyester, involved in the production of chlorotoluene.

Fabrichem (United States): Specializes in the production of various chemical intermediates, including chlorotoluene.

HTMC Chemicals (United States): Provides a range of chemical products, including chlorotoluene derivatives.

6. Conclusion

The North America Chlorotoluene Market is poised for steady growth, driven by advancements in chemical manufacturing, increasing demand from agrochemical and pharmaceutical sectors, and a focus on sustainable production practices. With a projected market size of USD 460 million by 2032, stakeholders have opportunities to invest in and capitalize on the evolving landscape of chlorotoluene applications in the region.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

0 Commentarii

0 Distribuiri

1596 Views